If you invest $1 per WEEK, which is only 14¢ per day, for 40 years (assuming you’re currently 25 years old and retire at 65):

- The total amount of money you put in = $1,920

- The total available for retirement after 40 years of compound interest = $21,244

- The total amount of money you put in = $1,920

- The total available for retirement after 40 years of compound interest = $21,244

Think I’ll start posting these **for whomever it concerns**. And for the people who tell cashiers to “keep the change”.

A lot of brokerages offer fractional shares. You can buy 0.008 of an Apple stock for $1. If you do that weekly, you’ll own about half of a share in 1 year.

A lot of brokerages offer fractional shares. You can buy 0.008 of an Apple stock for $1. If you do that weekly, you’ll own about half of a share in 1 year.

And extra emphasis on **for whomever it concerns** because I don’t want anybody coming at my neck about how they can’t afford to invest 14¢ per day.

I’m only here to share information that I know Black people don’t come across everyday.

I’m only here to share information that I know Black people don’t come across everyday.

Investing in a retirement fund is very VERY important because we don’t know what social security will look like 40 years from now. You’re going to need some money saved up (accumulating interest).

I’m shooting for $3M but you can shoot for whatever makes sense for you.

I’m shooting for $3M but you can shoot for whatever makes sense for you.

If you invest $2 per WEEK, which is only 28¢ per day, for 40 years (assuming you’re currently 25 years old and retire at 65):

- The total amount of money you put in = $3,840

- The total available for retirement after 40 years of compound interest = $42,488

- The total amount of money you put in = $3,840

- The total available for retirement after 40 years of compound interest = $42,488

*** The interest rate may be as low as 7% or even higher than 10%, depending on which stocks you invest in. But the safest bet is an index/mutual fund ***

Let’s say you go out every weekend and spend $50 at a club/bar/restaurant. If you stay home for ONE weekend per MONTH and invest the money instead..

-The total you put in= $24,000

-The total after 40 years of compound interest= $265,555

-The total you put in= $24,000

-The total after 40 years of compound interest= $265,555

NOT a regular savings account, but a *diversified* stock portfolio or mutual/index fund. Your money loses value in a regular savings account because inflation is like 2% per year and regular savings only yield 0.06%. You’ll have less purchasing power with the same $ amount.

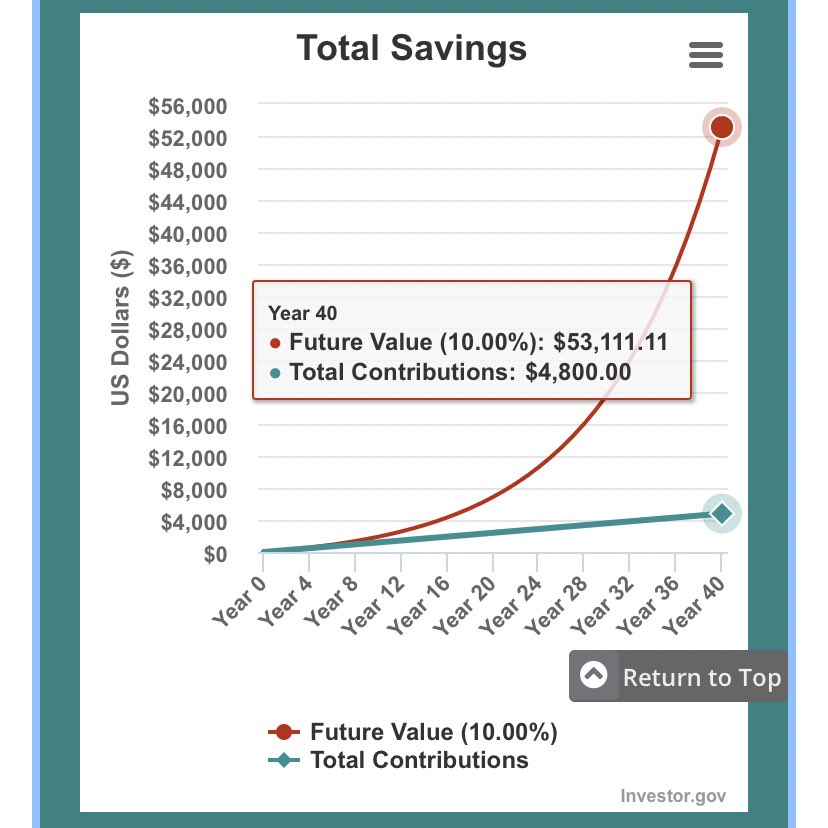

Let’s say you stop smoking ONE $10 blunt per MONTH and invest instead. (If your weed costs more than $10 because you’re bougie, factor that in accordingly)

- Total amount you saved over 40 years= $4,800

- Total after 40 years of compound interest at 10% average return= $53,111

- Total amount you saved over 40 years= $4,800

- Total after 40 years of compound interest at 10% average return= $53,111

Read on Twitter

Read on Twitter