When the news reports stuff like ‘The Pentagon lost $21 Trillion’, mfs are always like ‘that could’ve paid for college tuition for every student in the US for 50 years!!’—but I’m pretty sure colleges don’t accept internal bookkeeping transfers as legal tender

It’s the same shit about Bezos making 5 bajillion dollars in wealth nonsense—his assets aren’t all tied up in liquid, marked to market titles, and stock prices fluctuate wildly. He has no Scrooge mcduck style pool of gold he swims in

Wealth estimates at the billionaire level are just that—-estimates—nothing is more illustrative of this than the fact that they use the same estimation method for Smaug & Scrooge McDuck as they do for Bezos (don’t believe me? Look it up lol)

But just as Smaug’s assets are—since I last investigated the question at least—wholly fictional , So too the wealth estimates, *even those based on actual quantified liquid assets like stocks* are basically just heuristics with very little real world meaning

Let’s focus on the stocks for a second—because as I said, those are actually liquid & quantified—but they still provide little use, why?

1. Their share price fluctuates wildly

2. They depend highly on macroeconomic indicators & monetary policy which is cyclical & mercurial

1. Their share price fluctuates wildly

2. They depend highly on macroeconomic indicators & monetary policy which is cyclical & mercurial

3. Much of them are tied up with preferred stocks, specific ownership arrangements, or mutual buyouts of companies for mergers that function more like ownership/mgmt rights & accounting conveniences than assets

4. Stocks are split and new stocks are issued all the time. While, in theory, these are just accounting & market maneuvers, they have effects.

5. While stocks are limited liability arrangements, creditors get paid first in case of bankruptcy or sell off

5. While stocks are limited liability arrangements, creditors get paid first in case of bankruptcy or sell off

6. Stocks, like money, gold, & ex wives , derive price between their supply/scarcity, & demand, conditional on a market making arrangement.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> If they are illiquid & not in a market they don’t have a (sure) price. If not demanded, price falls. If over supplied, price falls.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> If they are illiquid & not in a market they don’t have a (sure) price. If not demanded, price falls. If over supplied, price falls. https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

7. Tying 3, 4, 5 & 6 together is the simple point that so much https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> of Bezos & other peoples wealth stems from their *power*—their controlling share of the company, among other things, which they lose if they sell too much of the stock

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> of Bezos & other peoples wealth stems from their *power*—their controlling share of the company, among other things, which they lose if they sell too much of the stock

8. Related to this, & fundamental—made even more so by how obvious it is—if someone sells all their stocks on a market, it will massively fall in price. This is especially so if the person doing so is the founder & owner of the company !! If you try to sell & spend it you lose it

9. Tying all of the above together, including the notes, & leading us to our next point, all of this is highly dependent on state, legal, institutional, accounting, market & social artifacts, customs, norms, metrics, fictions, frauds, forces & so on.

10. This leads us to a final point, namely, much of what SocDems discuss implies Or states that the state will tax, seize or nationalize these assets. But given the forgoing analysis it’s easy to see that that is basically meaningless—they’re not seizing Scrooge’s pools of gold

This all holds for any other financial arrangement, simple or complex, for credit, Fiat money, deposits, loans,

insurance, accounting, titles, deeds, rights, monopolies, tax credits, options, patents, copyrights, brands, & so on

insurance, accounting, titles, deeds, rights, monopolies, tax credits, options, patents, copyrights, brands, & so on

What is maybe not so obvious (or it might be at this point) is that this also applies to not only *all* money & credit in general, but also all property rights, all aristocratic & other titles, all contracts, all credentials,

all capitalization, & all complex coordination.

all capitalization, & all complex coordination.

And, if even this is obvious, what may not be obvious is that this further applies to ALL property *substantively*—i.e. land, gold, capital, labor, oil, forests, factories, houses, cars, trains, family heirlooms, washing machines, ex wives, Italians, etc

There is no property let alone rights beyond what:

1. You can enforce with violence

2. Others enforce with violence

3. Others respect

4. Others leave alone

5. Others cannot access

6. You can manipulate, control, possess

7. You can account

8. You can trade, hoard or use

1. You can enforce with violence

2. Others enforce with violence

3. Others respect

4. Others leave alone

5. Others cannot access

6. You can manipulate, control, possess

7. You can account

8. You can trade, hoard or use

—Note: Regarding my notes on the tweet above as well as this thread in general—

I could go forever on what I mean. Many words like social construct & objectivity I use out of convenience but are actually imprecise or less useful in this analysis

I could go forever on what I mean. Many words like social construct & objectivity I use out of convenience but are actually imprecise or less useful in this analysis

‘Uses’ for things come from several sources, But the feature of a commodity that defines it is its production for sale, or rather, that it serves as a means to a means—as sale, use & disposition are actually secondary to capitalism reproducing itself & the drive of accumulation.

The fundamental contradiction of the commodity between its value for use & value for exchange is socially & historically conditioned on production for exchange, itself in service of reproduction & accumulation, & is intrinsic to its nature & to value.

If ‘value’, the supposedly anterior quantum that gives property, labor, capital & economy its remit, & objectivity, is itself a social & material construction emergent from a contingent history, then property, not extending beyond custom, force, use & possession, surely Also is.

So the fundamental lesson to which I am gesturing is that EVEN IF Bezos DID have a giant pool of gold in which to swim like one fictional mallard of note, it would STILL be the case that his ~*wealth*~ was basically meaningless for the purposes with which we are concerned.

Pools of hoarded gold in one place would not make one lick of a difference to the livelihoods & outcomes of others without a social system in which they had definite meaning.

The question ‘Cui Bono?’ Is always a good one to ask when reading a text or listening to an argument or thinking about a social fact. Similarly, we should ask ‘Cui Utile?’ —the pragmatist prayer—in many of the same contexts.

Discussions about Bezos absurd wealth—as often explicitly stated or implied by the discussions of all the tuition for which it could pay—are discussions about what we should *do* with it—& to many this means tax, seize, nationalize, dispense

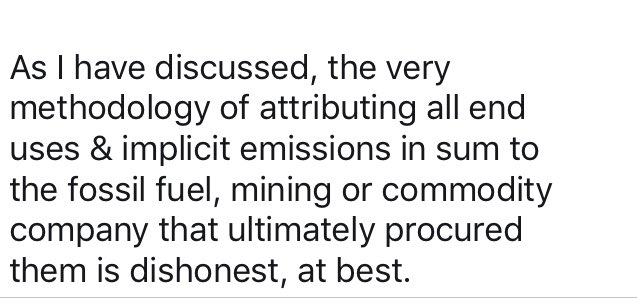

Much like the discussion of the ‘100 Companies Produce 71% of Emissions’ Meme, the subtle—or not so subtle—implication is that all we need to do is tax, regulate, fine, jail, punish, seize, nationalize & distribute these corporations

The meme can be critiqued many ways, but my focus is the fact that:

1. It implies emitters do so for fun

2. It implies that these corporations are privately owned & that nationalizing them fixes their issues

3. It obfuscates the sociotechnical/socioecological system

1. It implies emitters do so for fun

2. It implies that these corporations are privately owned & that nationalizing them fixes their issues

3. It obfuscates the sociotechnical/socioecological system

But:

1. The emissions are derived from demand & supply or are induced structurally

2. Most are state owned, many are non profit or bureaucracies & ALL are state supported, subsidized etc

3. We can’t change this part of the system without changing it all

1. The emissions are derived from demand & supply or are induced structurally

2. Most are state owned, many are non profit or bureaucracies & ALL are state supported, subsidized etc

3. We can’t change this part of the system without changing it all

At base here is that a map not only gets confused for its territory, it is substituted entirely, so all we have is a sequence of maps pointing to maps, & subsequently all talk about it becomes sound & fury signifying nothing

We can’t use Bezos wealth—even if it were in a giant pool of gold— to pay for college tuition https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> for the same reason we can’t nationalize 100 companies to end the climate crisis. We have substitute symptom, map, sign & index for cause.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> for the same reason we can’t nationalize 100 companies to end the climate crisis. We have substitute symptom, map, sign & index for cause.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

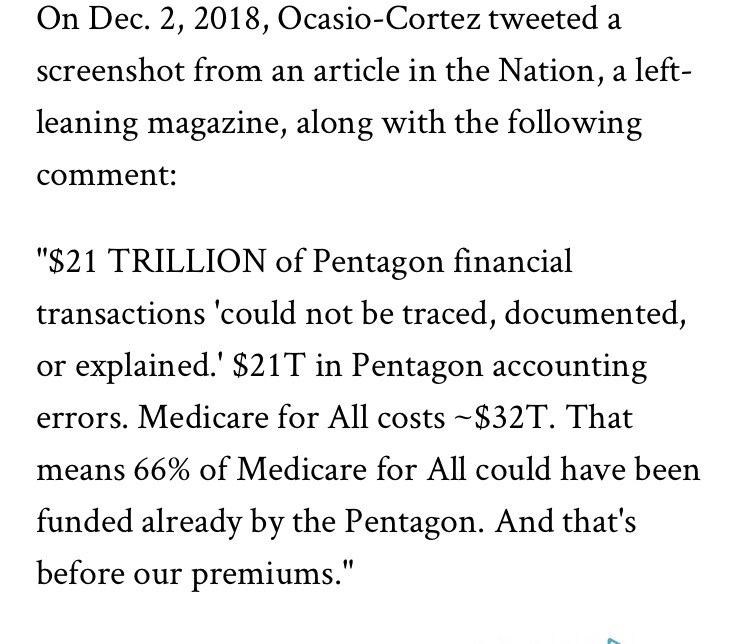

Finally, to return to my first example, the military accounting & Pentagon losing money thing—even more than money pools, amazon stocks or state owned fossil fuel companies, this example obfuscates what’s going on

The vast majority of the money for which they did not account, are *internal transfers* combined with bad accounting practices. Their columns literally just didn’t add up. The money was spent & only spent once.

Surely some of it is misplaced or ended up in peoples pockets or was used in graft. And surely some of it also under the table black ops, but neither of these can account for an apparently $21 Trillion deficit in military accounts.

Notably, this claim was often made by the NYT & WaPo with no issue, and it was only fact checked when the libertarian’s greatest nightmare (in more than one way) AOC made the claim. This is ironic but doesn’t change the facts. https://www.statesman.com/news/20181204/fact-check-21-trillion-in-lost-pentagon-spending-that-cant-be-right">https://www.statesman.com/news/2018...

The summary is straightforward:

1. $21 Trillion is more than the Pentagon has ever spent

2. The Pentagon accounts track an internal transfer more than once

3. $1 transferred internally 10 times is counted as $10

4. This isn’t how money works https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">

1. $21 Trillion is more than the Pentagon has ever spent

2. The Pentagon accounts track an internal transfer more than once

3. $1 transferred internally 10 times is counted as $10

4. This isn’t how money works

That the context was use for healthcare is fitting as that is the main way that Bezos’ wealth is discussed as well. But here’s a good rule: if you can’t eat it or turn it into something to eat, there’s a very good chance it isn’t a real resource or capital.

However this is even too vulgar for me, given what I said about use value & exchange value being social, so better yet—if you can’t use it to pay alimony/child support , or to bribe an Italian politician/policeman , then it isn’t really a ‘value’.

Since Pentagon internal transfer bookkeeping errors in excess of all money they’ve ever been allocated, or Bezos’ wealth bound up in stocks cannot be eaten, or used to pay for my no good son Jeremy’s tuition or his bail to a prison in Milan, they can’t be used for healthcare

Of course, perhaps a gold pool could be used to pay off some of these things, & if either the gold or stocks were sold, one could use them to pay 1000 high priced Milanese attorneys for no good adult sons named Jeremy, but that’s a different point.

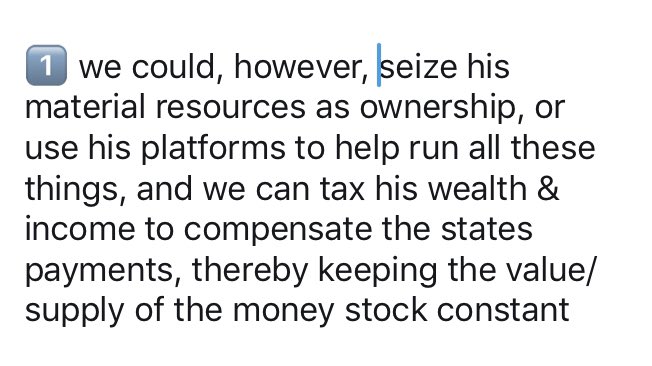

Because once a state seizure has occurred the scenario has changed:

1. If it is an asset like gold, then it must either be sold on the market, used directly in a process somehow, or transferred to an account that other states or investors recognize as collateral

1. If it is an asset like gold, then it must either be sold on the market, used directly in a process somehow, or transferred to an account that other states or investors recognize as collateral

2. If it is an asset like a property title registered in or piece of property located in another country, then it must be recognized by that country, and it must be either sold, or rented, or the state must coordinate its use

3. If it is an asset like foreign stocks, or foreign money, or foreign bonds, if it is located abroad, it is like (2), but if it located domestically, then it simply must either be sold, used to pay off others, or entered into an international account

4. If it is a domestic property title, then all they have done is effectively nullify that title, and not much in principle changes

5. If it is a domestic equity, unless they intend to exercise control, receive dividends or sell it, they’ve effectively nullified it

5. If it is a domestic equity, unless they intend to exercise control, receive dividends or sell it, they’ve effectively nullified it

6. If it is domestic money, credit, finance, insurance or unit of account all they have done is an accounting maneuver that changed distribution, incentives & allocations but whose resource effects are primarily that it changed the effective supply of money

7. If they seize all the titles/equities/assets/financial objects of a company, & do not sell it, or act as absentee owner earning dividends they have effectively nullified, liquidated & nationalized it , & they’ve no benefits beyond what the concern entails socially & materially

8. If they nationalize an oil company, punish its CEOs & managers, & gain its profits , it will do nothing for climate change & emissions unless they scale back production, raise the price of fuel, or re allocate its resources to environmental uses

9. If they spent the phantom internal transfer money of the Pentagon, all they have done, unless they have compensated it with taxes, is increase the money supply, in effect creating new money.

10. Otherwise, if they just move it around internally all they have done is a budgetary exercise with no real effects at all.

Read on Twitter

Read on Twitter If they are illiquid & not in a market they don’t have a (sure) price. If not demanded, price falls. If over supplied, price falls.https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">" title="6. Stocks, like money, gold, & ex wives , derive price between their supply/scarcity, & demand, conditional on a market making arrangement. https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> If they are illiquid & not in a market they don’t have a (sure) price. If not demanded, price falls. If over supplied, price falls.https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">">

If they are illiquid & not in a market they don’t have a (sure) price. If not demanded, price falls. If over supplied, price falls.https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">" title="6. Stocks, like money, gold, & ex wives , derive price between their supply/scarcity, & demand, conditional on a market making arrangement. https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> If they are illiquid & not in a market they don’t have a (sure) price. If not demanded, price falls. If over supplied, price falls.https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">">

If they are illiquid & not in a market they don’t have a (sure) price. If not demanded, price falls. If over supplied, price falls.https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">" title="6. Stocks, like money, gold, & ex wives , derive price between their supply/scarcity, & demand, conditional on a market making arrangement. https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> If they are illiquid & not in a market they don’t have a (sure) price. If not demanded, price falls. If over supplied, price falls.https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">">

If they are illiquid & not in a market they don’t have a (sure) price. If not demanded, price falls. If over supplied, price falls.https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">" title="6. Stocks, like money, gold, & ex wives , derive price between their supply/scarcity, & demand, conditional on a market making arrangement. https://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> If they are illiquid & not in a market they don’t have a (sure) price. If not demanded, price falls. If over supplied, price falls.https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">">

of Bezos & other peoples wealth stems from their *power*—their controlling share of the company, among other things, which they lose if they sell too much of the stock" title="7. Tying 3, 4, 5 & 6 together is the simple point that so muchhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> of Bezos & other peoples wealth stems from their *power*—their controlling share of the company, among other things, which they lose if they sell too much of the stock" class="img-responsive" style="max-width:100%;"/>

of Bezos & other peoples wealth stems from their *power*—their controlling share of the company, among other things, which they lose if they sell too much of the stock" title="7. Tying 3, 4, 5 & 6 together is the simple point that so muchhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> of Bezos & other peoples wealth stems from their *power*—their controlling share of the company, among other things, which they lose if they sell too much of the stock" class="img-responsive" style="max-width:100%;"/>

for the same reason we can’t nationalize 100 companies to end the climate crisis. We have substitute symptom, map, sign & index for cause. https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">" title="We can’t use Bezos wealth—even if it were in a giant pool of gold— to pay for college tuitionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> for the same reason we can’t nationalize 100 companies to end the climate crisis. We have substitute symptom, map, sign & index for cause. https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">">

for the same reason we can’t nationalize 100 companies to end the climate crisis. We have substitute symptom, map, sign & index for cause. https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">" title="We can’t use Bezos wealth—even if it were in a giant pool of gold— to pay for college tuitionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> for the same reason we can’t nationalize 100 companies to end the climate crisis. We have substitute symptom, map, sign & index for cause. https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">">

for the same reason we can’t nationalize 100 companies to end the climate crisis. We have substitute symptom, map, sign & index for cause. https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">" title="We can’t use Bezos wealth—even if it were in a giant pool of gold— to pay for college tuitionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> for the same reason we can’t nationalize 100 companies to end the climate crisis. We have substitute symptom, map, sign & index for cause. https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">">

for the same reason we can’t nationalize 100 companies to end the climate crisis. We have substitute symptom, map, sign & index for cause. https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">" title="We can’t use Bezos wealth—even if it were in a giant pool of gold— to pay for college tuitionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> for the same reason we can’t nationalize 100 companies to end the climate crisis. We have substitute symptom, map, sign & index for cause. https://abs.twimg.com/emoji/v2/... draggable="false" alt="2️⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">">

" title="The summary is straightforward:1. $21 Trillion is more than the Pentagon has ever spent 2. The Pentagon accounts track an internal transfer more than once3. $1 transferred internally 10 times is counted as $104. This isn’t how money workshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">">

" title="The summary is straightforward:1. $21 Trillion is more than the Pentagon has ever spent 2. The Pentagon accounts track an internal transfer more than once3. $1 transferred internally 10 times is counted as $104. This isn’t how money workshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">">

" title="The summary is straightforward:1. $21 Trillion is more than the Pentagon has ever spent 2. The Pentagon accounts track an internal transfer more than once3. $1 transferred internally 10 times is counted as $104. This isn’t how money workshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">">

" title="The summary is straightforward:1. $21 Trillion is more than the Pentagon has ever spent 2. The Pentagon accounts track an internal transfer more than once3. $1 transferred internally 10 times is counted as $104. This isn’t how money workshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">">

" title="The summary is straightforward:1. $21 Trillion is more than the Pentagon has ever spent 2. The Pentagon accounts track an internal transfer more than once3. $1 transferred internally 10 times is counted as $104. This isn’t how money workshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">">

" title="The summary is straightforward:1. $21 Trillion is more than the Pentagon has ever spent 2. The Pentagon accounts track an internal transfer more than once3. $1 transferred internally 10 times is counted as $104. This isn’t how money workshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1️⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">">