1/ With financial innovations such as #sustainablefinance and #impactinvesting increasingly viewed as key to the solution of current social and environmental crises, let’s take a look at how we got here, what might be problematic about that and what to do about it.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

2/ This is a thread about the empirical part of my book that traces the history of #socinv in the UK. I’ll leave the theoretical argument based on Fligstein & McAdam’s strategic action field theory & pragmatist action theory for another time. https://www.springer.com/gp/book/9783030060992">https://www.springer.com/gp/book/9...

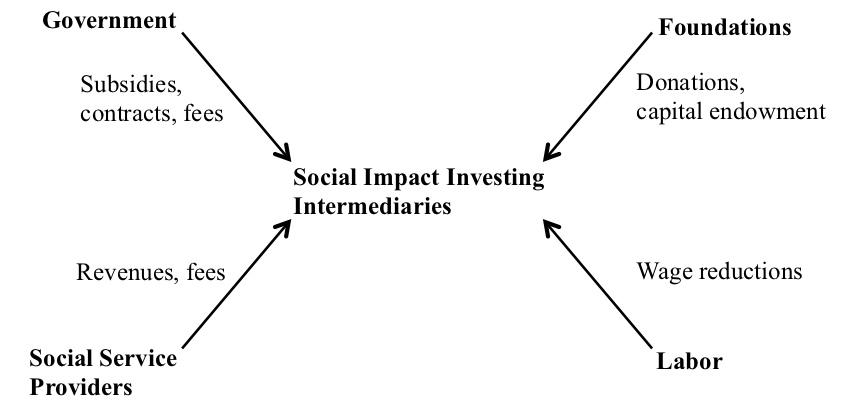

3/ Financial innovations such as #impinv or #socinv mean that firms succeed to make money from financial intermediation where they haven’t done before. To do so, these firms have to make others participate: investees wanting finance, gov to regulate (and often subsidize), etc.

4/ The first #socinv proponents found themselves in such a situation in the late 1990s. But although they needed support from nonfinancial actors such as charities and social orgs, until around 2005, they sought competition rather than cooperation.

5/ They attacked the voluntary sector for its “culture of philanthropy, paternalism and dependence”. Charities were, in their view, not focusing on wealth creation and, hence, not resolving poverty. In their view, social orgs should have used venture capital to build assets.

6/ Unsurprisingly, their strategy was rather unsuccessful. Charities and social orgs weren’t too keen on cooperating with emergent socinv funds, neither was central gov – despite socinv figurehead Ronald Cohen being a main donor to the Labour party & confidant of Gordon Brown.

7/ So in the early 2000s, they changed their framing and proposed the same solution – finance – for a different problem. They went from challenging charities to championing them, arguing charities’ activities were fine, but their lacking access to finance was holding them back.

8/ Meanwhile, Gordon Brown altered gov #evaluation of social service provision. Before, the focus was more on the nature of the providing organization. Now, Brown propelled a “Treasury view” which saw successful social policy as the value-for-money delivery of social #outcomes.

9/ Back in 2005, today’s differentiating signifiers #impact and #outcomes were unheard of in finance. In fact, this was New Labour policy discourse, which investors began importing to harvest a new financial opportunity: gov procurement. This saw the birth of #SIBs by 2007-10.

10/ BTW: Michelle Giddens, CEO of socinv fund Bridges, was the daughter of New Labour thought leader Anthony Giddens. Her father termed “social investment” as public investment into the labor force; she used the same term for private investment. https://www.theguardian.com/business/2009/nov/14/venture-capitalist-ethical-investments">https://www.theguardian.com/business/...

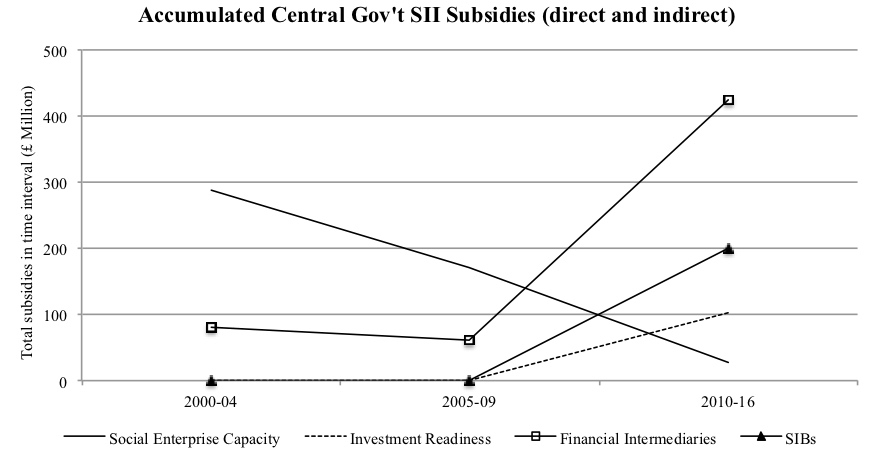

11/ Breakthrough came with the 2010 change of gov. Due to their ties with social orgs, investors labeled themselves as creators of outcomes, while claiming to lever in new funding for gov in #austerity. As a result, subsidies to investors exploded, and to social orgs declined.

12/ In contrast to investors’ imaginaries, the #politicaleconomy of impinv tells a different story. As these actors make money through financial intermediation, they set up various channels through which they redistribute funds towards themselves.

13/ What does this teach us? Financial innovators put in huge efforts to render finance digestible to others. They rely on opportunities from outside of fin, while using them may alter org identities. #financialization is a 2-way street btwn social skill & opportunity structures.

14/ Yet, finance as a solution to social problems works above all for finance itself, as it always entails new opportunities to make money from financial intermediation. Unless of course profit distribution is regulated, as for example in the French social and solidarity economy.

15/ So is it all bad? Not necessarily: sustainable finance does have the potential to improve our economy by making companies reduce social and environmental footprints. But it should know its place and stay out of what requires public solutions. See:

https://www.pioneerspost.com/news-views/20200519/beyond-metrics-how-impact-investing-all-its-forms-could-help-fight-the">https://www.pioneerspost.com/news-view...

https://www.pioneerspost.com/news-views/20200519/beyond-metrics-how-impact-investing-all-its-forms-could-help-fight-the">https://www.pioneerspost.com/news-view...

Read on Twitter

Read on Twitter