1/ HEY CRYPTO LAWYERS: buckle in bc a big piece of US #crypto regulatory puzzle fell in place yesterday. Culminates >2yr process, coordinating w/ SEC & other regulators, to clarify " #qualifiedcustodian." #NoActionLetter by #Wyoming Banking Division https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤠" title="Cowboy hat face" aria-label="Emoji: Cowboy hat face">here:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤠" title="Cowboy hat face" aria-label="Emoji: Cowboy hat face">here:

https://docs.google.com/viewer?a=v&pid=sites&srcid=d3lvLmdvdnxiYW5raW5nfGd4OjU2MDk2ZGQyYjg1ZDUzYTc">https://docs.google.com/viewer...

https://docs.google.com/viewer?a=v&pid=sites&srcid=d3lvLmdvdnxiYW5raW5nfGd4OjU2MDk2ZGQyYjg1ZDUzYTc">https://docs.google.com/viewer...

2/ Here& #39;s an article from @ForbesCrypto& #39;s @AndreaTinianow & a post from McDermott Will & Emery, the attorneys who obtained the letter for @TwoOceanTrust of #Wyoming.

So...WHAT DOES IT REALLY MEAN??? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://www.mwe.com/media/mcdermott-obtains-landmark-no-action-relief-for-two-ocean-trust-concerning-digital-asset-custody/">https://www.mwe.com/media/mcd... #199c4d3f5bb3">https://www.forbes.com/sites/andreatinianow/2020/10/27/two-ocean-trust-receives-first-ever-regulatory-clearance-from-a-banking-regulator-to-operate-as-a-qualified-custodian-for-digital-assets/ #199c4d3f5bb3">https://www.forbes.com/sites/and...

So...WHAT DOES IT REALLY MEAN???

https://www.mwe.com/media/mcdermott-obtains-landmark-no-action-relief-for-two-ocean-trust-concerning-digital-asset-custody/">https://www.mwe.com/media/mcd... #199c4d3f5bb3">https://www.forbes.com/sites/andreatinianow/2020/10/27/two-ocean-trust-receives-first-ever-regulatory-clearance-from-a-banking-regulator-to-operate-as-a-qualified-custodian-for-digital-assets/ #199c4d3f5bb3">https://www.forbes.com/sites/and...

3/ Follow along! Under SEC Custody Rule & SEC Customer Protection Rule, #RIAs (Registered Investment Advisers) & investment managers must hire a #qualifiedcustodian to store customers& #39; assets.

But traditional custody banks can& #39;t/won& #39;t touch #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> & other #crypto right now.

https://abs.twimg.com/hashflags... draggable="false" alt=""> & other #crypto right now.

But traditional custody banks can& #39;t/won& #39;t touch #bitcoin

4/ So, how can RIAs & asset managers offer #crypto to their clients, if custody banks won& #39;t provide the service? Until v recently the ONLY option was to use a trust company as custodian. But #Wyoming for the save! It started chartering banks & gave a trust co a #NoActionLetter. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤠" title="Cowboy hat face" aria-label="Emoji: Cowboy hat face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤠" title="Cowboy hat face" aria-label="Emoji: Cowboy hat face">

5/ Key point: liability for an #RIA or asset manager is HUGE if something goes wrong & a court finds their custodian *WASN& #39;T ACTUALLY* a #qualifiedcustodian. How can an #RIA/asset mgr manage this liability risk? Hire a bank as custodian, or hire a trust co w/ #NoActionLetter.

6/ AGAIN, I can& #39;t stress enuf how #Wyoming has helped pave way for US institutional investors to invest in #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> & #crypto. (This liability issue was big, bc many fiduciaries have personal liab for their decisions--esp in pensions--so they just can& #39;t take legal uncertainty.)

https://abs.twimg.com/hashflags... draggable="false" alt=""> & #crypto. (This liability issue was big, bc many fiduciaries have personal liab for their decisions--esp in pensions--so they just can& #39;t take legal uncertainty.)

7/ So, #RIAs/asset mgrs will likely gravitate to custodians that give more legal certainty that they are indeed #qualifiedcustodians.

Which custodians can give that?

* banks can

* #Wyoming #SPDI banks can https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤠" title="Cowboy hat face" aria-label="Emoji: Cowboy hat face">(Kraken+hopefully Avanti soon!

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤠" title="Cowboy hat face" aria-label="Emoji: Cowboy hat face">(Kraken+hopefully Avanti soon! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤞" title="Crossed fingers" aria-label="Emoji: Crossed fingers">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤞" title="Crossed fingers" aria-label="Emoji: Crossed fingers">)

* @TwoOceanTrust can (see its letter).

Which custodians can give that?

* banks can

* #Wyoming #SPDI banks can

* @TwoOceanTrust can (see its letter).

8/ But what about all the other trust companies in #crypto?  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

Read the details in the #NoActionLetter--most prob aren& #39;t #qualifiedcustodians. To be clear that letter applies only in #Wyoming, but you& #39;d be crazy if you think it won& #39;t have broad reach beyond Wyoming, bc it is...

Read the details in the #NoActionLetter--most prob aren& #39;t #qualifiedcustodians. To be clear that letter applies only in #Wyoming, but you& #39;d be crazy if you think it won& #39;t have broad reach beyond Wyoming, bc it is...

9/ ...literally the roadmap for attorneys advising #RIAs & asset mgrs to use in determining if their custodian is actually a #qualifiedcustodian. Big law firm (McDermott Will & Emery) obtained it. Yep, other key regulators were consulted. Its reach will go far beyond #Wyoming.

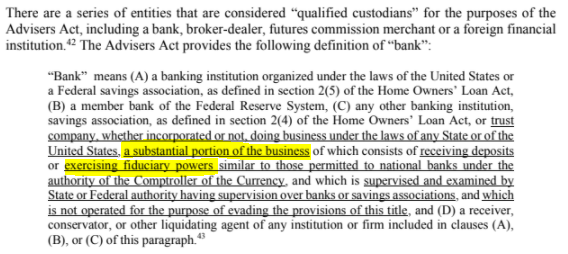

10/ What it DOESN& #39;T mean, tho, is that all trust cos fail to qualify. Here& #39;s the standard--a trust co is a #qualifiedcustodian as long as "a substantial portion" of its biz involves "exercising fiduciary powers similar to those permitted to national banks" as defined by the OCC.

11/ So a "substantial portion" of a trust co& #39;s biz must involve exercising fiduciary powers (which means exercising discretion over customer assets). The OCC takes position that custody isn& #39;t a fiduciary activity bc custody doesn& #39;t involve exercise of discretion (see the letter).

12/ So that means a trust co likely must PROVE to #RIAs/asset mgrs that a "substantial portion" of its biz involves activity other than custody where it exercises discretion.

Here& #39;s the rub tho. In the fine print, most trust cos EXPRESSLY SAY THEY ARE NOT FIDUCIARIES (!!!)

Here& #39;s the rub tho. In the fine print, most trust cos EXPRESSLY SAY THEY ARE NOT FIDUCIARIES (!!!)

13/ And if a trust co isn& #39;t a fiduciary for a "substantial portion" of its biz, then it& #39;s not a #qualifiedcustodian & the #RIAs or asset mgrs will probably need to find a different custodian that is.

Next, what does "substantial" mean? The letter goes into detail.

Next, what does "substantial" mean? The letter goes into detail.

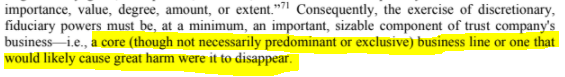

14/ "Substantial" isn& #39;t "necessarily predominant or exclusive"...but the trust co& #39;s fiduciary activity must be a "core" business of the trust co that "...would likely cause great harm were it to disappear."

Confusing?? In the next tweet, I& #39;ll summarize.

Confusing?? In the next tweet, I& #39;ll summarize.

15/ SUMMARY:

* if a trust co doesn& #39;t act as a fiduciary at all, then it& #39;s not a #qualifiedcustodian. Period.

* if a trust co does have some fiduciary activities in addition to #crypto custody, then the test is whether those fiduciary activities are "substantial" to the trust co.

* if a trust co doesn& #39;t act as a fiduciary at all, then it& #39;s not a #qualifiedcustodian. Period.

* if a trust co does have some fiduciary activities in addition to #crypto custody, then the test is whether those fiduciary activities are "substantial" to the trust co.

16/ I& #39;ve long suspected most of the trust cos formed in #crypto in past ~5+ yrs wouldn& #39;t pass the #qualifiedcustodian test, bc they aren& #39;t acting as fiduciaries in a "substantial" portion of their biz. @TwoOceanTrust is, tho, as the letter makes clear. It has a "golden ticket..."

17/ ...in the form of that #NoActionLetter. For all other trust cos, the test will be fact-specific & the burden is on the trust cos to prove they qualify. #RIAs/asset managers will start asking trust cos to provide disclosure on how "substantial" their fiduciary activities are.

18/ Now that banks are in the #crypto custody biz + one trust co has a #NoActionLetter, many #RIAs & asset mgrs just won& #39;t take legal risk of using a trust co that doesn& #39;t have such a letter.

A "gold standard" in #crypto custody used to be a trust charter. But the puck moved.

A "gold standard" in #crypto custody used to be a trust charter. But the puck moved.

19/ Now, banks are in #crypto custody ( #SPDIs are already here; OCC-chartered banks are on the way too (when the OCC is ready to supervise #digitalassets).

Next, ponder this: why do you think the big custodians in securities markets are banks, not trust cos? I think 4 reasons:

Next, ponder this: why do you think the big custodians in securities markets are banks, not trust cos? I think 4 reasons:

20/

i. banks are #qualifiedcustodians by def& #39;n,

ii. banks can access Fed liquidity,

iii. banks are much better capitalized, audited & subject to much more frequent supervisory exams, &

iv. banks offer customers clearer asset segregation protection in bankruptcy than trust cos.

i. banks are #qualifiedcustodians by def& #39;n,

ii. banks can access Fed liquidity,

iii. banks are much better capitalized, audited & subject to much more frequent supervisory exams, &

iv. banks offer customers clearer asset segregation protection in bankruptcy than trust cos.

21/ TO SUM UP, an unclear area of US #crypto regulation ( #qualifiedcustodian) just got much-needed clarification, just in time for the wave of #RIAs & other institutional investors now buying #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> for their customers. That& #39;s awesome for #crypto!

https://abs.twimg.com/hashflags... draggable="false" alt=""> for their customers. That& #39;s awesome for #crypto!

22/ NONE OF THIS IS LEGAL ADVICE! Talk to your own attorneys. Read the #NoActionLetter. Call #Wyoming (note its #SPDI charter has been open to applicants for 1yr).

And be sure to thank WY for this clarification, which will help bring more institutional investors into #crypto! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤠" title="Cowboy hat face" aria-label="Emoji: Cowboy hat face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤠" title="Cowboy hat face" aria-label="Emoji: Cowboy hat face">

And be sure to thank WY for this clarification, which will help bring more institutional investors into #crypto!

Read on Twitter

Read on Twitter here: https://docs.google.com/viewer..." title="1/ HEY CRYPTO LAWYERS: buckle in bc a big piece of US #crypto regulatory puzzle fell in place yesterday. Culminates >2yr process, coordinating w/ SEC & other regulators, to clarify " #qualifiedcustodian." #NoActionLetter by #Wyoming Banking Divisionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤠" title="Cowboy hat face" aria-label="Emoji: Cowboy hat face">here: https://docs.google.com/viewer..." class="img-responsive" style="max-width:100%;"/>

here: https://docs.google.com/viewer..." title="1/ HEY CRYPTO LAWYERS: buckle in bc a big piece of US #crypto regulatory puzzle fell in place yesterday. Culminates >2yr process, coordinating w/ SEC & other regulators, to clarify " #qualifiedcustodian." #NoActionLetter by #Wyoming Banking Divisionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤠" title="Cowboy hat face" aria-label="Emoji: Cowboy hat face">here: https://docs.google.com/viewer..." class="img-responsive" style="max-width:100%;"/>