A lot of excitement about the #recovery of manufacturing especially in the Eurozone and in #China , but is it real?

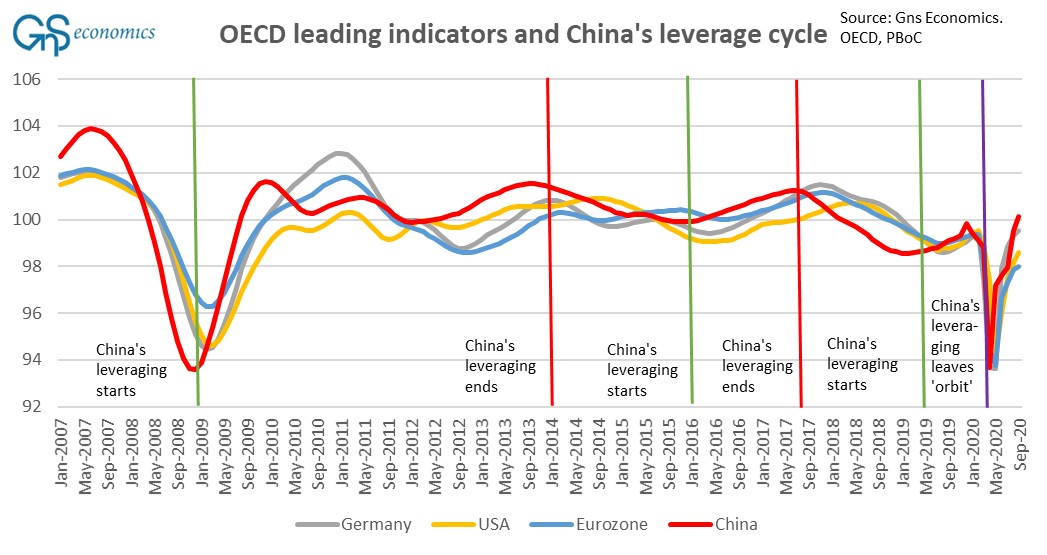

For three years, we have been trying to get the message of this figure through in the financial media with limited success.

Now, one more try (thread). 1/10

For three years, we have been trying to get the message of this figure through in the financial media with limited success.

Now, one more try (thread). 1/10

In 2017, while mulling through the global economic data, we had an epiphany.

Not only had #China led the global economic expansion that started in -09, but it had accomplished this with unsustainable debt stimulus. 2/

@GnSEconomics https://gnseconomics.com/2017/10/16/what-will-china-do/">https://gnseconomics.com/2017/10/1...

Not only had #China led the global economic expansion that started in -09, but it had accomplished this with unsustainable debt stimulus. 2/

@GnSEconomics https://gnseconomics.com/2017/10/16/what-will-china-do/">https://gnseconomics.com/2017/10/1...

The speedy recovery of the global #economy after the mini-recession in 2015 had baffled us. Why did the world economy suddenly jump off the brink of a #recession ?

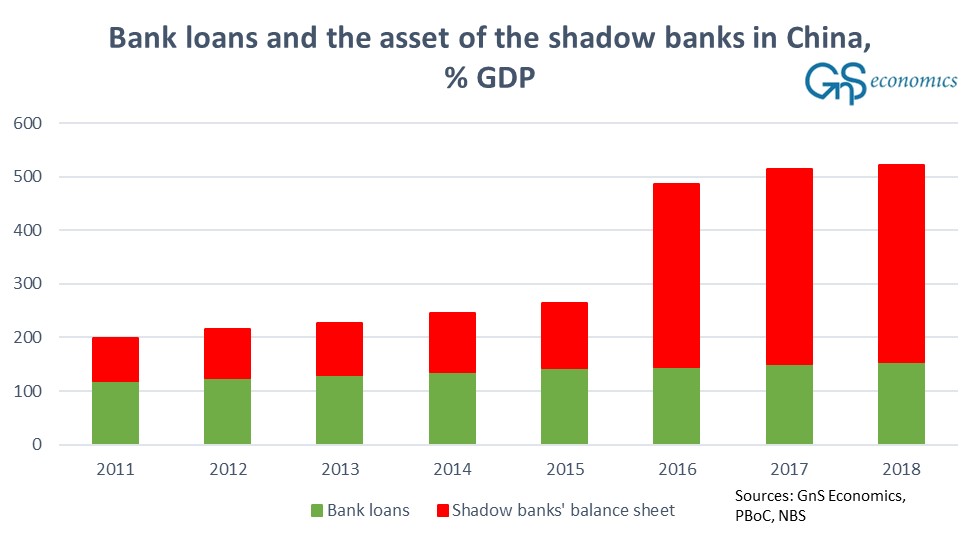

We found the answer from the & #39;shadow banking sector& #39; of #China .

In 2016, in just one year, its size tripled. 3/

We found the answer from the & #39;shadow banking sector& #39; of #China .

In 2016, in just one year, its size tripled. 3/

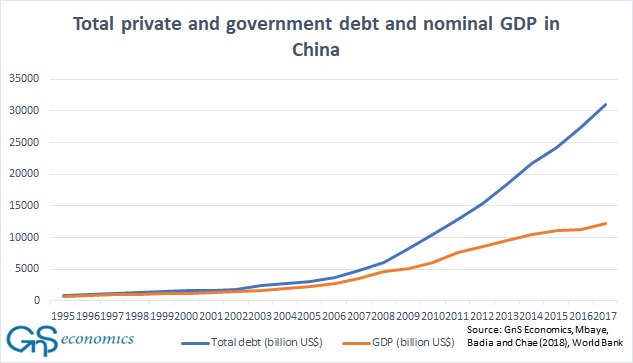

We dug deeper and found that while the Chinese economy had grown remarkably since -09, there was nothing "organic" or sustainable in it.

Chinese #economy had been accumulating a monstrous debt bubble. 4/

Chinese #economy had been accumulating a monstrous debt bubble. 4/

We quickly realized that especially the economy of the #Eurozone , which had slowly started to mimic the export-led economy of Germany, was almost totally dominated by the continuous debt-stimulus of #China.

Whenever Chine tried to deleverage, the global economy & #39;hiccupped& #39;. 5/

Whenever Chine tried to deleverage, the global economy & #39;hiccupped& #39;. 5/

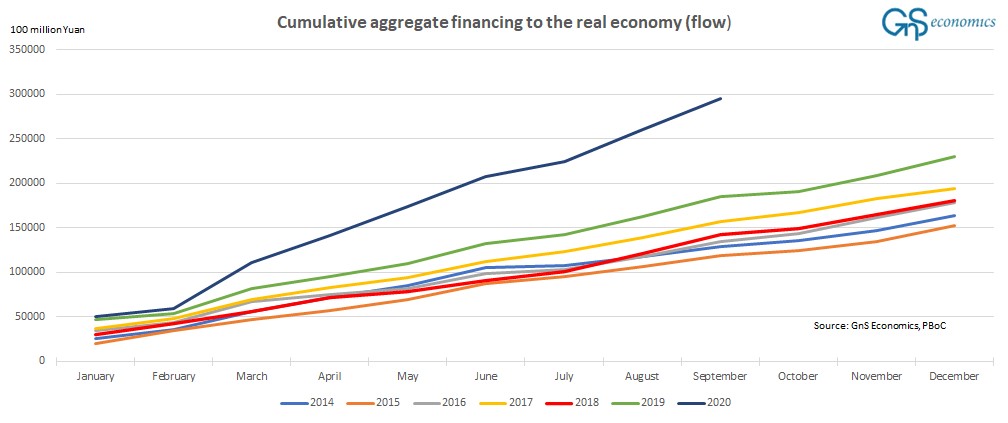

So, why has the global manufacturing sector, especially in Europe, seen to recover from the hit of the #coronavirus pandemic?

Quite simply, because of this. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Since March this year, China has run a & #39;credit bonanza& #39; not seen since 2016 (then run through the shadow banks). 6/

Quite simply, because of this.

Since March this year, China has run a & #39;credit bonanza& #39; not seen since 2016 (then run through the shadow banks). 6/

The total financing has grown by 12-14% this year, nearly a triple the recent GDP growth rate.

As the debt share to GDP is (at least) in the range of 600-700%, this is just nuts.

It also implies that there& #39;s no other end to this than a & #39;hard landing& #39;.7/ https://gnseconomics.com/2020/01/10/the-end-of-the-chinese-miracle/">https://gnseconomics.com/2020/01/1...

As the debt share to GDP is (at least) in the range of 600-700%, this is just nuts.

It also implies that there& #39;s no other end to this than a & #39;hard landing& #39;.7/ https://gnseconomics.com/2020/01/10/the-end-of-the-chinese-miracle/">https://gnseconomics.com/2020/01/1...

My friend, a former China economist, answered to my question about the sustainability of it all by stating that "doesn& #39;t everyone do it (debt stimulus)?"

This describes well the madness we have arrived.

Economic "growth" through massive debt-issuance is the & #39;new normal& #39;. 8/

This describes well the madness we have arrived.

Economic "growth" through massive debt-issuance is the & #39;new normal& #39;. 8/

Many economists seem to think that this (continuous astronomical monetary and fiscal stimulus) is the only way forward. But why?

It& #39;s my guess that many economists understand that a collapse awaits, and try to postpone it as long as possible. Many also cannot say it out loud. 9/

It& #39;s my guess that many economists understand that a collapse awaits, and try to postpone it as long as possible. Many also cannot say it out loud. 9/

And, many also probably fear the economic collapse, which is very human.

However, we should consider the consequences of our actions.

Especially as we will recover from a crisis, but not from the & #39;socialization& #39; of the #economy https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">.

/End https://gnseconomics.com/2020/10/08/the-destruction-of-the-world-economy-by-the-central-banks/">https://gnseconomics.com/2020/10/0...

However, we should consider the consequences of our actions.

Especially as we will recover from a crisis, but not from the & #39;socialization& #39; of the #economy

/End https://gnseconomics.com/2020/10/08/the-destruction-of-the-world-economy-by-the-central-banks/">https://gnseconomics.com/2020/10/0...

Read on Twitter

Read on Twitter

Since March this year, China has run a & #39;credit bonanza& #39; not seen since 2016 (then run through the shadow banks). 6/" title="So, why has the global manufacturing sector, especially in Europe, seen to recover from the hit of the #coronavirus pandemic?Quite simply, because of this. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">Since March this year, China has run a & #39;credit bonanza& #39; not seen since 2016 (then run through the shadow banks). 6/" class="img-responsive" style="max-width:100%;"/>

Since March this year, China has run a & #39;credit bonanza& #39; not seen since 2016 (then run through the shadow banks). 6/" title="So, why has the global manufacturing sector, especially in Europe, seen to recover from the hit of the #coronavirus pandemic?Quite simply, because of this. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">Since March this year, China has run a & #39;credit bonanza& #39; not seen since 2016 (then run through the shadow banks). 6/" class="img-responsive" style="max-width:100%;"/>