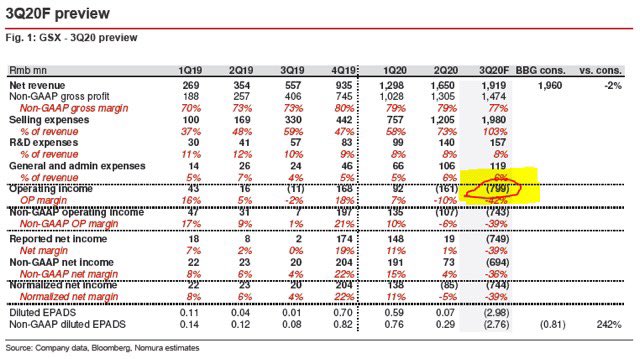

With the Nomura downgrade today, it’s very clear to me that the $GSX narrative from the company itself, has changed. They are now claiming that large losses are forthcoming, due to “marketing mistakes”. Whether or not you believe them is now irrelevant.

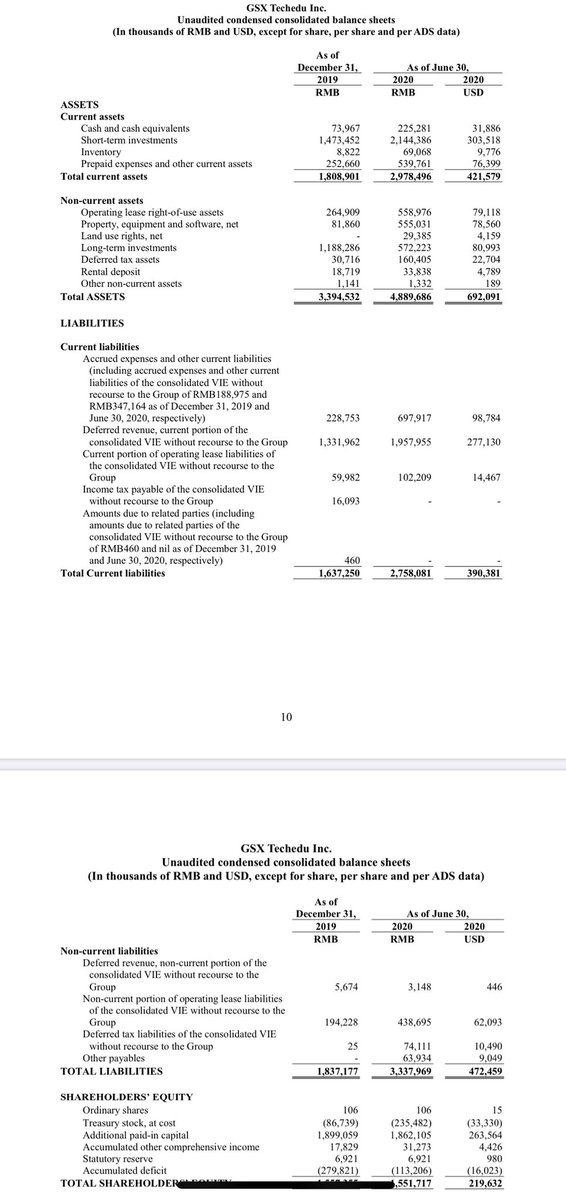

(2) With the Credit Suisse downgrade yesterday, it now looks like $GSX will lose about $120M in the 3Q. The reason that is significant is because the company only had WC ($31m) + LT “Investments” ($81M) of $112M, as of 6/30. That is gone as of today.

(3) And on a best-case basis, the entire “Cash/ST< Investments” amount of $416MM would be gone in the 1H of 2021. And that’s before any of the $472M in liabilities!

(4) So again, whether or not you think fraud is occurring here...it may not matter. The new business “model” the company is acknowledging is leading them to the same endgame. $GSX

Read on Twitter

Read on Twitter