Ok, secret message time. Don& #39;t hold back.

https://secret.viralsachxd.com/86d3ee132 ">https://secret.viralsachxd.com/86d3ee132...

https://secret.viralsachxd.com/86d3ee132 ">https://secret.viralsachxd.com/86d3ee132...

On the contrary, it& #39;s harder to get direct feedback when you& #39;re older. In college your friends don& #39;t hesitate to call you out. Now it& #39;s hard to get a straight answer on anything. Perhaps anonymity will help?

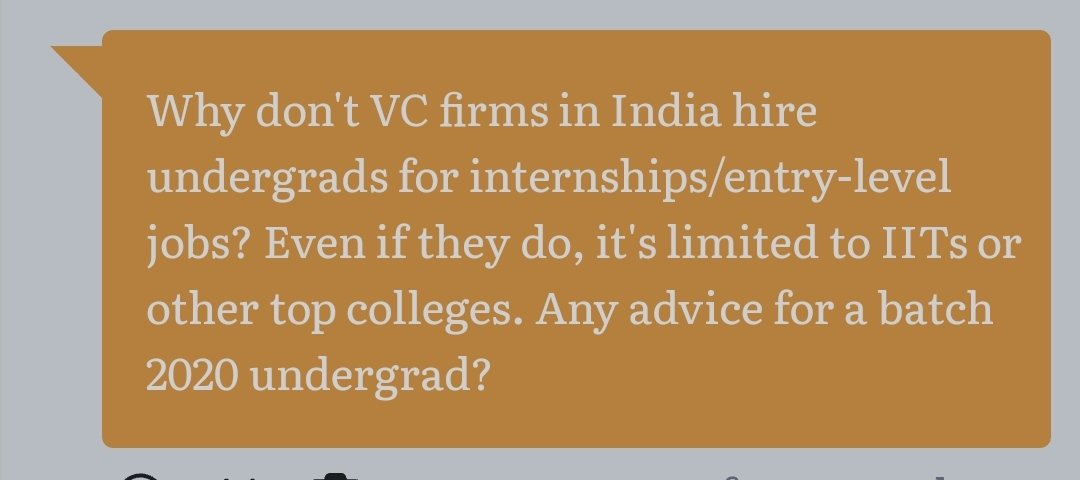

It& #39;s mostly a bias, but VC firms hardly have any internal work that doesn& #39;t involve interacting with outside parties (usually founders). Undergrad interns may not have the maturity to deal with founders,which is important because each interaction affects our reputation.That& #39;s why

Never attribute to malice what is adequately explained by forgetfulness :)

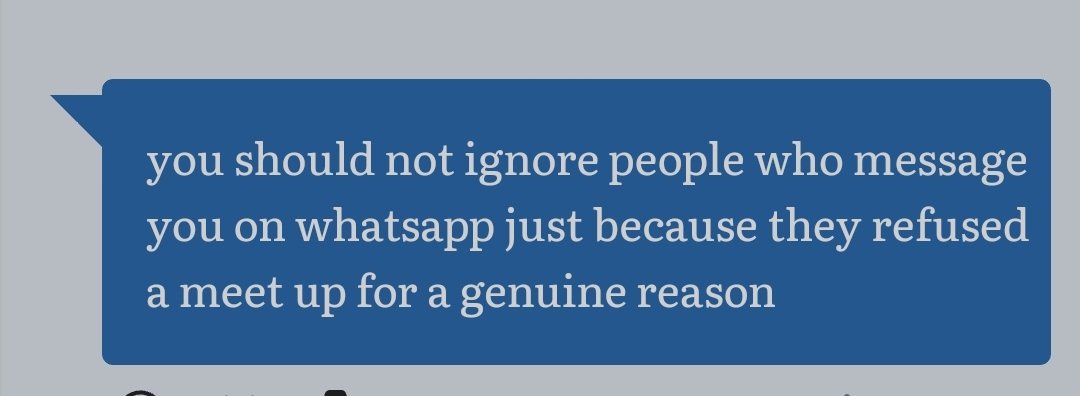

I& #39;m sure I just forgot to reply. Write again? *now furiously checking unread texts*

I& #39;m sure I just forgot to reply. Write again? *now furiously checking unread texts*

This narrows it down a bit!

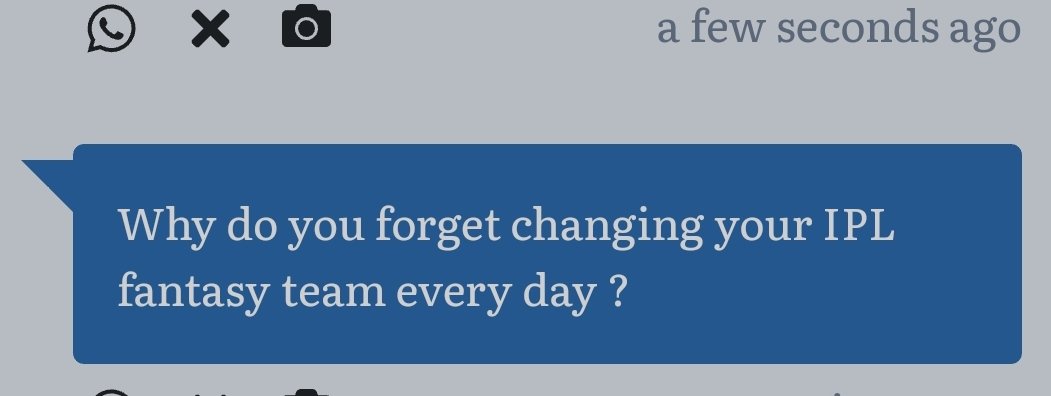

Mostly because of advanced middle age. Also, this is the first time I& #39;m playing fantasy cricket, and find that having a "stake" in certain players reduces my enjoyment of the game. So I try to not take it too seriously.

Mostly because of advanced middle age. Also, this is the first time I& #39;m playing fantasy cricket, and find that having a "stake" in certain players reduces my enjoyment of the game. So I try to not take it too seriously.

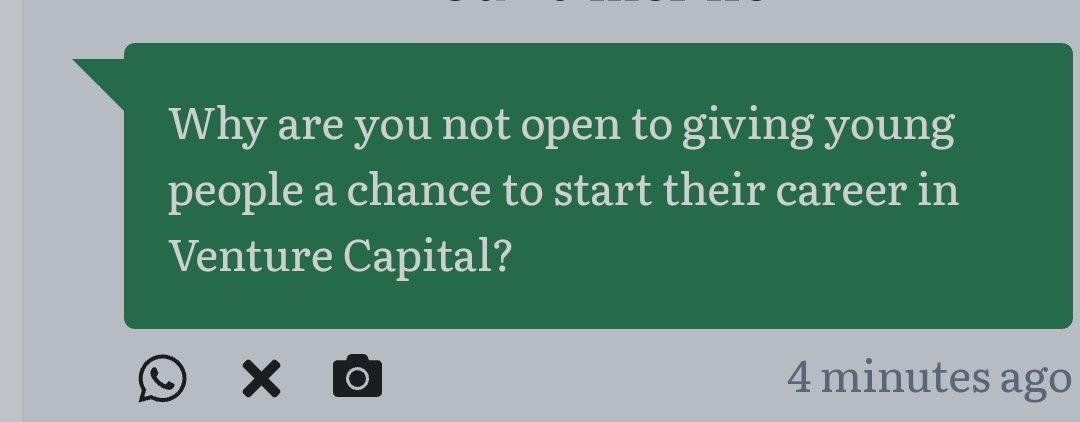

Mostly budget constraints. We are a small fund that neither needs nor can afford a large team. Within these limits though, I hugely enjoy working with young people.

Home truths! Like everyone else here, the honest answer is "too much". But I try to position it into writing time and reading time.Writing tweets doesn& #39;t take much time, and I keep a tab open all day for that.Try to restrict my reading to evenings and late nights when I have time

Taking a break now. Thanks for all the messages! Keep them coming - I& #39;ll pick it up again after dinner.

PS: I got a Nigerian scam message on this. What& #39;s the point? How do I even reply? Unless it& #39;s a 5D meta scam of some sort.

PS: I got a Nigerian scam message on this. What& #39;s the point? How do I even reply? Unless it& #39;s a 5D meta scam of some sort.

All in good time. True story: recently another VC and I got into a video call only to compare beards.

This is what every VC wants to hear! I can& #39;t guarantee we will invest, but I would love to hear the kickass idea and give honest feedback (and maybe also invest https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Leicht lächelndes Gesicht" aria-label="Emoji: Leicht lächelndes Gesicht">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Leicht lächelndes Gesicht" aria-label="Emoji: Leicht lächelndes Gesicht">)

We& #39;re doing our best. We obviously consider what we back "useful". In fact, the opposite criticism is equally fair - that we back only useful services, not wacky ones.

As for virtue signalling on Twitter, it is the human condition. VCs are far from the only culprits.

As for virtue signalling on Twitter, it is the human condition. VCs are far from the only culprits.

We have been investing for 15 years with approximately 1.5 large exits. I suppose we have taken a few risks.

Excellent question. If I were fully aware of it, it wouldn& #39;t be much of a blind spot TBH. But still, I think it is this: I sometimes fall in love with an idea or a founder and ignore evidence to the contrary. (1/2)

Being part of an investing team helps to some extent, but in the end it is often an individual call. Making a crucial judgment while in that infatuated state is dangerous in our profession. I try to step back but it& #39;s not so easy to recognize in the moment.

Yes and no. Many of the largest companies in India - Flipkart, PayTM, Ola, Byjus - were started by non-consultants/MBAs. Of course, there are also large companies built by ex-consultants (Zomato, Urbanclap). I continue to believe that past work experience matters very little.

Massive part IMO. In the early stages of your career you mostly can& #39;t make independent decisions, yet are judged by the companies you are attached to. If you don& #39;t have a success in the first 5-7 years of your career, it is hard to move to the next level.

Cat video person.

Love pets but don& #39;t have space in our lives for one right now.

(someone please send a non-work message else this will become deathly boring)

Love pets but don& #39;t have space in our lives for one right now.

(someone please send a non-work message else this will become deathly boring)

So do I! One of the biggest regrets of my investing career is not investing in an ex-student& #39;s company when I knew the guy was the real deal - smart, committed, deep thinker. Should& #39;ve paid more attention to the aspirations of my class participants.

Is that you Zuck? How do you know I just started jotting down a few thoughts on travel, and am trying to decide if it& #39;s a Twitter thread or blog post. Stay tuned!

This question makes me believe you& #39;re a younger millennial or Gen Z. Because everybody over 35 knows the answer to that question: Bombay Dyeing because Gwalior Suiting. You either found it uproariously funny or went "huh?". That& #39;s when I knew.

I am painfully aware of this fact. Unfortunately I have the same approach to jokes as to investing: you got to kiss a lot of frogs to find one prince. Certainly don& #39;t want to be on the receiving end of that.

Thank you for adding the "that& #39;s ok" though. You& #39;re kind :)

Thank you for adding the "that& #39;s ok" though. You& #39;re kind :)

Oh I hold a lot of political opinions, sometimes inconsistent ones. But I feel no need to share them here, for a couple of reasons:

1) Unfortunately our country is highly polarized. You are either with us or against us. There& #39;s no space for nuance, and I hate that. (1/2)

1) Unfortunately our country is highly polarized. You are either with us or against us. There& #39;s no space for nuance, and I hate that. (1/2)

2) Twitter is too performative, in both directions. I suspect most people exaggerate their own political positions for effect, and it is fruitless to engage with someone who is only posing.

That evaluating a startup is the easiest part of the job. The best startups and founders are so blindingly obvious that only the overthinkers miss them. The harder part is to get them to talk to you, and later to ensure they are successful.

Because the answer to everything in VC is "it depends". How large your market is, and how expensive it will be to acquire customers, depends far more on what you& #39;re building than on the domain you& #39;re in. You can build a large company by serving a massive need in a niche market.

Sometimes. In all cases it was the relationship with the founder and the resonance with their vision that made them go with us.

What& #39;s the plan? Be the first to invest in new spaces. Take small bets in early stages and let the rest of the market discover them in 18 months.

What& #39;s the plan? Be the first to invest in new spaces. Take small bets in early stages and let the rest of the market discover them in 18 months.

Ok going to bed now. Please do share more questions and feedback. I& #39;ll try to comment on more tomorrow.

Thank you for taking the time to share. Even the criticisms (especially those) are real selfless acts. Thank you https://abs.twimg.com/emoji/v2/... draggable="false" alt="❤️" title="Rotes Herz" aria-label="Emoji: Rotes Herz">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❤️" title="Rotes Herz" aria-label="Emoji: Rotes Herz">

Thank you for taking the time to share. Even the criticisms (especially those) are real selfless acts. Thank you

On Twitter, all the time.

In real life, I try to limit exposure and engage with only a few people who I think truly understand the startup space.

In real life, I try to limit exposure and engage with only a few people who I think truly understand the startup space.

I have had the pleasure of working with many wonderful VCs,but I think the best experience was with @NexusVP. Often in tough situations, VCs(including me) start to blame the founders. Suvir, though,was unrelentingly positive even in the middle of the biggest clusterf*ck I& #39;ve seen

This is something I have had experience with (advising portfolio founders in this position). I suggest taking up a job and building some functional expertise. It& #39;s incredible what small wins in a protected environment can do for your confidence.

Write to me. I won& #39;t judge.

Write to me. I won& #39;t judge.

This breaks my heart, because so often you build something phenomenal and India gets in the way.

There is no general solution. We like to say in venture that "your runway is your strategy". If you have the runway, find out what will make the stodgy industry move, and build that.

There is no general solution. We like to say in venture that "your runway is your strategy". If you have the runway, find out what will make the stodgy industry move, and build that.

I would go with someone who has deep trust of their clients rather than just a wide network. Raising money is only the first step.The client needs to understand the product and its risks and follow through on their commitment.That is also the banker& #39;s role. DM for recommendations

I-bankers rarely want to work in venture. The job is too slow-paced and the rewards too far out compared to what they& #39;re used to. To get hired at a VC, you will need to demonstrate long-term orientation and find joy in the work itself, not only in the reward.

- Spend your time on what matters: sourcing, building theses and helping founders; none on internal selling, building decks &c

- Don& #39;t be a slave to the firm& #39;s structure or the areas assigned to you.If you feel strongly about something,do it. VC firms are small and won& #39;t object.+

- Don& #39;t be a slave to the firm& #39;s structure or the areas assigned to you.If you feel strongly about something,do it. VC firms are small and won& #39;t object.+

-Don& #39;t "network". Instead, take a genuine interest in people. None of my transactional relationships from a decade ago have lasted; all the friendships have.

-Ask for more responsibility. You& #39;re not too young for responsibility in your early 30s,but people forget you& #39;re not a kid

-Ask for more responsibility. You& #39;re not too young for responsibility in your early 30s,but people forget you& #39;re not a kid

I find these boxes too restrictive. What do you call someone who believes that free markets create wealth but regulation is needed to keep it a level playing field? That the state should get out of the way of private enterprise but must care for the most vulnerable in society?

I started a business in 2005, a Netflix for India. There was no ecosystem and hardly any funding then. I needed to invest ~1 Cr to move from the pirated DVDs I was renting in the pilot to a proper business. Pitched to both the VCs that existed then, no bite. Had to shut it down.

When I got into VC, I initially thought I will start up again after a few years. But I loved the intellectual stimulation and learning value of VC too much to ever move out. Now of course, Stellaris is our startup.

8 am! It& #39;s a Saturday and I was up till late on this thread last night.

Even otherwise I& #39;m a late riser - the alarm goes off at 7 but I snooze it till 7.15 or 7.20. Pre-lockdown had to wake up earlier to get the kids ready for school. Now we& #39;re back to our natural rhythm. :)

Even otherwise I& #39;m a late riser - the alarm goes off at 7 but I snooze it till 7.15 or 7.20. Pre-lockdown had to wake up earlier to get the kids ready for school. Now we& #39;re back to our natural rhythm. :)

I don& #39;t really do well on this otherwise. Post-pandemic my plan is to reduce business travel and try to eat dinner at home every day.

It& #39;s hard and I don& #39;t really have any answers.

It& #39;s hard and I don& #39;t really have any answers.

Neither. We knew the first LP and the first founding team from before.

The 10th LP and the 10th founding team were much harder, because then we had to convince someone new. I think it& #39;s easier to pitch to LPs than founders, because the LP is already optimizing for the long term.

The 10th LP and the 10th founding team were much harder, because then we had to convince someone new. I think it& #39;s easier to pitch to LPs than founders, because the LP is already optimizing for the long term.

Usually when we come in, there is no or little data. We rely on our own judgment and ref checks to evaluate founder integrity. Outside agencies carry out financial diligence, but they rarely catch this kind of thing. Only once I& #39;ve reneged on a term sheet because they faked data.

Ooh, a school mate! I didn& #39;t like most things that people usually love about school - the fun, the friends, the mischief. But many of my guiding values - liberalism, adventure-seeking, skepticism - can be directly attributed to the school. (also, what success?)

Sadly, (most) VCs are human. So pitching and presentation matter. They not only help you stand out from the crowd, but also signal your future sales skills. I strongly suggest that you practice your pitch and answer questions authentically. It is an essential life skill.

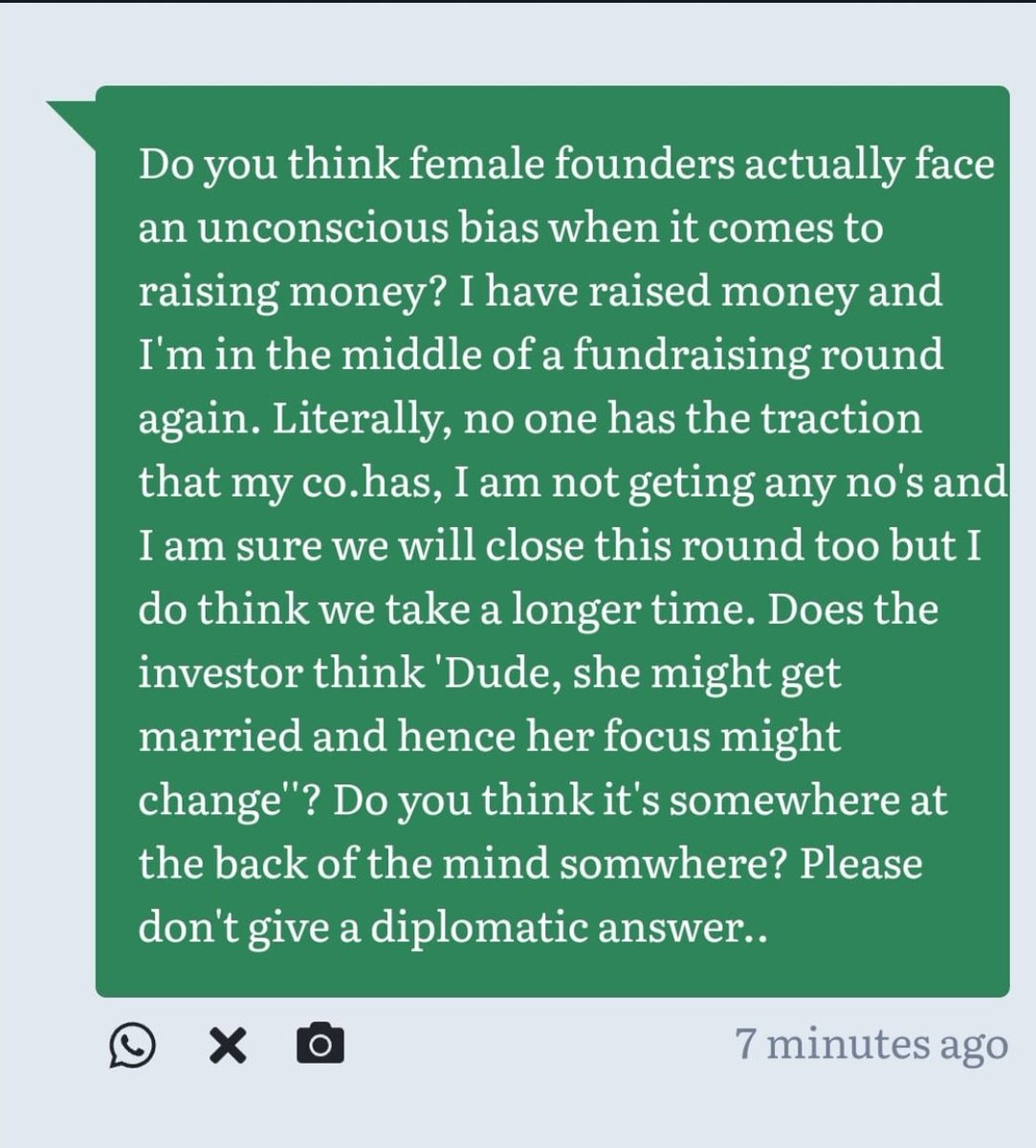

I do think there& #39;s a bias, but not of the explicit "she will get married and have kids" kind.

It manifests itself more as a bias towards engineers from the IITs/BITS, who tend to be overwhelmingly male. We may have to get rid of the engineer bias to be more inclusive.

It manifests itself more as a bias towards engineers from the IITs/BITS, who tend to be overwhelmingly male. We may have to get rid of the engineer bias to be more inclusive.

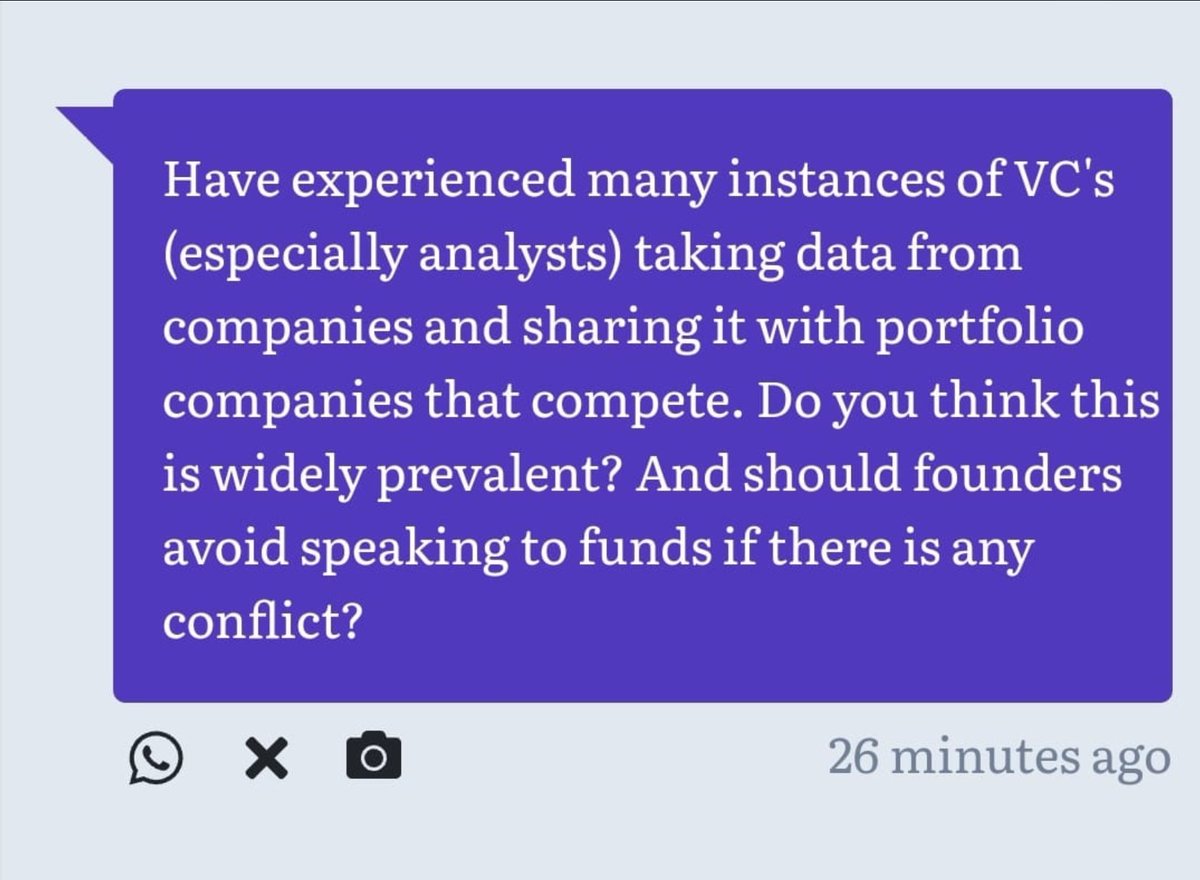

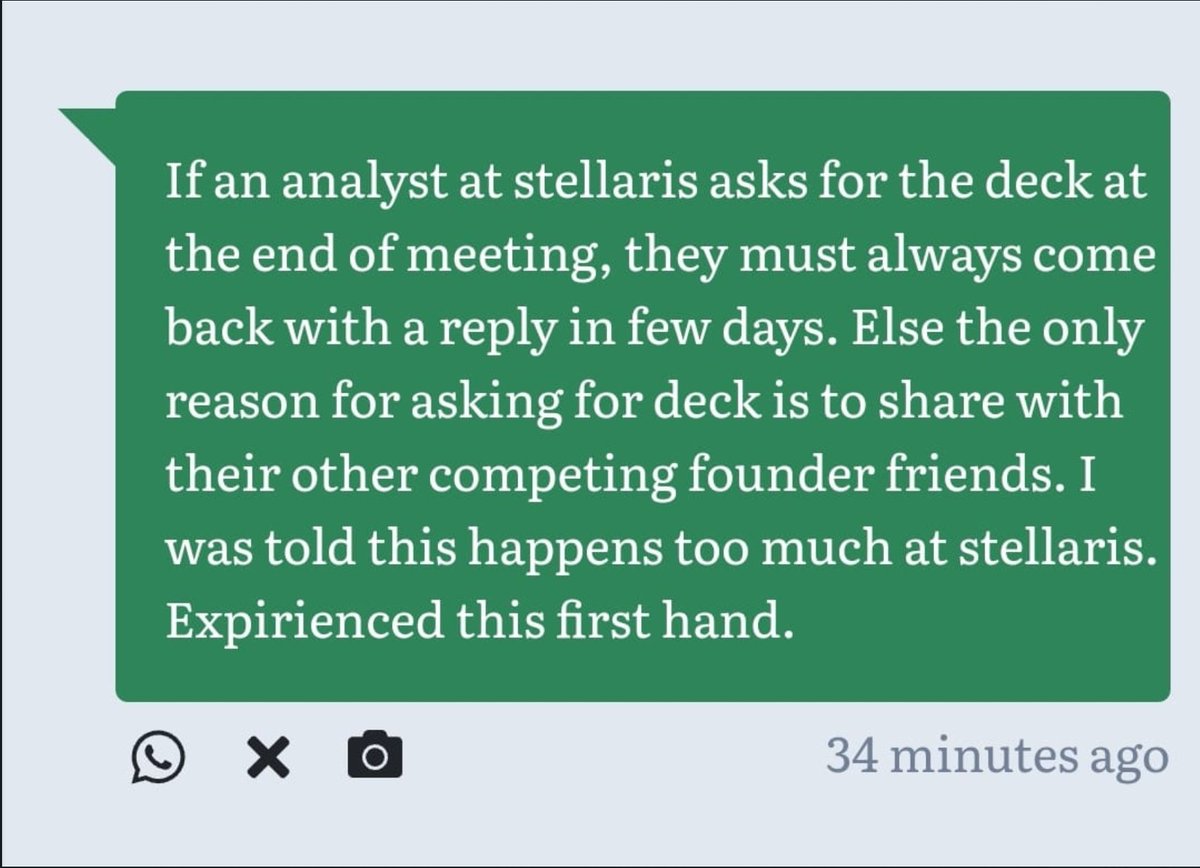

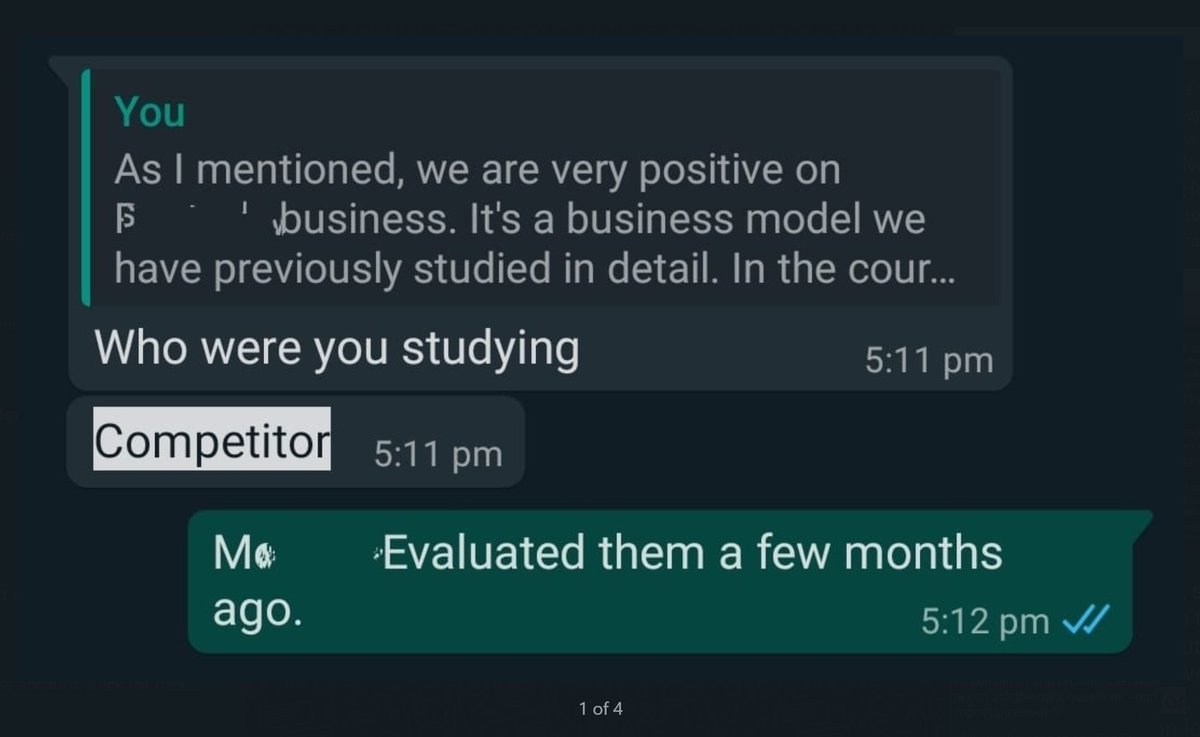

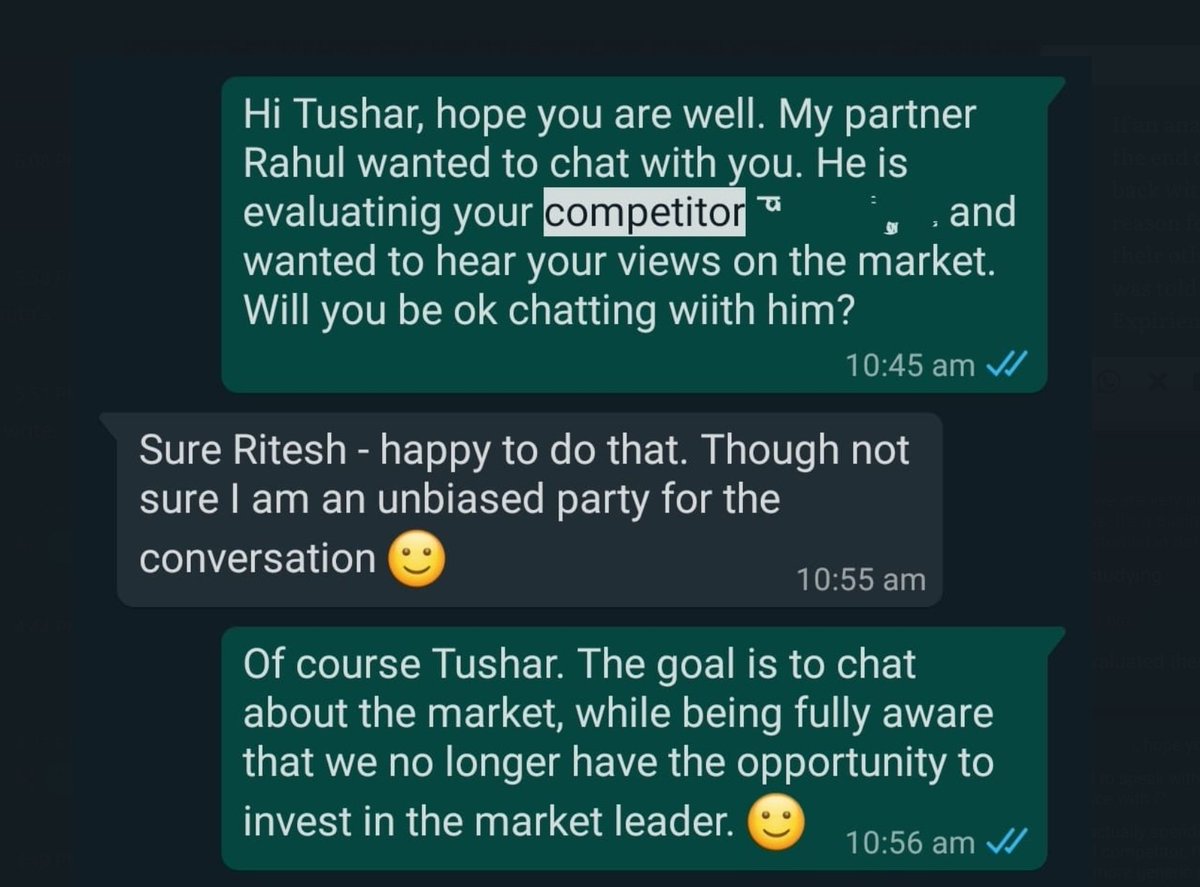

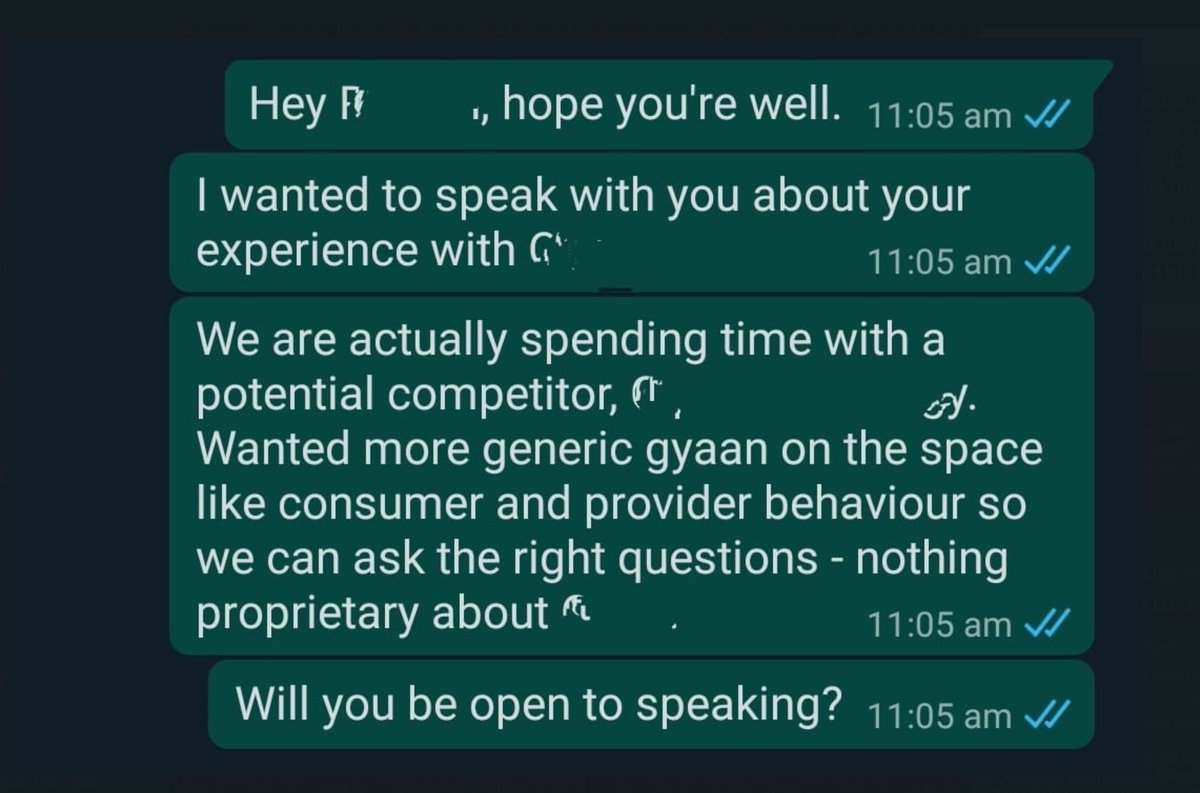

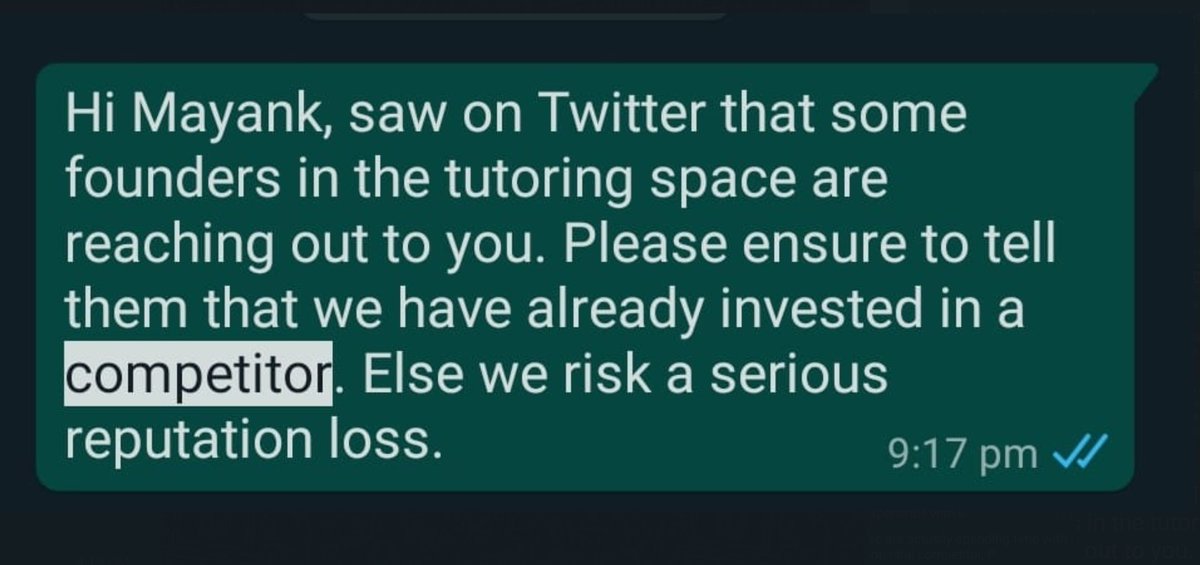

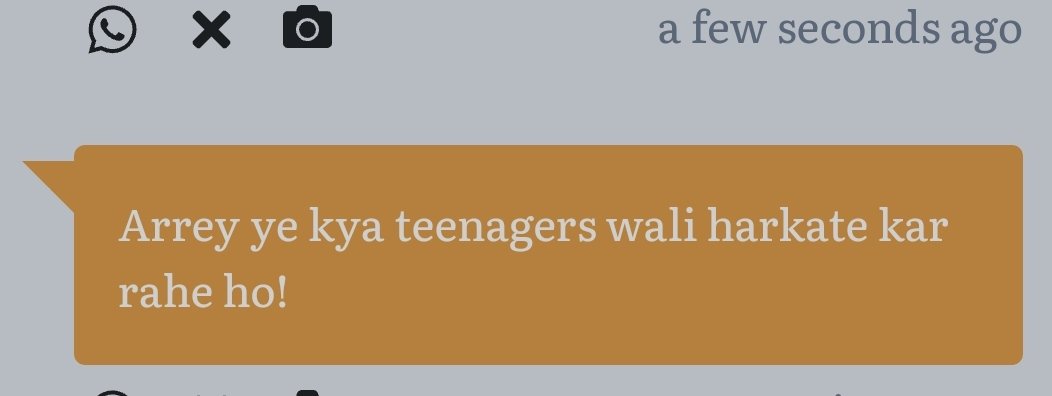

I am a 100% certain that we do no such thing at Stellaris. No investment team member has an incentive to share data with portfolio companies. In fact,we go out of the way to disclose conflicts of interest and tell founders up-front if our portfolio companies compete with them 1/2

We also never speak to startups merely to do diligence on other deals. Here are some examples from my whatsapp of how we disclose potential conflicts up-front. Our reputation depends on this.

Ex-VC analyst: thank you for your kind words. Say hi sometime. :-)

First-time founder: sorry if I was harsh with you. If possible can you share the context? Since we already said no, there& #39;s not much to lose. It will help me improve my communication with founders. Thank you!

Now we& #39;re asking the important questions. Millimetres matter.

Read on Twitter

Read on Twitter

)" title="This is what every VC wants to hear! I can& #39;t guarantee we will invest, but I would love to hear the kickass idea and give honest feedback (and maybe also investhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Leicht lächelndes Gesicht" aria-label="Emoji: Leicht lächelndes Gesicht">)" class="img-responsive" style="max-width:100%;"/>

)" title="This is what every VC wants to hear! I can& #39;t guarantee we will invest, but I would love to hear the kickass idea and give honest feedback (and maybe also investhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Leicht lächelndes Gesicht" aria-label="Emoji: Leicht lächelndes Gesicht">)" class="img-responsive" style="max-width:100%;"/>