1/CBDCs are going to completely overhaul the global financial system. The biggest change since Bretton Woods.

Interoperability and Standards are going to be key

@quant_network have laid the foundations for Overledger to be the global infrastructure for CBDCs

36-Tweet https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> $QNT

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> $QNT

Interoperability and Standards are going to be key

@quant_network have laid the foundations for Overledger to be the global infrastructure for CBDCs

36-Tweet

2/ 80% of Central Banks are now researching the deployment of CBDCs. The decline of cash usage, global stablecoins like Libra, COVID, need for lower cast / faster payments have all rapidly reduced the time at which CBDCs will be implemented.

3/ @RaoulGMI recently did a excellent video explaining the profound change this will have and encourage everyone to watch. Also, the highly anticipated interview with @gverdian is due to be released this week on @RealVision https://www.youtube.com/watch?v=qL2LfVRl3J0&feature=youtu.be">https://www.youtube.com/watch... https://www.youtube.com/watch...

4/ @gverdian has had the vision to see how blockchain and CBDCs will revolutionise the global financial system and founded Quant and has been laying the foundations to make that a reality ever since. Let& #39;s start with the Tech

5/ Quant& #39;s Blockchain Operating System @Overledger enables interoperability with any blockchain and any existing networks without the overhead of adding another blockchain in the middle, to provide a scalable and future proof solution. For more info see  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/CryptoSeq/status/1312298738891841537?s=20">https://twitter.com/CryptoSeq...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/CryptoSeq/status/1312298738891841537?s=20">https://twitter.com/CryptoSeq...

6/ Each central bank will likely issue their CBDC on their own blockchain, likely to be based on permissioned blockchains such as R3& #39;s Corda, Hyperledger and Quorum. Interoperability will be key not only to enable cross border payments between central banks but also ...

7/ with existing payment networks all the way down to integrating with existing payment infrastructure such as PIN Terminals, Point of Sale systems etc.

8/ Whatever form cross-border payments takes, whether it be atomic swaps of CBDCs, the creation of an IMF SDR Global Reserve Digital currency / Synthetic Hegemonic Currency, Fnality& #39;s USC or bridge assets built on open networks such as XRP and XLM Ledger, Quant connects them all.

9/ Their Interchange solution will enable payments across a variety of existing payment rails such as Faster Payments, CHAPS, SEPA, SWIFT, http://Pay.UK"> http://Pay.UK whilst integrating with RTGS systems, payment infrastructure all the way down to POS systems and mobile payments

10/ They have recently released an IETF RFC proposal for Open Digital Asset Protocol (ODAP) in collaboration with MIT and Intel for an open blockchain agnostic protocol, enabling Interoperability of assets and messages across DLTs as well as Oracle functionality ...

11/ with the use of decentralised trusted compute base gateways which you can read more about in this thread https://twitter.com/CryptoSeq/status/1315374265575841792.">https://twitter.com/CryptoSeq... This will form the basis for Gateway to Gateway communication in @OverledgerNet. Enabling banks, Central Banks to run an Overledger gateway to..

12/ enable interoperability in a scalable, secure, and compliant way. It has also been designed to meet strict regulatory requirements for Financial institutions to meet AML / KYC / FATF Travel rule requirements and other security requirements required for banks and governments.

13/ MIT have also recently partnered with the Federal Reserve in Boston to research the creation of a CBDC. Quant have been in discussions with the FED as well regarding a CBDC https://mobile.twitter.com/gverdian/status/1221819998152331264">https://mobile.twitter.com/gverdian/...

14/ Quant have also been in discussions with regulatory bodies such as the FCA https://twitter.com/gverdian/status/1168628166644183042?s=20">https://twitter.com/gverdian/...

15/ Meetings with the European Central Bank as well as being a founding member of International Association for Trusted Blockchain Applications (INATBA) https://twitter.com/gverdian/status/1154138874148532224?s=20">https://twitter.com/gverdian/...

16/ The Bank for International Settlements (BIS) has partnered with the Bank of Canada, the Bank of England, the European Central Bank, four Nordic central banks and the Federal Reserve in the research of CBDCs

17/ Central Banks and Banks don& #39;t send payments over the Internet, they have mission critical private infrastructure networks. In order for the tech to be used it needs to be integrated in those networks. This is why Quant& #39;s partnership with SIA is so important.

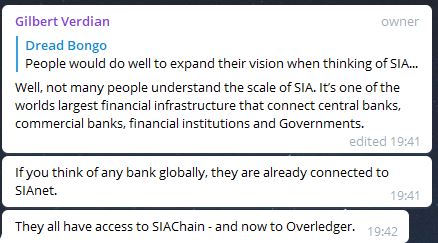

18/ SIA provide a private financial network which is the backbone of the European financial market. SIA and SWIFT are the only 2 providers for the Eurosystem Single Market Infrastructure Gateway, granting access to all RTGS, Securities and Instant Payment transactions for Europe.

19/ Overledger is integrated into SIAChain part of that private financial network (SIAnet) that is the backbone of the european financial market, enabling the 580 banks, central banks, trading venues that are building projects on SIAChain to benefit from scalable Interoperability

20/ SIA has not only partnered with the European Central Bank connecting all central banks in Europe to the ESMIG, but also provide networks for other Central Banks such as Bank of Canada, Nordic Central Banks and over 100+ Tier 1 Banks. https://www.sia.eu/en/media-events/news-press-releases/quant-network-and-sia-successfully-tested-blockchain-interoperability">https://www.sia.eu/en/media-...

21/ SIA& #39;s recent merger with Nexi makes them the Europe& #39;s largest payment provider

Combined, they have around two million merchants, 120 million cards, and an overall number of processed annual transactions equal to €21 billion. https://www.world-today-news.com/the-merger-of-nexi-and-sia-is-a-big-deal/">https://www.world-today-news.com/the-merge...

Combined, they have around two million merchants, 120 million cards, and an overall number of processed annual transactions equal to €21 billion. https://www.world-today-news.com/the-merger-of-nexi-and-sia-is-a-big-deal/">https://www.world-today-news.com/the-merge...

22/ Some of the largest blockchain projects in the world are being launched on SIAChain, one of those is the Spunta project.

Spunta is a huge project consisting of the entire italian banking system and looks to further expand into europe https://www.finextra.com/pressarticle/84485/100-italian-banks-go-live-on-spunta-blockchain">https://www.finextra.com/pressarti...

Spunta is a huge project consisting of the entire italian banking system and looks to further expand into europe https://www.finextra.com/pressarticle/84485/100-italian-banks-go-live-on-spunta-blockchain">https://www.finextra.com/pressarti...

23/ For the Bank of England, Gilbert has experience with previously working as the Chief Information Security Officer for Vocalink (Mastercard) and was in charge of security for the entire payments in the UK managing £6 Trillion per year. https://www.gilbertverdian.com/cv/ ">https://www.gilbertverdian.com/cv/"...

24/ They also had meetings with the Bank of England& #39;s Head of Future Technology, William Lovell as detailed in this Hyperledger Trade Finance call https://wiki.hyperledger.org/display/TFSIG/15+Oct+2019+-+Notes">https://wiki.hyperledger.org/display/T...

25/ Quant were made a guarantor of http://Pay.uk"> http://Pay.uk - the UK’s largest payment network. Through this relationship, Quant will shape the payment ecosystem and help set the strategic direction of the Payments infrastructure and adopting the New Payments Architecture (NPA)

26/ The Bank of England& #39;s RTGS will be interoperable with DLTs using an API platform https://twitter.com/quant_network/status/1247478633209442305?s=20">https://twitter.com/quant_net...

27/ Martin Hargreaves recently joined as Chief Product Officer. He has 12 years experience at Vocalink and was the Vice President of Product. Vocalink (Mastercard) manage the entire payments system for the UK as well as other payment networks in the US, Singapore

28/ Quant have partnered with Oracle (the 2nd largest Software provider in the world) as a Fintech Partner to deliver financial services infrastructure.

Quant are enabling #interoperability of DLTs to deliver mission-critical business applications and workloads for FS clients.

Quant are enabling #interoperability of DLTs to deliver mission-critical business applications and workloads for FS clients.

29/ Oracle has particular importance as not only are the databases the most widely used in general but they are used by pretty much every bank and Central bank, from the Bank of England, Federal Reserve, JP Morgan, HSBC etc. See Video below from 11:20

https://www.youtubetrimmer.com/view/?v=o35bk73TiG4&start=680&end=960">https://www.youtubetrimmer.com/view/...

https://www.youtubetrimmer.com/view/?v=o35bk73TiG4&start=680&end=960">https://www.youtubetrimmer.com/view/...

30/ Oracle invited Quant to attend the leading financial event of the year - SWIFT SIBOS where Oracle were co-marketing with Quant to take their solution to their 480,000 clients including meetings with Banks / Central Banks

31/ Global Standards are also crucial for interoperability and this is why Gilbert founded ISO TC 307 for Blockchain, the globally recognized standard which has 57 countries working towards. https://www.iso.org/committee/6266604.html?view=participation">https://www.iso.org/committee...

32/ ISO TC 307 also aligns with ISO 20022 for electronic data interchange between financial institutions. Standards are vitally important for Enterprise / Government adoption and designed from the start to adhere to those rather than have to redesign it later.

33/ Also complied with strict regulatory and security requirements to be integrated into banking networks and governments. Further examples of this is being able to engage with the UK government as a Crown Commercial Service Supplier https://www.quant.network/news-room/quant-named-a-supplier-on-uk-governments-crown-commercial-service-ccs-g-cloud-12-framework/">https://www.quant.network/news-room...

34/ They also have great contacts and guidance from board members at Quant such as Guy Dietrich the managing director of Rockefeller Capital (who manage assets worth over $30 billion)and has attended meetings personally with Gilbert such as with the FCA https://www.quant.network/news-room/guy-dietrich-managing-director-of-rockefeller-capital-joins-quant-networks-board-of-directors/">https://www.quant.network/news-room...

35/ Neil Smit, Vice Chairman at Comcast (2nd largest broadcasting and cable television company in the world) has joined the board of directors to help grow the company and has has the perfect background and experience in large-scale Internet networks.

https://www.quant.network/news-room/quant-network-appoints-neil-smit-to-board-of-directors/">https://www.quant.network/news-room...

https://www.quant.network/news-room/quant-network-appoints-neil-smit-to-board-of-directors/">https://www.quant.network/news-room...

36/ $QNT is key to it all, used not only in licenses, transaction costs, gateway fees, staking QNT for gateways, signing of transactions, no inflation and smaller supply than Bitcoin and all already in circulation. See @DavidW___ & #39;s article https://medium.com/@davW/a-deeper-look-into-the-quant-network-utility-token-qnt-valuation-dynamics-and-fundamentals-84633ca7cb58">https://medium.com/@davW/a-d...

Read on Twitter

Read on Twitter