Nicholas Darvas toured the world as a professional ballet dancer.

All the while reading hundreds of books on markets/trading.

He turned that knowledge into the famous Box Method and made $2M in stock market profits.

Here& #39;s how he did it ... https://macro-ops.com/how-i-made-2m-in-the-stock-market-a-book-review-darvas/">https://macro-ops.com/how-i-mad...

All the while reading hundreds of books on markets/trading.

He turned that knowledge into the famous Box Method and made $2M in stock market profits.

Here& #39;s how he did it ... https://macro-ops.com/how-i-made-2m-in-the-stock-market-a-book-review-darvas/">https://macro-ops.com/how-i-mad...

1/ Darvas& #39; Early Days As A Losing Trader

Darvas did everything wrong as a beginning trader:

- Bought high and sold low

- Bought off "hot tips" from friends/family

- Turned his losing trades into "pet" investments

Lesson: Don& #39;t buy stocks based on hot-tips. Do you own work.

Darvas did everything wrong as a beginning trader:

- Bought high and sold low

- Bought off "hot tips" from friends/family

- Turned his losing trades into "pet" investments

Lesson: Don& #39;t buy stocks based on hot-tips. Do you own work.

2/ Darvas& #39; First System: The Seven Rules

Tired of striking out, Darvas looked to something *real*, something *tangible* ... like a stock& #39;s fundamentals.

By focusing on the fundamentals, Darvas developed these Seven Rules for trading.

The big realization: "Study the fundies"

Tired of striking out, Darvas looked to something *real*, something *tangible* ... like a stock& #39;s fundamentals.

By focusing on the fundamentals, Darvas developed these Seven Rules for trading.

The big realization: "Study the fundies"

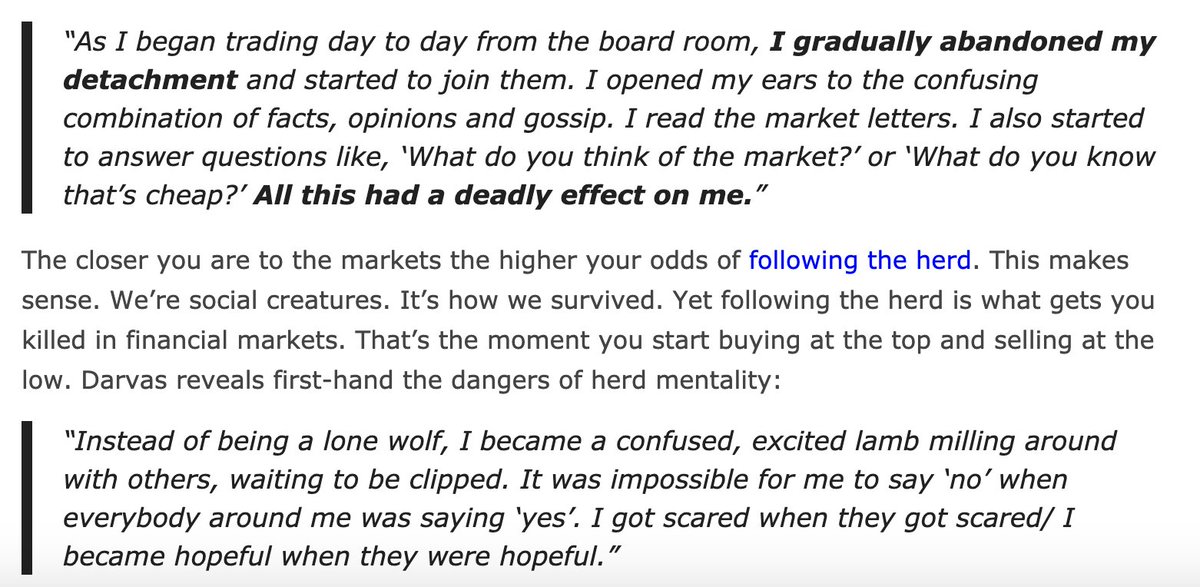

3/ Darvas& #39; Date With Destruction

Using these rules, Darvas found (in his opinion) a *sure bet* stock. A company that couldn& #39;t *possibly* fall.

It met his criteria:

- Strong Industry

- Strong Rating

- 6% Div

- Low P/E

The result: He bet too big and lost a fortune!

Using these rules, Darvas found (in his opinion) a *sure bet* stock. A company that couldn& #39;t *possibly* fall.

It met his criteria:

- Strong Industry

- Strong Rating

- 6% Div

- Low P/E

The result: He bet too big and lost a fortune!

4/ Darvas& #39; Secret: The Box Method

Despite the blow-up, one of Darvas& #39; stocks did *really* well. In fact, it was a stock he didn& #39;t realize he had.

He bought it because the price was rising on strong volume.

It was then Darvas realized the power of price action and volume.

Despite the blow-up, one of Darvas& #39; stocks did *really* well. In fact, it was a stock he didn& #39;t realize he had.

He bought it because the price was rising on strong volume.

It was then Darvas realized the power of price action and volume.

5/ Box Method Cont.

So what is this box method, you ask? It& #39;s simple:

- Wait for a stock to consolidate in a trading range ($12-$15, for ex.)

- Buy the stock on a breakout from that consolidation (I.e., box)

- Place a protective stop-loss below the low of the breakout bar

So what is this box method, you ask? It& #39;s simple:

- Wait for a stock to consolidate in a trading range ($12-$15, for ex.)

- Buy the stock on a breakout from that consolidation (I.e., box)

- Place a protective stop-loss below the low of the breakout bar

6/ Managing A "Box Method" Trade

Once in a trade, Darvas took an unemotional view to the stock.

If it traded back into a previous "box", he would cut his position.

If it traded up into new highs, he would trail his position with a protective stop-loss.

He kept it simple.

Once in a trade, Darvas took an unemotional view to the stock.

If it traded back into a previous "box", he would cut his position.

If it traded up into new highs, he would trail his position with a protective stop-loss.

He kept it simple.

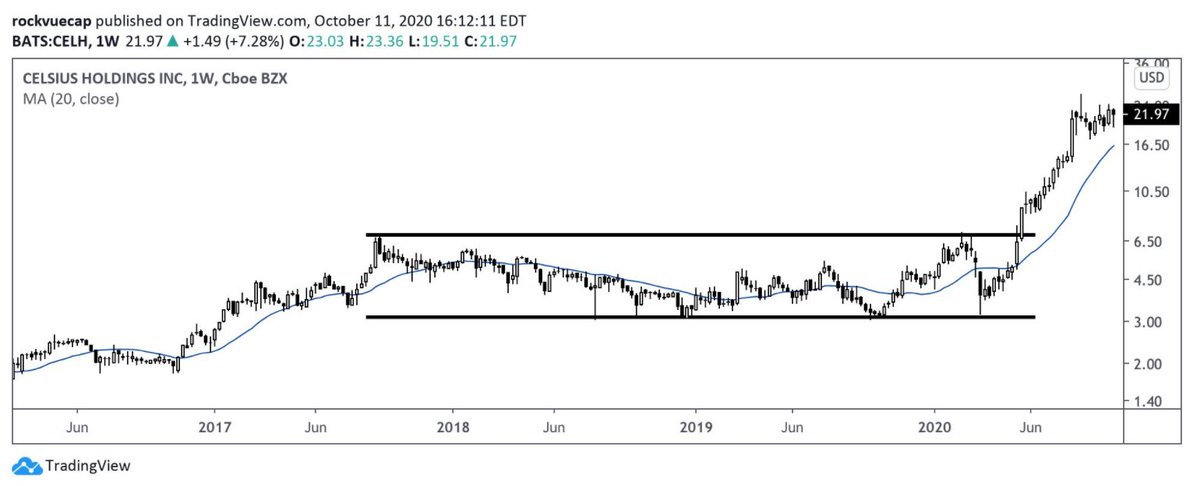

7/ Box Method Examples

Here& #39;s a few examples of the Box Method in action.

Note some common characteristics:

- Horizontal support/resistance levels

- Clear consolidation

- Strong breakouts into new "Box" zones

- Winners never test prior box

(disc: I own shares in TOBII)

Here& #39;s a few examples of the Box Method in action.

Note some common characteristics:

- Horizontal support/resistance levels

- Clear consolidation

- Strong breakouts into new "Box" zones

- Winners never test prior box

(disc: I own shares in TOBII)

Read on Twitter

Read on Twitter