The Crazy Math of Secular Stagnation

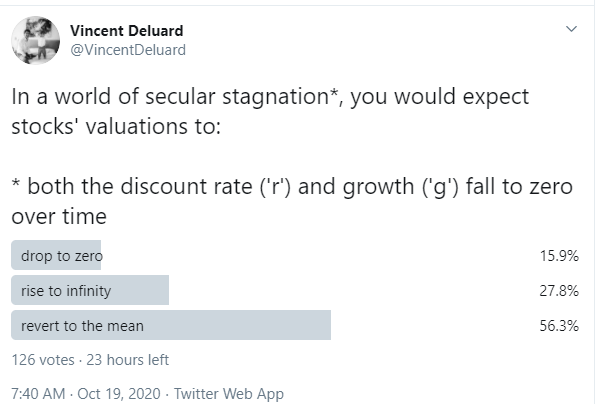

2 days ago, I asked how stocks& #39; valuations should behave in secular stagnation (& #39;r& #39; and & #39;g& #39; trend to zero over time)

Less than 30% got it right

Time for thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

2 days ago, I asked how stocks& #39; valuations should behave in secular stagnation (& #39;r& #39; and & #39;g& #39; trend to zero over time)

Less than 30% got it right

Time for thread

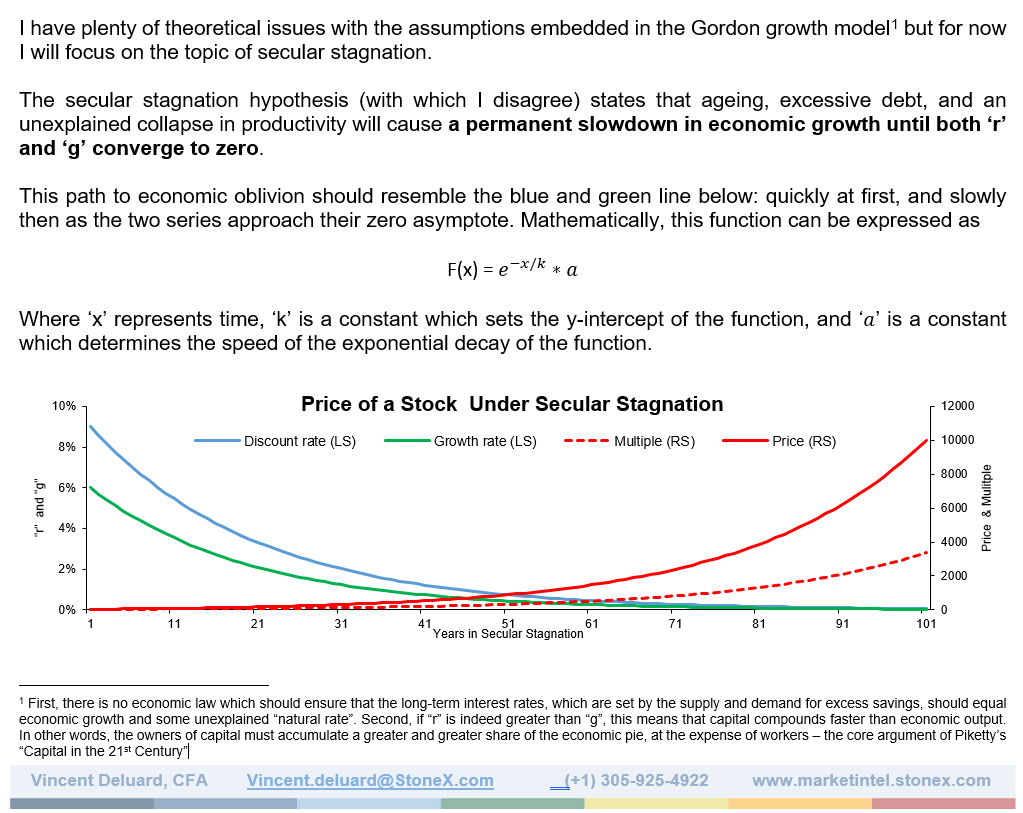

Most equity investors do not think enough about the denominator in the cash flow discount model

They think that & #39;r-g& #39; must be constant because & #39;g& #39; is in & #39;r& #39; (higher growth = higher rates)

FALSE

They think that & #39;r-g& #39; must be constant because & #39;g& #39; is in & #39;r& #39; (higher growth = higher rates)

FALSE

If "r" and "g" both fall to zero and "r" was higher than "g" (the premise of all discounted CF models), then "r" must fall faster and "r-g" falls to zero over time

If the denominator falls to zero, any ratio will reach infinity.

--> STOCKS SOAR IN SECULAR STAGNATION

If the denominator falls to zero, any ratio will reach infinity.

--> STOCKS SOAR IN SECULAR STAGNATION

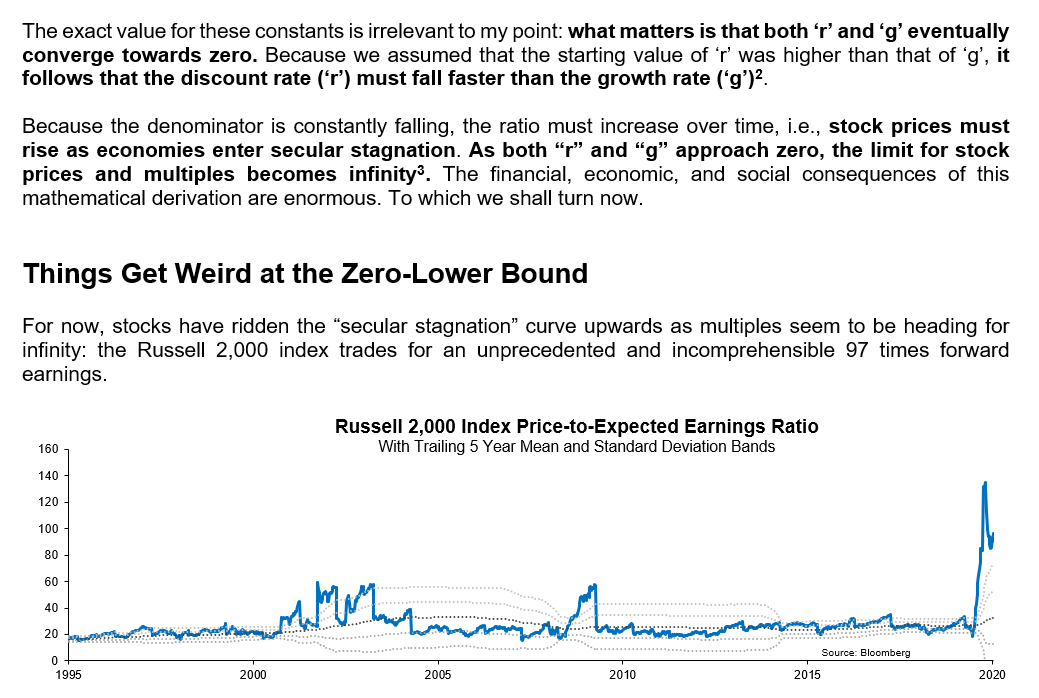

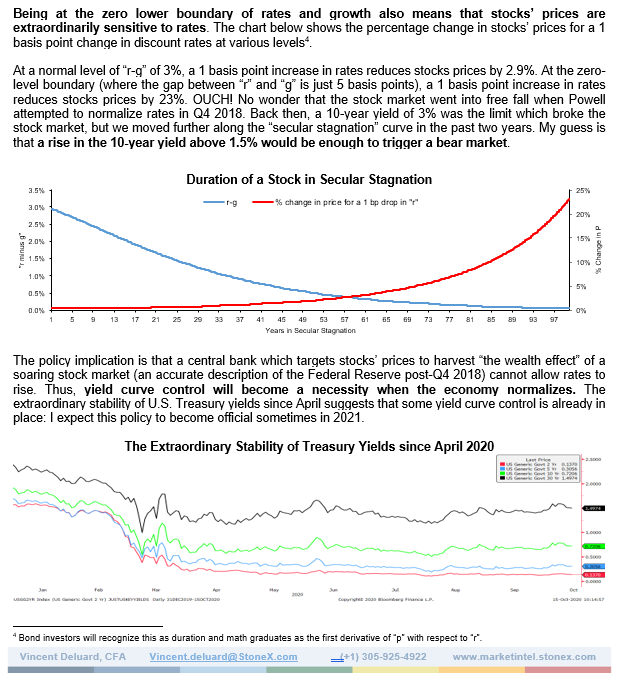

Implications:

- What goes up must go down (see what I did here @SarahPonczek ?): if the economy and "r-g" normalize, then stocks& #39; multiples will collapse

- If the Fed believes in "the wealth effect", rates cannot go up --> yield curve control is the only option

- What goes up must go down (see what I did here @SarahPonczek ?): if the economy and "r-g" normalize, then stocks& #39; multiples will collapse

- If the Fed believes in "the wealth effect", rates cannot go up --> yield curve control is the only option

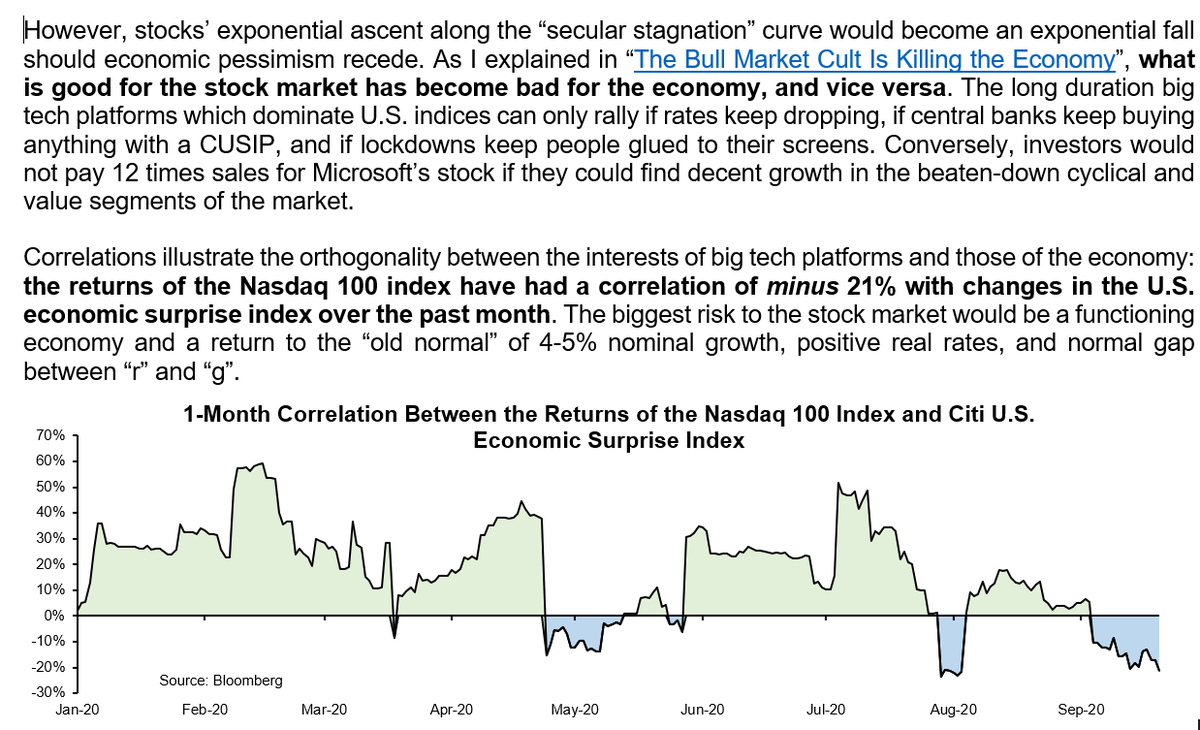

- what is good for the stock market has become bad for the economy, and vice versa.

The returns of the Nasdaq 100 index have had a correlation of -21% with the U.S. economic surprise index over the past month

The returns of the Nasdaq 100 index have had a correlation of -21% with the U.S. economic surprise index over the past month

--> if you think that the election will end the political gridlock and lead to pro-growth policies, you should sell this market.

--> if you are bearish on the economy, you should buy stocks

(FWIW I am bearish on the market because I think economic pessimism is excessive)

--> if you are bearish on the economy, you should buy stocks

(FWIW I am bearish on the market because I think economic pessimism is excessive)

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="The Crazy Math of Secular Stagnation 2 days ago, I asked how stocks& #39; valuations should behave in secular stagnation (& #39;r& #39; and & #39;g& #39; trend to zero over time)Less than 30% got it rightTime for thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="The Crazy Math of Secular Stagnation 2 days ago, I asked how stocks& #39; valuations should behave in secular stagnation (& #39;r& #39; and & #39;g& #39; trend to zero over time)Less than 30% got it rightTime for thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>