A few thoughts ahead of next week’s #ECB meeting:

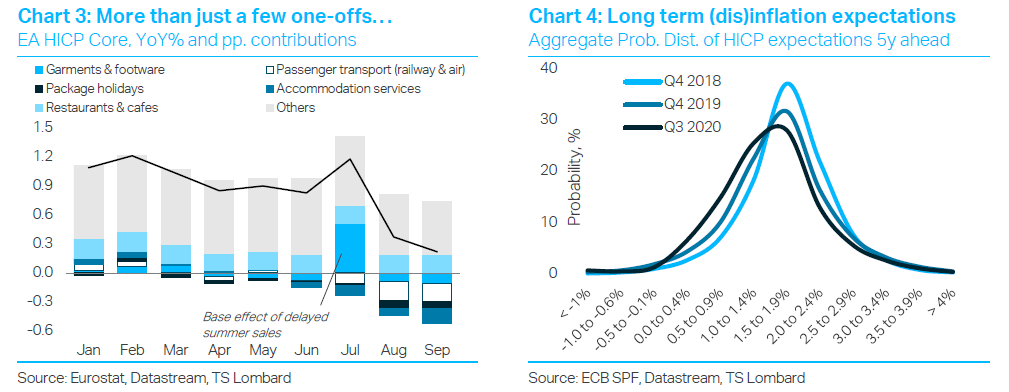

1) Covid second wave affects consumer behaviour sparking a negative feedback loop b/w confidence and service activity; 2) Growing double-dip risks mean more disinflation than the ECB projects and lower inflation expectations 1/

1) Covid second wave affects consumer behaviour sparking a negative feedback loop b/w confidence and service activity; 2) Growing double-dip risks mean more disinflation than the ECB projects and lower inflation expectations 1/

3) We @TS_Lombard think that fiscal transfers are the only effective way to support growth and inflation as long as the virus lingers on. Nonetheless, the ECB will need to act and show that it doesn’t tolerate deflation 2/

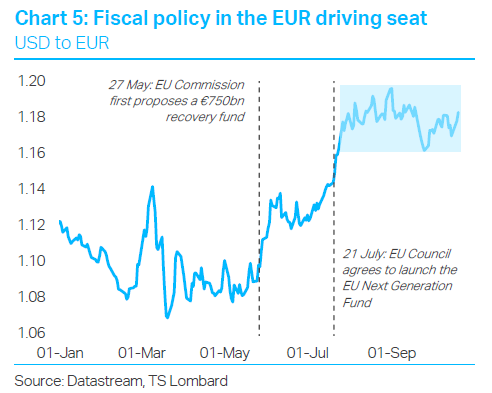

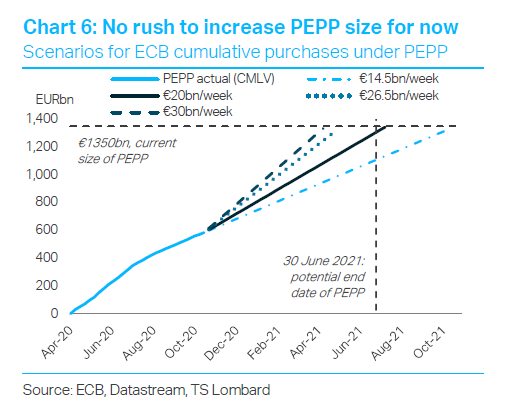

4) One option is increasing the pace of asset purchases to weaken the euro. A recent ECB article claims more than 50% of EUR appreciation this year is due to the Fed’s B/S having expanded 16% more than the ECB’s 3/ https://www.ecb.europa.eu/pub/economic-research/resbull/2020/html/ecb.rb201020~85fb68a983.en.html">https://www.ecb.europa.eu/pub/econo...

The study doesn’t seem to control for the launch of the #recoveryfund, which makes the conclusion above pretty spurious IMO, but it can give doves an excuse to push for action. Another option is cutting the TLTRO rate 4/

Read on Twitter

Read on Twitter