CBDC architectures, the financial system, and the central bank of the future: https://voxeu.org/article/cbdc-architectures-financial-system-and-central-bank-future

New">https://voxeu.org/article/c... @voxeu / @cepr_org column summarizing the motives for #CBDC issuance, possible architectures, and what they imply for the financial system. This column... [1/n]

New">https://voxeu.org/article/c... @voxeu / @cepr_org column summarizing the motives for #CBDC issuance, possible architectures, and what they imply for the financial system. This column... [1/n]

..updates our March 2020 @BIS_org QR article with what we have learned since: https://www.bis.org/publ/qtrpdf/r_qt2003j.htm">https://www.bis.org/publ/qtrp... There are three main lessons... [2/n]

1. with Covid19 and the associated decline in cash use, central banks’ core mandate to provide a resilient and universally accepted means of payment for the digital era has come to the fore. A concern is that in a cashless economy, a financial crisis could create havoc. [3/n]

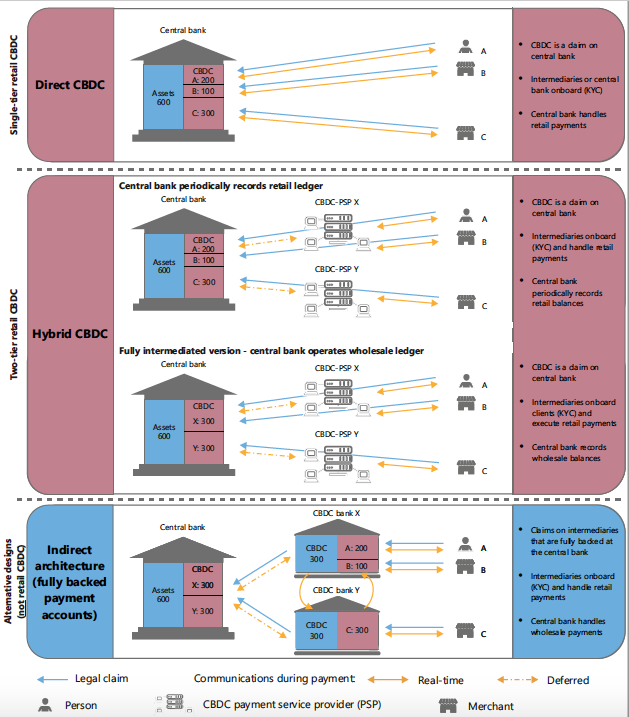

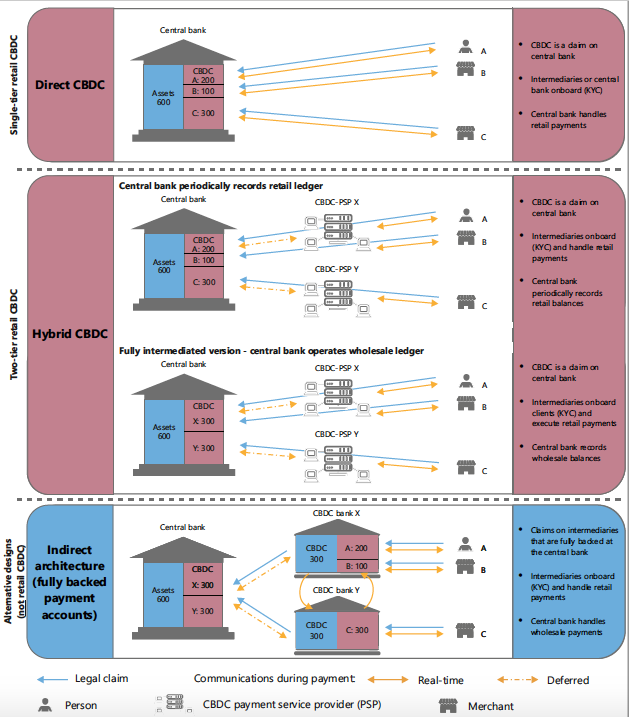

At the same time, a CBDC should by no means displace the private sector. We need to look for architectures that come with enhanced resilience and easy accessibility, while at the same time giving the private sector the primary role in the retail payment system.

2. On architectures, we have learned that many central banks argue that only direct claims on the central warrant the "CBDC" label. The indirect (or synthetic) architecture is thus no longer considered a CBDC (doesn& #39;t mean its a bad idea; its just a different category).

On architectures, we have further learned that some central bank shy away from knowing the retail data of consumers as this raises privacy concerns. We thus introduced the "intermediated" variant of the hybrid CBDC. Here the CBDC only know wholesale balances.

3. This of course comes at a cost: the downside of an intermediated CBDC architecture is that the central bank needs to honor claims of which it has no record. Consequently, to safeguard cash-like credibility, PSPs would need close supervision. And this is the synthesis:

In the digital era, there is a novel trade-off for central banks: they can either operate complex technical infrastructures or complex supervisory regimes. There are many ways to do so, but all will require the central bank to develop substantial technological expertise.

Read on Twitter

Read on Twitter