In response to my post regarding the Google case in the US, @stevesalop (a giant in our field) posted a (very) short comment on @TOTMblog.

I think it is worth replying with a detailed Twitter thread, because the point is really important for the case https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/AuerDirk/status/1318887072887902211">https://twitter.com/AuerDirk/...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/AuerDirk/status/1318887072887902211">https://twitter.com/AuerDirk/...

I think it is worth replying with a detailed Twitter thread, because the point is really important for the case

I think Steve Salop& #39;s basic point is the following:

The fact that consumers switch between Google Search and other websites is not proof that these services belong to the same relevant market (something that will be key to Google& #39;s defense).

The fact that consumers switch between Google Search and other websites is not proof that these services belong to the same relevant market (something that will be key to Google& #39;s defense).

This is because of something called the “cellophane fallacy”.

In simplified terms: when a firm imposes a monopoly price, consumers switch towards goods that they would not otherwise perceive as substitutes.

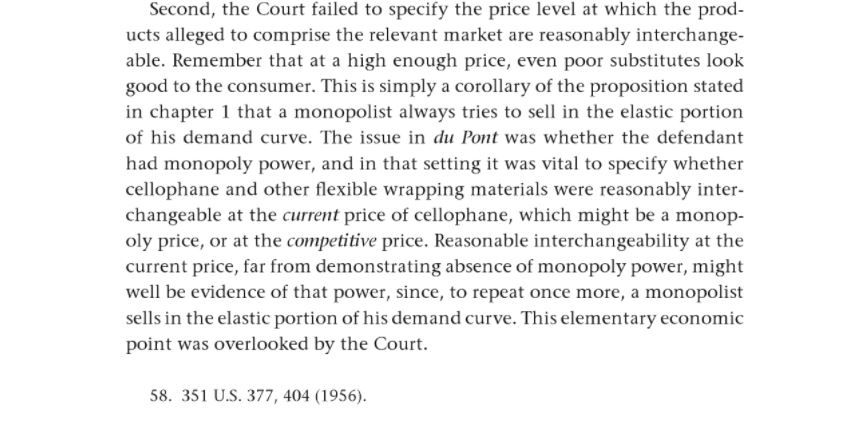

From Richard Posner& #39;s seminal Antitrust book:

In simplified terms: when a firm imposes a monopoly price, consumers switch towards goods that they would not otherwise perceive as substitutes.

From Richard Posner& #39;s seminal Antitrust book:

But the argument has less bearing on the case at hand than one might initially think.

The key question is:

Are consumers switching from Search to Amazon (and other sites) because they are "priced out" of the search market (because of suboptimal search results and ads)?

The key question is:

Are consumers switching from Search to Amazon (and other sites) because they are "priced out" of the search market (because of suboptimal search results and ads)?

This behavior might have everything to do with consumers preferring one zero price tool to another, rather than market power causing them to opt for a suboptimal choice.

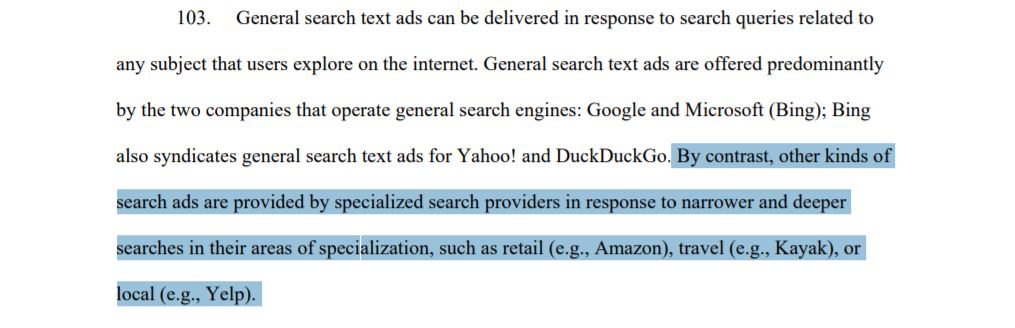

Note that the DOJ/state AG complaint does not meaningfully analyze switching between these services. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Note that the DOJ/state AG complaint does not meaningfully analyze switching between these services.

Let us reframe the Question:

What does a counterfactual Google Search with no market power look like?

- Would more consumers use Search if there were no ads?

- Would G. offer users money for their data?

The complainants offer no evidence that this would be the case https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

What does a counterfactual Google Search with no market power look like?

- Would more consumers use Search if there were no ads?

- Would G. offer users money for their data?

The complainants offer no evidence that this would be the case

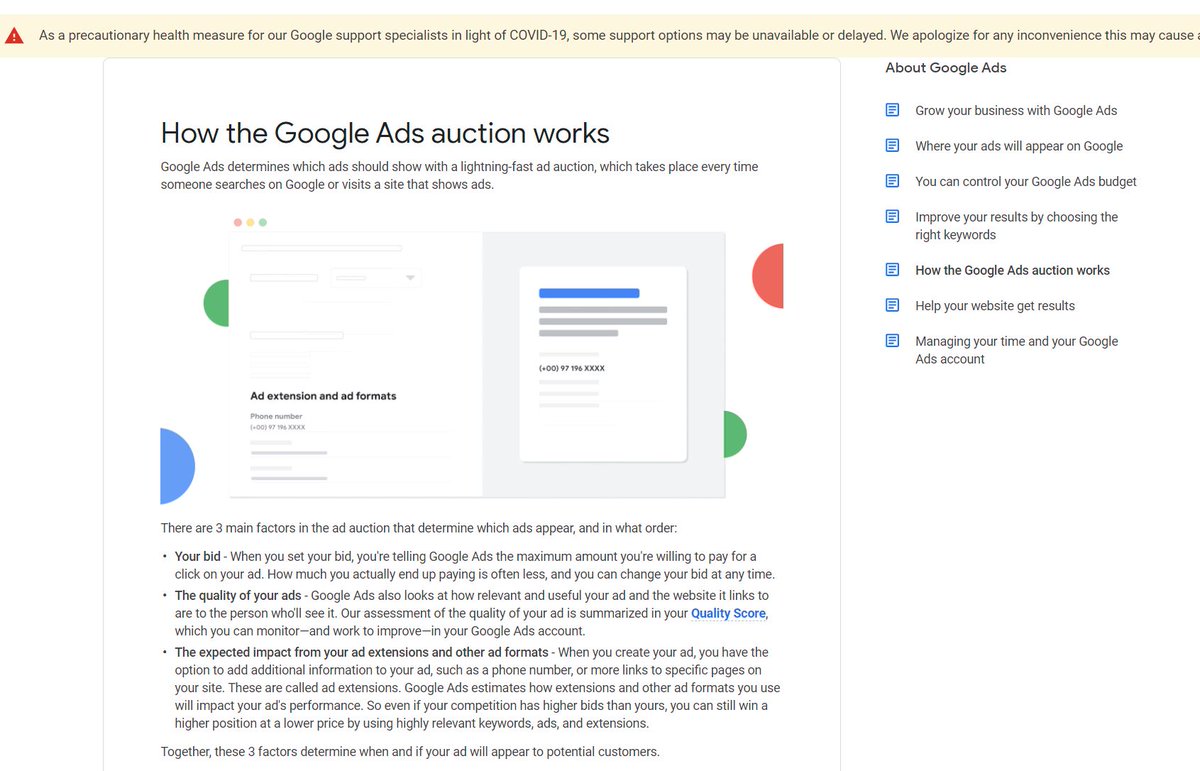

The advertising question can be assessed empirically:

Suppose, ad absurdum, that Google removed all ads from its platform or that it stopped tracking user behavior (this could be examined with a simple A/B test).

Suppose, ad absurdum, that Google removed all ads from its platform or that it stopped tracking user behavior (this could be examined with a simple A/B test).

1 ) Would this significantly increase Search output?

I am not sure the answer is yes. Top search results would then be selected solely by a search algorithm rather than the operation of markets.

I am not sure the answer is yes. Top search results would then be selected solely by a search algorithm rather than the operation of markets.

2) Would consumers derive more surplus?

The plaintiffs argue that this is the case but offer no evidence (not even anecdotal).

They ignore an important counterpoint: having the right ads could be what makes Google Search successful in the first place.

The plaintiffs argue that this is the case but offer no evidence (not even anecdotal).

They ignore an important counterpoint: having the right ads could be what makes Google Search successful in the first place.

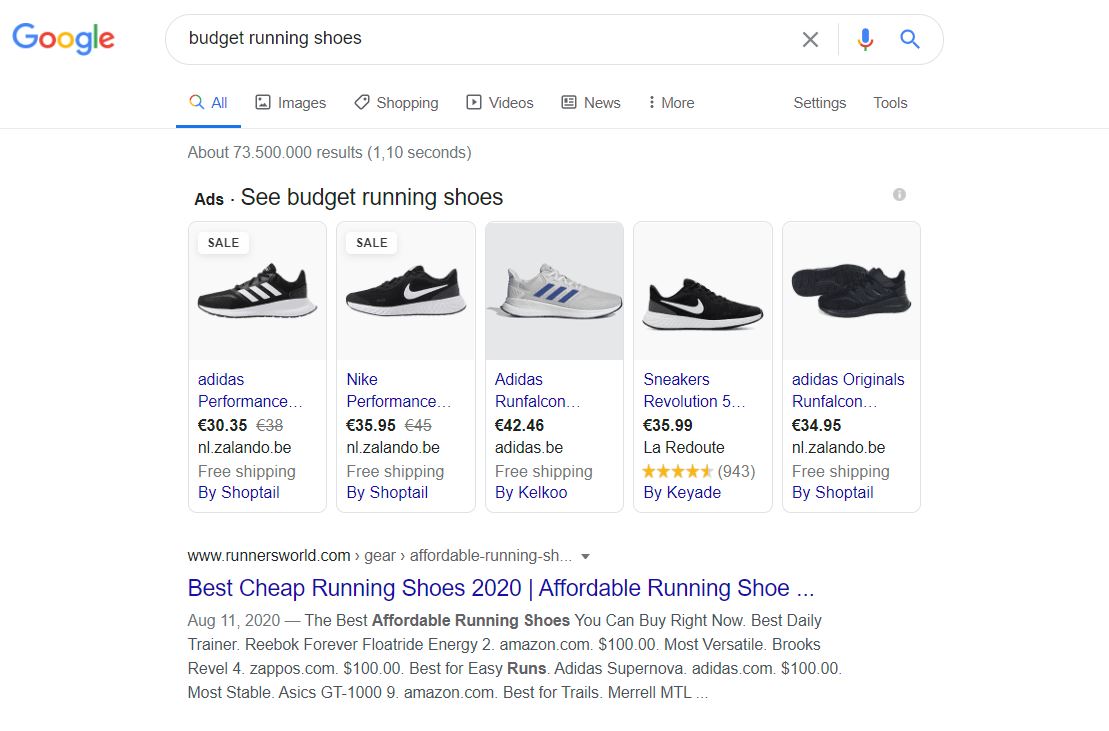

When I search for a shopping item or a hotel, I am really looking to make a purchase. Doesn& #39;t the operation of markets imply that the most efficient firm gets the top ad placement?

How is that bad for me?

E.g. Unclear that the second result is a better response to my search https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

How is that bad for me?

E.g. Unclear that the second result is a better response to my search

3) Would Google pay users for their data absent market power?

This business model is almost non-existant throughout the entire attention economy.

Market power seems an unlikely explanation -- are all of those markets really monopolies?

This business model is almost non-existant throughout the entire attention economy.

Market power seems an unlikely explanation -- are all of those markets really monopolies?

Potential reasons:

(i) frictions preclude this type of system (maybe blockchains and the BAT token will solve this issue)

(ii) paying users for their attention might distort their behavior, and undermine ad usefulness

(i) frictions preclude this type of system (maybe blockchains and the BAT token will solve this issue)

(ii) paying users for their attention might distort their behavior, and undermine ad usefulness

Whatever the explanation, one can hardly infer market power from the fact G. refuses to implement a business model that no other large player applies.

Finally, though authorities SHOULD be careful when applying SSNIP to the advertising side of the market (because of cellophane fallacy), that does not mean that quantitative tools are inapplicable.

Massimo Motta explains this well:

Massimo Motta explains this well:

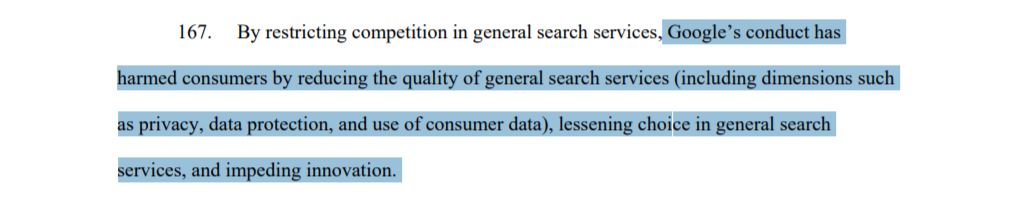

In short, the main point of my initial @TOTMblog post, and of this thread, is that the DOJ and state AGs have, so far, failed to show the basic requirements of a Section 2 antitrust case.

They have their work cut out. https://truthonthemarket.com/2020/10/21/what-is-a-search-engine-2/">https://truthonthemarket.com/2020/10/2...

They have their work cut out. https://truthonthemarket.com/2020/10/21/what-is-a-search-engine-2/">https://truthonthemarket.com/2020/10/2...

Read on Twitter

Read on Twitter https://twitter.com/AuerDirk/..." title="In response to my post regarding the Google case in the US, @stevesalop (a giant in our field) posted a (very) short comment on @TOTMblog.I think it is worth replying with a detailed Twitter thread, because the point is really important for the case https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/AuerDirk/..." class="img-responsive" style="max-width:100%;"/>

https://twitter.com/AuerDirk/..." title="In response to my post regarding the Google case in the US, @stevesalop (a giant in our field) posted a (very) short comment on @TOTMblog.I think it is worth replying with a detailed Twitter thread, because the point is really important for the case https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/AuerDirk/..." class="img-responsive" style="max-width:100%;"/>

" title="This behavior might have everything to do with consumers preferring one zero price tool to another, rather than market power causing them to opt for a suboptimal choice. Note that the DOJ/state AG complaint does not meaningfully analyze switching between these services. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="This behavior might have everything to do with consumers preferring one zero price tool to another, rather than market power causing them to opt for a suboptimal choice. Note that the DOJ/state AG complaint does not meaningfully analyze switching between these services. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="Let us reframe the Question: What does a counterfactual Google Search with no market power look like? - Would more consumers use Search if there were no ads? - Would G. offer users money for their data? The complainants offer no evidence that this would be the case https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="Let us reframe the Question: What does a counterfactual Google Search with no market power look like? - Would more consumers use Search if there were no ads? - Would G. offer users money for their data? The complainants offer no evidence that this would be the case https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="When I search for a shopping item or a hotel, I am really looking to make a purchase. Doesn& #39;t the operation of markets imply that the most efficient firm gets the top ad placement? How is that bad for me?E.g. Unclear that the second result is a better response to my searchhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="When I search for a shopping item or a hotel, I am really looking to make a purchase. Doesn& #39;t the operation of markets imply that the most efficient firm gets the top ad placement? How is that bad for me?E.g. Unclear that the second result is a better response to my searchhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>