Thread

How I managed my short strangles today and ended up in profit.

1) Overnight I had carried

-50 lots 24600 PE sold at 225

-50 lots 25000 CE sold at 170

As I had a bullish view for overnight and was expecting 24600 to hold.

#trading #OptionsTrading

How I managed my short strangles today and ended up in profit.

1) Overnight I had carried

-50 lots 24600 PE sold at 225

-50 lots 25000 CE sold at 170

As I had a bullish view for overnight and was expecting 24600 to hold.

#trading #OptionsTrading

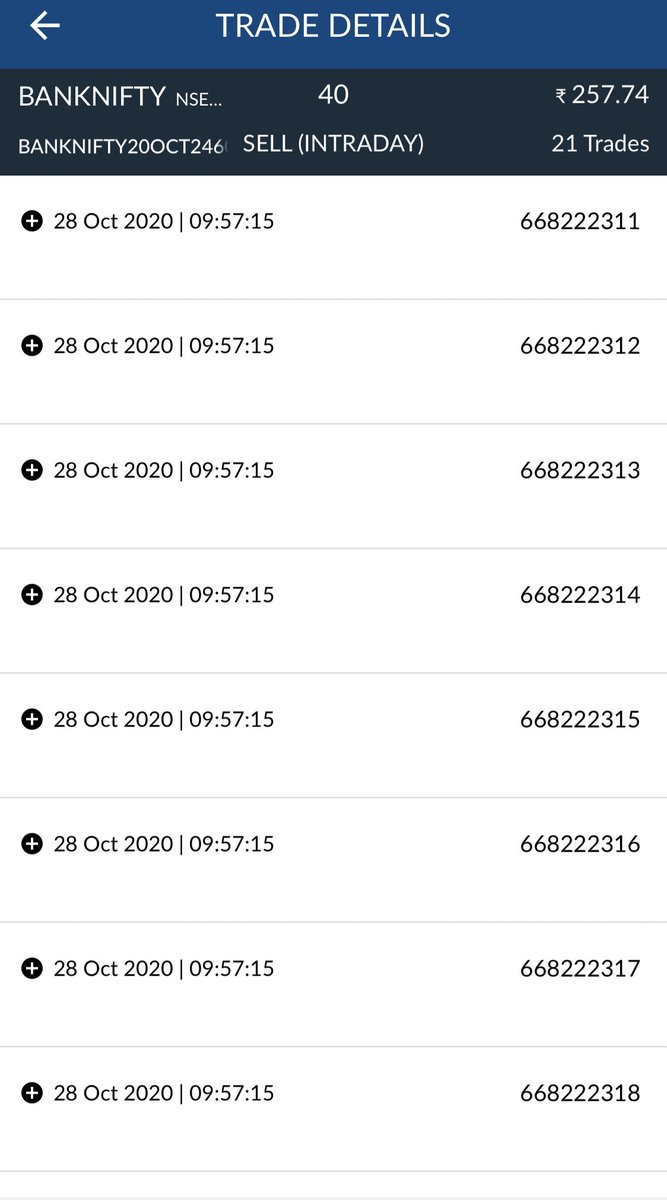

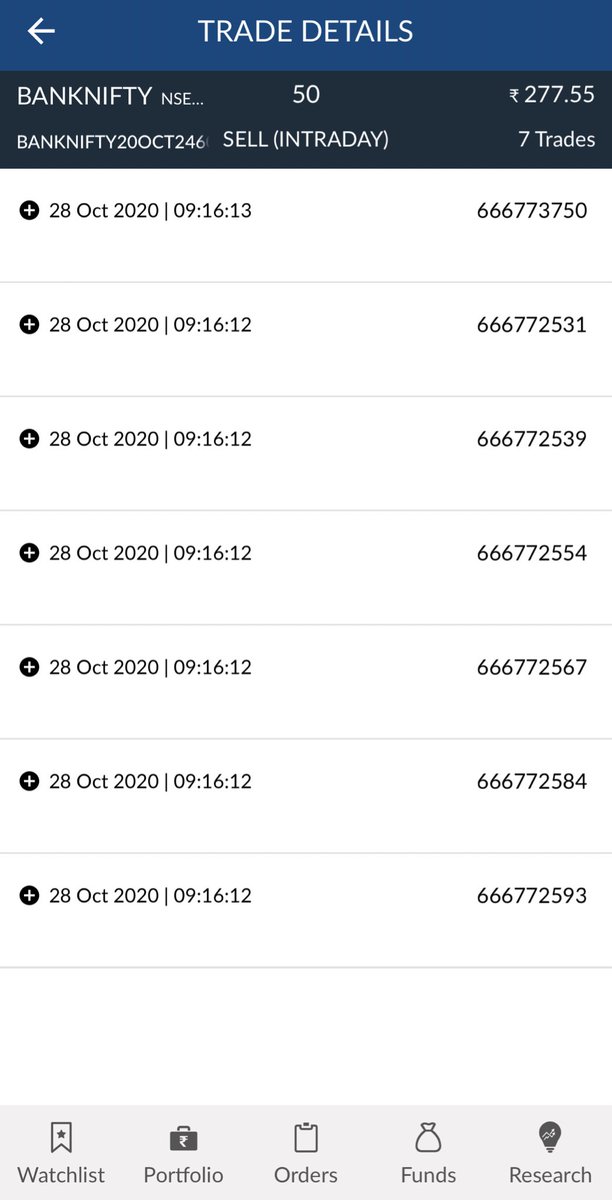

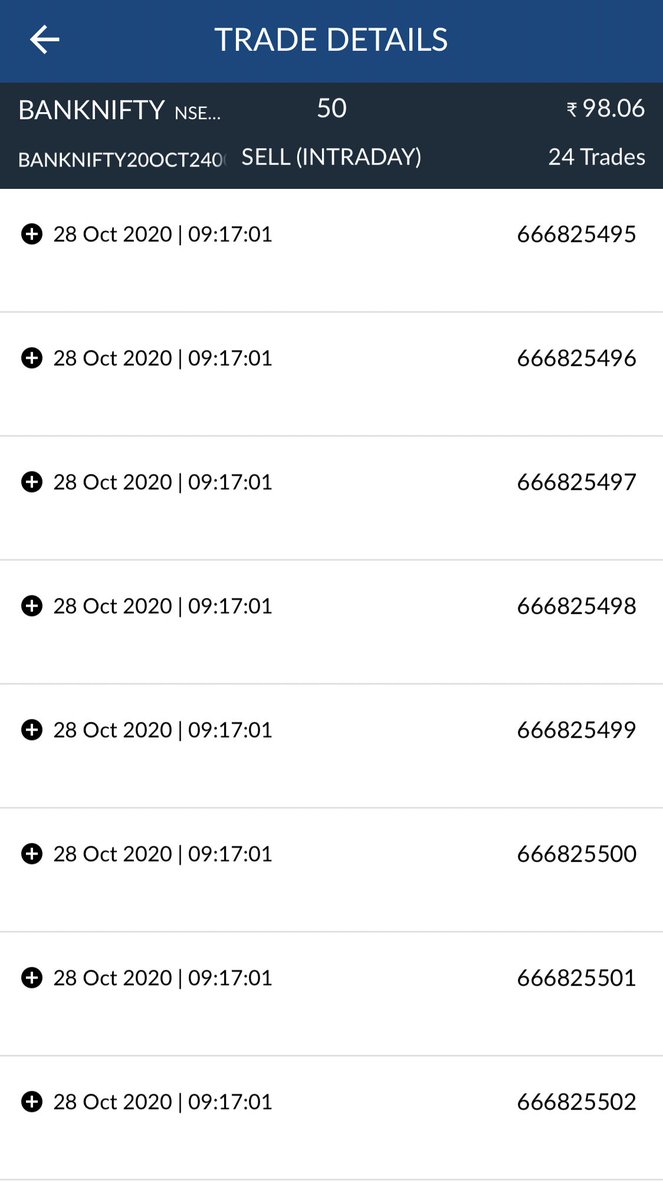

2) In the morning around 9:16 am sold additional

50 lots 24600 CE at 277 &

50 lots 24000 PE at 98

(Counter bearish strangle)

as bnf was down at 9:15 and to save my 24600 PE(overnight sell)

50 lots 24600 CE at 277 &

50 lots 24000 PE at 98

(Counter bearish strangle)

as bnf was down at 9:15 and to save my 24600 PE(overnight sell)

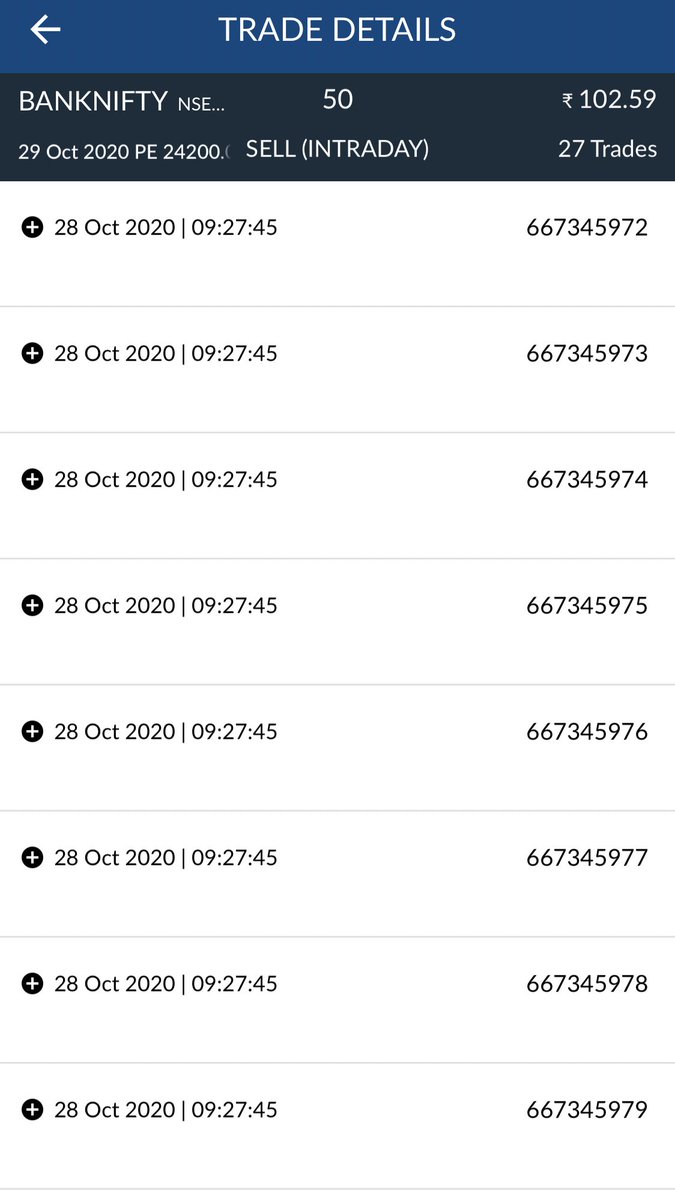

3.But in next 2 candles bnf spiked to 24800

so I sold additional

50 lots of 24200 PE at 102

and kept sell stoploss order on 50 lots of 25000 CE at 135 which got triggered after 5 mins https://abs.twimg.com/emoji/v2/... draggable="false" alt="😖" title="Verblüfftes Gesicht" aria-label="Emoji: Verblüfftes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😖" title="Verblüfftes Gesicht" aria-label="Emoji: Verblüfftes Gesicht">

Till now Bnf was very volatile with no clear range and my mtm was in red.

so I sold additional

50 lots of 24200 PE at 102

and kept sell stoploss order on 50 lots of 25000 CE at 135 which got triggered after 5 mins

Till now Bnf was very volatile with no clear range and my mtm was in red.

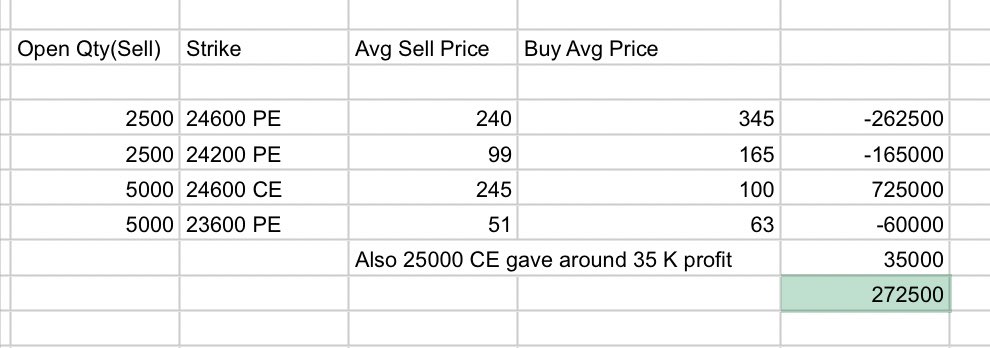

4) As bnf went below 24600

I rolled down entire 25000 CE to 24600 CE

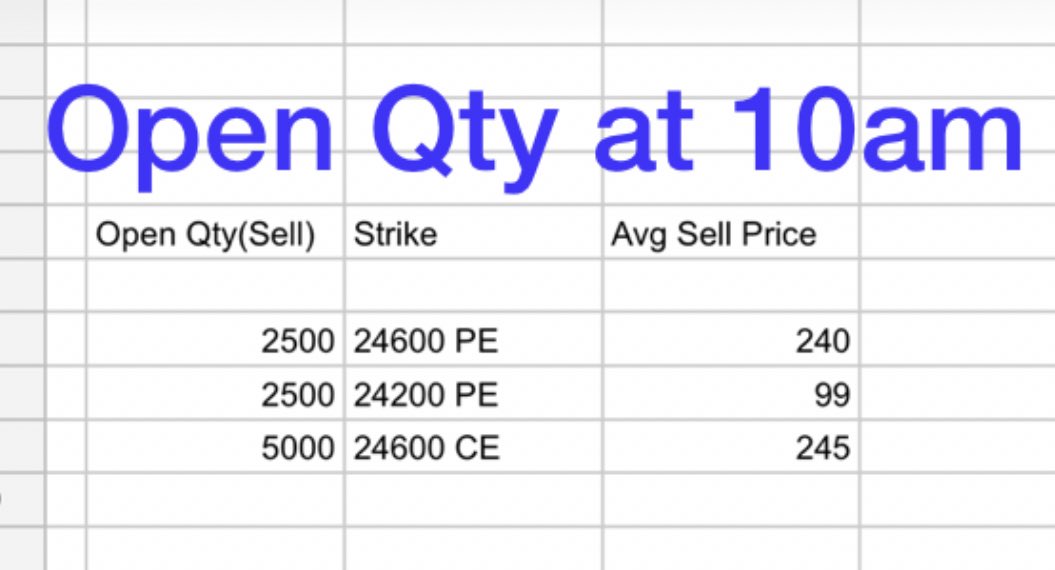

So at 10 am my open postions were:

100 lots sell 24600 PE at avg price of 240

100 Lots sell 24200 PE at avg price of 99

200 lots sell 24600 CE at avg price of 245

I rolled down entire 25000 CE to 24600 CE

So at 10 am my open postions were:

100 lots sell 24600 PE at avg price of 240

100 Lots sell 24200 PE at avg price of 99

200 lots sell 24600 CE at avg price of 245

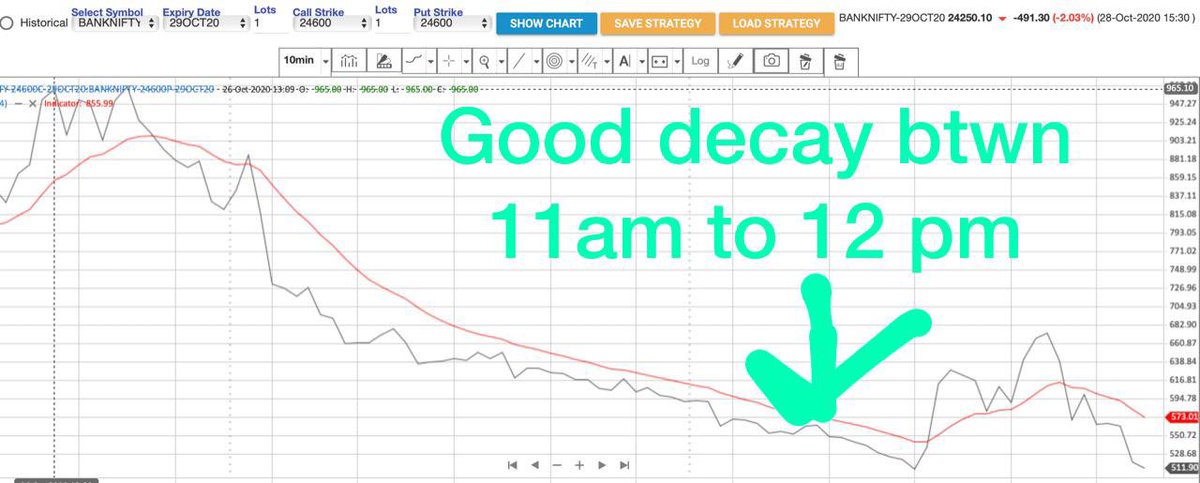

5) By 11:30 am bnf came back till 24600 and 24600 straddle had given good theta decay.

I was in decent profit till now.

I had kept SL in

24600 PE at 345 (10% above vwap)

And on

24200 PE sl was 165 (10% above vwap)

I was in decent profit till now.

I had kept SL in

24600 PE at 345 (10% above vwap)

And on

24200 PE sl was 165 (10% above vwap)

6) At 12:28 am my put side SL got hit and bnf was at day low.

So I sold 200 lots 23600 PE at 51 Rs ( as my view changes to bearish I sold a far away put with lower delta)

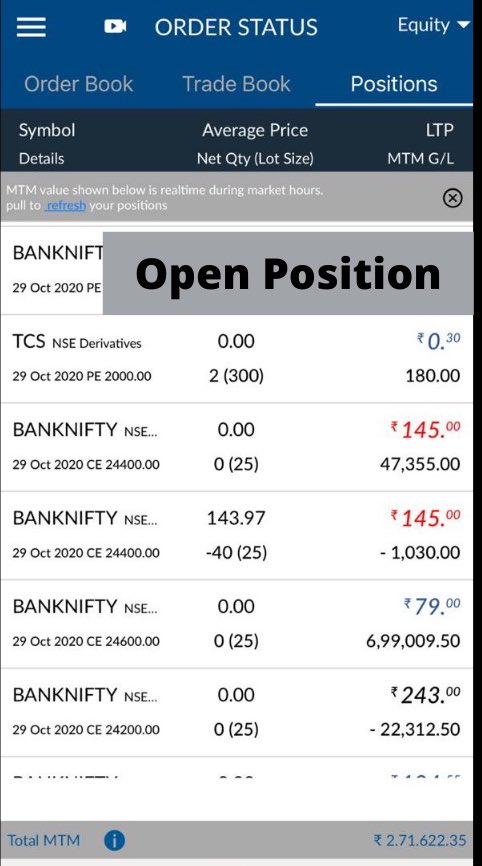

So current open positions :

-200 lots 23600 PE sold at 51

-200 lots 24600 CE sold at 245

So I sold 200 lots 23600 PE at 51 Rs ( as my view changes to bearish I sold a far away put with lower delta)

So current open positions :

-200 lots 23600 PE sold at 51

-200 lots 24600 CE sold at 245

7) At 2:20 my 24600 SL got hit at 100 due to upward spike and I exited 23600 PE simultaneously also at 63

8) So that’s how I managed my strangles and changed my view as per market direction and benefited both from theta as well as delta.

Oct month has been really difficult for sellers but it’s part of the game.

Just focus on the process and manage risk

Oct month has been really difficult for sellers but it’s part of the game.

Just focus on the process and manage risk

Read on Twitter

Read on Twitter

Till now Bnf was very volatile with no clear range and my mtm was in red." title="3.But in next 2 candles bnf spiked to 24800 so I sold additional50 lots of 24200 PE at 102and kept sell stoploss order on 50 lots of 25000 CE at 135 which got triggered after 5 minshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😖" title="Verblüfftes Gesicht" aria-label="Emoji: Verblüfftes Gesicht">Till now Bnf was very volatile with no clear range and my mtm was in red." class="img-responsive" style="max-width:100%;"/>

Till now Bnf was very volatile with no clear range and my mtm was in red." title="3.But in next 2 candles bnf spiked to 24800 so I sold additional50 lots of 24200 PE at 102and kept sell stoploss order on 50 lots of 25000 CE at 135 which got triggered after 5 minshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😖" title="Verblüfftes Gesicht" aria-label="Emoji: Verblüfftes Gesicht">Till now Bnf was very volatile with no clear range and my mtm was in red." class="img-responsive" style="max-width:100%;"/>