Fossil Fuel Divestment is the responsible choice for @uwaterloo. The University is late to the party, but the cake is not yet cut.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> Here is my address to the Board of Governors - a thread. #divestUWaterloo

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> Here is my address to the Board of Governors - a thread. #divestUWaterloo

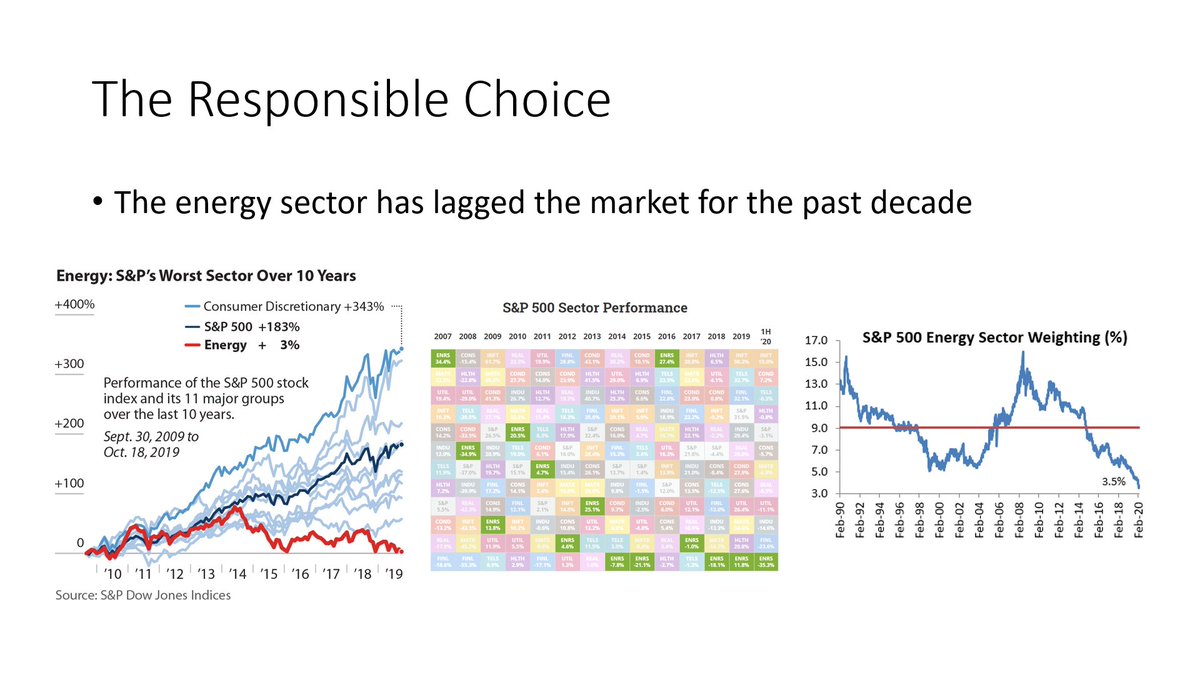

No surprise, the energy sector has struggled for nearly a decade. It& #39;s been the worst-performing sector on the S&P nearly every year since 2014 - and consequently, the weighting of energy equities has fallen, to a paltry 3.5% of the S&P today.

Simultaneously, fossil-free indexes have proved to be competitive. The MSCI ex-fossil-fuels fund, for example, outperformed its benchmark by 113 points over the last 3 years and 248 points over the last year.

Universities have also benefited from divesting. Berkley added $2.4 billion in value since 2014 while making no new investments in fossil fuels + divesting from coal and the oil sands. UBC& #39;s sustainable futures fund also outperformed its policy benchmark by 148 points.

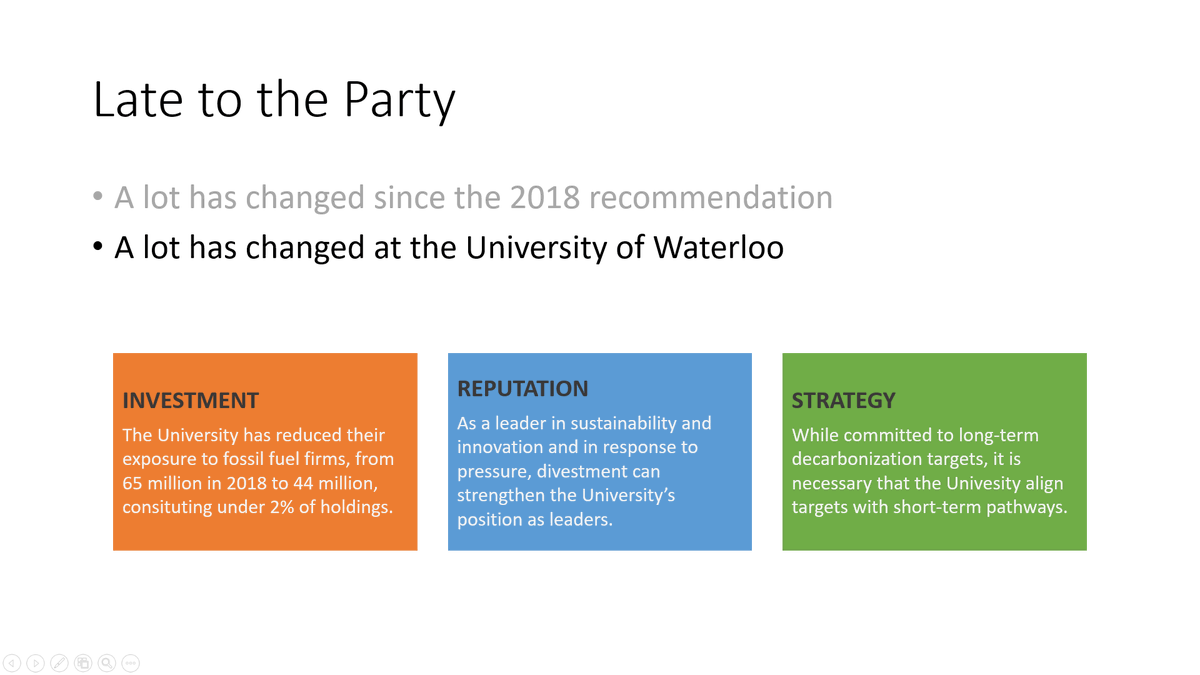

Since the decision to *not* divest in 2018 - global commitments have nearly doubled to $14.5T AUM. Canadian universities including neighbours Guelph and Queens, alongside major investors, lenders, insurers, and industry have all begun distancing themselves from fossil fuels.

Credit where credit is due - uWaterloo has made strides on incorporating ESG into investment decisions and has reduced their exposure to fossil fuel stocks from $65M to $44M (less than 2% of their entire portfolio). But more can be done toward decarbonizing their investments.

Given immense pressure from faculty, staff, and students, I believe a pledge to divest the remaining 2% of FF holdings can strengthen @UWaterloo position as a sustainability and innovation leader and offer a short term pathway to meeting their long term decarbonization targets.

Read on Twitter

Read on Twitter