A lot of new investors are entering the stock markets. That’s good. But a lot will burn their fingers too. If you are a new investor, here are a few mental models I have learnt and re-learnt over the last 15+ years of investing. 1/n

2/n Investing in stocks is exciting. It also generates wealth. However, excitement and wealth-building rarely happen together. So the first question is: what are you in it for? For the readers of Daniel Kahneman - excitement is System 1 thinking and building wealth is system 2.

3/n If it is for excitement or even learning, limit yourself to smaller amounts. Say less than 5% of your net worth or even lesser. Be aware of the fact that it is for fun/learning. If it is for building wealth, there are two options: do it yourself or hire an advisor.

4/n On advisor: first things first. Your bank/broker/distributor/investment platform is not your advisor. If they are the same, check if there is a conflict of interest. (disclosure: Groww does not provide personal advice, not yet).

5/n Consider MFs if you can& #39;t hire a good stock advisor. Can also explore indexing if you don’t believe fund managers can generate alpha. Plug: Index funds and ETFs are available on Groww. They are available almost everywhere but very few will sell you (guess why?)

6/n One trick question to ask an advisor. Will the markets go up or down? Any answer other than “don& #39;t know” or “can& #39;t say” is a red flag. Nobody can predict the markets.

7/n Picking stocks yourself? This gets interesting. First, curb your excitement. If you are like me, excitement is what would have got you started. Separate it from building wealth. If needed, allocate some money for excitement (play money). Building wealth should be boring.

8/n Before picking stocks, I am assuming you have done your asset allocation exercise - your age, risk etc and diversification across asset classes like equity, debt, gold. If not, do that first. We will go directly into stocks.

9/n Buying a stock is like buying a tiny share in the real company. Because these shares are traded on exchanges - prices fluctuate.

10/n You can make money in two ways - you think the company you invest in will groww or you think that the price that is offered in the market is cheap compared to what it& #39;s worth and someday the markets will re-evaluate it. Or both.

11/n Please note, traders view markets very differently from investors, and I will cover that viewpoint separately. For now, just take it that the trading mindset is different. If you are looking at the price every hour or every day - you are most likely trading.

12/n Coming back to investing. Let’s look at the first point, finding the company that will grow. You cannot discover that company unless you really understand the sector - there comes your circle of competence. The deeper the understanding - the easier it gets.

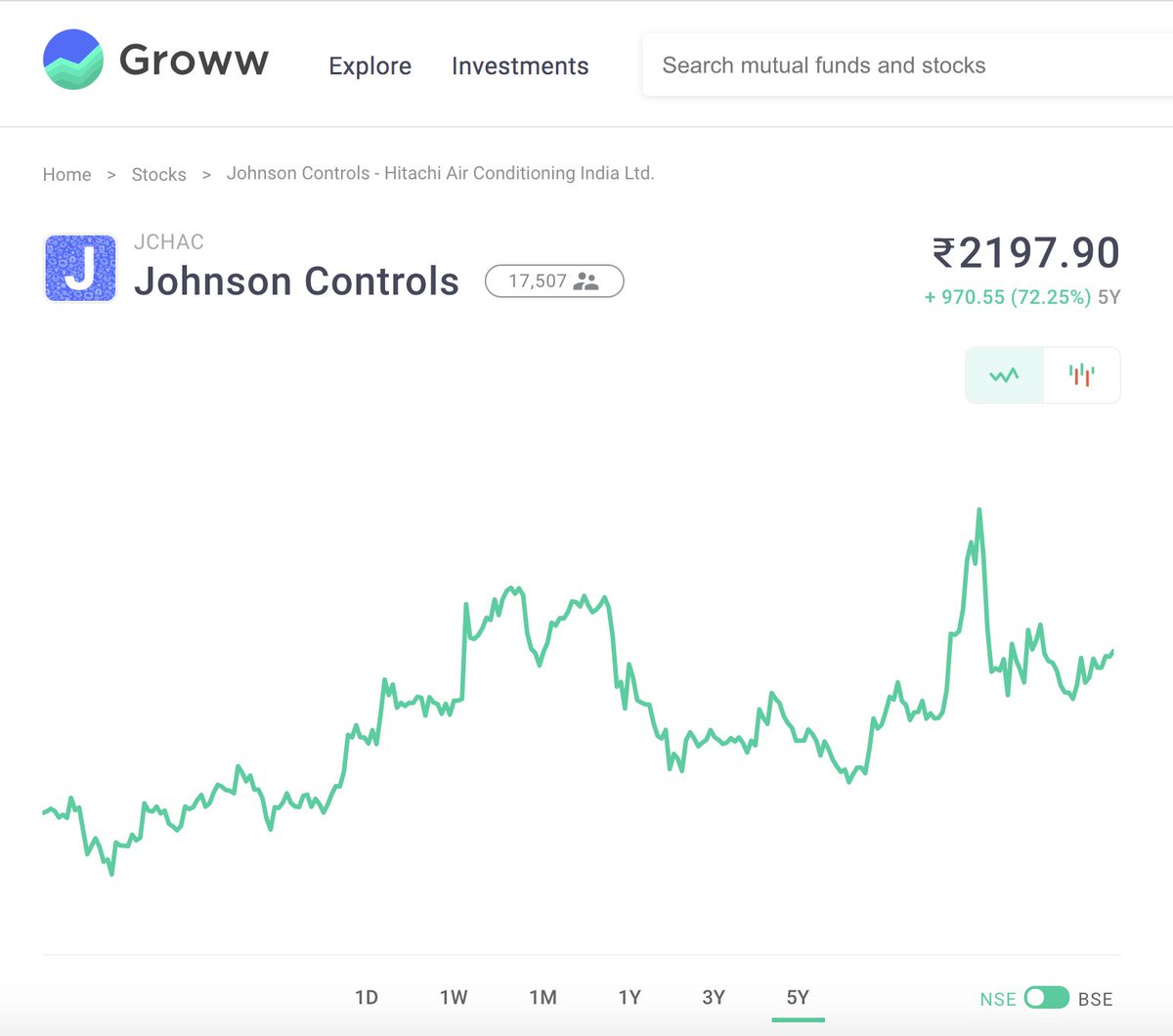

13/n Let’s also discuss examples (warning: you will see hindsight and survival biases in these). In 2005, after reading a lot of Peter Lynch - I started looking for companies for all the products I used. Spotted Hitachi and learnt about the industry.

14/n Common sense understanding was that as India gets rich, AC penetration should go up. Read research reports and annual reports, understood more. Built a circle of competence over a year (On the circle of competence - https://fs.blog/2013/12/circle-of-competence/)">https://fs.blog/2013/12/c...

15/n Next, the past is no guarantee of the future but the past can give you some indication of the future. Especially about the management. Before getting into details, check for the red flags.

16/n One red flag nullifies all good about the company. Yours truly learnt this the hard way by losing all the profits ever made by investing in two companies that went the fraud way.

17/n That also brings the role of diversification. You are unlikely to lose that much money because of a few bad bets if you diversify enough. I got a bit overconfident by my investing success (or should I say luck) and concentrated too much in a few companies.

18/n Usually, the less you understand, the more you should diversify. And if you are Jon Snow about stocks, just buy MFs or ETFs. OTOH, excess diversification can impact your returns. Imagine getting a 100 bagger with just 1% allocation vs 10% allocation from your portfolio.

19/n Then comes your usual checklist. Industry growth. Revenue/profit/margin growth. ROCE/ROE. Debt. Shareholding. Moat. You can keep going as deep you want. And most likely you would interpret things in the way you want to perceive. So be aware of preferential perception bias.

20/n In investing, your biases kill you ( https://en.wikipedia.org/wiki/List_of_cognitive_biases).">https://en.wikipedia.org/wiki/List... For every share that is traded - there is a buyer and a seller and both think they are smart. On that note, don’t forget to read Atul Gawande’s checklist manifesto. Checklists can reduce your error rates.

21/n In spite of doing all these things, you will still make mistakes. And it’s okay. It is good to make a record of mistakes. Limit the losses and move on. It’s okay to have smaller losses and a few big wins.

22/n Finally, the valuation - how you evaluate the company is a mix of art & science. Frameworks like DCF can give you some guidance but that is rarely how the fruitful investments work. I rely more on simple math if something falls in the right range with a good margin of safety

23/n AFAIR, Hitachi was less than 300Cr co. when I looked at it in 2005 & it did not make sense. So did the valuations of other consumer brands - it& #39;s a different story now though (not recos, just examples). Read about the Margin of Safety.

n/n So, continue learning, and that is the best thing about investing. It is helping me learn about business (without b-school). Learn from others, avoid tips. And, do read this book - Psychology of Money by @morganhousel - a lot of wisdom in one simple book. I am still learning.

Read on Twitter

Read on Twitter