Important tidbits from $TSLA Q3& #39;20 10-Q for long-term investors:

1. Top Agenda: decrease production costs to increase affordability. In-house 4680 cell production + iterative mfr design play a big role in this.

2. Expected incr. non-GAAP net margins due to op. leverage tailwind

1. Top Agenda: decrease production costs to increase affordability. In-house 4680 cell production + iterative mfr design play a big role in this.

2. Expected incr. non-GAAP net margins due to op. leverage tailwind

3. Total CAPEX in & #39;21-22 = $4.5-6b; continued self-funding with op. cash flow > CAPEX spend.

NOTE: while this is a high spend, not all of it hits cash right away as ~1/3 of it comes in the form of capital leases, which are noncash except periodic principal & interest pmts.

NOTE: while this is a high spend, not all of it hits cash right away as ~1/3 of it comes in the form of capital leases, which are noncash except periodic principal & interest pmts.

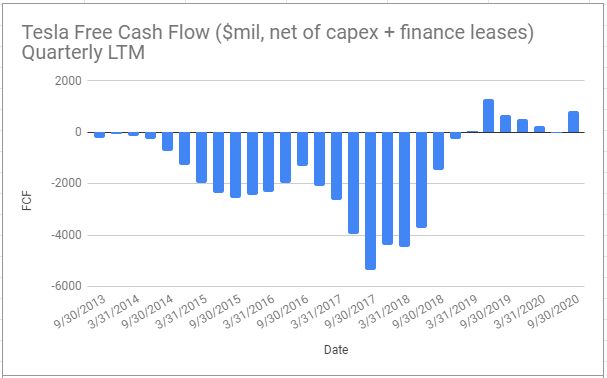

However, $TSLA is *still* free cash flow positive even after counting the off-balance sheet capital leases + CAPEX up front against operating cash flow:

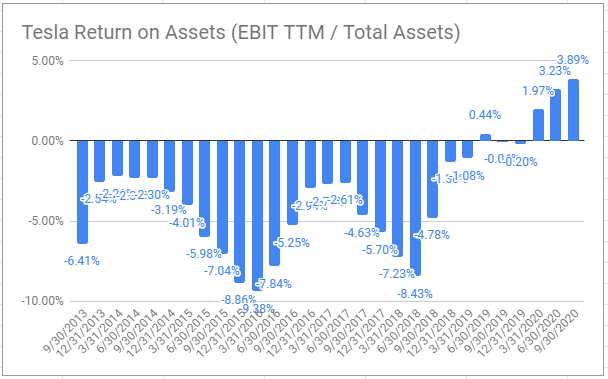

Increased deliveries + lower unit production costs in & #39;21 and & #39;22 should be able to cover this higher capital spend, while moderately expanding return on assets, which is the most important long-term metric of value creation.

In my opinion only.

In my opinion only.

4. Energy gross margins declined Y-o-Y from 22% to 4% because Tesla has started recognizing fixed costs in COGS related to Solar Roof; margins should increase dramatically as they scale Solar Roof production & deliveries.

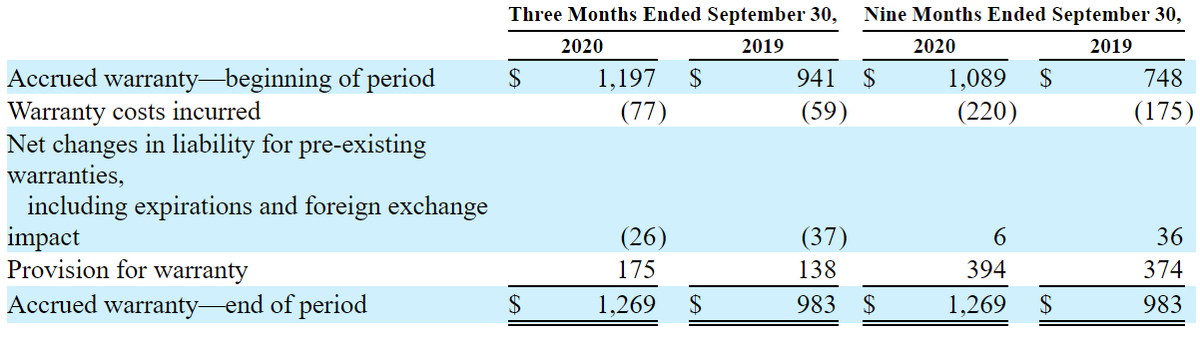

5. Accrued warranty provisions continue to track well above actual warranty costs incurred despite exponential growth in deliveries Y-o-Y.

Warranty exp is normally irrelevant for LT investors but plummeting warr. costs incurred per in-warranty vehicle implies ongoing mfr & vehicle design improvements such as fewer parts per vehicle, structural battery pack, diecast body-in-white, etc.

Overall, very bullish.

Overall, very bullish.

Read on Twitter

Read on Twitter