A(nother) thread about Annual Allowance (errors)

AA tax is very complicated! But common errors by employers, pension schemes and sometimes advisors could cost you many £’000s. Pay attention and share (please RT) and I& #39;ll talk you through common errors and correcting them

AA tax is very complicated! But common errors by employers, pension schemes and sometimes advisors could cost you many £’000s. Pay attention and share (please RT) and I& #39;ll talk you through common errors and correcting them

2/ First things first. You need a basic understanding of AA. It’s supposed to be a tax on the annual growth of your pension (even though growth is also taxed by the LTA). In the NHS pension scheme (and other "DB" schemes) this has nothing to do with your/employer contributions.

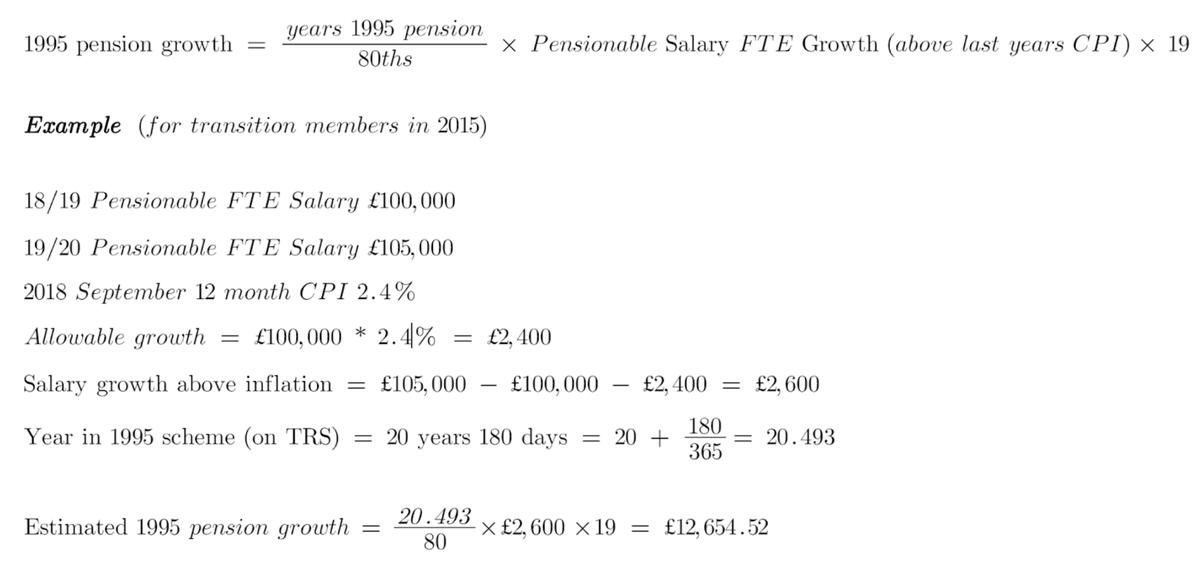

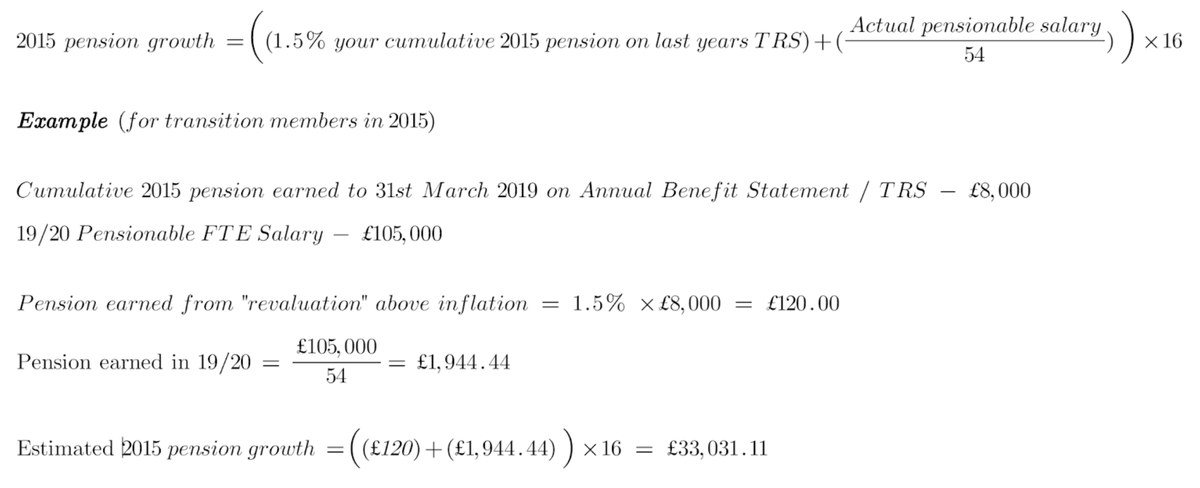

3/ Instead growth is based on the annual growth of your pension (at retirement age) above last years inflation (CPI). So for the 19/20 tax year your pension can grow by 2.4%, and in 20/21 by 1.7%. Above this your "deemed growth" is 16x the pension growth plus lump sum

4/ So your best chance of spotting an error is knowing what your pension growth SHOULD be. The formula for doing this in 1995 and 2015 schemes for transition members is below. It& #39;s more complicated if you are in 2008, have full/tapered 1995 protection or added years.

5/ If you& #39;re in 1995/2015 as above you can use the formulas or this https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> spreadsheet or get a better estimate using @TheBMA Goldstone pension calculator (and also do 2008, transition protection / hokey etc) & will also do all tax years and carry forward.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> spreadsheet or get a better estimate using @TheBMA Goldstone pension calculator (and also do 2008, transition protection / hokey etc) & will also do all tax years and carry forward.

http://bit.ly/1920NHSPIA ">https://bit.ly/1920NHSPI...

http://bit.ly/1920NHSPIA ">https://bit.ly/1920NHSPI...

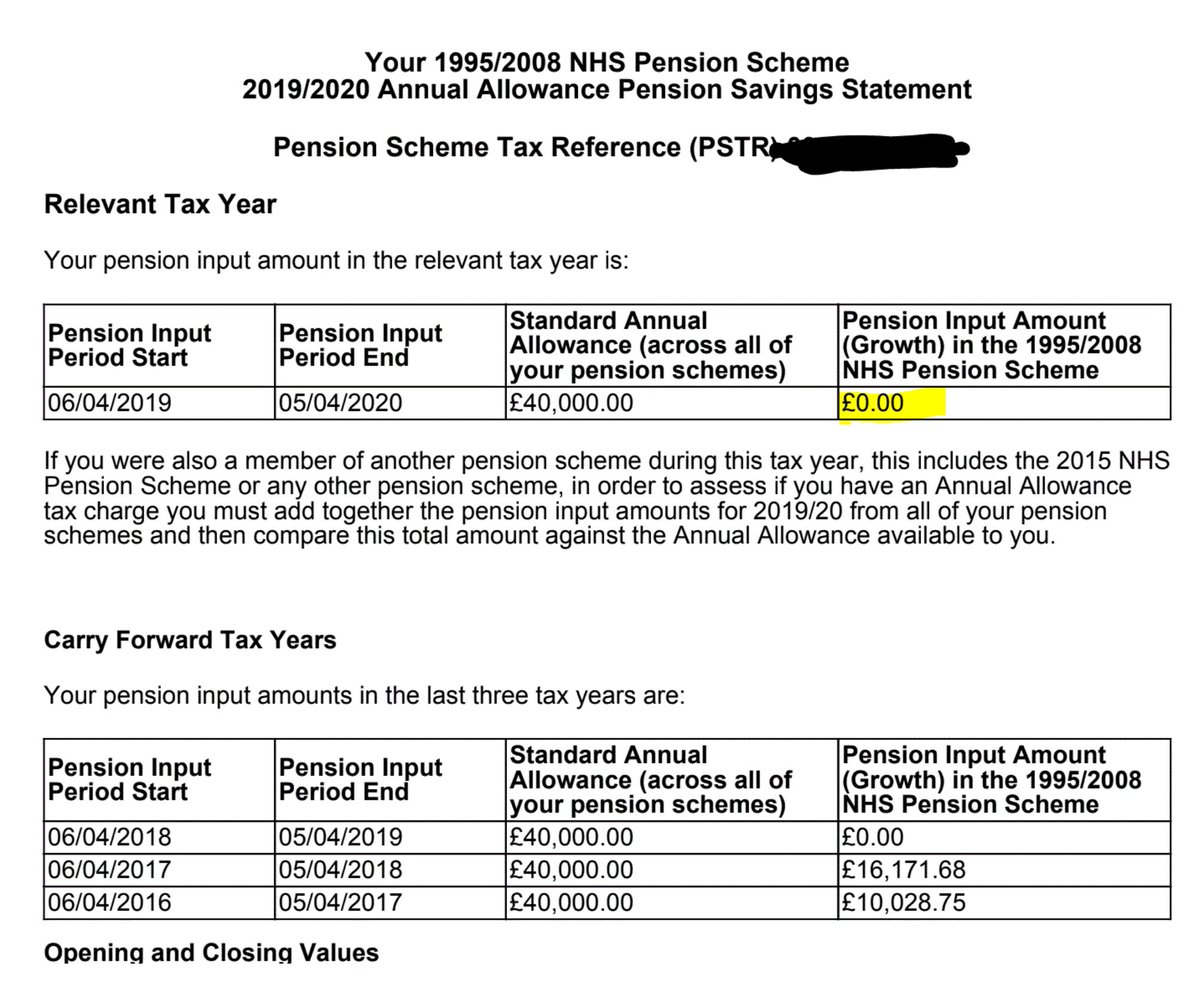

6/ You might have noticed from that 1995 formula if your salary grows LESS than inflation (or falls) you SHOULD get a "negative PIA". Sadly these are not allowed so are zeroed (this is basically government sponsored theft of your pension). Anyway, I digress.

7/The commonest error is that your employer/PCSE/Capita have not provided NHS pensions with your correct salary. This should be straightforward, but there are common some errrors. The following represents my understanding of the most common issues (but this is not advice!)

8/ A. Misallocated pensionable CEAs & pay arrears of pensionable pay - these should be allocated to the tax year they should have been paid - i.e your employer should have paid you 5% call supplement for 3 years- that should be allocated as 5pc in each tax year not 15pc in 1 year

9/ B. Maternity pay - employers should work out your “deemed pay” - what your pay would have been had you not gone on leave. When you return there should be no false “pseudo growth” of your salary, no "big jumps" and almost never any huge pension growth (also see C below)

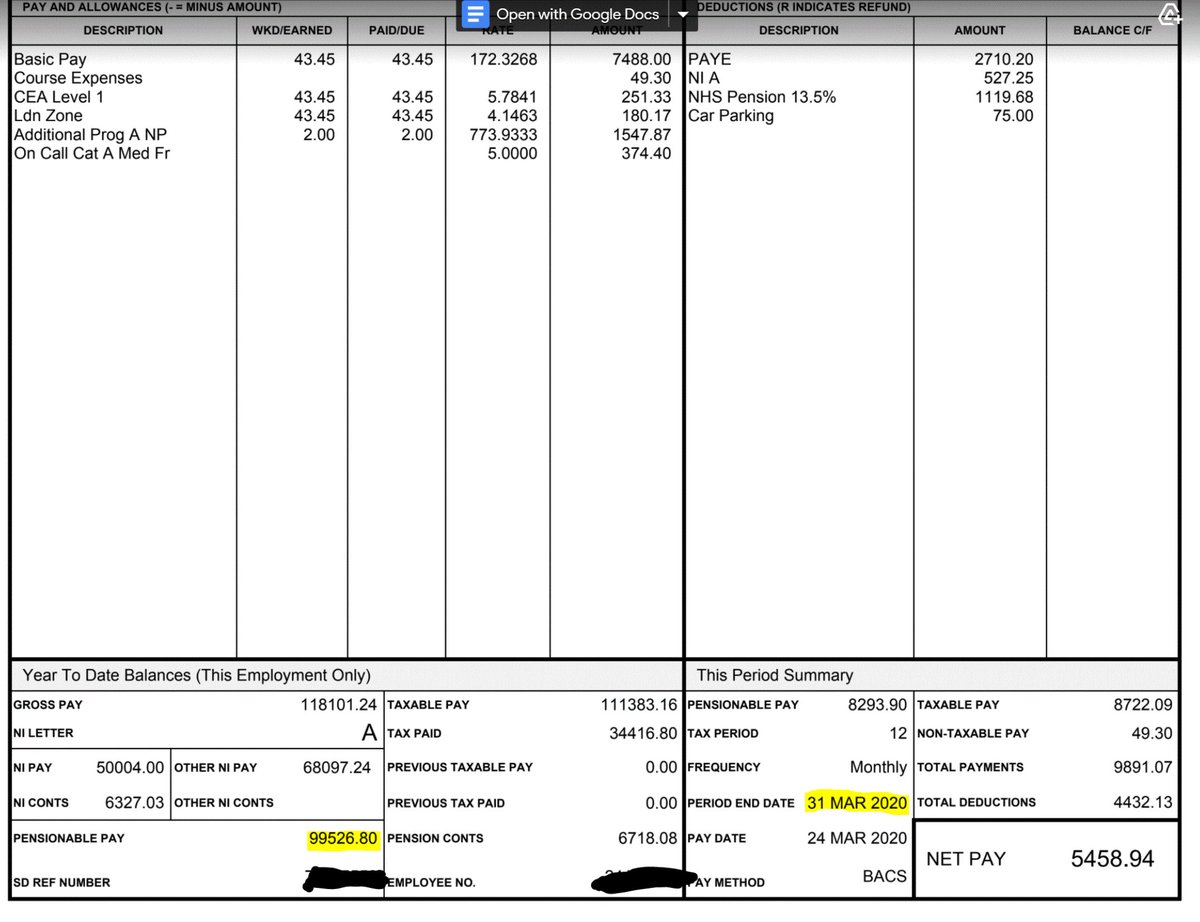

10/ C. Best of 3 - 1995 pension is based on the best of the last 3 years FTE salary and the same is true for salary for AA. Check your YTD pensionable pay on your March payslips.....

11/ If your pensionable salary drops (any reason), @nhs_pensions should use the best of last 3- if they don’t you could pay twice for the same growth (if pay dips for <3 years). This didnt always happen automatically, so they may need to recalculate https://docs.google.com/document/d/1T-dJXxotLRAP8fkSwtQWPYBPIeScKLcMM8jlHadyhhk/edit">https://docs.google.com/document/...

12/ D. Errors after time out of the scheme or “hokey”- employers need to report your pensionable pay for periods of time when you were IN the scheme. Generally FTE pensionable pay on your 1995 TRS should be no more than FTE of March YTD on payslip.

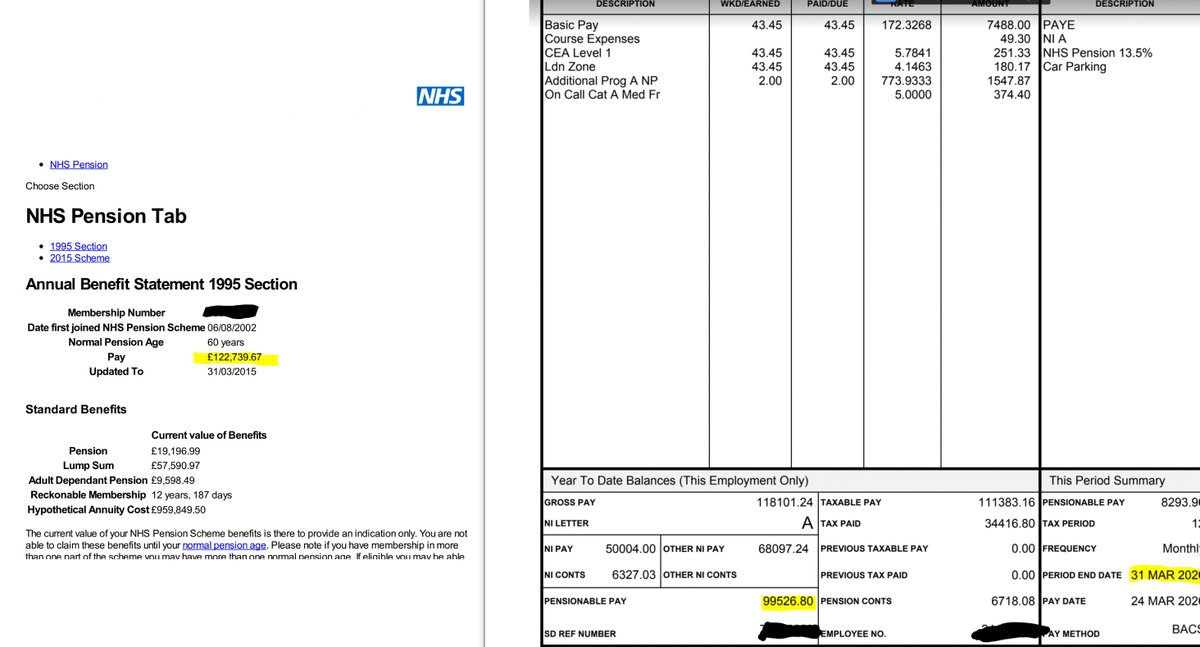

13/ TOP TIP: If 1995 TRS pay is > March payslip pay (corrected for FTE) then pay data might be wrong. Check the dates you were in the scheme with your employer, and the salary pensioned during those periods.

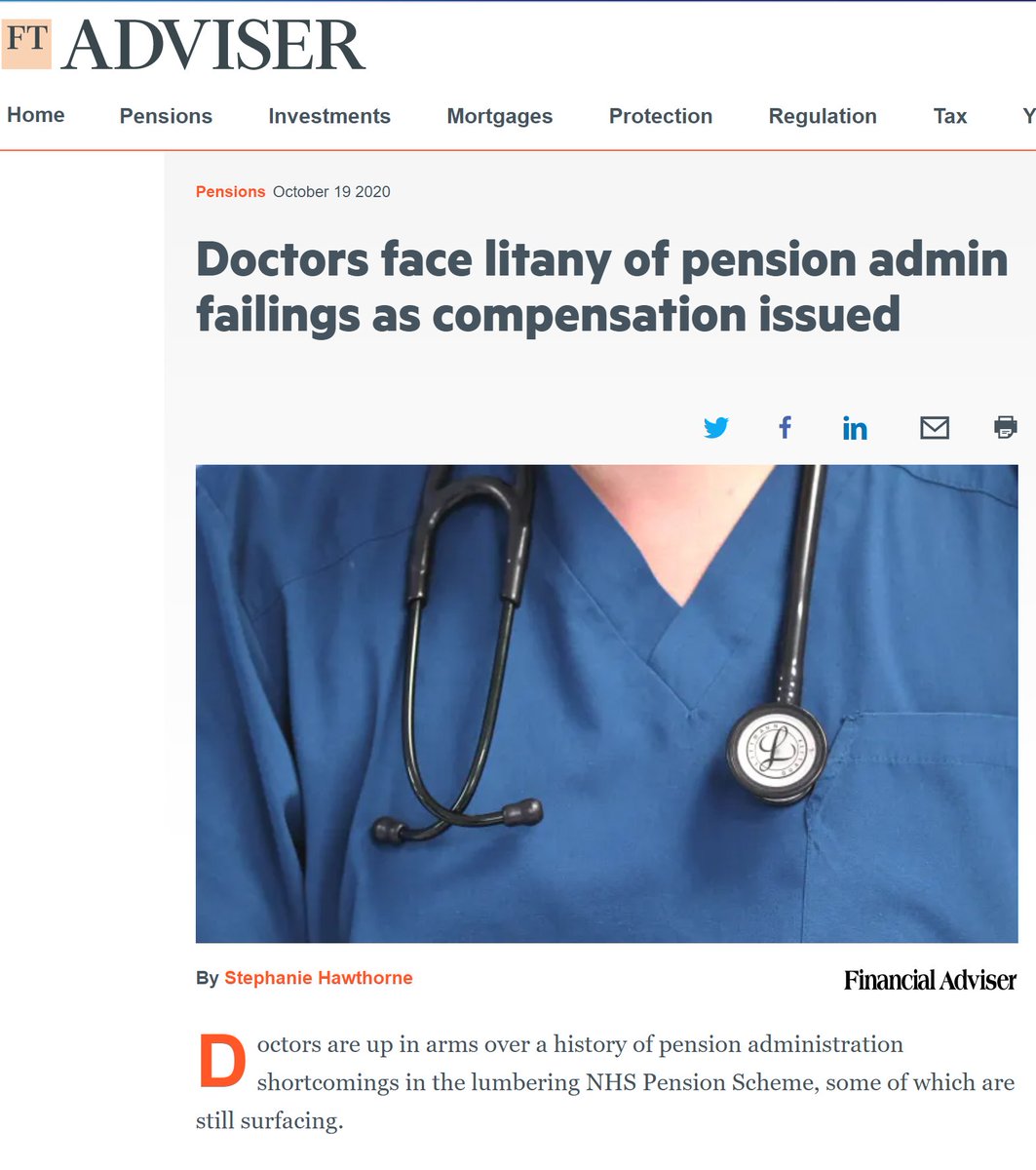

14/ E. Sadly for GPs the biggest problem is getting PCSE / @CapitaPlc to update records on time with actual amounts (or indeed at all). Check your record carefully for gaps. Goverment really needs to review the outsourcing of parts of GP pensions admin.

15/ As per my last thread... calculation of AA charges is complicated. So even if your pension growth (as above) is correct, the two commonest errors I see (including from some accountants and professional advisers)....

16/ F. Confusion around “threshold income”. This is basically all your “taxable income”. But on your payslip/P60 “taxable pay” ALREADY has employee pension contributions deducted so DONT deduct these again. See video below from 1:45 https://www.youtube.com/watch?v=NcBb7ukOgR0&ab_channel=TonyGoldstone">https://www.youtube.com/watch...

17/ Also reliefs for AA are different to income tax (ie gift aid of cash vs shares/property, dividend free allowance) so check the rules carefully!

18/ G. AA "carry forward" is complicated- I would always advise using the HMRC calculator & enter data for at least 7 prior carry forward years. Calculate this yourself using the HMRC calculator even if your adviser already has.

https://www.tax.service.gov.uk/pension-annual-allowance-calculator

OK">https://www.tax.service.gov.uk/pension-a... time for a case study-

https://www.tax.service.gov.uk/pension-annual-allowance-calculator

OK">https://www.tax.service.gov.uk/pension-a... time for a case study-

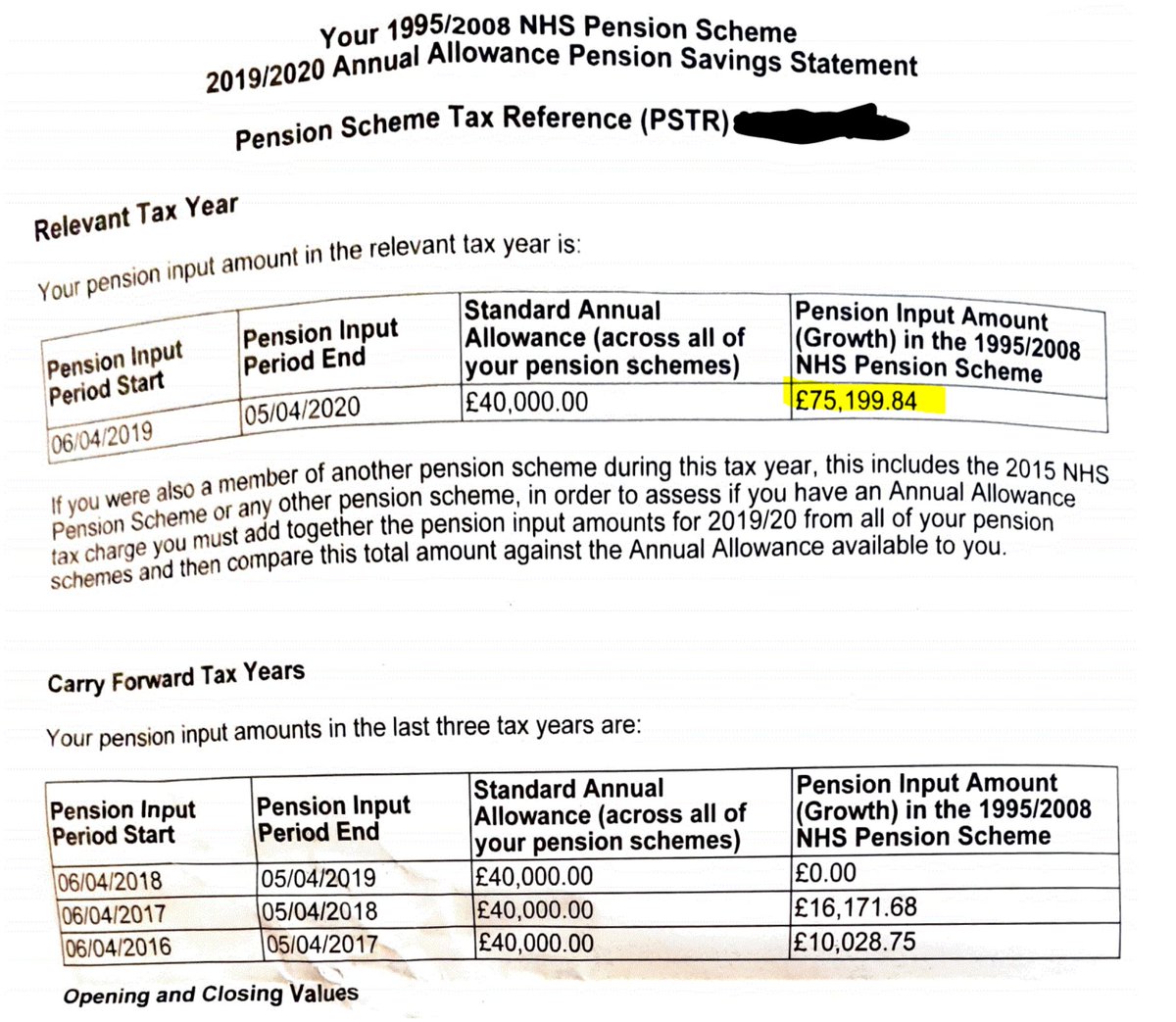

19/ Dr X is a consultant. Due to punitive AA charges he came out of the scheme for 6 months to decrease his pension growth. When his pension statement arrived he had massive growth in his 1995 pension despite having only a small pay rise

20/ The clue that there was an error with pay - as tweet 13 above - FTE pay on his 1995 TRS was £122.7k but was £99.5k on his March payslip. Also the estimated pension growth was wildy different on @theBMA Goldstone pension modeller

https://www.bma.org.uk/pay-and-contracts/pensions/tax/the-bma-goldstone-pension-modeller">https://www.bma.org.uk/pay-and-c...

https://www.bma.org.uk/pay-and-contracts/pensions/tax/the-bma-goldstone-pension-modeller">https://www.bma.org.uk/pay-and-c...

21/ Pay errors must be fixed by the employer first, so he asked his employer to confirm pay data and dates in the scheme provided to the pension agency, and sure enough the employer had incorrectly doubled pay (ie had included his time out during hokey) for a period

22/ After his employer updated his pay record, he asked @nhs_pensions to recalculate his growth based on the corrected pay data and £75k pension growth became £0. This saved him paying a potential £33,839.93 bill he didnt in fact have to pay

23/ In summary, knowledge is everything with AA. You need to understand it to have a chance of spotting an error- you could save MANY £000s. Dont assume your accountant/adviser will spot an error either. In my experience, many (thought not all) will not pick up on scheme errors

24/ Once again this thread shows what a throughly stupid and overcomplicated tax this is. It really is a completely inappropriate tax in the context of a DB scheme, and must be scrapped, as per the OTS recommendation

#ScrapAAinDB

#ScrapAAinDB

25/25 Clinicians remain very busy dealing with winter pressures & COVID, & really shouldn& #39;t be dealing with this hideously complex & thoroughly unfair tax. Do the right thing @RishiSunak & #ScrapAAinDB

Please RT & share with colleagues

Please RT & share with colleagues

Read on Twitter

Read on Twitter

spreadsheet or get a better estimate using @TheBMA Goldstone pension calculator (and also do 2008, transition protection / hokey etc) & will also do all tax years and carry forward. https://bit.ly/1920NHSPI..." title="5/ If you& #39;re in 1995/2015 as above you can use the formulas or thishttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> spreadsheet or get a better estimate using @TheBMA Goldstone pension calculator (and also do 2008, transition protection / hokey etc) & will also do all tax years and carry forward. https://bit.ly/1920NHSPI..." class="img-responsive" style="max-width:100%;"/>

spreadsheet or get a better estimate using @TheBMA Goldstone pension calculator (and also do 2008, transition protection / hokey etc) & will also do all tax years and carry forward. https://bit.ly/1920NHSPI..." title="5/ If you& #39;re in 1995/2015 as above you can use the formulas or thishttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> spreadsheet or get a better estimate using @TheBMA Goldstone pension calculator (and also do 2008, transition protection / hokey etc) & will also do all tax years and carry forward. https://bit.ly/1920NHSPI..." class="img-responsive" style="max-width:100%;"/>