Time for a thread about US NatGas and why it will surprise to the upside...

There’s an exceptional opportunity setting up in the energy space, in particular for US NatGas and related equities.

I’ll explain the setup in this thread and also reveal my top pick. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤠" title="Cowboy hat face" aria-label="Emoji: Cowboy hat face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤠" title="Cowboy hat face" aria-label="Emoji: Cowboy hat face">

There’s an exceptional opportunity setting up in the energy space, in particular for US NatGas and related equities.

I’ll explain the setup in this thread and also reveal my top pick.

1- I’ve been meaning to write this thread for awhile now, but the recent M&A action in the energy space has brought this opportunity to the forefront.

Let’s start simply by charting Henry Hub continuous NatGas prices over the last 20 years:

Let’s start simply by charting Henry Hub continuous NatGas prices over the last 20 years:

2- It’s at a generational low.

NatGas hit an ATH of almost $16 in Dec of 2005.

Since then, it’s been a brutal grind to much lower prices, owed to the all-too-easy access to financing as well as the hypergrowth in US shale and associated gas.

NatGas hit an ATH of almost $16 in Dec of 2005.

Since then, it’s been a brutal grind to much lower prices, owed to the all-too-easy access to financing as well as the hypergrowth in US shale and associated gas.

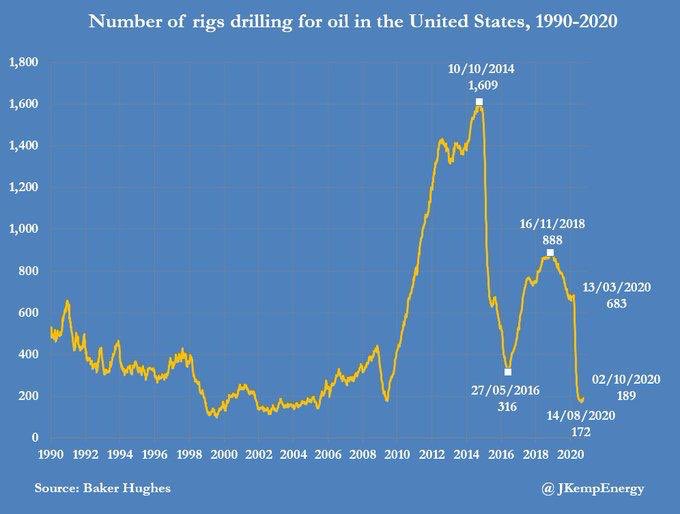

3- That’s all coming to an end. After more than a decade of this dynamic, financing for drillers is now getting yanked. As a result, they’re drilling a lot less. Capex is collapsing and more cashflow is expected to go toward paying down debt.

Rig count is now at historic lows:

Rig count is now at historic lows:

4- You might be wondering, how can prices be at generational lows while rig count is too? It almost seems counterintuitive.

But the answer is simple: low prices discourage drilling, hence, the lower the price the lower the number of rigs. And vice-versa.

But the answer is simple: low prices discourage drilling, hence, the lower the price the lower the number of rigs. And vice-versa.

5- Importantly, there is a lag between drilling and pumping, so the effects on production of this historically low rig count will be felt soon enough.

Put simply, the seeds have been sown for a massive and unavoidable structural loss in US shale supply growth.

Put simply, the seeds have been sown for a massive and unavoidable structural loss in US shale supply growth.

6- Currently, there’s some exciting M&A action taking place too. $EQT just made a takeover proposal to $CNX.

If $EQT acquires $CNX as rumoured, $EQT would become responsible for ~6.5 Bcf/d, giving them material pricing power.

If $EQT acquires $CNX as rumoured, $EQT would become responsible for ~6.5 Bcf/d, giving them material pricing power.

7- As I see it, consolidation in the industry is great for NatGas prices because it makes it easier to enforce discipline, meaning that prices need to rise higher before raising production.

This will ultimately result in a longer bull cycle.

This will ultimately result in a longer bull cycle.

8- While I love both $EQT and $CNX as individual companies, my favourite pick is neither. I believe the greatest risk/reward exists in $AR, both from a relative and fundamental standpoint.

9- Brief note on $AR: Aside from gas, $AR is the 2nd largest NGL producer in the US, and propane demand is ramping thanks to increased use of outdoor heating lamps as restaurants prepare for socially-distanced, outdoor seating this winter.

But $AR is also quite gas-heavy.

But $AR is also quite gas-heavy.

10- Now, even though the working down of current gas inventories still largely depends on weather outcomes, if weather delivers, we could see silly upside volatility across the Winter’21 strip.

11- But even if upside is limited from here, the entire Winter’21 and ‘22 strips are already sitting comfortably above $3. If these prices hold steady, I am of the opinion that NatGas E&Ps should trade a lot higher from this point.

12- I’ll also note that while $AR is my preferred pick, I favour a basket approach for this play, with my top picks having been $AR/ $EQT/ $RRC/ $SD.

13- Also, the recent reversal in energy relative to tech (which I proxy by the QQQ/XLE ratio) is interesting and worth noting.

Charting the last 20 years of this ratio, we can see how overstretched tech is from a relative standpoint to energy:

Charting the last 20 years of this ratio, we can see how overstretched tech is from a relative standpoint to energy:

14- When this unwinds, I believe the unwind will be violent.

In March 2000, as @contrarian8888 has noted, tech was outperforming energy by 100%. By year end, energy was outperforming tech by 100%. So a 200% reversal in under a year.

Will history will rhyme here? Perhaps...

In March 2000, as @contrarian8888 has noted, tech was outperforming energy by 100%. By year end, energy was outperforming tech by 100%. So a 200% reversal in under a year.

Will history will rhyme here? Perhaps...

15- All in all, very exciting times for NatGas investors.

Buckle up, the best is yet to come!

Buckle up, the best is yet to come!

HT to those who’ve been on top of this opportunity for awhile now:

@hkuppy @HFI_Research @pineconemacro @WarrenPies @TwainsMustache @In_Sapiens @contrarian8888 @ericnuttall.

Thoughts/criticisms/feedback always welcome and appreciated.

@hkuppy @HFI_Research @pineconemacro @WarrenPies @TwainsMustache @In_Sapiens @contrarian8888 @ericnuttall.

Thoughts/criticisms/feedback always welcome and appreciated.

Read on Twitter

Read on Twitter