BREAKING: The Government is accused of attempting a “sneaky” change to tax law, in a row over whether 600,000 people should face an income tax bill for claiming the Pandemic Unemployment Payment. More on @VirginMediaNews in a moment

The Finance Bill includes a change which enshrines the fact the PUP is taxable - but some think it’s an underhand admission that the payment is NOT subject to income tax. 600,000 people could be affected by the row

Here’s the row. (Prepare for a whistlestop tour of tax law...)

In general, all income is taxable. However the law over time has always included a list of payments or incomes which are not subject to tax.

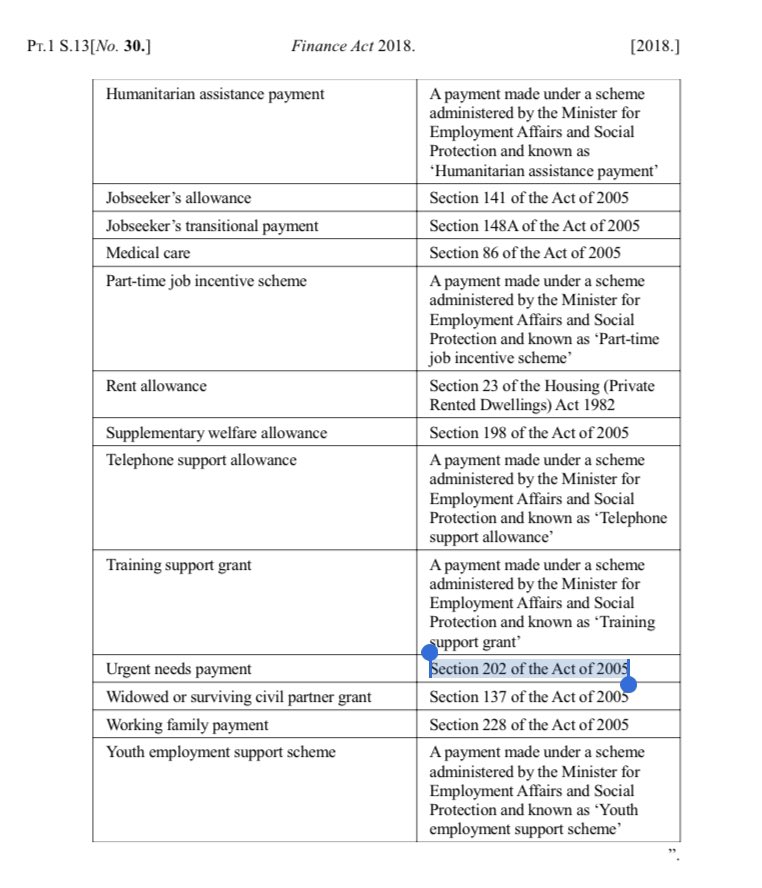

The Finance Act 2018 updated the list of tax-free income to include this:

In general, all income is taxable. However the law over time has always included a list of payments or incomes which are not subject to tax.

The Finance Act 2018 updated the list of tax-free income to include this:

So, an ‘Urgent Needs Payment’ (paid under Section 202 of the Social Welfare Consolidation Act 2005) is not subject to tax.

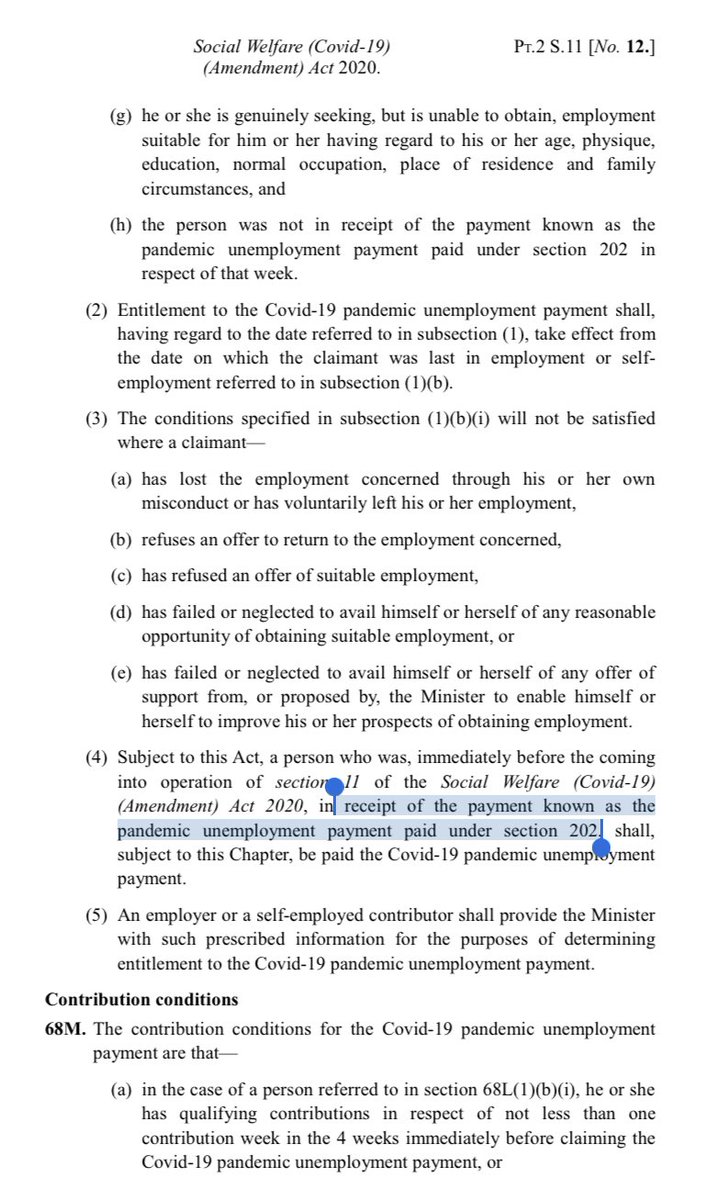

This is important, because when the PUP was finally placed on a legal footing this summer, all previous instalments were described as Section 202 payments:

This is important, because when the PUP was finally placed on a legal footing this summer, all previous instalments were described as Section 202 payments:

So it would *appear* the PUP is a form of welfare payment which is not subject to tax. Right?

If you believe that, then THIS clause in the new Finance Bill 2020, published yesterday, is interesting - it adds PUP to a list of other welfare payments which ARE taxable after all:

If you believe that, then THIS clause in the new Finance Bill 2020, published yesterday, is interesting - it adds PUP to a list of other welfare payments which ARE taxable after all:

So is this an attempt to quietly the law, potentially forcing a tax liability on nearly 600,000 recipients of the PUP? Pearse Doherty certainly thinks so:

But the Department of Finance takes a different view - and argues this is only a housekeeping provision.

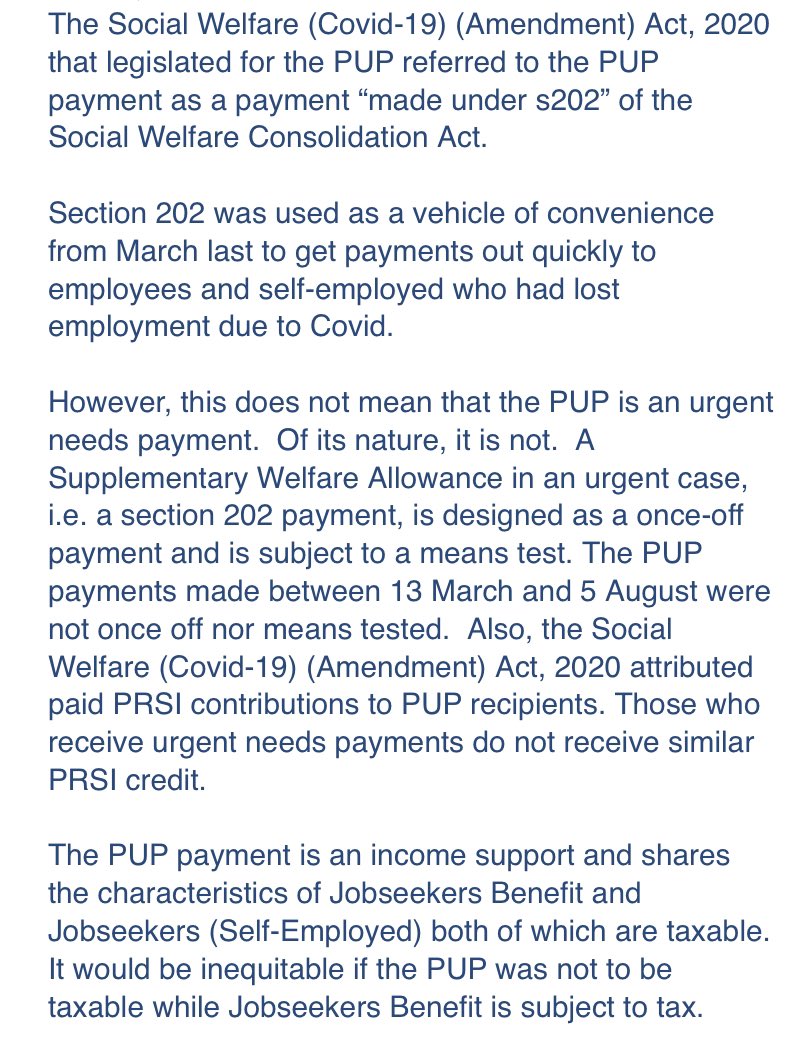

It tells @VirginMediaNews in a statement this evening that S202 was a “vehicle of convenience” to distribute the PUP… but that the PUP was NOT really a S202 payment at all:

It tells @VirginMediaNews in a statement this evening that S202 was a “vehicle of convenience” to distribute the PUP… but that the PUP was NOT really a S202 payment at all:

And they might well be right. This is the Section 202 it talks about - and evidently it’s supposed to be paid on a case-by-case basis depending on the particular circumstances of the claimant.

The PUP was not means tested, and originally paid at a flat rate - so does it count?

The PUP was not means tested, and originally paid at a flat rate - so does it count?

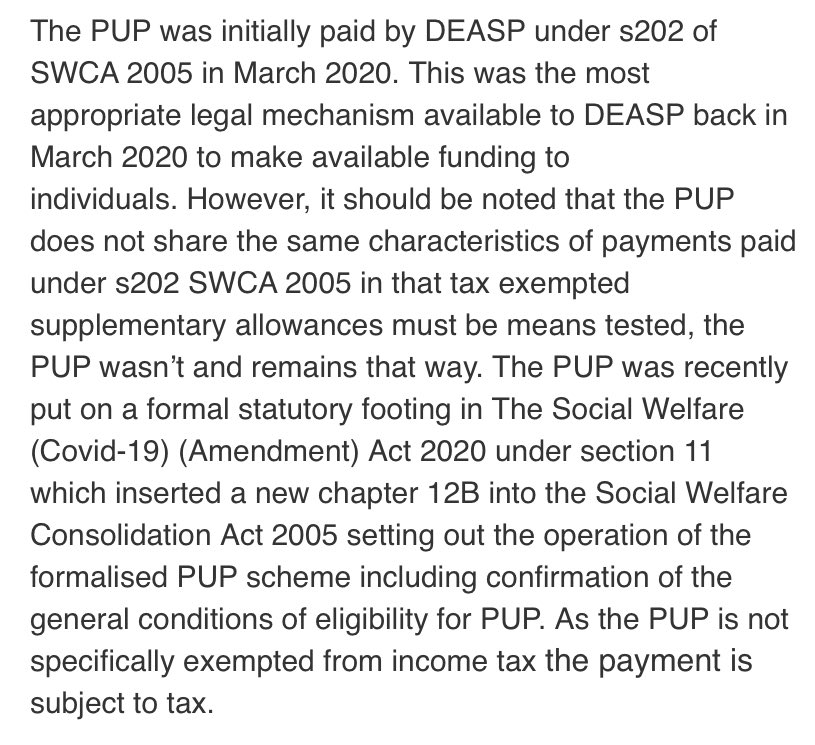

A similar position came from the Revenue Commissioners when we asked about it previously.

Basically both the taxman and the Government say: the PUP was a Section 202 payment in practice, but not in spirit.

Basically both the taxman and the Government say: the PUP was a Section 202 payment in practice, but not in spirit.

Is that a tenable position? Who knows?...

The Finance Bill is due in the Dáil the week in two weeks’ time and this could easily become a bit of a tinderbox.

While the legal status of the PUP changed in August, the row could affect the tax treatment of nearly 600,000 people.

The Finance Bill is due in the Dáil the week in two weeks’ time and this could easily become a bit of a tinderbox.

While the legal status of the PUP changed in August, the row could affect the tax treatment of nearly 600,000 people.

Read on Twitter

Read on Twitter