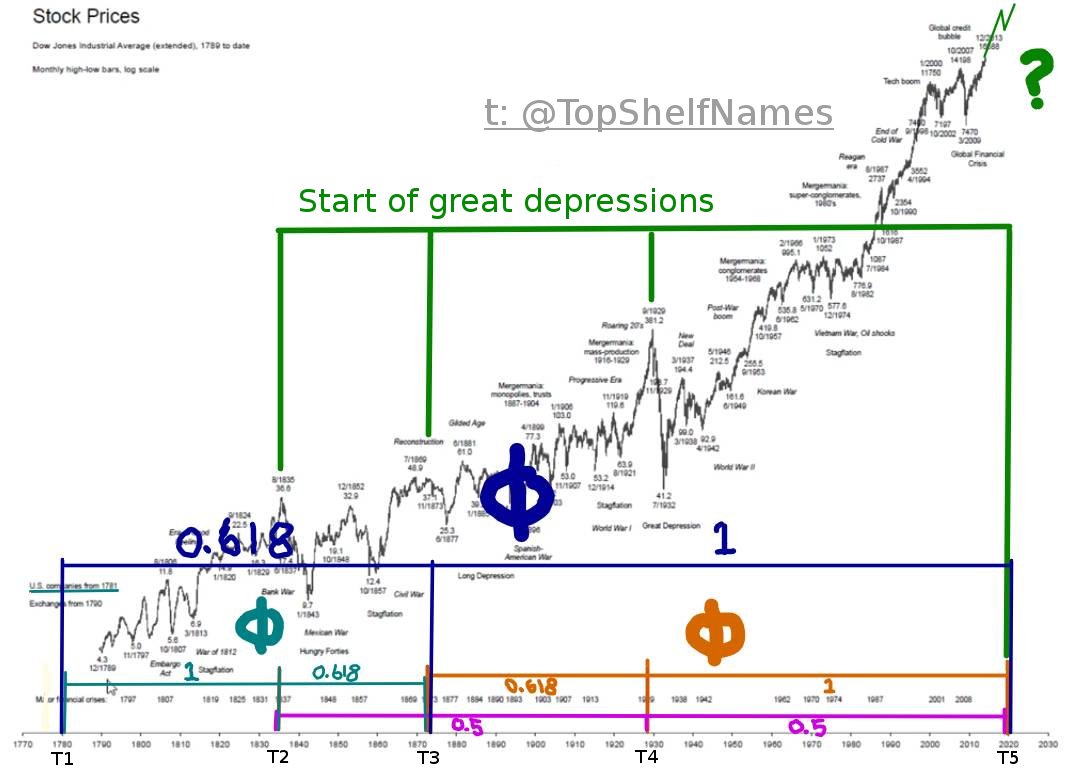

1/n – Analysis of US historical stock prices based on #DJIA, from 1781 to 2020, using #Phi point time markers (aka the golden ratio) denoting the onset of major depressions. Sorry for crudely drawn graphic. Further discussion below....

#Stocks #Markets #Economy #GoldenRatio #US

#Stocks #Markets #Economy #GoldenRatio #US

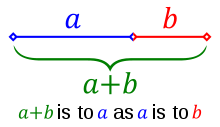

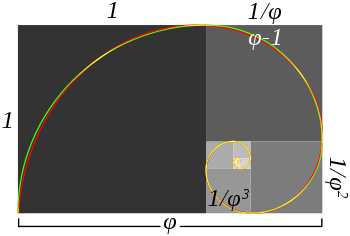

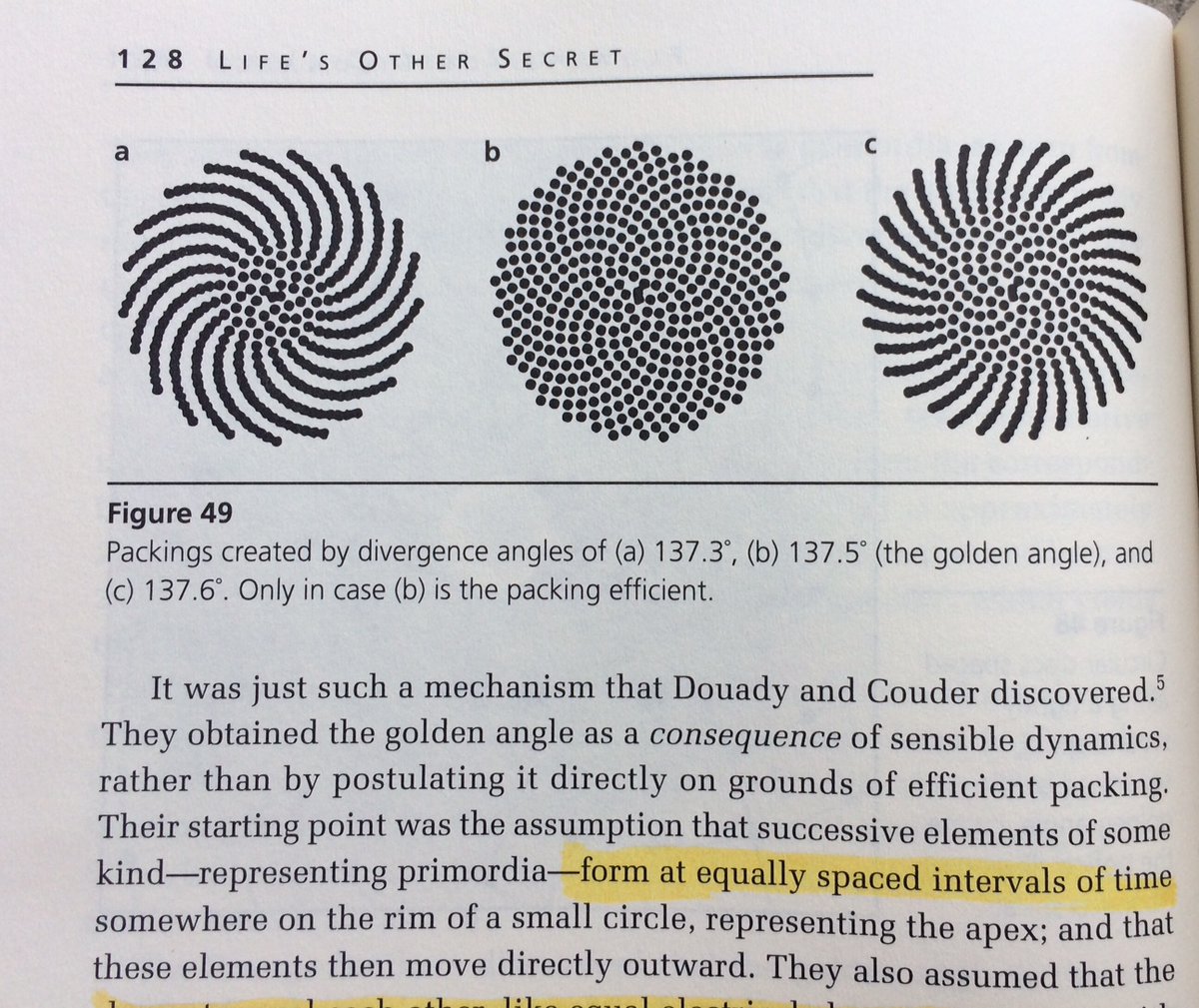

2/n - The circle with a line through it = Phi or the Golden Ratio: “the limit of the ratios of consecutive terms of the Fibonacci sequence 1, 1, 2, 3, 5, 8, 13,…” #Fibonacci numbers are everywhere in nature, & in common use 2day by chart analysts to find patterns in stock prices

3/n – Time Markers:

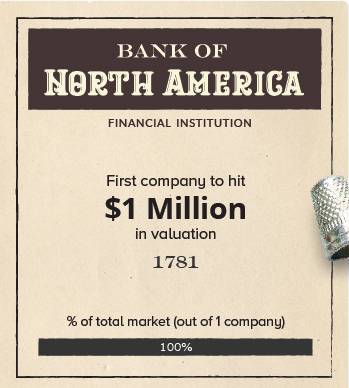

T1: 1781 – First ever #IPO in US (Bank of N. America)

T2: 1837 – Panic of 1837, start of major 7-year #Depression

T3: 1873 – Panic of 1873, start of 4-year & #39;Long Depression& #39;

T4: 1929 – Great Crash of 1929, start of Great Depression

T5: 2020 – ???

T1: 1781 – First ever #IPO in US (Bank of N. America)

T2: 1837 – Panic of 1837, start of major 7-year #Depression

T3: 1873 – Panic of 1873, start of 4-year & #39;Long Depression& #39;

T4: 1929 – Great Crash of 1929, start of Great Depression

T5: 2020 – ???

4/n – While not down to the precision of days, I& #39;ve a high degree of confidence ratios are not off by more than 6 months at most - impressive given a time scale of 239 years! Even for the smallest subset of 1781–1873 (92 years) that would represent a 0.54% (0.0054) tolerance

5/n – What would invalidate this data/theory? Pretty simple – If at some point in the future it cannot be said that the window of #2020 to early 2021 turned out to be the start of another great depression, then this chart will have been invalidated. #Time will tell

6/n – Interpretation/Discussion:

If this chart is in fact meaningful, what exactly does it mean?

There& #39;s the data, and then there& #39;s the interpretation of the data ….

If this chart is in fact meaningful, what exactly does it mean?

There& #39;s the data, and then there& #39;s the interpretation of the data ….

7/n – Markets are the result of human activity, in aggregate, over time. Yet when mapped, to display such a highly coherent level of mathematical correspondence on such a high time frame means what? ….

8/n – In my view, whether or to what extent any sum total of human activity is capable of causing such emergent geometry from bottom up, said activity in the collective may be occurring either: consciously, unconsciously, or accidentally (i.e. by #coincidence) ….

9/n – Or, is it within the realm of possibility that rather than bottom up, some form of higher #geometric order is subtly influencing the aggregate of human activity from top down? Or, is it some combination of the two … an interplay? ….

10/n – C.G. #Jung understood #synchronicity as & #39;meaningful coincidences& #39; with no causal relationship, yet nonetheless meaningfully related, or as events which have an “acausal connecting principle”. (Of note here: in mathematics Phi is an & #39;irrational& #39; number) ….

11/n – Yet the rise and fall of stock markets is surely driven by causal connections resulting from human agency, is it not? (e.g. buy low, sell high, etc.,) … At least, it has always seemed rational to think so ….

12/n – Even if all we are looking at here is a strange synchronicity, it sure is an elegant one. So elegant, it& #39;s as though it were, intelligent ….

13/n – If intelligent, and the result of human agency, then I ask again, is it: merely accidental (no motivation), unconsciously directed (unknown motivation), or consciously directed (known motivation)? ….

14/n – If intelligent and not the result of human agency, what other, higher forces are at work? I have no answers, only questions ….

15/n – Some object to the application of Fibonacci harmonics in #TA, claiming that because everyone now relies on these tools it causes market movements to line up accordingly. So which came first, the trader or the analyst? The market or the recurring Fibonacci sequences?  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐔" title="Huhn" aria-label="Emoji: Huhn">/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐔" title="Huhn" aria-label="Emoji: Huhn">/ https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥚" title="Ei" aria-label="Emoji: Ei">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥚" title="Ei" aria-label="Emoji: Ei">

16/n – Some will no doubt accuse me of finding patterns where none exist. Personally, I think the whole “people look for patterns where none exist” ship is destined to go down in flames, and the sooner one comes to grips with this, the sooner we can all get on board with #reality

17/n – One final question: If major players are/were already aware of the existence of this pattern, what is the likelihood for such intel to be leveraged, exaggerated, or exploited for gain? Especially if the economic pie is seen as limited (more for you is less for me) ….

18/n - …. versus being openly shared, in a spirit of good faith, so that we can all try to understand and take heed of what is/has been (potentially) taking shape, so as to avoid suffering ….

19/n – I don& #39;t believe I& #39;m necessarily first to find this #sync, only first to publish it. We all want to gain an edge. I& #39;m no different. But when gaining an edge comes at the cost of others suffering, we need to seriously re-examine the way we are living. Will you?

20/n – The info herein is 100% all-original analysis.

What do YOU think?

What do YOU think?

21/n – None of this thread constitutes financial advice. Do your own due diligence before making any decisions, financial or otherwise.

22/n – Special thanks to:

@WaveSix18 for the original stock chart, which I screen-captured from one of his vids. Follow for excellent charting & TA

@Etemenankian for the inspiration to explore phi points within the chart data. Follow for one-of-a-kind, extra-esoteric content

@WaveSix18 for the original stock chart, which I screen-captured from one of his vids. Follow for excellent charting & TA

@Etemenankian for the inspiration to explore phi points within the chart data. Follow for one-of-a-kind, extra-esoteric content

23/n – Additional image sources:

https://en.wikipedia.org/wiki/Golden_ratio

https://en.wikipedia.org/wiki/Gold... href=" https://www.visualcapitalist.com/valuation-milestones-apple-1-trillion/

Life& #39;s">https://www.visualcapitalist.com/valuation... Other Secret, by Ian Stewart - @JoatStewart

https://en.wikipedia.org/wiki/Golden_ratio

Life& #39;s">https://www.visualcapitalist.com/valuation... Other Secret, by Ian Stewart - @JoatStewart

Read on Twitter

Read on Twitter