1/ Thread: $ETSY 3Q’2020 update

A month ago, I published a deep dive on $ETSY.

At that time, I hoped ETSY will make a complete mockery of my reverse DCF, and guess what, they are doing exactly that!

https://mbi-deepdives.com/etsy-a-handmade-giant-in-the-passion-economy/">https://mbi-deepdives.com/etsy-a-ha...

A month ago, I published a deep dive on $ETSY.

At that time, I hoped ETSY will make a complete mockery of my reverse DCF, and guess what, they are doing exactly that!

https://mbi-deepdives.com/etsy-a-handmade-giant-in-the-passion-economy/">https://mbi-deepdives.com/etsy-a-ha...

2/ Assuming mid-point of their GMS guidance for Q4, its GMS this year will be ~3% higher than my 2021 GMS estimates. This year’s FCF will be close to my 2023 estimates.

LOL.

Here’s snapshot of this quarter+ YTD numbers.

LOL.

Here’s snapshot of this quarter+ YTD numbers.

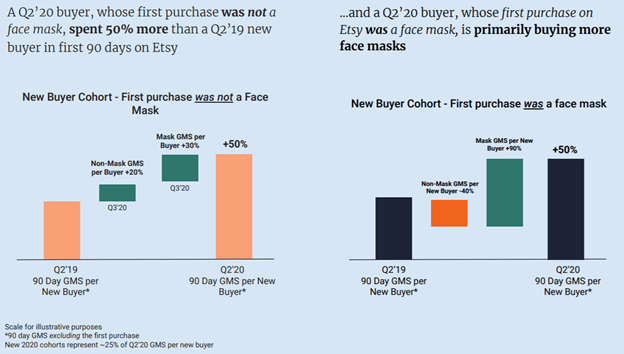

3/ Lots of interesting data points of buyers.

75% of current quarter’s GMS was from pre-covid buyer cohorts.

Non-mask GMS is +93%, but bit of a downer is people whose first buy was a mask are primarily buying only masks.

Mask is ~11% of total GMS and decelerating fast.

75% of current quarter’s GMS was from pre-covid buyer cohorts.

Non-mask GMS is +93%, but bit of a downer is people whose first buy was a mask are primarily buying only masks.

Mask is ~11% of total GMS and decelerating fast.

4/ Good news is Habitual buyers and repeat buyers, the two most important customer segments, are up +104% and +70% respectively.

5/ As expected, take rates continue to expand. <2% sellers opted out of offsite ads program. TTM GMS per active seller is +18%.

6/ The beauty of the marketplace model is you don’t have to predict what will sell in the future.

Your sellers are tweaking and iterating every minute to figure out exactly that.

The role of marketplace owner is to increase the awareness of the marketplace...

Your sellers are tweaking and iterating every minute to figure out exactly that.

The role of marketplace owner is to increase the awareness of the marketplace...

7/ ...and make the experience on the site seamless for the buyer.

So, what is $ETSY doing?

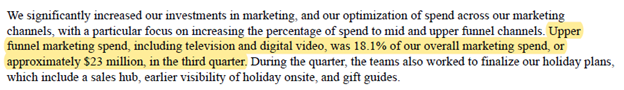

For the first time this year, they have gone beyond bottom of the funneling and started spending on TV ads to build awareness of the broader utility of the marketplace.

So, what is $ETSY doing?

For the first time this year, they have gone beyond bottom of the funneling and started spending on TV ads to build awareness of the broader utility of the marketplace.

10/ Why is the margin guidance lot weaker than the current quarter (34% adj. EBITDA margin)?

CFO explains why. FYI GMS from paid channel was 19% this year vs 14% in 3Q& #39;19.

CFO explains why. FYI GMS from paid channel was 19% this year vs 14% in 3Q& #39;19.

11/ CEO Josh Silverman ends the call with a nice 2-minute pitch on $ETSY.

As a shareholder, I gotta say now, “Great quarter, guys!”

As a shareholder, I gotta say now, “Great quarter, guys!”

End/ I will also cover $FB, $GOOG, and $AMZN call tomorrow.

All my twitter threads can be found here.

https://mbi-deepdives.com/twitter-threads/">https://mbi-deepdives.com/twitter-t...

All my twitter threads can be found here.

https://mbi-deepdives.com/twitter-threads/">https://mbi-deepdives.com/twitter-t...

Read on Twitter

Read on Twitter