CHART THREAD INTO THE WEEKEND: Lots of great runners in some of my favorite value plays this week like $BKNG and $IWM on stimulus talks, and as I predicted on the most recent episode of @PoundingDaTable, they& #39;ve been selling growth, so I did too and hedged the rest 1:1...

...So, clearly it& #39;s a pickers market. The market will continue to rotate between growth, value, and big tech names, in and out until the market decides to rally in tandem. But, that& #39;ll likely come after the stimulus and elections are done. Here are some charts to guide the way:

$AAPL. We& #39;ve rallied in growth and now sold off growth. We& #39;re now rallying value, but eventually, that will rotate back to big tech. When this starts, $AAPL and $GOOGL are going to blow.$126 can happen fast once we rotate back in.

$AYX. Spicy down wedge here, look to turn up and retest the recent high at $154, if breaks can close the gap!

$BLFS. Med tech was super hot for the last month, and sold off a bit over the last few days along with other tech growth names. People are selling off more speculative positions into the election, these rotations are why $SPX stalling. Look for the pennant break!

$CDLX. Just a matter of time, has held up very well in this growth sell. Look for $88 break!

$CELH. Looks to be setting up beautifully. I ordered some this weekend, well worth the buy. 3rd biggest on Amazon in its category. Can move quickly through $27!

$DDOG. Hedged this one all the way from the highs and removed most of my hedge. Looking for a reversal turn up over this recent breakout high at $99. If doesn& #39;t hold back to the Anchored-VWAP, but I think it holds because this was a news-related breakout.

$DKNG. Secondary at $52 sent this lower to its overall trend line. Nice wick hammer and looks to finally break this huge down wedge finally! $52 will be super hard level above since that is secondary price!

$FLGT. Winding and grindin& #39; in a beautiful pennant. Likely looks to test lower line and then head higher and break for a test of all time highs!

$FOUR. Love the long term growth prospects in this name. This is a strong basing pattern here, and looks very much like will run to all time highs soon. To me, this stock can easily double in a few months. $63 first.

$FTCH. Nice news on the addition of live videos for showcasing luxury products on their site. 2x normal volume today, looking ready to turn up to highs! $32 break can rally hard.

$FTHM. Back to overall trend line but such low market cap and price to sales ratio, and looks like back to highs can happen fast at $25. This one really doesn& #39;t need much volume.

$GOOGL. I& #39;ve been riding November calls since $1440 are, looking for a spike near $1653 to take them off into earnings report. That rally to $1730 area was the Softbank gamma squeeze, so may be harder to run that high up but with ADs rev from snapchat, can be $1800.

$GRWG. I know a lot of people like this name. I& #39;m in $TCNNF and $TRSSF, also nice breakouts, but this one goes hand in hand. Look out of $21 and $23.

$IPOB. Another big down wedge that can potentially break up back hard. Let& #39;s see if it rallies over this line!

$LVGO. Finally support at this big uptrend line, finally looks like it can bounce from here and turn up over all time highs. It& #39;s been basing for so long so when it runs it& #39;s not looking back. $150 close is all it needs.

$MELI. This beast lead the growth way higher and also back lower. Back over $1321 and it can really get going back to highs. I still see $1427 soon before report.

$NET. Been accumulating a position here near $55. Looks like its ready to break out of this mini wedge and hit highs when growth finally gets back in gear!

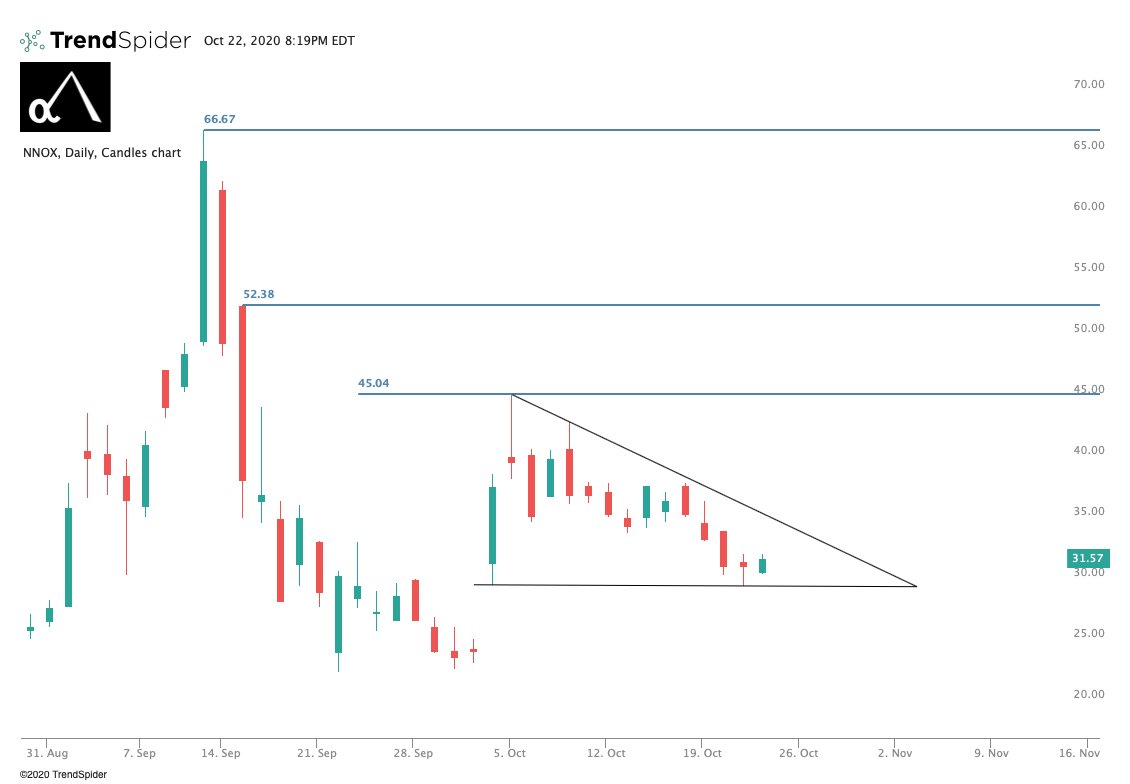

$NNOX. Strong support at gap up from the demo announcement day at $30. Don& #39;t think it breaks under before the demo so possible it breaks back up higher to $45 again.

$NVTA. Another nice down wedge here. Will be getting back into this name over the coming days, big fan of the company!

$RUN. Huge downtrending channel, had a huge rally but coming to anchored VWAP so I think ill be adding some shares soon in anticipation of the election. Anchored-VWAP looks like a nice place near the $50 area.

$TTCF. Back to anchored-VWAP. The long term prospects blow $BYND out of the water comparatively, so finally going to be adding this one back soon personally. Right here at nice support, looks good to me if I can snag it under $18.

$TCNNF. Broke out huge and ran from $18 to $23.7 since I posted this chart. But looks ready for another leg with this close, keep an eye on it.

$U. Will this pull a $SNOW? I killed the $252.5 calls this week from $3.7, maybe be able to do the same with this one once it starts. Keep an eye on!

Just be sure to understand, the rotations can continue for a while. Growth to Value to Big tech and all in between. This is when you have to pick the best set ups and watch the internals and key leading stocks (for me, it& #39;s BKNG and MELI) that move the easiest +show strength...

And I know a lot of people say they can be great investors by not being great traders, but that& #39;s just a load of crap. There is 0% chance you can get close to the best return on these names just buying and holding. It takes action for the best returns....

Read on Twitter

Read on Twitter