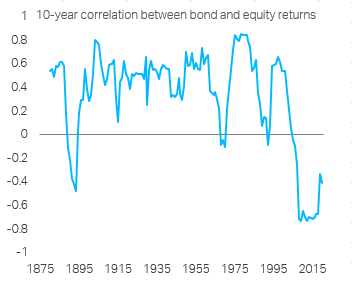

Been getting lots of questions about bond-equity correlation, the subject of my Macro Picture this week. Issue has gone mainstream in part because of what happened in March, when yields spiked while equities sold off. This proved temporary, but investor concerns are broader

Bonds and equities have rallied together over past decade, which has confused people (lower r*). You have to detrend them to see high-frequency correlation. Correlation has been negative since 2000s - but it wasn& #39;t always that way. Here is the UK correlation since late-1800s

What drives this? Until 2009 wasn& #39;t a lot of research. People just assumed the correlation was + & only flipped temporarily eg LTCM. Last 5 years there have been lots of papers on this, particularly the last two years. Research has identified two underlying macro forces:

1) cyclicality of inflation (demand vs supply shocks), which also flipped in early 2000s. Inflation went from counter-cyclical to pro-cyclical as demand shocks took over. 2)CBs like to attribute this to "good policy" rather than good luck. Inflation targets anchored expectations

Consensus is a combination of these factors. So how could this change in 2020s? Everyone currently focused on permazero world, which implies less credibility for CBs as struggle to reflate economies. This is probably a world in which bond-equity correlation edges towards 0

Bonds would lose their "insurance properties". But history suggests we cant rule out a more dramatic shift - correlation becomes positive. This would require series of supply shocks (eg climate change, deglobalization) & lose of CB independence (MMT world would be perfect)

Remember also that negative correlation is a key reason the term premium in bonds has trended to negative (this is the "insurance premium"). So if the correlation flipped to positive, you could imagine a nastier equilibrium in financial markets. Not saying this happens soon

We have 2 main episodes in past where correlation flipped from negative to positive. Late 1800s, the end of the Long Depression (think populism, first socialist parties, de-globalization, start of worker power/trade unions) and 1970s (loss of monetary anchor - passive mon policy)

Read on Twitter

Read on Twitter