The $TSLA 10Q review thread begins. As always, the tweets are not in order of materiality & apologies to those that posted the info already.

Today, we will begin on page 1, noting the 1.3% dilution of shares as of Oct 20th vs. reported count. Dilution ex raises is > 1% a Q

1/

Today, we will begin on page 1, noting the 1.3% dilution of shares as of Oct 20th vs. reported count. Dilution ex raises is > 1% a Q

1/

$TSLA notes that estimates of "sales return reserves" may be materially off due to covid, but . . . $TSLA never discloses its reserves.

All we know is Tesla discontinued the 7 day return period immediately following the Q. Yet no change to estimates, we are told . . & A/R??

2/

All we know is Tesla discontinued the 7 day return period immediately following the Q. Yet no change to estimates, we are told . . & A/R??

2/

In the Q, $TSLA took $12mm topline/ $7mm EBIT hit due to pricing reductions, major further price cuts taken post Q in Oct

Worse, short-term portion of reserve up ~33% q/q & ~80% y/y to $163mm

$TSLA is about to be stuffed with a ton of used cars at the worst possible time

3/

Worse, short-term portion of reserve up ~33% q/q & ~80% y/y to $163mm

$TSLA is about to be stuffed with a ton of used cars at the worst possible time

3/

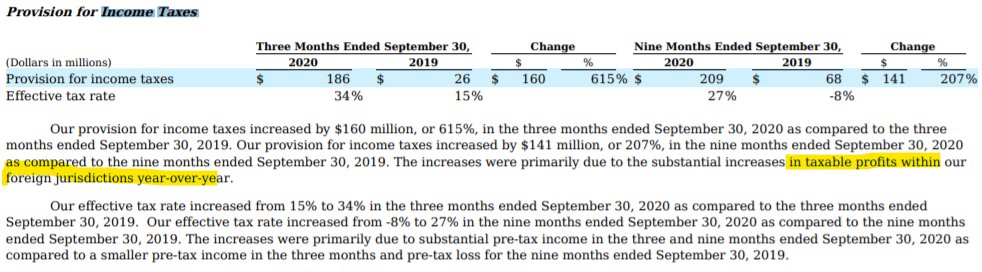

For those that think $TSLA reg credit sales should be tax adjuste . . .prob not

For those that think $TSLA will ever be profitable in US. . . .prob not

Amount of tax assets w full valuation allowance (<50% chance of profit) fell only $11mm q/q

Fremont remains unprofitable

4/

For those that think $TSLA will ever be profitable in US. . . .prob not

Amount of tax assets w full valuation allowance (<50% chance of profit) fell only $11mm q/q

Fremont remains unprofitable

4/

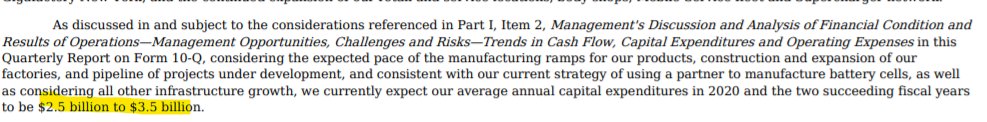

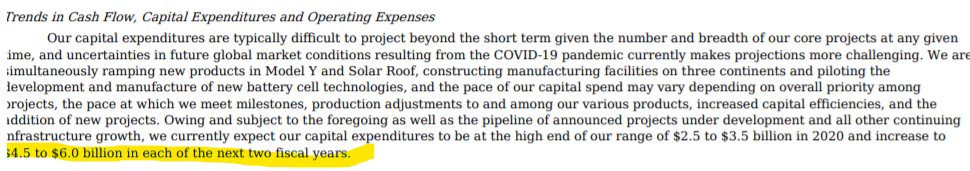

$TSLA raised 2021/2022 capex forecast from $2.5- $3.5bn as of last Q to now $4.5- $6bn .

If $TSLA announced this last Q, would have had to disclose cap raise plans to support, So they didn& #39;t til they had the cash.

But now Shanghai is already > Chinese capacity, so expand?

5/

If $TSLA announced this last Q, would have had to disclose cap raise plans to support, So they didn& #39;t til they had the cash.

But now Shanghai is already > Chinese capacity, so expand?

5/

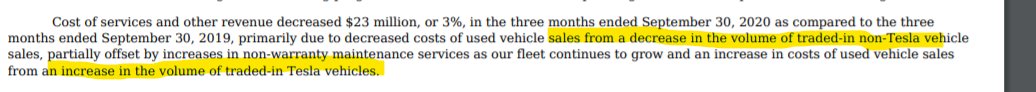

Whoa-

I dont know how this is even possible, $TSLA demand- an inch wide.

Non $TSLA vehicle trade-ins apparently declined in absolute terms, while $TSLA vehicle trade-ins accelerate.

Tesla appears to just be selling to existing owners ( or fleet operators more likely)

6/

I dont know how this is even possible, $TSLA demand- an inch wide.

Non $TSLA vehicle trade-ins apparently declined in absolute terms, while $TSLA vehicle trade-ins accelerate.

Tesla appears to just be selling to existing owners ( or fleet operators more likely)

6/

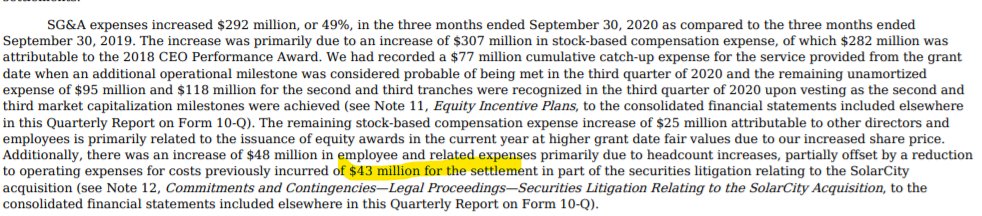

as had seen pointed out elsewhere, $TSLA took a $43 benefit to SG&A (likely at no tax adjustment) for reduction to SCTY liability.

Reminder, the derivative suit originally settled for last March, happens March 2021, & the fraud is evident.

7/

Reminder, the derivative suit originally settled for last March, happens March 2021, & the fraud is evident.

7/

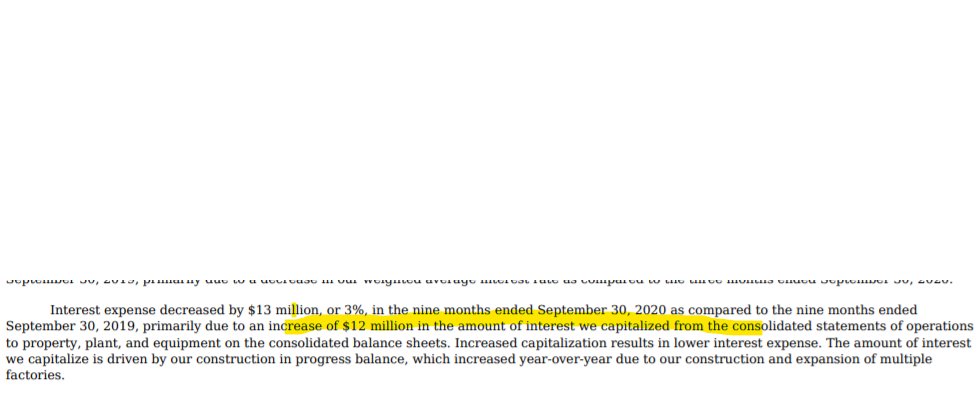

just one small way $TSLA uses construction-in-progress to inflate its profitability.

Building something? capitalize interest expense. $12mm in profits added in the Q.

Tesla is a fractal of both legal & illegal accounting frauds.

8/

Building something? capitalize interest expense. $12mm in profits added in the Q.

Tesla is a fractal of both legal & illegal accounting frauds.

8/

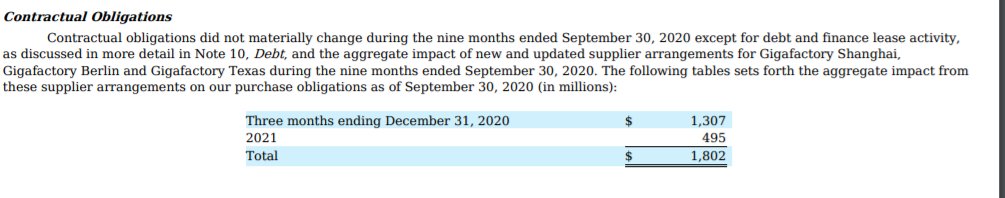

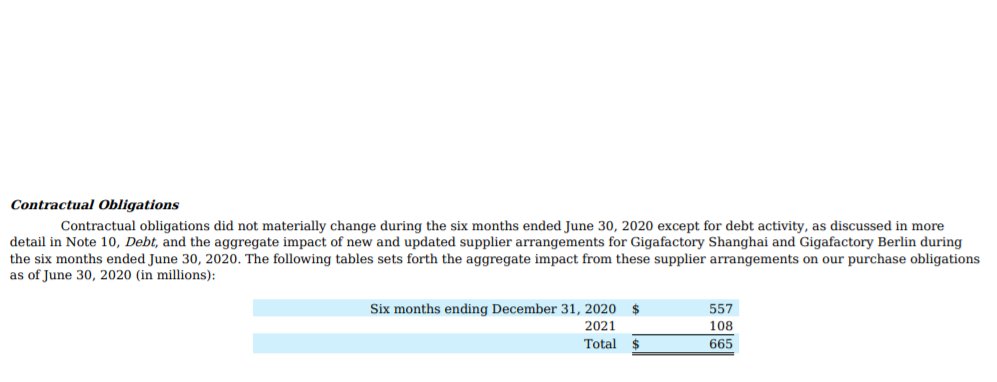

Boom

$TSLA YTD new purchase obligations for 2020/2021 increased > $1.1bn to $1.8bn despite now having only 5 Q& #39;s remaining.

A huge number, for which $TSLA historically takes 5%+ of commitments as benefit to current Q, or $60mm+ in one-time Q3 profit. Pay it backward.

9/

$TSLA YTD new purchase obligations for 2020/2021 increased > $1.1bn to $1.8bn despite now having only 5 Q& #39;s remaining.

A huge number, for which $TSLA historically takes 5%+ of commitments as benefit to current Q, or $60mm+ in one-time Q3 profit. Pay it backward.

9/

par for the course, another $12mm fine from an authority for "non-compliance under applicable laws", this time German.

$TSLA, of course, did not take a financial hit in the Q for its law-breaking.

10/

$TSLA, of course, did not take a financial hit in the Q for its law-breaking.

10/

First time risk disclosure language added to this $TSLA Q, if products "take longer than expected to become fully functional" shows up for first time as well as reference to "solar panels installed by us"

4 years later . . . cc @teslacharts

This Q vs. last language shown

11/

4 years later . . . cc @teslacharts

This Q vs. last language shown

11/

Holy hell-

Musk got $3mm for providing 90 days of D&O coverage up to $100mm . . . discounted 50% vs. cost

So market cost for mere $100mm of D&O insurance is $24mm annually

and $TSLA valued $400bn+ based solely on said CEO

these two realities are not compatible long-term

12/

Musk got $3mm for providing 90 days of D&O coverage up to $100mm . . . discounted 50% vs. cost

So market cost for mere $100mm of D&O insurance is $24mm annually

and $TSLA valued $400bn+ based solely on said CEO

these two realities are not compatible long-term

12/

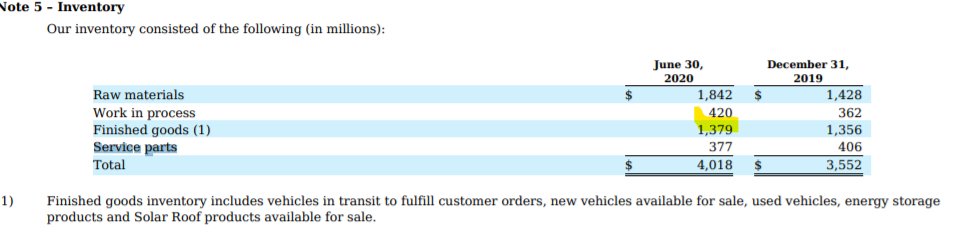

If production exceeded deliveries by only 4k Model 3 & 1k Model S/X, how did $TSLA finished good inventory increase by $300mm q/q?

Bueller?

For those that want to say "trade-ins", $TSLA claimed Q2 was extraordinarily back-end loaded even for it

13/

Bueller?

For those that want to say "trade-ins", $TSLA claimed Q2 was extraordinarily back-end loaded even for it

13/

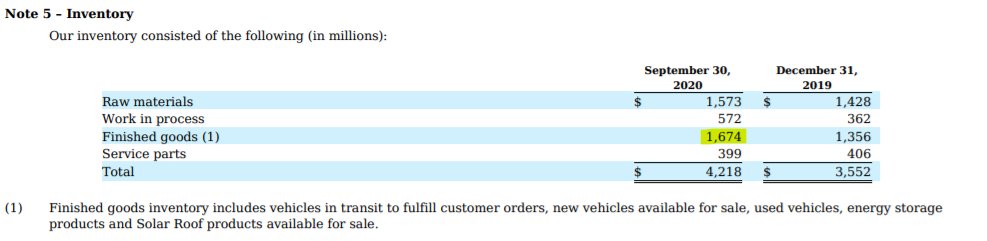

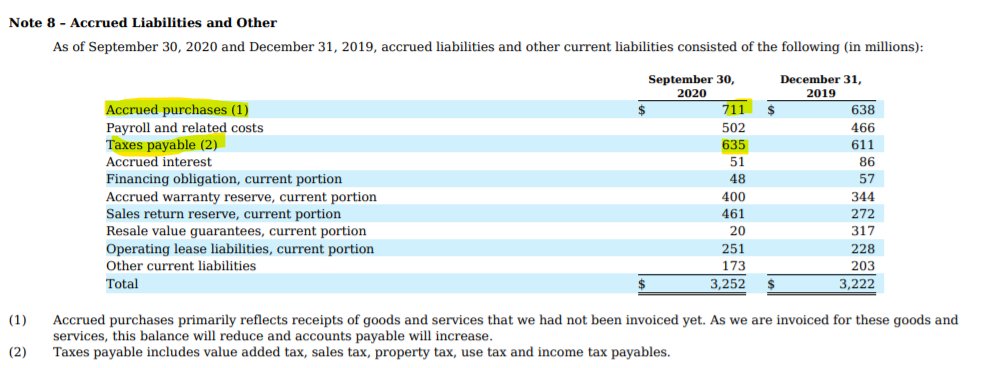

$TSLA claims to be sitting on $711mm of assets that suppliers haven& #39;t bothered to yet bill. In what world does this make sense?

Part of reason $TSLA objective D&B ratings continue to be abysmal & tier 1 companies refuse to do business

taxes payable? out the door Oct 1st

14/

Part of reason $TSLA objective D&B ratings continue to be abysmal & tier 1 companies refuse to do business

taxes payable? out the door Oct 1st

14/

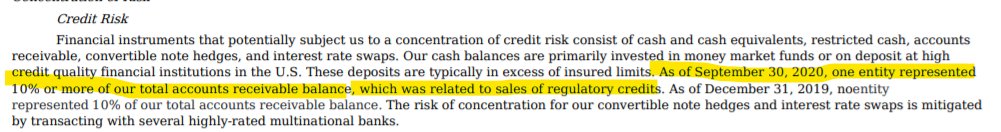

$TSLA has recorded > $170mm of "profit" from regulatory credit sales to FCAU (perhaps much more) that they have yet to receive.

Does Fiat agree?

15/

Does Fiat agree?

15/

Read on Twitter

Read on Twitter