$APPS - A mobile powerhouse and CTV Darkhorse

A thread of one of our top holdings with earnings up this week

Overview

Digital Turbine provides their Ignite platform to mobile operators and OEMs (phone makers) in order monetize their Android mobile devices

A thread of one of our top holdings with earnings up this week

Overview

Digital Turbine provides their Ignite platform to mobile operators and OEMs (phone makers) in order monetize their Android mobile devices

App developers pay $APPS to get their apps in front of the end user, either through pre-install onto the device at activation or promotion of their app over the lifetime of the phone through a host of new products they have. Revenue is then split between $APPS, OEMs and carriers

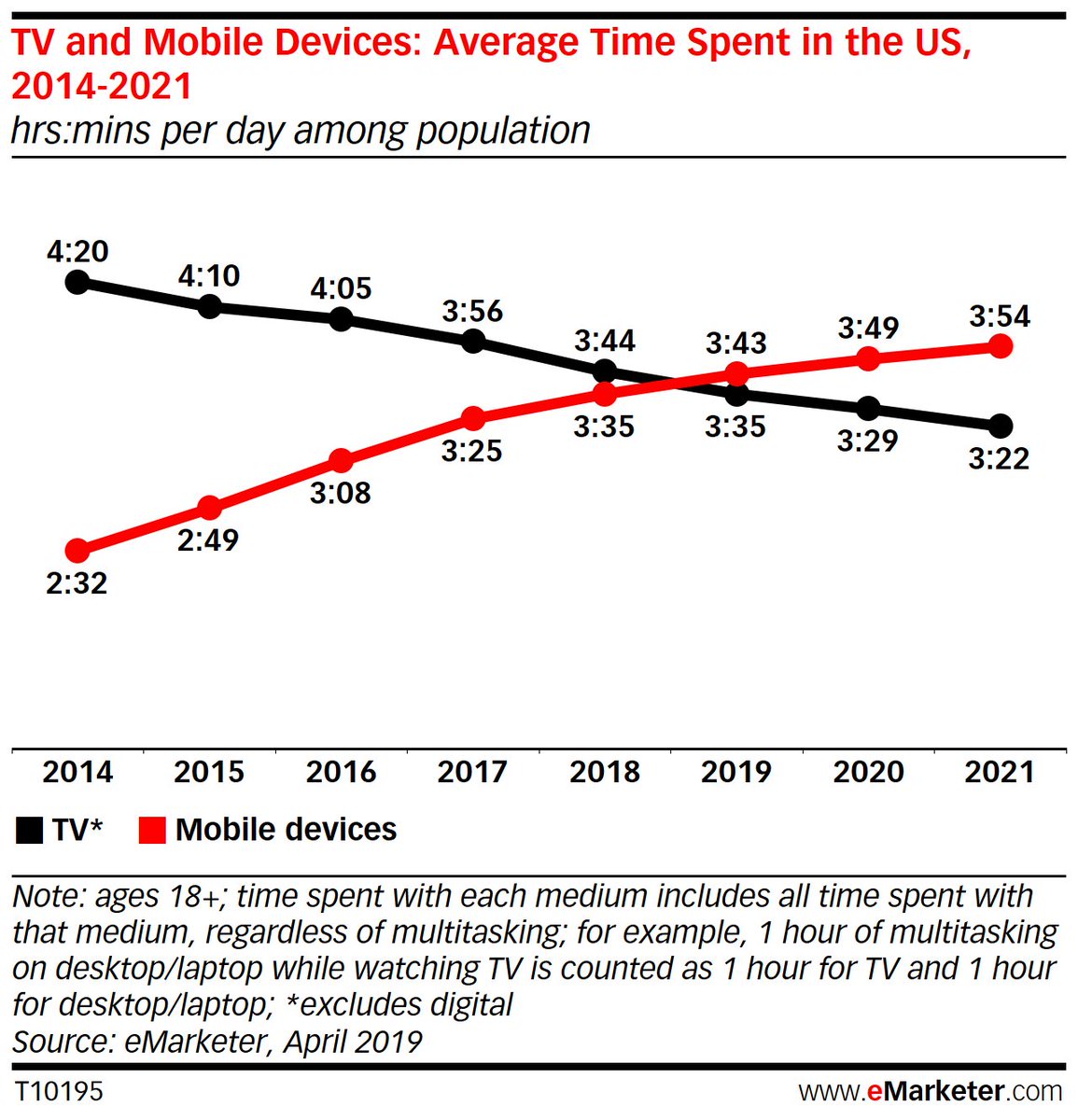

Shift to Mobile

- 2019 will be the first year that adults in the U.S. will spend more time on their mobile devices then watching TV.

-Since 2011 the number of who said they own a smartphone jumped from 35% to 81%

- U.S. smartphone users spend 90%of their phone time in apps

- 2019 will be the first year that adults in the U.S. will spend more time on their mobile devices then watching TV.

-Since 2011 the number of who said they own a smartphone jumped from 35% to 81%

- U.S. smartphone users spend 90%of their phone time in apps

App based Economy

U.S. smartphone users spend 90% of their phone time in apps. As of Sept 2020 their were 3.04 million apps in the Google play store. Competition is fierce to get your app in front of end users and developers are using $APPS to do it.

U.S. smartphone users spend 90% of their phone time in apps. As of Sept 2020 their were 3.04 million apps in the Google play store. Competition is fierce to get your app in front of end users and developers are using $APPS to do it.

Why Developers like it?

Competition for app adoption is fierce and developers want the most cost effective way to get their app in front of as many users as possible. $APPS allows developers to develop their own programmatic advertising campaign that provides actionable ROI.

Competition for app adoption is fierce and developers want the most cost effective way to get their app in front of as many users as possible. $APPS allows developers to develop their own programmatic advertising campaign that provides actionable ROI.

Why operators/OEMs like it?

$APPS provides them with a platform to further monetize their mobile devices at no cost to themselves. To develop this on their own would cost time, people and money. Large operators are slow to innovate and $APPS allows to boost revenue easily.

$APPS provides them with a platform to further monetize their mobile devices at no cost to themselves. To develop this on their own would cost time, people and money. Large operators are slow to innovate and $APPS allows to boost revenue easily.

Growth Opportunities

International expansion continues to see strong growth +50% last quarter lead by partnerships such as Samsung. Considering $APPS was installed on 13M Samsung devices in the quarter and Samsung sold 296M phones in 2019 there is plenty of growth left with ...

International expansion continues to see strong growth +50% last quarter lead by partnerships such as Samsung. Considering $APPS was installed on 13M Samsung devices in the quarter and Samsung sold 296M phones in 2019 there is plenty of growth left with ...

...Samsung alone. Not to mention other partnerships with Telefonica, America Movil, Xiaomi and others. As of the June quarter management said they were only on 15% of Android devices globally so they are far from the ceiling when it comes to international growth.

Connected TV

Last quarter management announced the expansion of their platform to power over the top TV streaming. Specifically having their platform power the the OTT offerings of all the major U.S. mobile operators such as AT&T, Verizon and T-Mobile. This move into....

Last quarter management announced the expansion of their platform to power over the top TV streaming. Specifically having their platform power the the OTT offerings of all the major U.S. mobile operators such as AT&T, Verizon and T-Mobile. This move into....

...connected TV has been something I’ve been begging for them to do for some time and something that thing have hinted at for years now, so it’s exciting to see it happening. This will have $APPS competing with giants in the space like $ROKU, $AMZN and $AAPL. Stiff competition...

... and $APPS is way behind the pack but I believe that they carve out a nice piece of the CTV pie. Their key will be leveraging their partnerships, specifically with Samsung and Xiaomi which accounted for 19.8% and 5.8% of the global TV market share in units sold. Getting...

...their platform on the devices of these two partners in addition other operators and OEMs will hopefully allow $APPS to swim with the other big CTV fish. In the end what the move to CTV highlights is the the optionality of the business something I don’t think is being priced in

Single Tap

One of $APPS additional application products is Single Tap, which allows users to download an application from an ad without taking them from their current application to the Google Play store. You simply tap the ad, a pop up will appear to install, press that and the

One of $APPS additional application products is Single Tap, which allows users to download an application from an ad without taking them from their current application to the Google Play store. You simply tap the ad, a pop up will appear to install, press that and the

app will begin to download in the background. This is a much more frictionless way for users to download the app. In recent quarters many high profile apps such as Pinterest, Twitter and Epic Games have adopted Single Tap and I’m excited to how it’s adoption continues to grow.

Risks: Client concentration

The concentration of revenue among the big U.S. operator has been a common criticism of $APPS and one that probably keeps many from investing. However I believe that this concern is overblown. First, the the end of the March quarter...

The concentration of revenue among the big U.S. operator has been a common criticism of $APPS and one that probably keeps many from investing. However I believe that this concern is overblown. First, the the end of the March quarter...

revenue from their initial 4 US partners was 50%. This was down from 90% of revenue in FY19. With the Samsung partnership in its early innings and international growth flying that concentration should continue to fall.

Risk #2: Revenue reliant on cellphone sales

This has caused shareholders trouble in the past when cell phone sales did not meet expectations, causing the stock to cell off. Due to this management has focused on product diversification which was aided by the Mobile Posse...

This has caused shareholders trouble in the past when cell phone sales did not meet expectations, causing the stock to cell off. Due to this management has focused on product diversification which was aided by the Mobile Posse...

...acquisition, focus on the content businesses and development of products such as Single Tap. As of last Q dynamic installs for 60% of revenue down from 85% the year prior. So it is trending in the right direction.

Things I’ll be looking for in the ER this week:

- Rollout and future plans for CTV

- International growth

- Can they maintain RPD in the US (+25% last Q)

- Single Tap growth

- New partnerships

- Organic rev growth without Mobile Posse

- Customer and product diversification

- Rollout and future plans for CTV

- International growth

- Can they maintain RPD in the US (+25% last Q)

- Single Tap growth

- New partnerships

- Organic rev growth without Mobile Posse

- Customer and product diversification

$APPS has fallen almost 35% from all time highs of a few weeks ago. Of course this was after a massive run this year leading into October. Having owned this stock for a couple years now, drops like this one are not uncommon so allocate accordingly and know your pain tolerance.

Read on Twitter

Read on Twitter