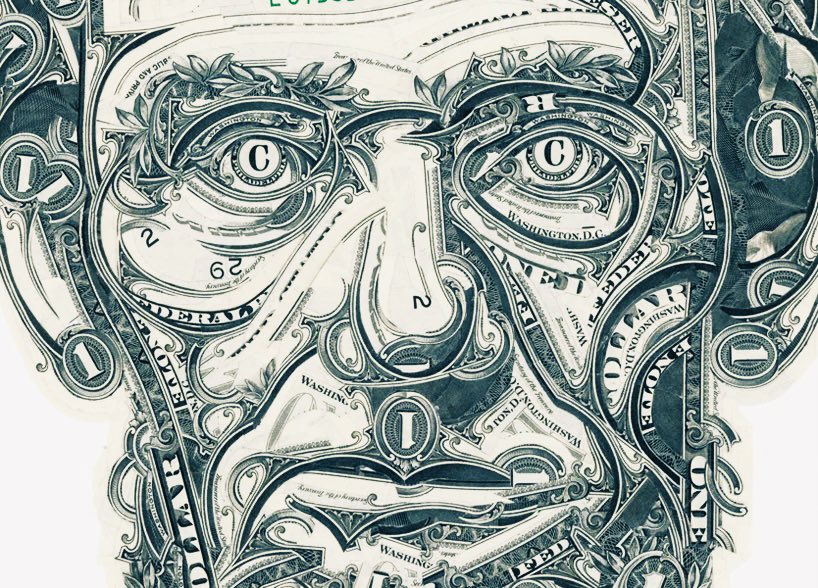

Don’t let money stresses you out.

Here’s how to be financially resilient.

Get your peace of mind back.

| Thread |

Here’s how to be financially resilient.

Get your peace of mind back.

| Thread |

1/

Be conscious of your cash flow.

Watch what you spend.

Look at what expenses you can cut.

Practice financial minimalism to better manage your money.

Be conscious of your cash flow.

Watch what you spend.

Look at what expenses you can cut.

Practice financial minimalism to better manage your money.

2/

Have a spending budget:

• Save where you can

• Pay the burning debts

• List down the essentials to spend on

Cut down on whatever that’s unnecessary.

You don’t “need” that pair of new sneakers.

Have a spending budget:

• Save where you can

• Pay the burning debts

• List down the essentials to spend on

Cut down on whatever that’s unnecessary.

You don’t “need” that pair of new sneakers.

3/

Tailor your lifestyle.

Reassess what truly enhances your quality of life.

You don’t always need to spend to be happy.

• Cook and dine with your family

• Break out a sweat with pushups

• Have a walk under the morning sun

Unchain yourself from material attachments.

Tailor your lifestyle.

Reassess what truly enhances your quality of life.

You don’t always need to spend to be happy.

• Cook and dine with your family

• Break out a sweat with pushups

• Have a walk under the morning sun

Unchain yourself from material attachments.

4/

Financial spring cleaning.

Cut your fixed expenses.

Examine the money you’re spending on things you aren’t using.

Unused subscriptions and bloated investment fees are enemies of financial resilience.

Financial spring cleaning.

Cut your fixed expenses.

Examine the money you’re spending on things you aren’t using.

Unused subscriptions and bloated investment fees are enemies of financial resilience.

5/

Build your net worth.

Net worth = your assets - liabilities

Think in net worth.

You will see how debts affect your future wealth. (Liabilities)

And you will know what will build your wealth. (Assets)

Build your net worth.

Net worth = your assets - liabilities

Think in net worth.

You will see how debts affect your future wealth. (Liabilities)

And you will know what will build your wealth. (Assets)

6/

Know and prioritize your debts.

Pay off your debts with the highest interest first.

E.g. credit cards, vehicles and house mortgages.

Find the available relief rates on debts to take pressure off your cash flow.

Know and prioritize your debts.

Pay off your debts with the highest interest first.

E.g. credit cards, vehicles and house mortgages.

Find the available relief rates on debts to take pressure off your cash flow.

7/

Make your assets work for you.

If you have extra cash, invest.

Study:

• Stocks

• Index fund

• Real estate

Decide your risk profile.

Use your money to make more money. https://twitter.com/distillmike/status/1302991461516849154">https://twitter.com/distillmi...

Make your assets work for you.

If you have extra cash, invest.

Study:

• Stocks

• Index fund

• Real estate

Decide your risk profile.

Use your money to make more money. https://twitter.com/distillmike/status/1302991461516849154">https://twitter.com/distillmi...

8/

Build your emergency stash.

Have enough cash to take care of your 6-12 months expenses.

Create this safety net for rainy days.

With lesser stress, you’ll tend to take on more new opportunities.

Build your emergency stash.

Have enough cash to take care of your 6-12 months expenses.

Create this safety net for rainy days.

With lesser stress, you’ll tend to take on more new opportunities.

Read on Twitter

Read on Twitter