The big rise in UK house prices relative to incomes 1985-2018 can be more than accounted for by the substantial decline in real risk-free interest rates over the period, David Miles @imperialcollege & Victoria Munro @bankofengland, #EconomicPolicy72 https://www.economic-policy.org/72nd-economic-policy-panel/rising-uk-house-prices/">https://www.economic-policy.org/72nd-econ...

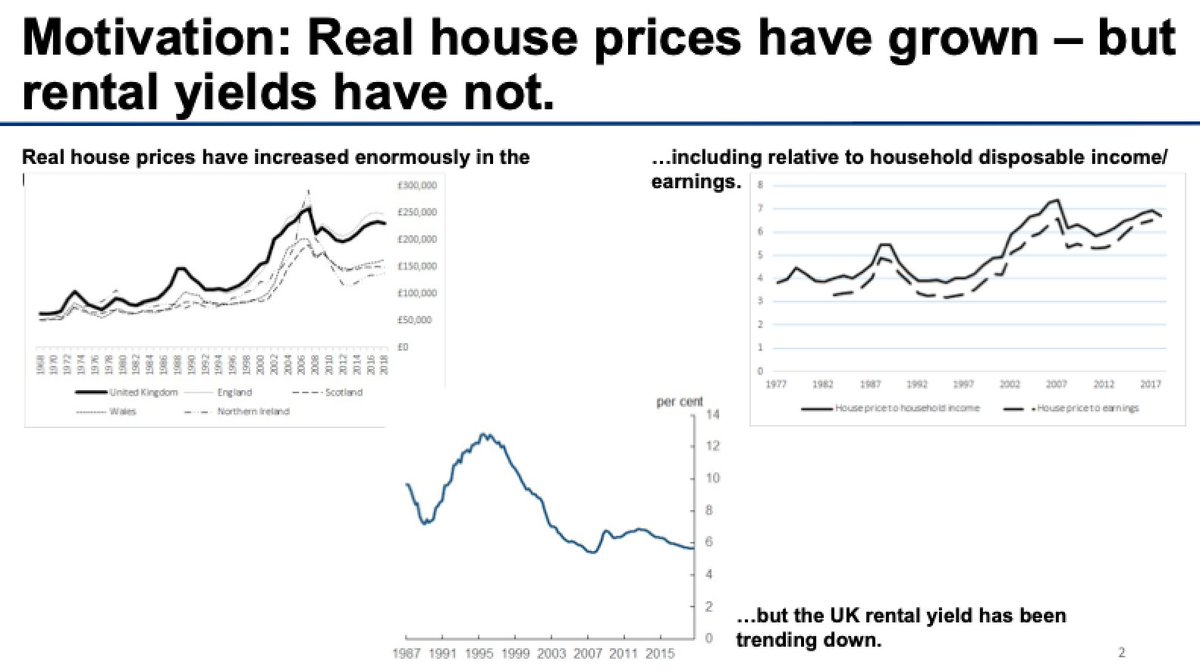

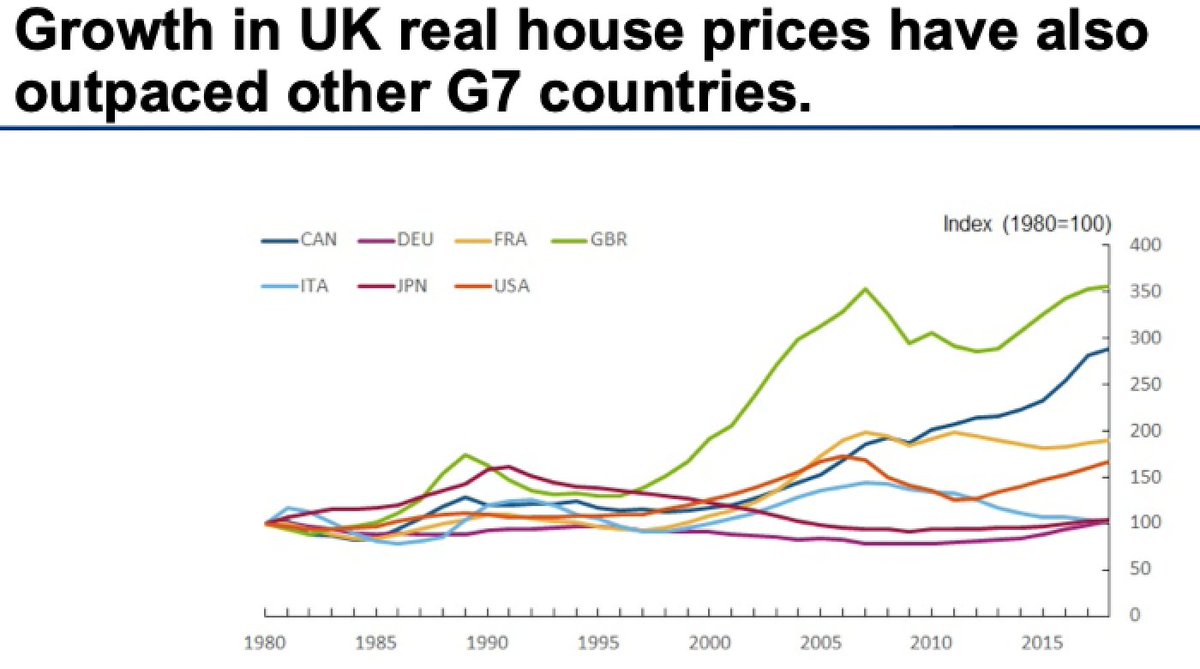

UK real house prices have grown, including relative to household disposable income, 1985-2018 – but rental yields have not; growth in UK real house prices has also outpaced other G7 countries, #EconomicPolicy72

The results suggest that the almost 6pp decrease in real yields since 1985 (based on the real 10 year index-linked gilt) caused more than a doubling of average UK house prices; increasing the supply of housing alone cannot return us to the housing affordability of 30 years ago

Were the 35-year trend to reverse & gilt yields to rise rather than fall, there would be a very substantial long-term consequence for real house prices; a 1% change in real interest rates that was persistent could move real house prices by around 20% across many years

Consequences for policy-makers: for those concerned with financial stability, it may be reassuring that this evidence does not point to a bubble, but it does indicate that high levels of mortgage debt to incomes may be here to stay (at least in the medium term)

For government, there are distributional consequences to house price growth to the degree seen in the UK; this is increasingly important in an economy where home ownership is often valued in its own right & is generally aspired to, #EconomicPolicy72

Increasing the supply of housing may be valuable for many reasons, particularly where extra supply is used to increase options/lower costs for those with most housing insecurity; but it is unlikely to make housing materially more affordable; perhaps #Covid19 could change this

One possible solution: increase tax rate on owners of property, to the value of 1% of their housing costs; this can offset the declining risk-free rate in the user cost, & is roughly consistent with charging VAT of 20% on housing costs; such a policy would need to be phased in

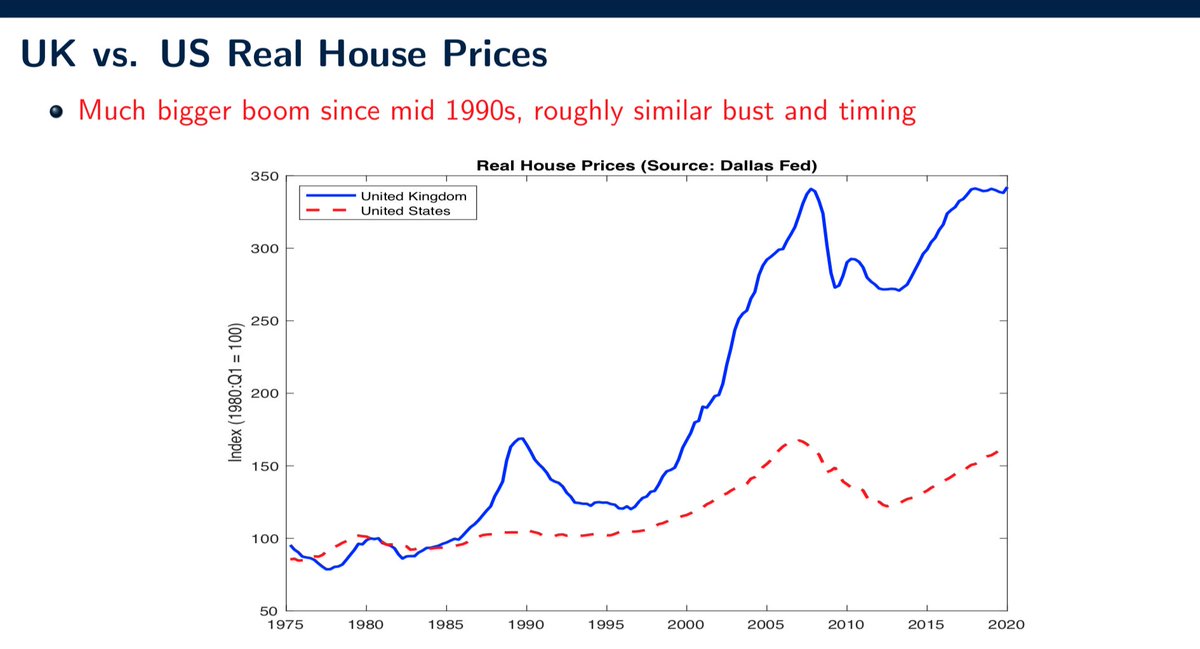

Comparison of UK & US house prices over the period 1975-2020 shows a much bigger boom in the UK since the mid-1990s, but roughly similar bust & timing, @APFerrero discussion of #EconomicPolicy72 study by Miles & Munro of rising UK house prices /end thread

Read on Twitter

Read on Twitter