Operates an Electronic Trading Platform for credit markets

Sales reached $ 184B in Q2 ’20

Here is an EASY thread

$MKTX MarketAxess was founded in 2000 by Richard McVey  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👤" title="Silhouette einer Büste" aria-label="Emoji: Silhouette einer Büste"> It began by trading investment-grade corporate bonds

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👤" title="Silhouette einer Büste" aria-label="Emoji: Silhouette einer Büste"> It began by trading investment-grade corporate bonds  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📃" title="Seite mit Eselsohr" aria-label="Emoji: Seite mit Eselsohr">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📃" title="Seite mit Eselsohr" aria-label="Emoji: Seite mit Eselsohr">

It also provided investors access to new issues and research https://abs.twimg.com/emoji/v2/... draggable="false" alt="📑" title="Lesezeichen" aria-label="Emoji: Lesezeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📑" title="Lesezeichen" aria-label="Emoji: Lesezeichen">

It also provided investors access to new issues and research

In 2001, it acquired Trading Edge Inc  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛍" title="Einkaufstaschen" aria-label="Emoji: Einkaufstaschen"> A company that enables investors to buy and sell bonds online

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛍" title="Einkaufstaschen" aria-label="Emoji: Einkaufstaschen"> A company that enables investors to buy and sell bonds online  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧾" title="Receipt" aria-label="Emoji: Receipt">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧾" title="Receipt" aria-label="Emoji: Receipt">

Today, $MKTX operates an online trading platform https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> that enables institutional investors

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> that enables institutional investors  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏢" title="Bürogebäude" aria-label="Emoji: Bürogebäude"> and broker-dealers to trade corporate bonds

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏢" title="Bürogebäude" aria-label="Emoji: Bürogebäude"> and broker-dealers to trade corporate bonds  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📑" title="Lesezeichen" aria-label="Emoji: Lesezeichen"> and other fixed-income instruments

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📑" title="Lesezeichen" aria-label="Emoji: Lesezeichen"> and other fixed-income instruments

Today, $MKTX operates an online trading platform

According to Bloomberg  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗞" title="Eingerollte Zeitung" aria-label="Emoji: Eingerollte Zeitung"> In 2018, it held around 85% of the electronic bond trading market

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗞" title="Eingerollte Zeitung" aria-label="Emoji: Eingerollte Zeitung"> In 2018, it held around 85% of the electronic bond trading market  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> Representing around 20% of all corporate bond trading volume in the USA

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> Representing around 20% of all corporate bond trading volume in the USA  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇺🇸" title="Flagge der Vereinigten Staaten" aria-label="Emoji: Flagge der Vereinigten Staaten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇺🇸" title="Flagge der Vereinigten Staaten" aria-label="Emoji: Flagge der Vereinigten Staaten">

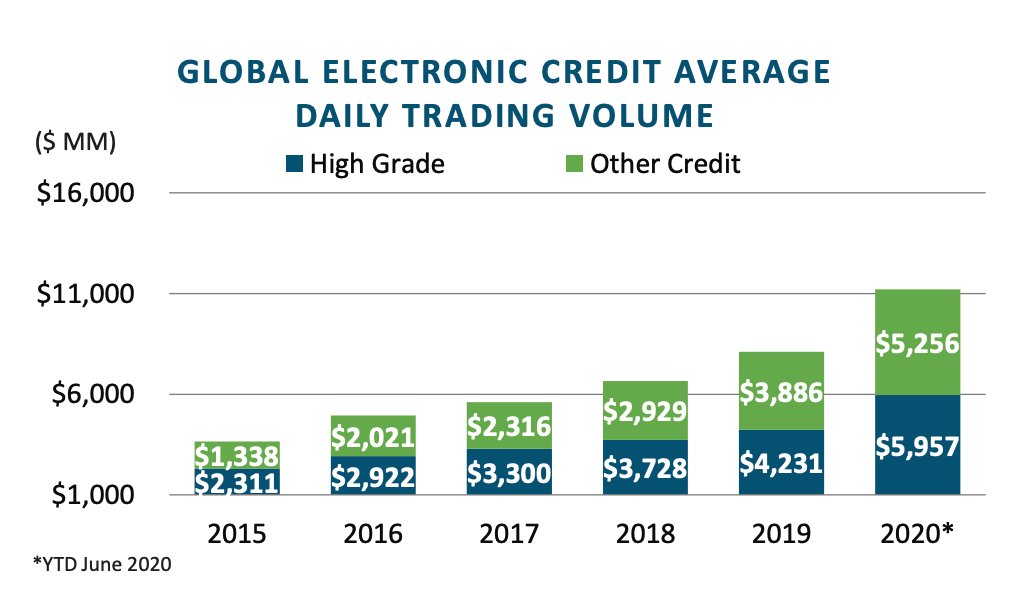

So… The more electronic corporate bond trading https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> The better for $MKTX

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> The better for $MKTX  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

Yes!

So… The more electronic corporate bond trading

Yes!

Ok  https://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen"> What is electronic trading in fact

https://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen"> What is electronic trading in fact  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen">

Let’s look at electronic trading in the stock market https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> Something you should be familiar with

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> Something you should be familiar with  https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> You want to buy some $AAPL stock? Well, open your trading app and pass the order

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> You want to buy some $AAPL stock? Well, open your trading app and pass the order  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon">

Let’s look at electronic trading in the stock market

That’s EASY right? Yes!

The VAST majority of equities trading is done electronically

So right now, electronic bond trading represents just 20 to 30% (depending on the months) of the total trading volumes  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">

Why is that so https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen"> One main factor can explain this

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen"> One main factor can explain this  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Why is that so

At its peak, there were 8,800 equities listed in the U.S.

How could that reduce the appeal of electronic bond trading  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> There are plenty of bonds so there is a huge market right?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> There are plenty of bonds so there is a huge market right?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛑" title="Stop sign" aria-label="Emoji: Stop sign"> Well, this makes the market very fragmented, each bond is therefor NOT OFTEN EXCHANGED

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛑" title="Stop sign" aria-label="Emoji: Stop sign"> Well, this makes the market very fragmented, each bond is therefor NOT OFTEN EXCHANGED

Here are some more facts  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

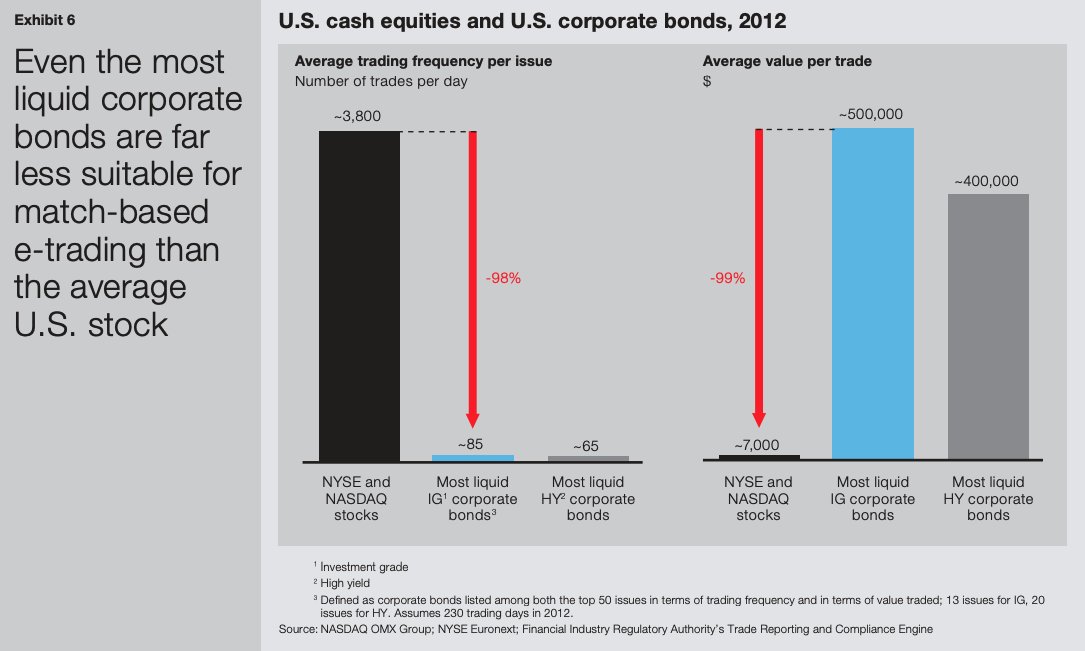

The average U.S. stock traded around 3,800 times a day on 2012 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

In comparison https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> The 13 most liquid Investment Grade corporate bonds traded on average 85 times a day

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> The 13 most liquid Investment Grade corporate bonds traded on average 85 times a day  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend">

The average U.S. stock traded around 3,800 times a day on 2012

In comparison

From

Well, you could say that broker dealer just have to put their bonds  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📃" title="Seite mit Eselsohr" aria-label="Emoji: Seite mit Eselsohr"> for sale on an electronic platform and wait some time

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📃" title="Seite mit Eselsohr" aria-label="Emoji: Seite mit Eselsohr"> for sale on an electronic platform and wait some time  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏳" title="Sanduhr mit fließendem Sand" aria-label="Emoji: Sanduhr mit fließendem Sand">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏳" title="Sanduhr mit fließendem Sand" aria-label="Emoji: Sanduhr mit fließendem Sand">

As in the end, someone will come and make a deal https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> since each bond is traded on average 85 times a day

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> since each bond is traded on average 85 times a day  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎭" title="Darstellende Künste" aria-label="Emoji: Darstellende Künste">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎭" title="Darstellende Künste" aria-label="Emoji: Darstellende Künste">

As in the end, someone will come and make a deal

Not really  https://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen"> Let’s say that you are work at a pension fund and have to sell $ 2B worth of bonds

https://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen"> Let’s say that you are work at a pension fund and have to sell $ 2B worth of bonds  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">

Of course, you cannot just place your sell-order and WAIT until someone fills https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> It could take days

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> It could take days  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📆" title="Abreißkalender" aria-label="Emoji: Abreißkalender">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📆" title="Abreißkalender" aria-label="Emoji: Abreißkalender">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="☎️" title="Telefon" aria-label="Emoji: Telefon"> You end up picking up the phone and find someone that buys these

https://abs.twimg.com/emoji/v2/... draggable="false" alt="☎️" title="Telefon" aria-label="Emoji: Telefon"> You end up picking up the phone and find someone that buys these

Of course, you cannot just place your sell-order and WAIT until someone fills

Greenwich says  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

“The total number of corporate bonds available to trade in the U.S. alone is so large, and most of those bonds so illiquid, that the chances of finding a “natural” other side of a trade at an exact moment in time are slim at best.” https://www.greenwich.com/blog/challenge-trading-corporate-bonds-electronically">https://www.greenwich.com/blog/chal...

“The total number of corporate bonds available to trade in the U.S. alone is so large, and most of those bonds so illiquid, that the chances of finding a “natural” other side of a trade at an exact moment in time are slim at best.” https://www.greenwich.com/blog/challenge-trading-corporate-bonds-electronically">https://www.greenwich.com/blog/chal...

Now, let’s say that you need to buy $ 2B worth of bonds  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">

What do you do? You tell the whole market that you have $ 2B of cash and want to BUY a certain bond?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> By disclosing this piece of information you would shoot yourself in the foot

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> By disclosing this piece of information you would shoot yourself in the foot  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💀" title="Schädel" aria-label="Emoji: Schädel">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💀" title="Schädel" aria-label="Emoji: Schädel">

What do you do? You tell the whole market that you have $ 2B of cash and want to BUY a certain bond?

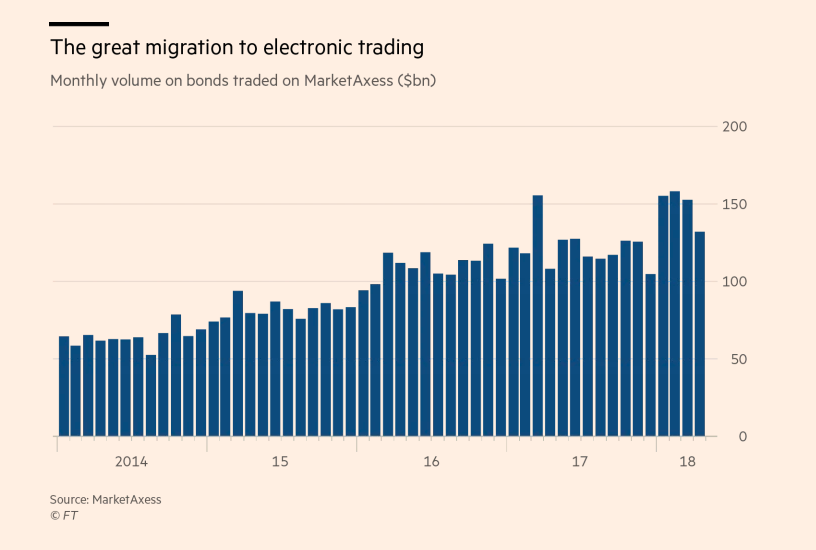

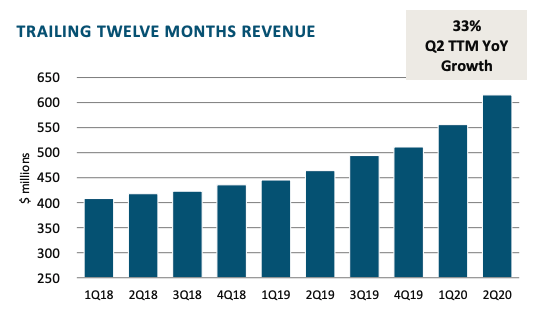

But wait… $MKTX is now a $ 20B company  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

And here are the monthly volumes traded on $MKTX

(from https://www.ft.com/content/67e48ae4-4fab-11e8-9471-a083af05aea7)">https://www.ft.com/content/6...

And here are the monthly volumes traded on $MKTX

(from https://www.ft.com/content/67e48ae4-4fab-11e8-9471-a083af05aea7)">https://www.ft.com/content/6...

Why is electronic bond trading taking off?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> Before the 2008 crisis, it was relatively easier for banks to buy and sell massive amounts of debt

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> Before the 2008 crisis, it was relatively easier for banks to buy and sell massive amounts of debt

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛔️" title="Nicht betreten" aria-label="Emoji: Nicht betreten"> Due to regulations

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛔️" title="Nicht betreten" aria-label="Emoji: Nicht betreten"> Due to regulations  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👮♂️" title="Man police officer" aria-label="Emoji: Man police officer"> Banks cannot trade as heavily as they want and supply the liquidity the bond market needs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👮♂️" title="Man police officer" aria-label="Emoji: Man police officer"> Banks cannot trade as heavily as they want and supply the liquidity the bond market needs  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln">

“The feedback that we got from dealers was that they were not quoting on the phone. They couldn’t do that, they couldn’t keep up with that”

from https://www.reuters.com/article/us-health-coronavirus-bond-trading-insig-idUSKBN23T0MP">https://www.reuters.com/article/u...

from https://www.reuters.com/article/us-health-coronavirus-bond-trading-insig-idUSKBN23T0MP">https://www.reuters.com/article/u...

You want to read the full take? Here it is  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://www.ft.com/content/67e48ae4-4fab-11e8-9471-a083af05aea7">https://www.ft.com/content/6...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://www.ft.com/content/67e48ae4-4fab-11e8-9471-a083af05aea7">https://www.ft.com/content/6...

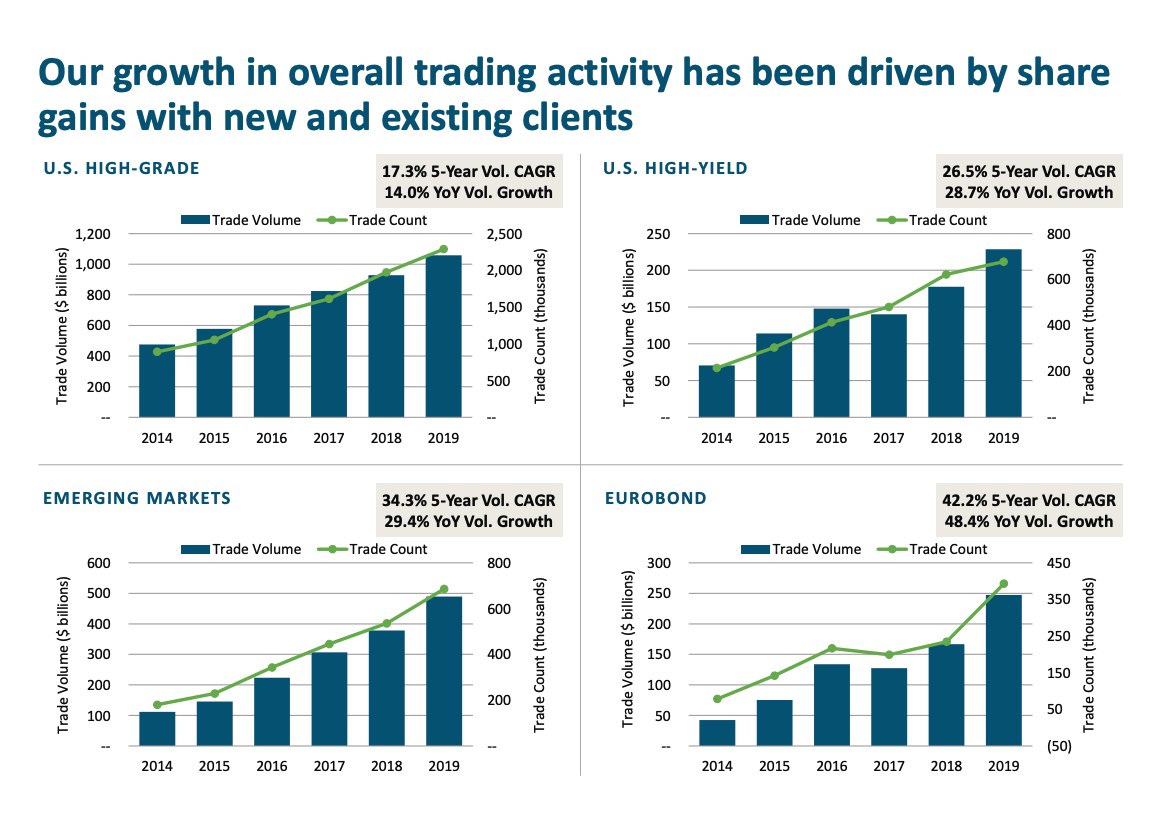

How does that translate for $MKTX  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> Over 144K trades completed using automated execution

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> Over 144K trades completed using automated execution  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> Up from 105K in Q2 ’19

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> Up from 105K in Q2 ’19

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💼" title="Aktenkoffer" aria-label="Emoji: Aktenkoffer"> 83 firms used automated execution functionality in 2Q20

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💼" title="Aktenkoffer" aria-label="Emoji: Aktenkoffer"> 83 firms used automated execution functionality in 2Q20  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧗♀️" title="Kletternde Frau" aria-label="Emoji: Kletternde Frau"> Up from 55 in Q2 ’19

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧗♀️" title="Kletternde Frau" aria-label="Emoji: Kletternde Frau"> Up from 55 in Q2 ’19

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> Approximately 3.5 million algo responses in 2Q20

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> Approximately 3.5 million algo responses in 2Q20  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete"> Up 45% from Q2 ’19

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete"> Up 45% from Q2 ’19

The numbers look stunning  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> How does it compare to its competitors

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> How does it compare to its competitors  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⁉️" title="Ausrufe-Fragezeichen" aria-label="Emoji: Ausrufe-Fragezeichen">

$TW sales stand at $ 212m in Q2 ’20 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> Growing 11% YoY

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> Growing 11% YoY  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤼" title="People wrestling" aria-label="Emoji: People wrestling"> Versus 47% for $MKTX

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤼" title="People wrestling" aria-label="Emoji: People wrestling"> Versus 47% for $MKTX

Its Net Profit Margin stands at 14% https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤼" title="People wrestling" aria-label="Emoji: People wrestling"> Versus 45% for $MKTX

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤼" title="People wrestling" aria-label="Emoji: People wrestling"> Versus 45% for $MKTX

$TW sales stand at $ 212m in Q2 ’20

Its Net Profit Margin stands at 14%

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ Financial Times

✑ Reuters

✑ Greenwich

✑ McKinsey & Company

✑ WSJ

Sources

✑ Investor presentation

✑ Company website

✑ Financial Times

✑ Reuters

✑ Greenwich

✑ McKinsey & Company

✑ WSJ

Hope you liked this thread!

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> For more content, follow us on Twitter

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> For more content, follow us on Twitter  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Want to get UNDER HYPED companies delivered straight to your inbox

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Want to get UNDER HYPED companies delivered straight to your inbox  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📩" title="Umschlag mit nach unten zeigendem Pfeil darüber" aria-label="Emoji: Umschlag mit nach unten zeigendem Pfeil darüber"> Don’t MISS IT

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📩" title="Umschlag mit nach unten zeigendem Pfeil darüber" aria-label="Emoji: Umschlag mit nach unten zeigendem Pfeil darüber"> Don’t MISS IT  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://getbenchmark.substack.com"> https://getbenchmark.substack.com

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://getbenchmark.substack.com"> https://getbenchmark.substack.com

Read on Twitter

Read on Twitter 47% GROWTH and 45% Net INCOME Margin https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Operates an Electronic Trading Platform for credit markets https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln">Sales reached $ 184B in Q2 ’20 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> Now valued at $ 20B https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank"> A company that originated at $JPM and #BearStearnsHere is an EASY thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht"> 47% GROWTH and 45% Net INCOME Margin https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Operates an Electronic Trading Platform for credit markets https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln">Sales reached $ 184B in Q2 ’20 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> Now valued at $ 20B https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank"> A company that originated at $JPM and #BearStearnsHere is an EASY thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

47% GROWTH and 45% Net INCOME Margin https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Operates an Electronic Trading Platform for credit markets https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln">Sales reached $ 184B in Q2 ’20 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> Now valued at $ 20B https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank"> A company that originated at $JPM and #BearStearnsHere is an EASY thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht"> 47% GROWTH and 45% Net INCOME Margin https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Operates an Electronic Trading Platform for credit markets https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln">Sales reached $ 184B in Q2 ’20 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> Now valued at $ 20B https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank"> A company that originated at $JPM and #BearStearnsHere is an EASY thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

In 2012, 38% of the 37,000 eligible bonds did not even traded ONCE A DAYhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln"> On top of that, the average trade size for the most liquid U.S. investment grade securities is 70 times that of the average U.S. stock tradeFrom https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> https://www.mckinsey.com/~/media/m..." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht"> In 2012, 38% of the 37,000 eligible bonds did not even traded ONCE A DAYhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln"> On top of that, the average trade size for the most liquid U.S. investment grade securities is 70 times that of the average U.S. stock tradeFrom https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> https://www.mckinsey.com/~/media/m..." class="img-responsive" style="max-width:100%;"/>

In 2012, 38% of the 37,000 eligible bonds did not even traded ONCE A DAYhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln"> On top of that, the average trade size for the most liquid U.S. investment grade securities is 70 times that of the average U.S. stock tradeFrom https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> https://www.mckinsey.com/~/media/m..." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht"> In 2012, 38% of the 37,000 eligible bonds did not even traded ONCE A DAYhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln"> On top of that, the average trade size for the most liquid U.S. investment grade securities is 70 times that of the average U.S. stock tradeFrom https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> https://www.mckinsey.com/~/media/m..." class="img-responsive" style="max-width:100%;"/>

And here are the monthly volumes traded on $MKTX(from https://www.ft.com/content/6..." title="But wait… $MKTX is now a $ 20B company https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">And here are the monthly volumes traded on $MKTX(from https://www.ft.com/content/6..." class="img-responsive" style="max-width:100%;"/>

And here are the monthly volumes traded on $MKTX(from https://www.ft.com/content/6..." title="But wait… $MKTX is now a $ 20B company https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">And here are the monthly volumes traded on $MKTX(from https://www.ft.com/content/6..." class="img-responsive" style="max-width:100%;"/>

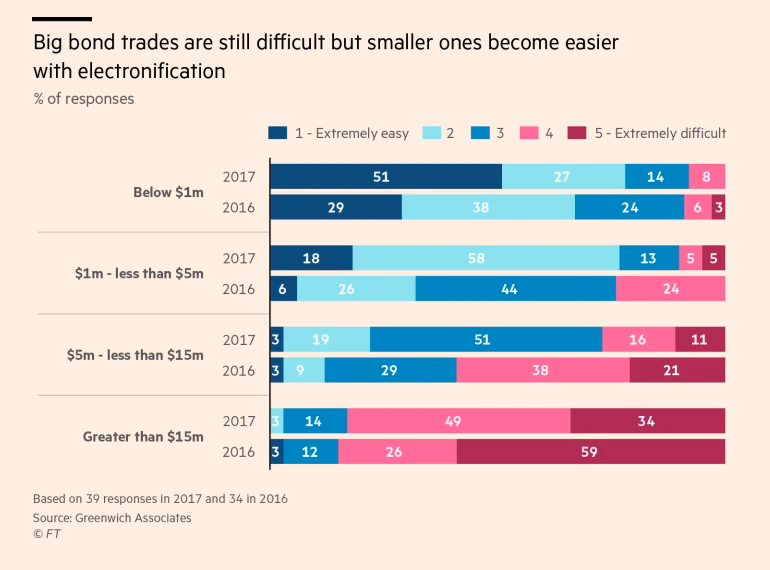

Electronic trading provides a new outlet for buying and selling bonds https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛍" title="Einkaufstaschen" aria-label="Emoji: Einkaufstaschen"> Increasing liquidity https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> Beginning of course with smaller chunks of debt but now evolving to larger, more important amounts" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Electronic trading provides a new outlet for buying and selling bonds https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛍" title="Einkaufstaschen" aria-label="Emoji: Einkaufstaschen"> Increasing liquidity https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> Beginning of course with smaller chunks of debt but now evolving to larger, more important amounts" class="img-responsive" style="max-width:100%;"/>

Electronic trading provides a new outlet for buying and selling bonds https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛍" title="Einkaufstaschen" aria-label="Emoji: Einkaufstaschen"> Increasing liquidity https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> Beginning of course with smaller chunks of debt but now evolving to larger, more important amounts" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Electronic trading provides a new outlet for buying and selling bonds https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛍" title="Einkaufstaschen" aria-label="Emoji: Einkaufstaschen"> Increasing liquidity https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> Beginning of course with smaller chunks of debt but now evolving to larger, more important amounts" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> Over 144K trades completed using automated execution https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> Up from 105K in Q2 ’19 https://abs.twimg.com/emoji/v2/... draggable="false" alt="💼" title="Aktenkoffer" aria-label="Emoji: Aktenkoffer"> 83 firms used automated execution functionality in 2Q20 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧗♀️" title="Kletternde Frau" aria-label="Emoji: Kletternde Frau"> Up from 55 in Q2 ’19 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> Approximately 3.5 million algo responses in 2Q20 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete"> Up 45% from Q2 ’19" title="How does that translate for $MKTX https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> Over 144K trades completed using automated execution https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> Up from 105K in Q2 ’19 https://abs.twimg.com/emoji/v2/... draggable="false" alt="💼" title="Aktenkoffer" aria-label="Emoji: Aktenkoffer"> 83 firms used automated execution functionality in 2Q20 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧗♀️" title="Kletternde Frau" aria-label="Emoji: Kletternde Frau"> Up from 55 in Q2 ’19 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> Approximately 3.5 million algo responses in 2Q20 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete"> Up 45% from Q2 ’19" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> Over 144K trades completed using automated execution https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> Up from 105K in Q2 ’19 https://abs.twimg.com/emoji/v2/... draggable="false" alt="💼" title="Aktenkoffer" aria-label="Emoji: Aktenkoffer"> 83 firms used automated execution functionality in 2Q20 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧗♀️" title="Kletternde Frau" aria-label="Emoji: Kletternde Frau"> Up from 55 in Q2 ’19 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> Approximately 3.5 million algo responses in 2Q20 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete"> Up 45% from Q2 ’19" title="How does that translate for $MKTX https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> Over 144K trades completed using automated execution https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> Up from 105K in Q2 ’19 https://abs.twimg.com/emoji/v2/... draggable="false" alt="💼" title="Aktenkoffer" aria-label="Emoji: Aktenkoffer"> 83 firms used automated execution functionality in 2Q20 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧗♀️" title="Kletternde Frau" aria-label="Emoji: Kletternde Frau"> Up from 55 in Q2 ’19 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📟" title="Pager" aria-label="Emoji: Pager"> Approximately 3.5 million algo responses in 2Q20 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete"> Up 45% from Q2 ’19" class="img-responsive" style="max-width:100%;"/>

Over 1,700 active firms and around 1,000 active firms trading 3 or more productshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌏" title="Asien-Australien auf dem Globus" aria-label="Emoji: Asien-Australien auf dem Globus"> Approximately 1,200 active firms trading emerging markets an increase 12% from Q2 ’19 https://abs.twimg.com/emoji/v2/... draggable="false" alt="👥" title="Silhouette von Büsten" aria-label="Emoji: Silhouette von Büsten"> Over 870 active international client firms, up 11% from Q2 ’19" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏢" title="Bürogebäude" aria-label="Emoji: Bürogebäude"> Over 1,700 active firms and around 1,000 active firms trading 3 or more productshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌏" title="Asien-Australien auf dem Globus" aria-label="Emoji: Asien-Australien auf dem Globus"> Approximately 1,200 active firms trading emerging markets an increase 12% from Q2 ’19 https://abs.twimg.com/emoji/v2/... draggable="false" alt="👥" title="Silhouette von Büsten" aria-label="Emoji: Silhouette von Büsten"> Over 870 active international client firms, up 11% from Q2 ’19" class="img-responsive" style="max-width:100%;"/>

Over 1,700 active firms and around 1,000 active firms trading 3 or more productshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌏" title="Asien-Australien auf dem Globus" aria-label="Emoji: Asien-Australien auf dem Globus"> Approximately 1,200 active firms trading emerging markets an increase 12% from Q2 ’19 https://abs.twimg.com/emoji/v2/... draggable="false" alt="👥" title="Silhouette von Büsten" aria-label="Emoji: Silhouette von Büsten"> Over 870 active international client firms, up 11% from Q2 ’19" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏢" title="Bürogebäude" aria-label="Emoji: Bürogebäude"> Over 1,700 active firms and around 1,000 active firms trading 3 or more productshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌏" title="Asien-Australien auf dem Globus" aria-label="Emoji: Asien-Australien auf dem Globus"> Approximately 1,200 active firms trading emerging markets an increase 12% from Q2 ’19 https://abs.twimg.com/emoji/v2/... draggable="false" alt="👥" title="Silhouette von Büsten" aria-label="Emoji: Silhouette von Büsten"> Over 870 active international client firms, up 11% from Q2 ’19" class="img-responsive" style="max-width:100%;"/>

Financials checkhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> Sales grew by 47% YoY https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> to $ 184m for the last quarter https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad"> Operating margins stand at 56% https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> Up from 50% in prev. yearshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🏢" title="Bürogebäude" aria-label="Emoji: Bürogebäude"> Income from operations stood at $104m up from a $ 61m a year earlierhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> Current assets of $ 675m and cur. liabilities of $ 91m" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Financials checkhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> Sales grew by 47% YoY https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> to $ 184m for the last quarter https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad"> Operating margins stand at 56% https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> Up from 50% in prev. yearshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🏢" title="Bürogebäude" aria-label="Emoji: Bürogebäude"> Income from operations stood at $104m up from a $ 61m a year earlierhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> Current assets of $ 675m and cur. liabilities of $ 91m" class="img-responsive" style="max-width:100%;"/>

Financials checkhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> Sales grew by 47% YoY https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> to $ 184m for the last quarter https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad"> Operating margins stand at 56% https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> Up from 50% in prev. yearshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🏢" title="Bürogebäude" aria-label="Emoji: Bürogebäude"> Income from operations stood at $104m up from a $ 61m a year earlierhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> Current assets of $ 675m and cur. liabilities of $ 91m" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> Financials checkhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen"> Sales grew by 47% YoY https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> to $ 184m for the last quarter https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad"> Operating margins stand at 56% https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> Up from 50% in prev. yearshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🏢" title="Bürogebäude" aria-label="Emoji: Bürogebäude"> Income from operations stood at $104m up from a $ 61m a year earlierhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> Current assets of $ 675m and cur. liabilities of $ 91m" class="img-responsive" style="max-width:100%;"/>