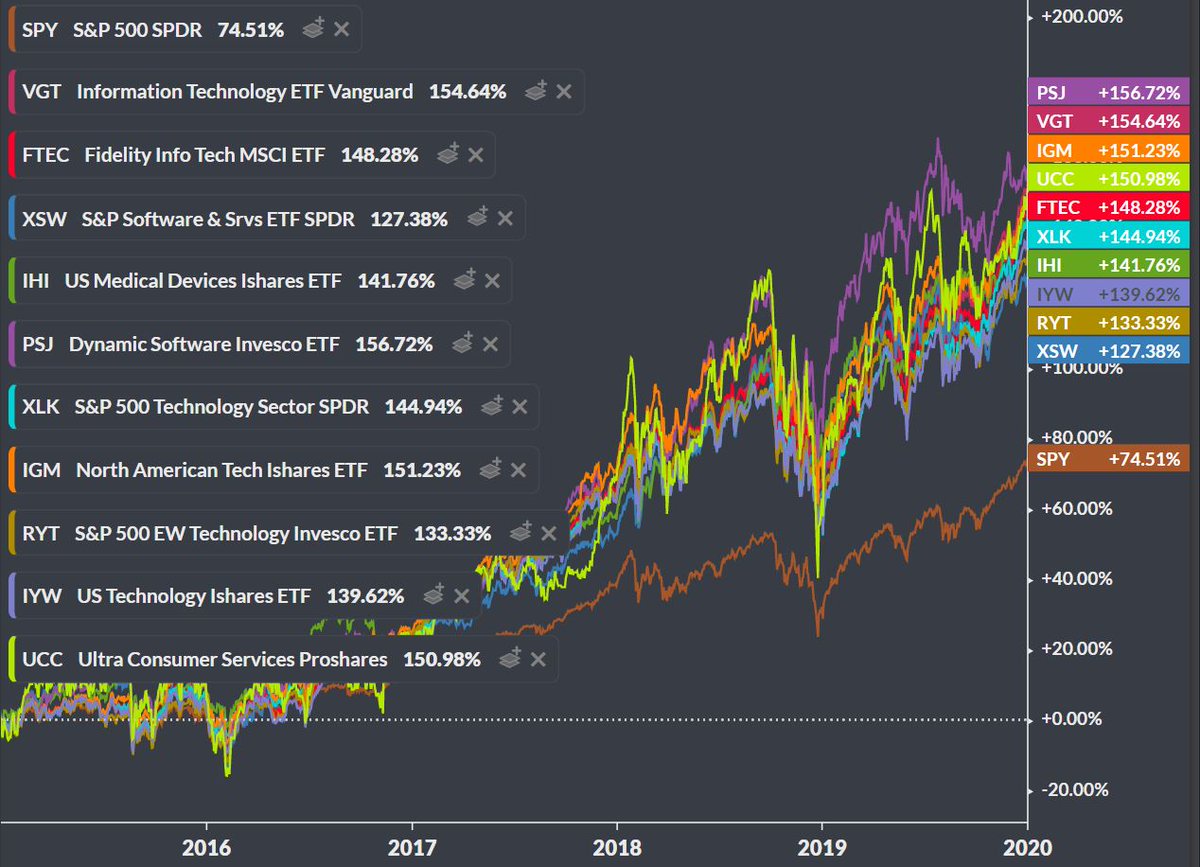

I looked at 1559 ETFs from 2015 - 2019. Surprisingly only the following amount outperformed the $SPY in a given year:

2015: 295, 19%

2016: 405, 26%

2017: 780, 50%

2018: 633, 41%

2019: 265, 17%

Only 10 outperformed in each of the 5 years.

Here is a thread of those

2015: 295, 19%

2016: 405, 26%

2017: 780, 50%

2018: 633, 41%

2019: 265, 17%

Only 10 outperformed in each of the 5 years.

Here is a thread of those

$VGT - Vanguard Information Technology ETF

Expense Ratio: 0.10%

327 Holdings

Largest Holding = $AAPL at 21.78%

Expense Ratio: 0.10%

327 Holdings

Largest Holding = $AAPL at 21.78%

$IGM- iShares Expanded Tech Sector ETF

Expense Ratio: 0.46%

296 Holdings

Largest Holding = $MSFT at 8.44%

Expense Ratio: 0.46%

296 Holdings

Largest Holding = $MSFT at 8.44%

$UCC- ProShares Ultra Consumer Services

Expense Ratio: 0.95%

133 Holdings

Largest Holding = $AMZN at 28.59%

*This is a 2x daily leveraged ETF

Expense Ratio: 0.95%

133 Holdings

Largest Holding = $AMZN at 28.59%

*This is a 2x daily leveraged ETF

$FTEC- Fidelity MSCI Information Technology Index ETF

Expense Ratio: 0.08%

312 Holdings

Largest Holding = $AAPL at 21.76%

Expense Ratio: 0.08%

312 Holdings

Largest Holding = $AAPL at 21.76%

$XLK- Technology Select Sector SPDR Fund

Expense Ratio: 0.13%

73 Holdings

Largest Holding = $AAPL at 23.59%

Expense Ratio: 0.13%

73 Holdings

Largest Holding = $AAPL at 23.59%

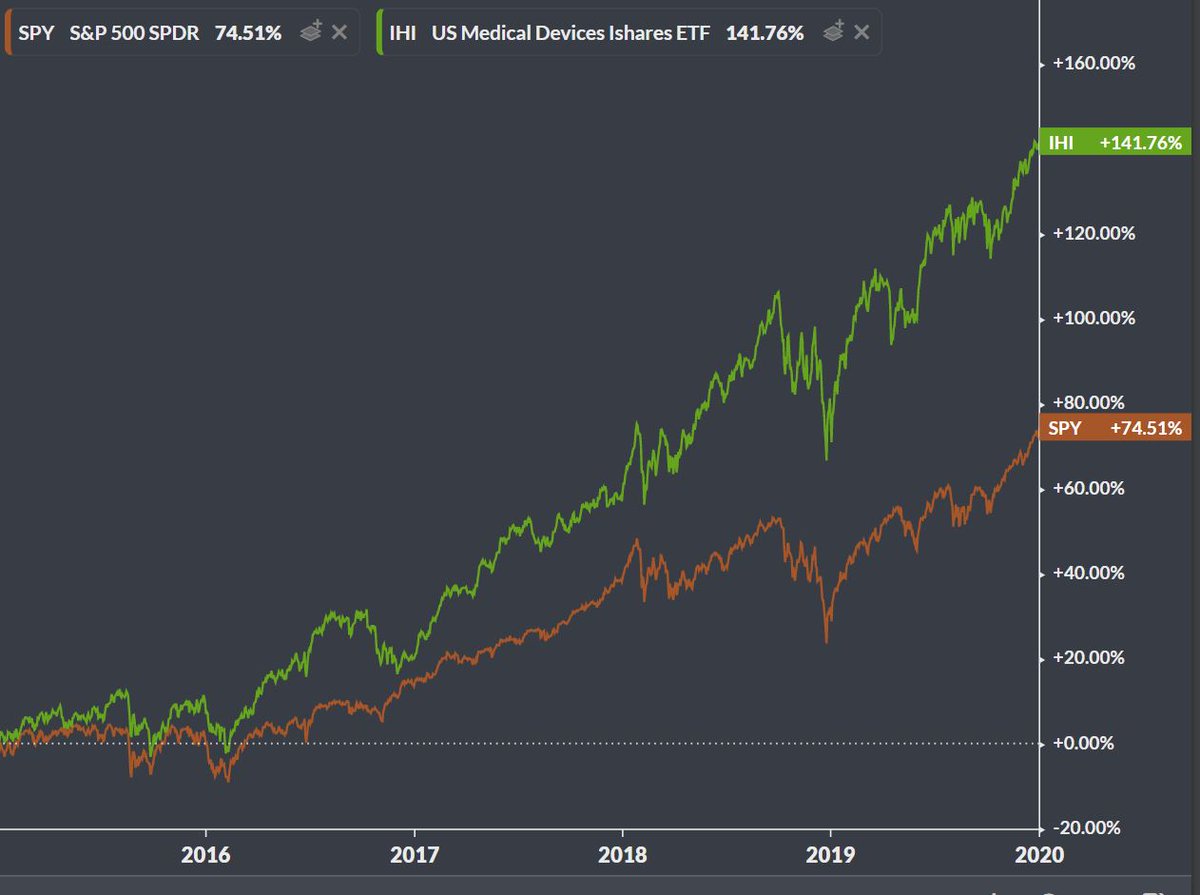

$IHI- iShares U.S. Medical Devices ETF

Expense Ratio: 0.43%

64 Holdings

Largest Holding = $ABT at 13.97%

Expense Ratio: 0.43%

64 Holdings

Largest Holding = $ABT at 13.97%

$RYT- Invesco S&P 500 Equal Weight Technology ETF

Expense Ratio: 0.40%

73 Holdings

Largest Holding = $LRCX at 1.54%

Expense Ratio: 0.40%

73 Holdings

Largest Holding = $LRCX at 1.54%

$XSW- SPDR S&P Software & Services ETF

Expense Ratio: 0.35%

170 Holdings

Largest Holding = $AVYA at 0.81%

Expense Ratio: 0.35%

170 Holdings

Largest Holding = $AVYA at 0.81%

If you liked this thread, I write a weekly email on Tech ETFs at

https://finlister.substack.com/ ">https://finlister.substack.com/">...

and will be releasing an ETF screening tool shortly.

https://finlister.substack.com/ ">https://finlister.substack.com/">...

and will be releasing an ETF screening tool shortly.

Read on Twitter

Read on Twitter