If there is one market where the “this time its different” narrative can never take hold, it’s E$s. A thread:

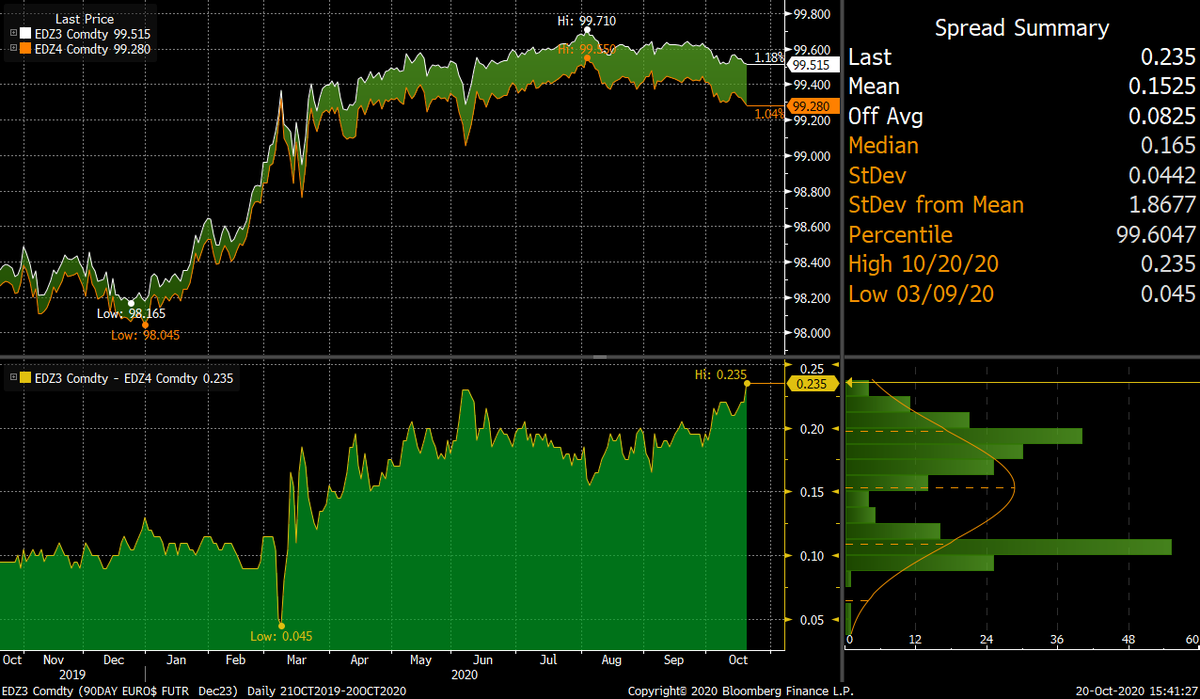

EDZ3 is basically pricing in the first hike. It’s okay to hope that the economy would have reached full employment and start generating sustainable inflation in 3y 1/5

EDZ3 is basically pricing in the first hike. It’s okay to hope that the economy would have reached full employment and start generating sustainable inflation in 3y 1/5

But... EDZ4 is pricing in only one more hike! That makes no sense! It& #39;s unreasonable to argue that the US would have hit full employment by 2023, with inflation also consistently printing north of 2%, and yet the Fed would only be hiking once a year? 2/5

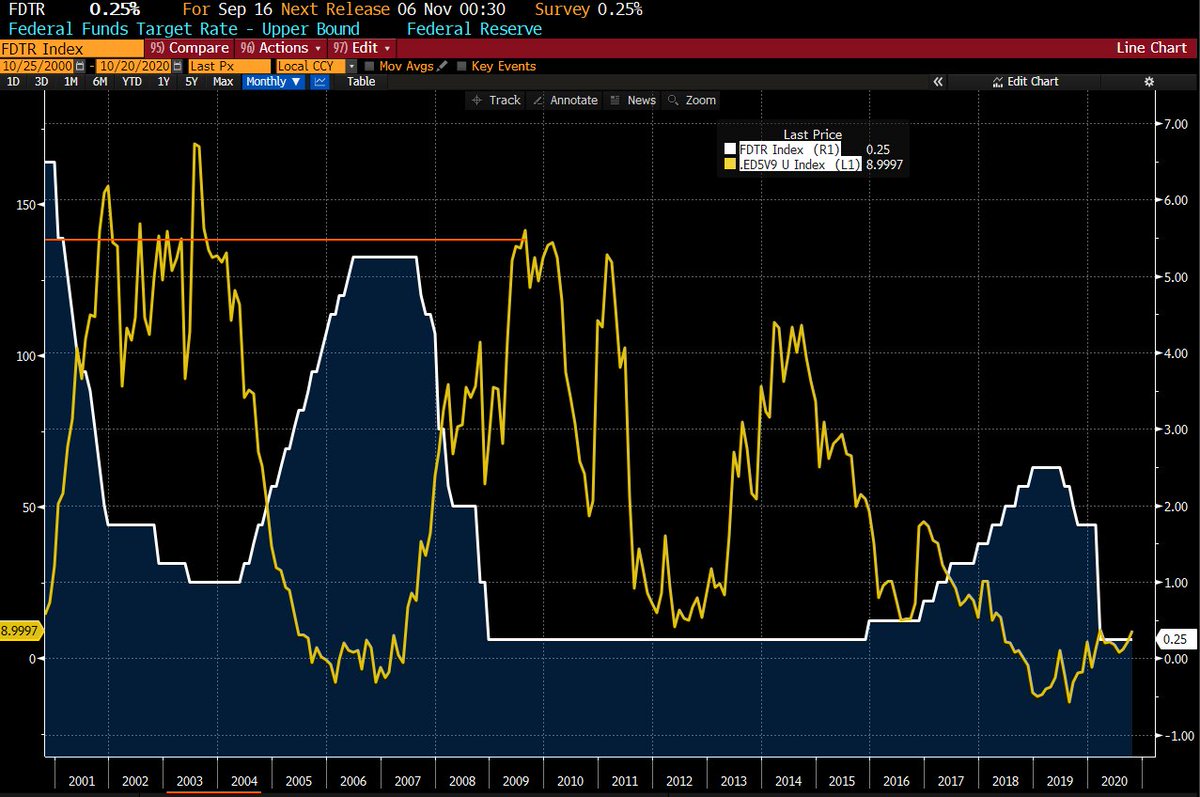

So, what is the logic behind the current shape of the curve? Recency Bias! This is what happened in the previous cycle. The Fed hiked for the first time in Dec 2015, and then in the whole of 2016, there was only one more hike. 3/5

This is not all. If you look at the previous cycle, E$ spreads used to trade in triple digits, just because the Fed didn’t wait long after the Dot-Com recession to begin the rate hike cycle. 4/5

Read on Twitter

Read on Twitter