How does @compoundfinance& #39;s business model work?

Compound coordinates decentralized borrowing and lending by providing the rules and incentives to get users to supply their capital in order to build money markets for assets on Ethereum.

Compound coordinates decentralized borrowing and lending by providing the rules and incentives to get users to supply their capital in order to build money markets for assets on Ethereum.

Users provide their capital to Compound in exchange for the interest that Compound generates from putting that capital to productive use in lending.

The capital @compoundfinance raises from users is not permanent.

Users may withdraw their capital whenever they want and only keep their capital in Compound so long as they believe in the protocol& #39;s ability to stay solvent and deliver interest on that capital.

Users may withdraw their capital whenever they want and only keep their capital in Compound so long as they believe in the protocol& #39;s ability to stay solvent and deliver interest on that capital.

Compound generates fees to the extent it continues to best serve users looking to permissionlessly borrow and lend assets peer-to-peer without trusted third parties.

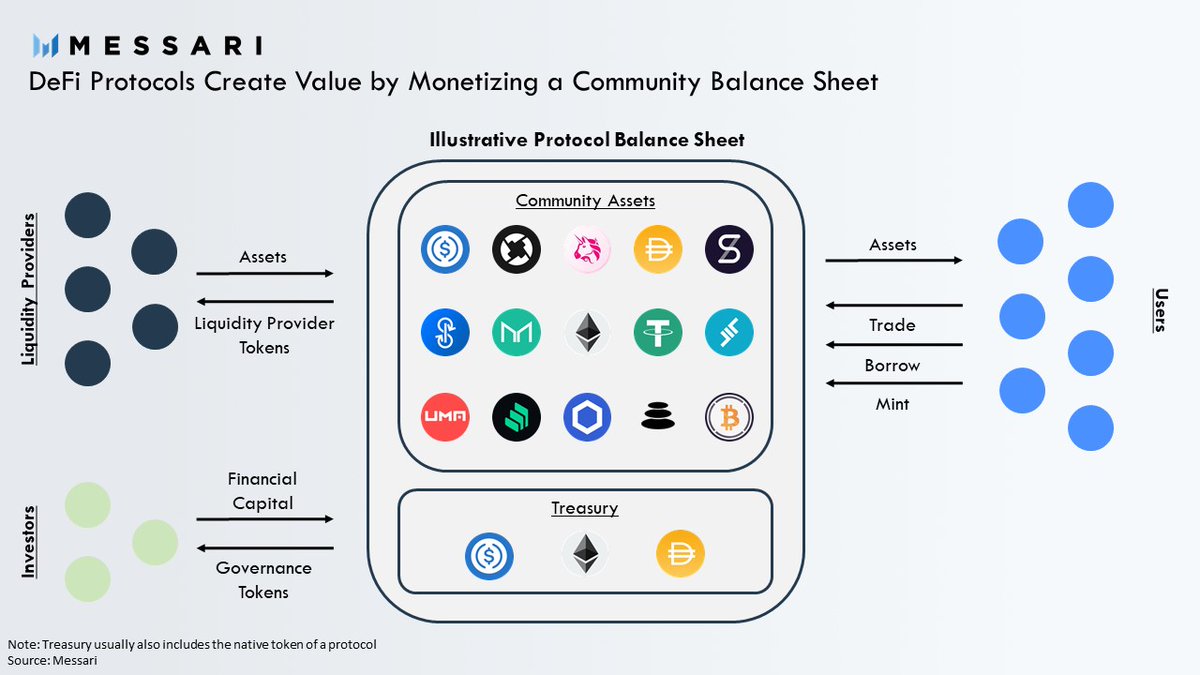

If you& #39;ve picked up on the fact that this thread looks starkly similar to our thread on @UniswapProtocol yesterday, it& #39;s because most DeFi protocol business models are the same

At the core of this business model sits the protocol& #39;s balance sheet https://twitter.com/MessariCrypto/status/1321495278323728385?s=20">https://twitter.com/MessariCr...

At the core of this business model sits the protocol& #39;s balance sheet https://twitter.com/MessariCrypto/status/1321495278323728385?s=20">https://twitter.com/MessariCr...

To learn how DeFi protocols can better leverage their balance sheets to create and capture value, read the full analysis https://messari.io/article/defi-citadels-how-defi-protocols-create-and-capture-value?utm_source=messaricrypto&utm_medium=compoundfinance&utm_campaign=deficitadels">https://messari.io/article/d...

Read on Twitter

Read on Twitter