OIL MARKET 1: An imaginary line cutting across the Suez Canal divides the oil market. East of Suez demand continues to improve, led by China, India and Japan. Soon, ex-jet fuel (a big ex, I must admit) oil demand East of Suez will be back to pre-covid levels | 1/12  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> #OOTT

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> #OOTT

OIL MARKET 2: Globally, the Asian pull, hurricane GoM losses plus strong OPEC+ compliance means 4Q will see crude stockdraws (albeit smaller than expected 3 months ago), extending 3Q draws. But demand recovery isn’t looking great West of Suez, particularly in Europe 2/12

OIL MARKET 3: Asian differentials (ESPO notably) are strengthening, in part as some got “Rong-footed” when super tea-pot Rongsheng came in force. Oman is trading at premium to Dubai. And Asian crude stocks are slowly clearing (see floating outside China or INE Shanghai) 3/12

OIL MARKET 4: The Asian pull is reverberating throughout the global market, mostly via structure. Brent M1-M7 contango has narrowed to a 3-month high this week of -$1.52 a barrel compared to -$3.2 a barrel in mid-Sep. That’s despite weak local demand for North Sea oil | 4/12

OIL MARKET 5: Factoid not to forget when thinking about the East of Suez crude oil pull: China, India and Japan account today together for 21m b/d in oil demand -- that’s 3-times more than the top-five European nations (Germany, France, Italy, UK and Spain) combined | 5/12

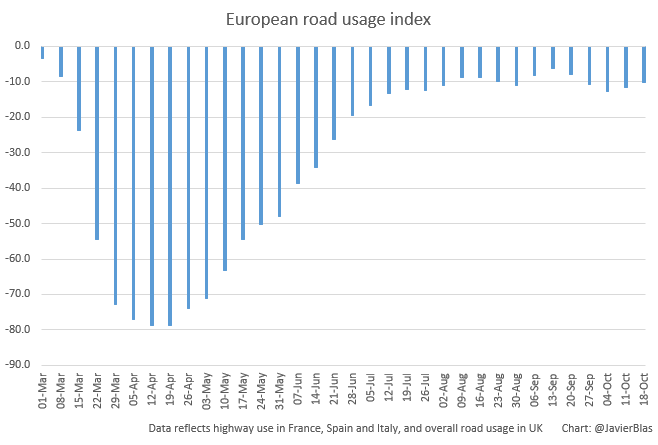

OIL MARKET 6: West of Suez, things aren’t looking great. Surging covid cases are denting European demand. The index that @alexlongley1 and I compile (high frequency data for UK, France, Italy and Spain) shows road usage down to -10%, from a recovery peak of -6% hit mid-Sep | 6/12

OIL MARKET 7: The European crude market has been therefore struggling, with barrels floating in North Sea awaiting for Asian arbitrage (which is now starting to emerge). Regional refining margins are weakening. Worse, Libya output is recovering fast | 7/12

OIL MARKET 8: US regional S/D has benefited from ~29m in crude supply losses from US GoM due to hurricanes since Aug 22 (that’s close to 500,000 b/d). But that’s going soon to face. Demand doesn’t look great, although probably isn’t deteriorating as much as in Europe | 8/12

OIL MARKET 9: While car usage is down in Europe/US, the same isn’t true about freight, with demand for trucking, railway and container shipping up strongly (boosted by e-commerce and a global supply chain inventory re-build). Diesel is getting a sorely needed bid | 9/12

OIL MARKET 10: West of Suez weakness shows the fragility of oil recovery. Until a vaccine is ready, we will see pull and push waves: refineries cut runs; crude weakens, product stocks draw, margins improve, refineries boost runs, crude strengthens, margins weaken. Repeat | 10/12

OIL MARKET 11: OPEC+ appears heading to delay the tapering, rather than hike 2m b/d in Jan as previously planned. But Saudi-Russia are still bidding for time for more info on: US election; demand in Oct / early Nov; vaccine news likely 3rd week of Nov, and Libya output | 11/12

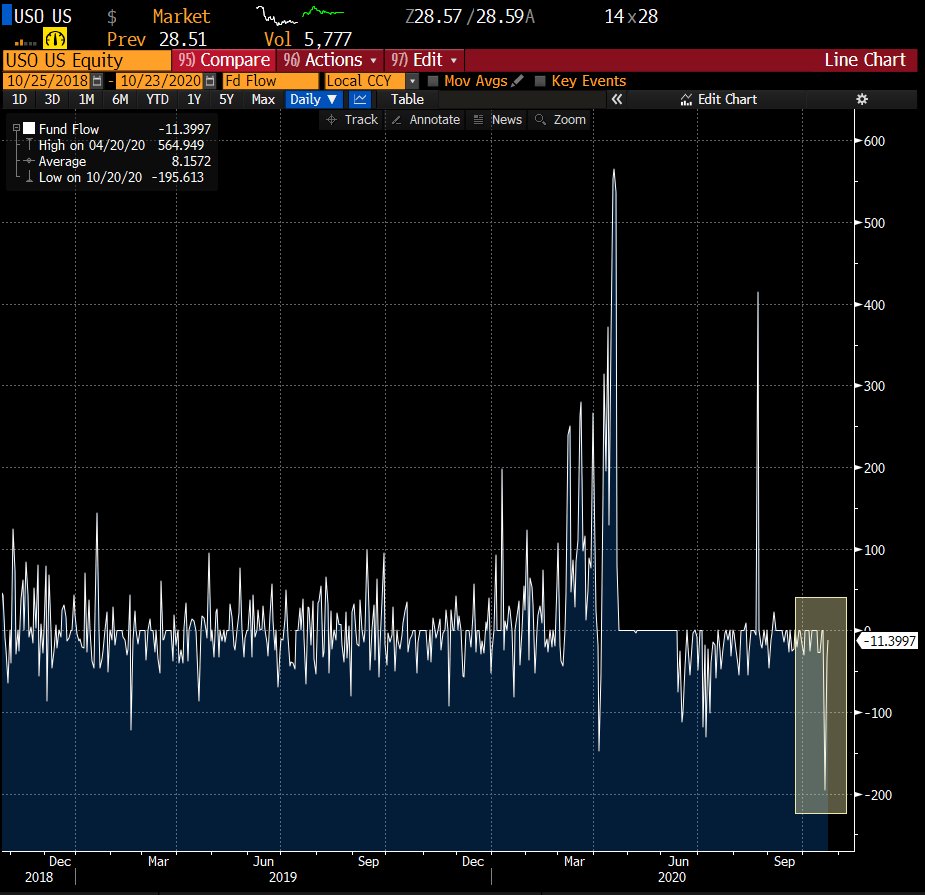

OIL MARKET 12: Plenty of speculative money selling oil. CTAs in particular. And petroleum ETFs, such as the US Oil Fund, of fame during the negative prices episode, have seen some heavy money outflows recently (chart) | 12/12 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> #OOTT

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> #OOTT

OIL MARKET Final thought: as much as covid and the vaccine, global politics are going to dictate the headlines that are likely to move oil prices in the next few weeks. Putin, MbS and whoever wins the US elections | #OOTT https://www.bloomberg.com/news/articles/2020-10-22/putin-says-russia-open-to-delaying-planned-opec-output-hike?sref=5dj0X2VO">https://www.bloomberg.com/news/arti...

Read on Twitter

Read on Twitter

#OOTT" title="OIL MARKET 12: Plenty of speculative money selling oil. CTAs in particular. And petroleum ETFs, such as the US Oil Fund, of fame during the negative prices episode, have seen some heavy money outflows recently (chart) | 12/12https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> #OOTT" class="img-responsive" style="max-width:100%;"/>

#OOTT" title="OIL MARKET 12: Plenty of speculative money selling oil. CTAs in particular. And petroleum ETFs, such as the US Oil Fund, of fame during the negative prices episode, have seen some heavy money outflows recently (chart) | 12/12https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> #OOTT" class="img-responsive" style="max-width:100%;"/>