Fixed-rate lending is one of the most important primitives underpinning the global financial system

And yet it has been sorely lacking in DeFi... that is until recently

This is a big deal and here’s why https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

And yet it has been sorely lacking in DeFi... that is until recently

This is a big deal and here’s why

Not only do these instruments provide certainty for lenders/borrowers looking to accurately forecast their cost/return on capital

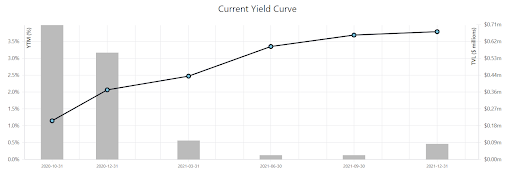

But it creates important derivative metrics that provide valuable insight into investor sentiment https://messari.io/article/the-yield-curve-cometh-why-fixed-rate-loans-in-crypto-matter?utm_source=jpurd17&utm_medium=thread&utm_campaign=curvecometh">https://messari.io/article/t...

But it creates important derivative metrics that provide valuable insight into investor sentiment https://messari.io/article/the-yield-curve-cometh-why-fixed-rate-loans-in-crypto-matter?utm_source=jpurd17&utm_medium=thread&utm_campaign=curvecometh">https://messari.io/article/t...

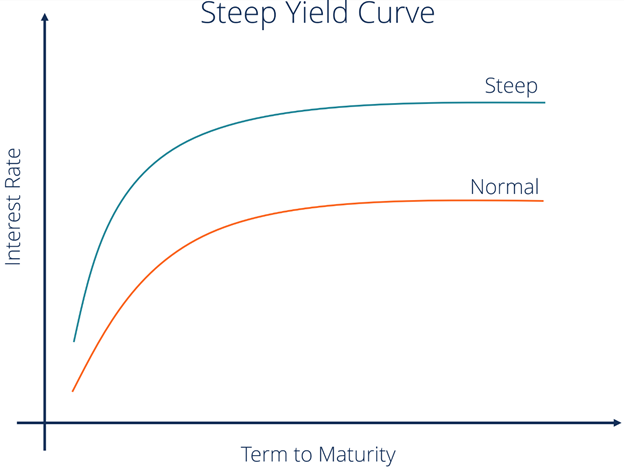

When the yield curve steepens it means lenders require a higher return to compensate them for locking up capital

This suggests that they expect there to be higher yielding opportunities elsewhere

Which translates to positive expectations for future growth

This suggests that they expect there to be higher yielding opportunities elsewhere

Which translates to positive expectations for future growth

On the flipside, when the curve flattens it shows lenders are comfortable with lower yields as the prospects for future growth aren& #39;t as bright

Taken to the extreme, when long-term maturities dip below short-term this is known as inversion

Taken to the extreme, when long-term maturities dip below short-term this is known as inversion

When the yield curve inverts it& #39;s because investors are willing to lock in low long-term rates as they expect a more severe downturn will lead central banks to lower rates

This indicator has predicted every recession in recent memory

This indicator has predicted every recession in recent memory

Translating this into cryptospeak…

Yield curves could steepen when the next big corporate announces a BTC purchase as it may mean we’re in the next bull market

Lenders will then a require higher return on capital since the opportunity cost of lending is higher

Yield curves could steepen when the next big corporate announces a BTC purchase as it may mean we’re in the next bull market

Lenders will then a require higher return on capital since the opportunity cost of lending is higher

Now if @BKBrianKelly starts shilling XRP on CNBC again then the market may feel the top is near and the curve may start flattening as investors would rather park stablecoins in a stable, low rate instrument

So who is seeing this vision of fixed-rate lending in crypto come to fruition?

The first instance came this summer with @UMAprotocol yield dollar

The first instance came this summer with @UMAprotocol yield dollar

Users can deposit ETh to mint up to 80% of the USD value in uUSD which is then redeemable for $1 of collateral at maturity

uUSD can then be sold on the market at a discount to anyone willing to wait for expiry to earn that premium

uUSD can then be sold on the market at a discount to anyone willing to wait for expiry to earn that premium

There are currently ~$23 million uUSD for the next Dec. expiry between he two collateral types

While this is a good start, it is obviously somewhat restricted given the single maturity

https://tools.umaproject.org/?address=0x3605Ec11BA7bD208501cbb24cd890bC58D2dbA56">https://tools.umaproject.org/...

While this is a good start, it is obviously somewhat restricted given the single maturity

https://tools.umaproject.org/?address=0x3605Ec11BA7bD208501cbb24cd890bC58D2dbA56">https://tools.umaproject.org/...

Based on the same whitepaper, Yield Protocol launched with a few key differences

Rather than being redeemable for $1 of collateral fyDai can be redeemed 1:1 with Dai as the collateral is automatically rolled into a @MakerDAO vault eliminating forced exposure to the collateral

Rather than being redeemable for $1 of collateral fyDai can be redeemed 1:1 with Dai as the collateral is automatically rolled into a @MakerDAO vault eliminating forced exposure to the collateral

fyDai also trades on its own custom AMM

Instead of naively charging a flat 0.01% the fee is based on the current interest rate and time to maturity ensuring its proportional to the interest received

This prevents a situation where users pay more in fees than interest received

Instead of naively charging a flat 0.01% the fee is based on the current interest rate and time to maturity ensuring its proportional to the interest received

This prevents a situation where users pay more in fees than interest received

Another soon to be launched protocol is @Mainframe_HQ which continues to build on this idea

They introduce the concept of a guarantor pool where users deposit Dai (or cDai, aDai, etc.) which sits ready to liquidate underwater loans

They introduce the concept of a guarantor pool where users deposit Dai (or cDai, aDai, etc.) which sits ready to liquidate underwater loans

This backstops the system and allows users another opportunity to earn yield

In addition, both guarantor and borrower collateral will be used for flash loans to further juice yields

In addition, both guarantor and borrower collateral will be used for flash loans to further juice yields

This is only the beginning.

We’re just now touching the surface of whats possible with fixed rate loans...

We’re just now touching the surface of whats possible with fixed rate loans...

In their mature state, we could see them included in interest rate algorithms for @compoundfinance money markets

Or used in tandem with @barn_bridge to price different tranches of debt

The possibilities are endless https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

Or used in tandem with @barn_bridge to price different tranches of debt

The possibilities are endless

What the first iteration of DeFi floating-rate lending did to interest-bearing accounts, leveraged trading etc...

These new fixed-rate products will do for all types of financial instruments were accustomed to as well as new ones enabled by this uniquely composable world of DeFi

These new fixed-rate products will do for all types of financial instruments were accustomed to as well as new ones enabled by this uniquely composable world of DeFi

Read on Twitter

Read on Twitter " title="Fixed-rate lending is one of the most important primitives underpinning the global financial system And yet it has been sorely lacking in DeFi... that is until recentlyThis is a big deal and here’s why https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="Fixed-rate lending is one of the most important primitives underpinning the global financial system And yet it has been sorely lacking in DeFi... that is until recentlyThis is a big deal and here’s why https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>