1/ Elon Musk keeps wholesale transfer pricing power:

“Tesla is absolutely vertically integrated compared to other auto companies or basically most any company. We have a massive amount of internal manufacturing technology that we built ourselves." https://www.fool.com/earnings/call-transcripts/2020/10/22/tesla-tsla-q3-2020-earnings-call-transcript/">https://www.fool.com/earnings/...

“Tesla is absolutely vertically integrated compared to other auto companies or basically most any company. We have a massive amount of internal manufacturing technology that we built ourselves." https://www.fool.com/earnings/call-transcripts/2020/10/22/tesla-tsla-q3-2020-earnings-call-transcript/">https://www.fool.com/earnings/...

2/ Musk refuses to buy components from traditional suppliers who want unit prices to remain high since (1) the suppliers see the demand for launch as inelastic. and (2) he wants to retain wholesale. pricing power. Being just an OEM is a hard knock life. https://25iq.com/2016/06/18/a-dozen-things-ive-learned-from-elon-musk-about-business-and-investing/">https://25iq.com/2016/06/1...

3/ If a business doesn& #39;t do things that are hard for competitors to replicate, then prices for the product drop to the opportunity cost of capital. This force is like gravity for a business and slowing the speed at which it lowers prices is what maintaining a moat is all about.

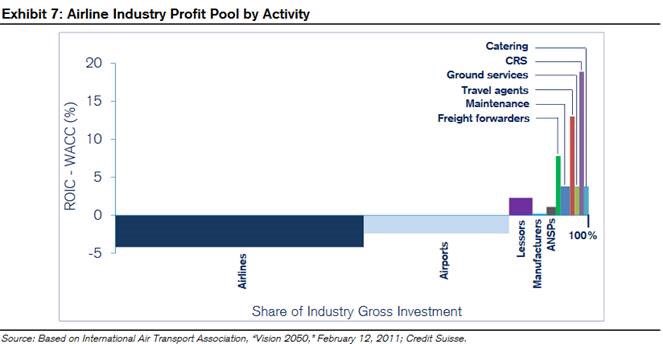

4/ The value chain in the airline industry can be depicted like this, as you know from reading my blog post on Lil Wayne. https://25iq.com/2017/04/07/a-dozen-lessons-about-business-investing-and-money-from-lil-wayne-weezy/

What">https://25iq.com/2017/04/0... does the value chain look like for a SpaceX Falcon 9 or Starship Rocket? Are there any suppliers with wholesale pricing power?

What">https://25iq.com/2017/04/0... does the value chain look like for a SpaceX Falcon 9 or Starship Rocket? Are there any suppliers with wholesale pricing power?

5/ SpaceX& #39;s launch and Starlink businesses are among the most interesting real world public experiments in history.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍿" title="Popcorn" aria-label="Emoji: Popcorn"> If the amounts of capital spent before business results are available don& #39;t make you dizzy, you don& #39;t understand the factors involved and how they may interact.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍿" title="Popcorn" aria-label="Emoji: Popcorn"> If the amounts of capital spent before business results are available don& #39;t make you dizzy, you don& #39;t understand the factors involved and how they may interact.

6/ To understand Starlink you must at least know finance, distribution, marketing, management, microeconomics, regulation, politics, software, hardware, physics, chemistry and manufacturing. It must work technically and financially. If you don& #39;t think this will be fun to watch...

Read on Twitter

Read on Twitter

If the amounts of capital spent before business results are available don& #39;t make you dizzy, you don& #39;t understand the factors involved and how they may interact." title="5/ SpaceX& #39;s launch and Starlink businesses are among the most interesting real world public experiments in history. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍿" title="Popcorn" aria-label="Emoji: Popcorn"> If the amounts of capital spent before business results are available don& #39;t make you dizzy, you don& #39;t understand the factors involved and how they may interact." class="img-responsive" style="max-width:100%;"/>

If the amounts of capital spent before business results are available don& #39;t make you dizzy, you don& #39;t understand the factors involved and how they may interact." title="5/ SpaceX& #39;s launch and Starlink businesses are among the most interesting real world public experiments in history. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍿" title="Popcorn" aria-label="Emoji: Popcorn"> If the amounts of capital spent before business results are available don& #39;t make you dizzy, you don& #39;t understand the factors involved and how they may interact." class="img-responsive" style="max-width:100%;"/>