Decoding the Waiver of Compound Interest (Interest on Interest) Scheme by the Govt

a) How much will be my benefit?

b) Am I eligible for this?

c) When will I get it?

And all such Qs answered in this thread which will help you quickly understand this complex topic

(1/n)

a) How much will be my benefit?

b) Am I eligible for this?

c) When will I get it?

And all such Qs answered in this thread which will help you quickly understand this complex topic

(1/n)

Q1: What is the scheme of waiver of Compound interest announced by Govt?

Ans: If u hv a loan that u had taken before 29Feb20 (pre-covid), then Govt will ensure that u will not hv to bear Compound Interest i.e. "Interest on Interest" for the period 1stMar20 to 31st Aug20

(2/n)

Ans: If u hv a loan that u had taken before 29Feb20 (pre-covid), then Govt will ensure that u will not hv to bear Compound Interest i.e. "Interest on Interest" for the period 1stMar20 to 31st Aug20

(2/n)

Q2: So I don& #39;t have to pay ANY interest for this period on my loan?

Ans: No. You hv to pay interest. Just that u don& #39;t hv to bear "Interest on Interest" i.e. no compound interest for this period

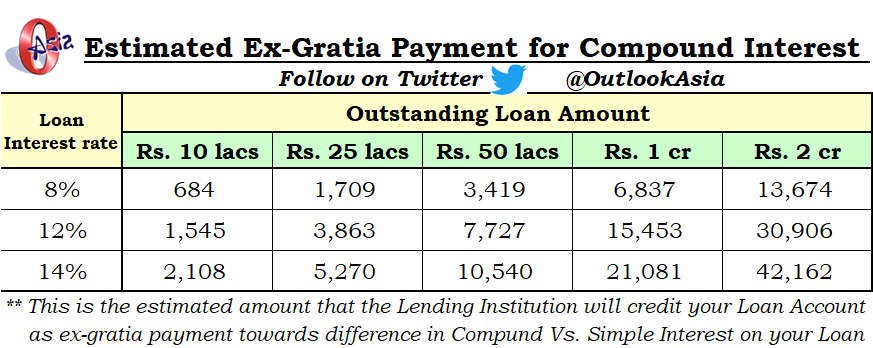

Q3: How much do I benefit?

Here& #39;s a quick table to tell ur approx benefit

(3/n)

Ans: No. You hv to pay interest. Just that u don& #39;t hv to bear "Interest on Interest" i.e. no compound interest for this period

Q3: How much do I benefit?

Here& #39;s a quick table to tell ur approx benefit

(3/n)

Q4: Is it applicable to any kind any amount of loan I have?

Ans: It is only applicable if

a) Ur total loan amt < 2 cr

b) across foll type of loans

Auto, Education, Home Loan, Consumer / durable loan, Personal Loan, Credit Card dues and MSME Loan

Only above is covered

(4/n)

Ans: It is only applicable if

a) Ur total loan amt < 2 cr

b) across foll type of loans

Auto, Education, Home Loan, Consumer / durable loan, Personal Loan, Credit Card dues and MSME Loan

Only above is covered

(4/n)

Q5: From whom shud I have taken a loan from?

Ans: Only if u hv taken loan from a recognised institution like Bank, NBFC, Housing Fin Co etc

Q6: I have taken loan from my friend/uncle/father/loan shark. Is that covered?

Ans: No - any such loans are not covered

(5/n)

Ans: Only if u hv taken loan from a recognised institution like Bank, NBFC, Housing Fin Co etc

Q6: I have taken loan from my friend/uncle/father/loan shark. Is that covered?

Ans: No - any such loans are not covered

(5/n)

Q6: I hv a loan but took moratorium? Am I covered?

Ans: Yes it started with u. Since those who took moratorium shud not be made to compound interest, hence scheme was made

Q7: Shucks! I paid EMIs on time? So I don& #39;t get benefit?

Ans: U also get it. Govt is giving u also

(6/n)

Ans: Yes it started with u. Since those who took moratorium shud not be made to compound interest, hence scheme was made

Q7: Shucks! I paid EMIs on time? So I don& #39;t get benefit?

Ans: U also get it. Govt is giving u also

(6/n)

Q8: Shucks, Shucks, Shucks! I didn& #39;t take any loan because I worked hard and used my own money for house. So will Govt exclude me from this benefit? Honest log ko?

Ans: No, you won& #39;t get this benefit. Don& #39;t u think that you are now extending the logic too much?

(7/n)

Ans: No, you won& #39;t get this benefit. Don& #39;t u think that you are now extending the logic too much?

(7/n)

Q9: When and how will I get it?

Ans: Your loan account will be credited this amount by 5th Nov 2020

Q10: I had stopped paying my EMIs even before 29thFeb. I also get it?

Ans: If ur loan account was not an NPA as on 29Feb, only then u will get it

(8/n)

Ans: Your loan account will be credited this amount by 5th Nov 2020

Q10: I had stopped paying my EMIs even before 29thFeb. I also get it?

Ans: If ur loan account was not an NPA as on 29Feb, only then u will get it

(8/n)

Q11: I had a loan as on 29Feb. But it got over before 31Aug (either prepaid or got fully paid). Do I get this?

Ans: You will get it pro-rata for the period ur loan was active in this period

Q12: What will this amount credited to me, be called?

Ans: Ex-gratia payment

(9/n)

Ans: You will get it pro-rata for the period ur loan was active in this period

Q12: What will this amount credited to me, be called?

Ans: Ex-gratia payment

(9/n)

Q13: What will be taxability of this ex-gratia amount paid to me

Ans: It will be added as income and will be taxed as per your tax-slab

Q14: Haila! I have to pay tax on this? So actually, my benefit is lesser?

Ans: Yes, it will be treated as income and taxed next year

(10/n)

Ans: It will be added as income and will be taxed as per your tax-slab

Q14: Haila! I have to pay tax on this? So actually, my benefit is lesser?

Ans: Yes, it will be treated as income and taxed next year

(10/n)

Q15: What is process?

Do I have to apply to get this?

Which form to fill?

Any loan certificate to give?

Ans: No... There is no form to fill, no process, no document to give. Your lending institution will auto-calculate and credit ur loan account. Its Simple

*** End ***

(11/n)

Do I have to apply to get this?

Which form to fill?

Any loan certificate to give?

Ans: No... There is no form to fill, no process, no document to give. Your lending institution will auto-calculate and credit ur loan account. Its Simple

*** End ***

(11/n)

Read on Twitter

Read on Twitter