This small thread is about access to capital in Jamaica for MSMEs & SMEs.

I live in JA and run @TcpTings. We registered a US entity and we use @Shopify.

They told me I became eligible for their Shopify Capital programme, so I applied - https://www.shopify.com/capital ">https://www.shopify.com/capital&q...

I live in JA and run @TcpTings. We registered a US entity and we use @Shopify.

They told me I became eligible for their Shopify Capital programme, so I applied - https://www.shopify.com/capital ">https://www.shopify.com/capital&q...

Being from (and living in) JA I was unsure whether we would qualify.

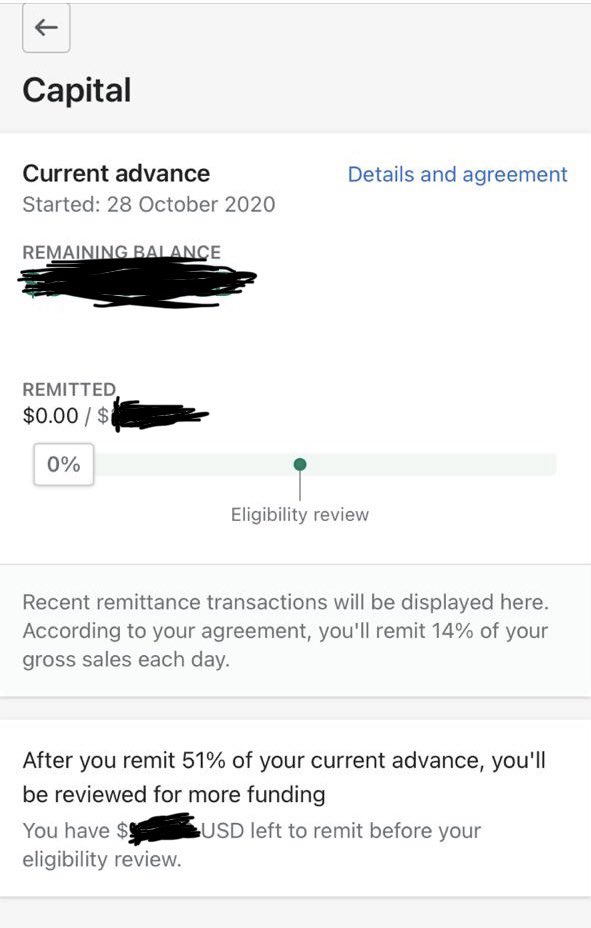

Their programme is nice because even though it’s a little expensive (9% - 17% per loan amount on USD), you repay out of sales.

Once you have the margin to absorb that, it works nicely.

Their programme is nice because even though it’s a little expensive (9% - 17% per loan amount on USD), you repay out of sales.

Once you have the margin to absorb that, it works nicely.

You don’t have to stress about repaying a loan and all of that jazz, it just happens automatically.

Anyway I applied and I got notified a few days ago that we got approved.

The application process took about 15 minutes, but there were delays sometimes based on their requests.

Anyway I applied and I got notified a few days ago that we got approved.

The application process took about 15 minutes, but there were delays sometimes based on their requests.

For example, they asked me to send my national ID (I sent my passport), then they asked me to send a pic of me holding my passport next to my face (lol...I know). It is all uploaded to a secure section of the website.

But just getting the time to do that took me a few days.

But just getting the time to do that took me a few days.

Once I did it though, it took them a few days.

I would say, the entire process back and forth took about 1 - 2 weeks (ignoring my delays).

Once I got approved, they told me the amounts I qualify for and I choose which one I want.

I chose it and they deposited it next day.

I would say, the entire process back and forth took about 1 - 2 weeks (ignoring my delays).

Once I got approved, they told me the amounts I qualify for and I choose which one I want.

I chose it and they deposited it next day.

Then over the next few days, as sales came in they just deducted it and my balance has been going down.

I was actually shocked that I “didn’t do anything” and have already repaid 15% of my balance in less than a week.

It’s a surreal feeling.

I was actually shocked that I “didn’t do anything” and have already repaid 15% of my balance in less than a week.

It’s a surreal feeling.

So contrast all of that with my trying to get a loan from 3 banks in JA and it’s been nothing but pure headache.

I had been trying to do it, on and off, from about last October to June/July this year until I eventually just gave up.

I had been trying to do it, on and off, from about last October to June/July this year until I eventually just gave up.

Granted, the Shopify financing is much smaller than I was seeking at the institutions locally, but none of them ever came back and said “Rather than getting X, why don’t you start with Y and we can build up to X”.

I wanted to be able to pay out of sales, not a fixed schedule.

I wanted to be able to pay out of sales, not a fixed schedule.

But again, none of the major banks are equipped for this.

I think it is a major indictment on the local financial sys. (re: MSME & SME financing), that it is easier for a Jamaican SME to get financing from a non-banking institution in Canada than from any of their local banks.

I think it is a major indictment on the local financial sys. (re: MSME & SME financing), that it is easier for a Jamaican SME to get financing from a non-banking institution in Canada than from any of their local banks.

Nevertheless, we push on.

I am always open to giving specific feedback to any financial institution that is interested in taking MSMEs & SMEs seriously.

But you have to do things differently. The world has changed & you have to adapt.

I am always open to giving specific feedback to any financial institution that is interested in taking MSMEs & SMEs seriously.

But you have to do things differently. The world has changed & you have to adapt.

Also check out this great thread about a similar process by @redrory. https://twitter.com/redrory/status/1322018986511503362">https://twitter.com/redrory/s...

Read on Twitter

Read on Twitter