1/11

I wrote a blog about why the US should allow payment companies to participate directly in payment systems. Currently, access is limited to depository institutions.

https://transferwise.com/us/blog/us-payments-charter

A">https://transferwise.com/us/blog/u... thread:

I wrote a blog about why the US should allow payment companies to participate directly in payment systems. Currently, access is limited to depository institutions.

https://transferwise.com/us/blog/us-payments-charter

A">https://transferwise.com/us/blog/u... thread:

2/11

Payment companies can’t directly access the payments infrastructure despite it being their core expertise.

That& #39;s like telling a heart specialist that they can’t use a stethoscope in private practice; stethoscopes can only be used in big hospitals.

Payment companies can’t directly access the payments infrastructure despite it being their core expertise.

That& #39;s like telling a heart specialist that they can’t use a stethoscope in private practice; stethoscopes can only be used in big hospitals.

3/11

Why is “direct access” good policy?

Because consumers benefit from lower costs and better services.

The financial ecosystem benefits from innovation and competition.

And financial stability benefits from increased diversification of risks.

Why is “direct access” good policy?

Because consumers benefit from lower costs and better services.

The financial ecosystem benefits from innovation and competition.

And financial stability benefits from increased diversification of risks.

4/11

This is central to payments modernization in other countries, often following the development of faster payments systems.

This is central to payments modernization in other countries, often following the development of faster payments systems.

5/11

For example, in 2018, the UK first allowed “direct access” for payment companies via Faster Payments Scheme membership and a settlement account with the Bank of England.

The EU, Canada, Singapore, and Australia are following suit.

https://www.bankofengland.co.uk/-/media/boe/files/markets/other-market-operations/accessfornonbankpaymentserviceproviders.pdf">https://www.bankofengland.co.uk/-/media/b...

For example, in 2018, the UK first allowed “direct access” for payment companies via Faster Payments Scheme membership and a settlement account with the Bank of England.

The EU, Canada, Singapore, and Australia are following suit.

https://www.bankofengland.co.uk/-/media/boe/files/markets/other-market-operations/accessfornonbankpaymentserviceproviders.pdf">https://www.bankofengland.co.uk/-/media/b...

6/11

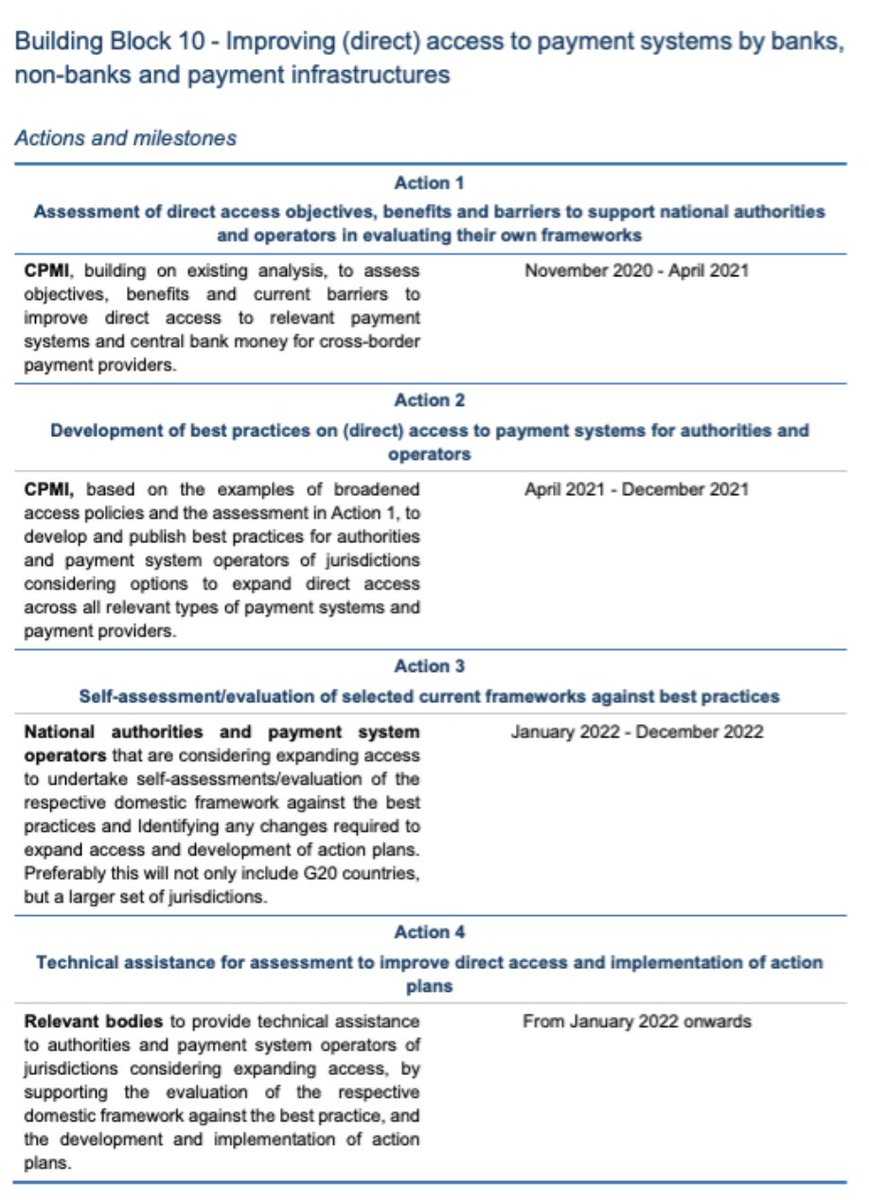

And the G20/FSB recently called for direct access for payment companies to reduce the cost of international payments. The World Bank and others have a similar view.

And the G20/FSB recently called for direct access for payment companies to reduce the cost of international payments. The World Bank and others have a similar view.

7/11

Consumer Costs: In the US, while FedACH only charges .35 cents to send payments directly, the cost for payment companies via bank partners is closer to 20/30/40 cents. That’s potentially a 100x markup. Consumers eat the costs.

Consumer Costs: In the US, while FedACH only charges .35 cents to send payments directly, the cost for payment companies via bank partners is closer to 20/30/40 cents. That’s potentially a 100x markup. Consumers eat the costs.

8/11

Innovation and Competition: Under the current rules, payment companies rely on bank partners - often competitors - to access payment rails. That means relying on a bank’s technology and infrastructure rather than integrating directly.

Innovation and Competition: Under the current rules, payment companies rely on bank partners - often competitors - to access payment rails. That means relying on a bank’s technology and infrastructure rather than integrating directly.

9/11

Financial Stability: Two banks originate more than 50% of ACH payments. That’s not a surprise because many payment companies rely on the same two. That means risk is concentrated and there are single points of failure for retail payments in this country.

Financial Stability: Two banks originate more than 50% of ACH payments. That’s not a surprise because many payment companies rely on the same two. That means risk is concentrated and there are single points of failure for retail payments in this country.

10/11

I agreed with Fed Governor @laelbrainard when she suggested, “contrasting the US oversight framework for retail payment systems with other jurisdictions.”

I agreed with Fed Governor @laelbrainard when she suggested, “contrasting the US oversight framework for retail payment systems with other jurisdictions.”

11/11 She’s right. We’d discover this is a conversation we should be having in the US. Other countries and international orgs are focused on expanding direct payments access. We’re not. American consumers are worse off for it.

Lots of smart people have written about direct access for payments companies including @DanAwrey @DGorfine @jp_koning

And this might be of interest to those focused on payments policy like @Aarondklein @ZaringDavid @FintechDiego @JonahCrane and fintech thought leaders like @mikulaja @iankar_ @rshevlin @NikMilanovic

Read on Twitter

Read on Twitter