While the U.S. #election conversation will dominate #investor attention for at least the next couple weeks, for those with long-term #investment time horizons, we think the secular (more tectonic) shifts underway in the #economy warrant much greater consideration.

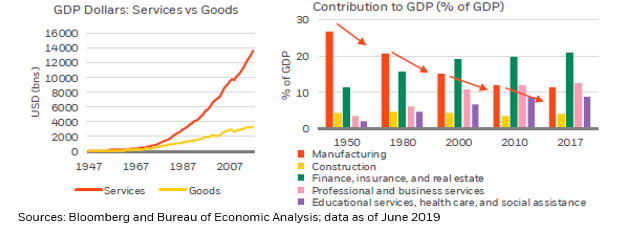

A case in point, the transition of the #economy away from #goods production and toward #services has been incredibly dramatic in recent decades and permeates virtually all categories of the #economic landscape: employment, wages, #income, consumption, #inflation and #investment.

Indeed, the growth of services consumption has not been negative once since the #GreatDepression, while goods consumption has witnessed six declines into negative territory since then.

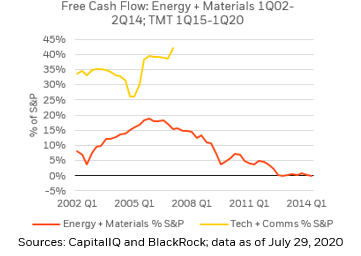

Further, the rise of highly #productive and scalable #technology platform firms is delivering #financial results unlike those seen in prior cycles, and that is only likely to accelerate in the current context of our #Covid-impacted #economy.

We can see this evolution most readily in the actions of firms across virtually all #industries, many of which are embracing #technological and services-led business-model solutions to the current #economic crisis, which mainly accelerated trends already firmly in place.

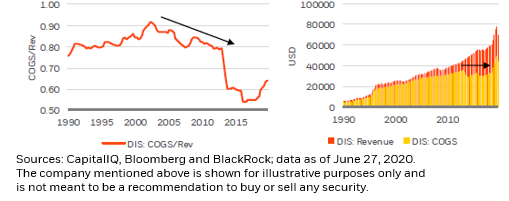

For instance, @Disney has announced a major reorg that places online #streaming as its “primary focus” for entertainment, since the in-person theme park business struggles with the #pandemic. #Tech-driven efficiencies could stabilize costs, while allowing #revenue to grow.

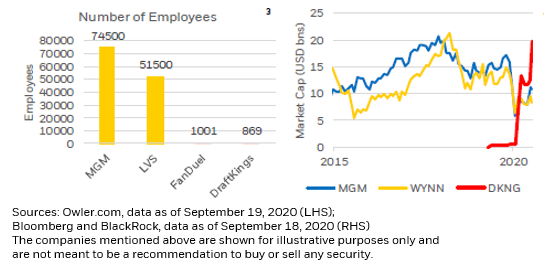

Likewise, a similar dynamic is at play as the brick-and-mortar #gaming #business attempts to fend off #online competitors, where business models are intrinsically #AssetLight and lower cost. This holds major implications for employment too.

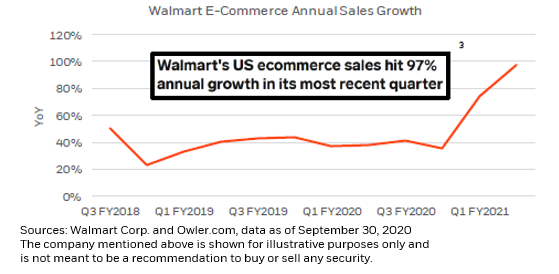

Finally, this trend can perhaps be witnessed most dramatically in the #investment and success @Walmart has had in swiftly expanding into #ecommerce, where #sales recently hit 97% year-on-year growth.

Read on Twitter

Read on Twitter