ANT Financial – a detailed view into the IPO and the company

A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> http://bestengagingcommunities.com/2020/10/22/ant-financial-a-detailed-view-into-the-ipo-and-the-company/">https://bestengagingcommunities.com/2020/10/2...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> http://bestengagingcommunities.com/2020/10/22/ant-financial-a-detailed-view-into-the-ipo-and-the-company/">https://bestengagingcommunities.com/2020/10/2...

A thread

Ant Financial is a financial services company that was previously a part of Alibaba. Ant recorded about $17B in revenue last year and about $1.7B in profit. In March 2020 alone they profited over $1.3B, a 560% increase over last year. Alibaba owns about 33% of Ant.

The company is planning to go public in Hong Kong sometime in November 2020. It is expected to raise more than $30B.

With a forward price-to-earnings multiple of 40, in line with big global payments companies, Ant could fetch a market capitalization in excess of $300B, more than any bank in the world.

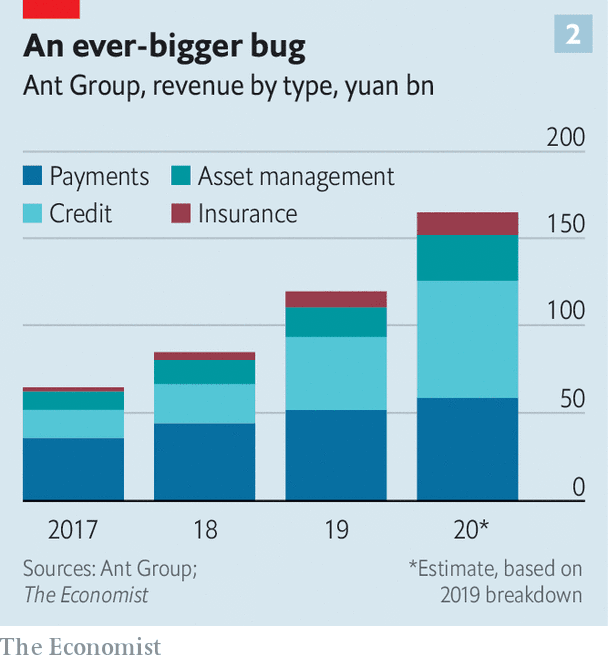

There are 4 business lines that Ant makes money from - payments, loans, insurance and asset management (mostly mutual fund investment services).

The company’s latest annual total consisted of RMB 51.9 billion ($7.6B) in digital-payments revenue (Payments) and RMB 41.9 ($6.1B) billion in credit-technology (Loans) revenue.

Ant added RMB 8.9 billion ($1.3B) in revenue from insurance technology (Insurance) and RMB 17 billion ($255M) from investment technology (Mutual Funds).

Alipay was rebranded as Ant Group Services on 23 October 2014, and the company changed its name to Ant Group Co., Ltd on 13 July 2020.

Market

There are over 3.4 Billion bank accounts (3.1 B payment, 300 M credit cards) in China. Widespread use of Ant Financial started via QR Codes and on eCommerce marketplaces in China - Taobao, Tmall, http://JD.com"> http://JD.com and others.

There are over 3.4 Billion bank accounts (3.1 B payment, 300 M credit cards) in China. Widespread use of Ant Financial started via QR Codes and on eCommerce marketplaces in China - Taobao, Tmall, http://JD.com"> http://JD.com and others.

Products

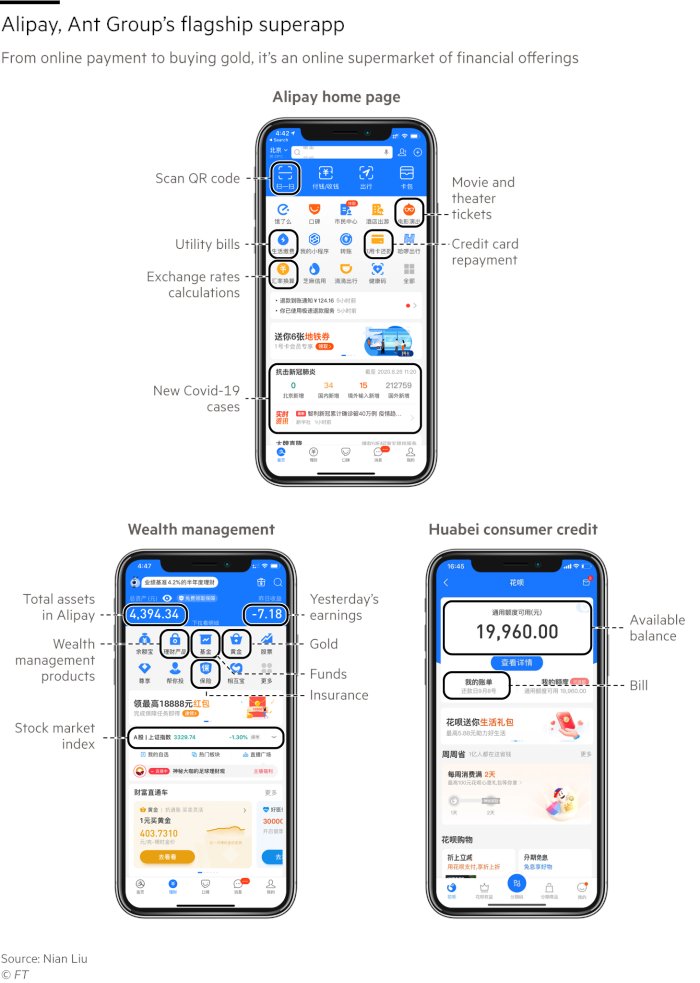

Alipay (payments, similar to PayPal) was introduced by Alibaba group in 2004. This payment app competes with WeChat payments (owned by Tencent). That is now Any payments.

Alipay (payments, similar to PayPal) was introduced by Alibaba group in 2004. This payment app competes with WeChat payments (owned by Tencent). That is now Any payments.

Alipay and WeChat own about 84% of the entire third-party payment market in China. Alipay is the largest (51%), WeChat (33%) as of 2016.

The organization has expanded beyond mobile wallet Alipay to include an online lending platform, MyBank, and an investment fund, Yu’e Bao. In June 2018, Ant Financial introduced the world’s first cross-border remittance network based on blockchain.

Yu’e Bao has become the largest money market fund in the world, with over 400M users and $211B assets under management today. Ant claims 116 — nearly all — of China’s mutual fund asset management companies sell products on Ant Fortune to its 180M users.

Ant has 392M users annually use Ant’s insurance marketplace to find thousands of products sold by over 80 Chinese insurance companies. Like Ant Fortune, Ant’s insurance services also see strong margins, charging insurers tech and service fees to be featured in its marketplace.

Ant earned $2.6 B in net profit, on $120 B of revenue in 2019.

Consumers paying with Alipay also start borrowing from it. Alipay arranges small loans to consumers and small businesses and earns a service fee from the lender tied to the loan balance. Last year 500 M customers took a loan from Ant. This business is growing at 80% YoY.

Ant introduced its Yu’E Bao fund in 2013, allowing customers to invest the piles of cash growing in their Alipay accounts.

Lending

In lending, Ant offers three major financing services:

Ant Micro-Loan: The credit loan service arm of Ant’s private commercial bank, MyBank. The platform provides micro-credit loans to small businesses in China and issued loans to 3M applicants by mid-2016.

Ant Micro-Loan: The credit loan service arm of Ant’s private commercial bank, MyBank. The platform provides micro-credit loans to small businesses in China and issued loans to 3M applicants by mid-2016.

JieBei: A consumer credit loan service for Ant users with high Sesame Credit scores (600+). JieBei claims to hand out, on average, 3000 yuan (roughly $440 USD) to consumers each month, driving consumption on Alibaba’s shopping marketplaces.

Huabei: Ant Check Later, was launched in April 2015 to allow users to buy items with credit with no-interest installment repayment. HuaBei claimed 80M active users at the end of 2016.

Ant has put an emphasis on the impact artificial intelligence has in driving its loan success.

Ant has put an emphasis on the impact artificial intelligence has in driving its loan success.

Credit Scoring

Launched in 2015, Sesame Credit (or Zhima Credit) provides a private credit scoring and loyalty program system using data from Alibaba’s services to compile its score. China lacks a reliable credit system like FICO in the US.

Sesame provides its consumer and business users with a score from 350 to 950 and may be used in China’s forthcoming social credit system.

In January 2018, Ant was punished for automatically enrolling users into its credit rating system and, a month later, Sesame Credit stopped servicing unlicensed financial businesses, including certain banks, consumer finance companies, and online microlenders.

Today, Sesame is largely used for non-financial purposes, such as credit checks for bike rentals and visa approvals. Ant portfolio company Hellobike, for example, offers a deposit-free bikeshare service in 180+ cities for users with a 650+ Sesame Credit score.

Ant as a fintech platform

One of the key tenets of Ant’s strategy is its focus on providing an open platform for existing financial institutions to leverage Ant’s technology and tap into new users.

As it shifts its revenue focus away from primarily financial services, Ant is prioritizing the tech services it provides to banks, asset management companies, and insurers.

Ant doesn’t need to rely on payments for profitability if it can use payments as a gateway into its financial services ecosystem, where it charges financial institutions tech and service fees with high margins.

Ant has global ambitions

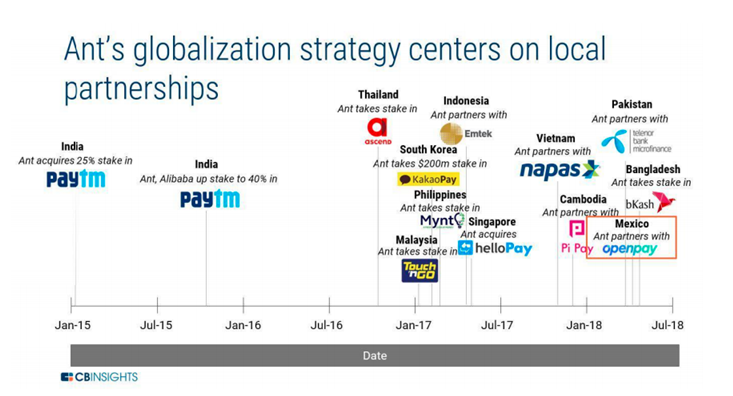

Looking to the longer term, Ant is focused on expanding its presence globally to drive growth. Ant’s globalization strategy to date has focused on striking partnerships and making minority investments with local partners.

Looking to the longer term, Ant is focused on expanding its presence globally to drive growth. Ant’s globalization strategy to date has focused on striking partnerships and making minority investments with local partners.

Southeast Asia, in particular, has been a major focus as Ant hopes to link its technology into partners across markets including Thailand, India, Indonesia, and the Philippines and Latin America.

Investing in Ant Financial

If you want to buy shares in Ant, and you are in the US, you have to open an account with Interactive Brokers or Schwab. All the other brokers do not offer Hong Kong market access.

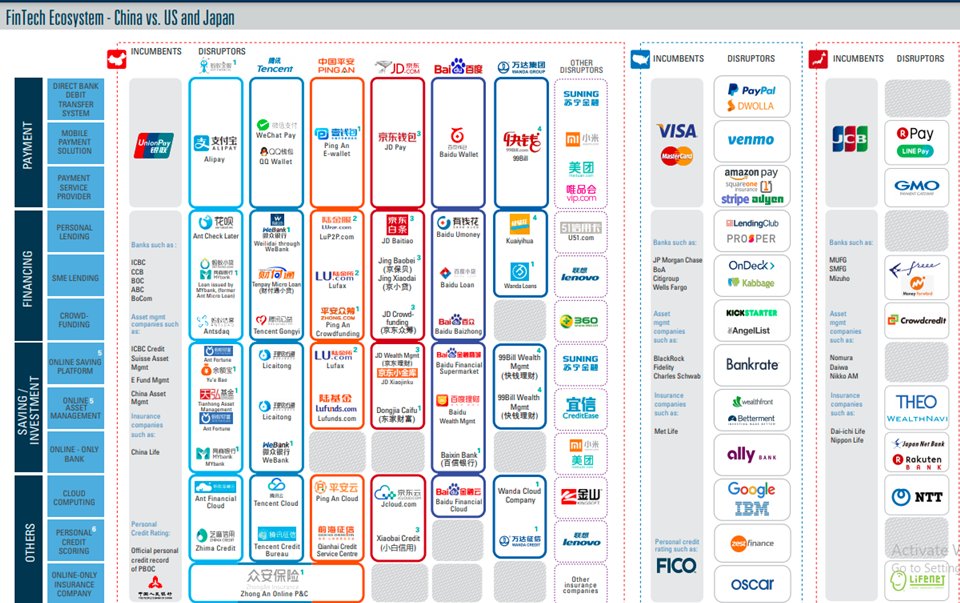

Fintech Ecosystems

If you want to buy shares in Ant, and you are in the US, you have to open an account with Interactive Brokers or Schwab. All the other brokers do not offer Hong Kong market access.

Fintech Ecosystems

References

C B Insights https://www.cbinsights.com/research/ant-financial-alipay-fintech/

Technode">https://www.cbinsights.com/research/... https://technode.com/2018/09/21/ant-financial-technology/

TechInAsia">https://technode.com/2018/09/2... https://www.techinasia.com/surprising-number-countries-accept-wechat-pay-alipay

FT:">https://www.techinasia.com/surprisin... https://www.ft.com/content/b4785e9a-0d66-4a10-8f0f-68eb77623dc1

Research">https://www.ft.com/content/b... Gate https://www.researchgate.net/publication/316967782_Research_on_the_Consumer_Finance_System_of_Ant_Financial_Service_Group

Wikiwandhttps://www.researchgate.net/publicati... href=" https://www.wikiwand.com/en/Ant_Group ">https://www.wikiwand.com/en/Ant_Gr...

C B Insights https://www.cbinsights.com/research/ant-financial-alipay-fintech/

Technode">https://www.cbinsights.com/research/... https://technode.com/2018/09/21/ant-financial-technology/

TechInAsia">https://technode.com/2018/09/2... https://www.techinasia.com/surprising-number-countries-accept-wechat-pay-alipay

FT:">https://www.techinasia.com/surprisin... https://www.ft.com/content/b4785e9a-0d66-4a10-8f0f-68eb77623dc1

Research">https://www.ft.com/content/b... Gate https://www.researchgate.net/publication/316967782_Research_on_the_Consumer_Finance_System_of_Ant_Financial_Service_Group

Wikiwand

This thread can be read here: http://bestengagingcommunities.com/2020/10/22/ant-financial-a-detailed-view-into-the-ipo-and-the-company/">https://bestengagingcommunities.com/2020/10/2...

Read on Twitter

Read on Twitter