Oh, Wall Street. You’re making the same mistake as in 2016.

When the Street won’t even entertain an outcome that you think is possible – or probable – there’s your opportunity.

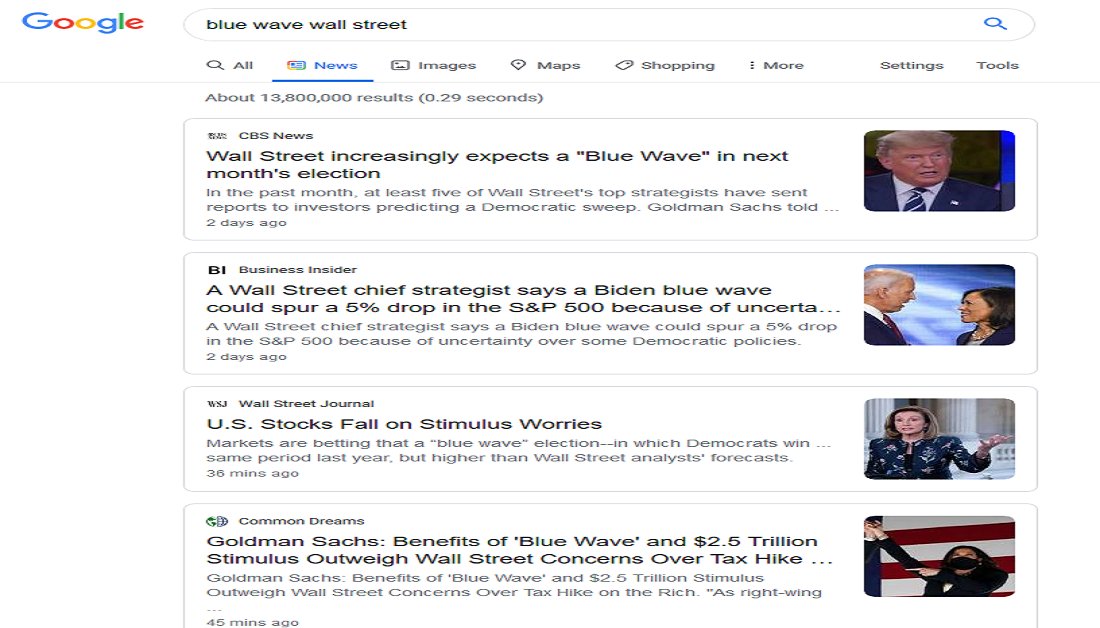

Google “Blue Wave Wall Street” and “Red Wave Wall Street.” The same CBS article for both.

THREAD

When the Street won’t even entertain an outcome that you think is possible – or probable – there’s your opportunity.

Google “Blue Wave Wall Street” and “Red Wave Wall Street.” The same CBS article for both.

THREAD

Why do you think this stock market peaked on Sept 2?

The Street is already measuring the curtains for Biden, so you need to be sober and get in front of the surprise: Trump victory, which I think is odds-on at this point (see my recent tweets for voting math).

The Street is already measuring the curtains for Biden, so you need to be sober and get in front of the surprise: Trump victory, which I think is odds-on at this point (see my recent tweets for voting math).

If you’re super wealthy – making more than $1mm per year – is your plan in the last weeks of 2020 to take capital losses on your stocks, like usual, or capital gains?

This year, you’re probably taking gains.

Why?

Book the profit in 2020 and you pay “only” 20% tax on it.

This year, you’re probably taking gains.

Why?

Book the profit in 2020 and you pay “only” 20% tax on it.

But if you wait until 2021 or 2022, Biden could be president – and he wants to raise the capital gains rate to 39.6% for people making more than a million dollars a year, in line with the Obama-era top marginal ordinary income tax rate.

I think this partially explains why FB, AAPL, AMZN, MSFT and GOOG have all declined harder than the market since Sept. 2.

Selling winners and booking the profit now, before Biden doubles the tax bill.

Meantime, everyone who earns under a million per year would seemingly...

Selling winners and booking the profit now, before Biden doubles the tax bill.

Meantime, everyone who earns under a million per year would seemingly...

...have their capital gains rate held constant, so they are continuing to engage their end-of-year ritual of selling losing stocks to book capital losses. This is perpetuating the struggle in a group like Energy.

Now let& #39;s say you’re a Wall Street equity analyst. You’re publishing research right now. You are starting to think about a 28% corporate tax rate, up from the current 21% rate.

This is especially so if your in-house political strategist tells you Biden has it wrapped up.

This is especially so if your in-house political strategist tells you Biden has it wrapped up.

There are more taxes on the docket, but you get the gist.

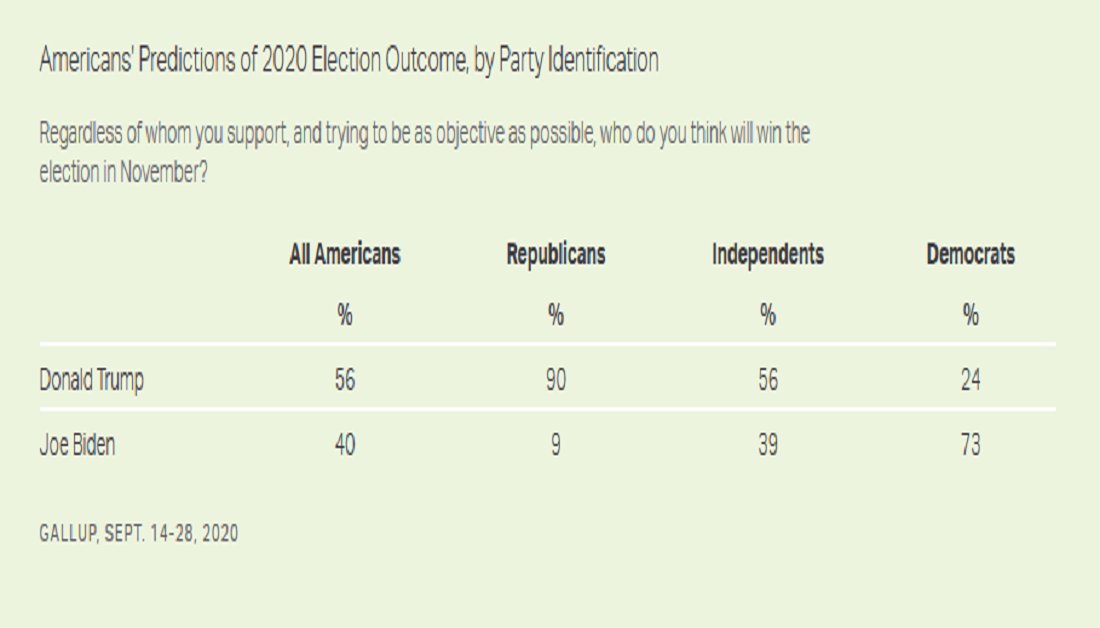

Ask the wisdom of crowds. The American public – cashiers, carpenters, teachers – believes Trump will win.

Why? Because they talk to their neighbors and gauge sentiment against conversations they had in prior years.

Ask the wisdom of crowds. The American public – cashiers, carpenters, teachers – believes Trump will win.

Why? Because they talk to their neighbors and gauge sentiment against conversations they had in prior years.

So we wake up after the dust has settled on a Trump victory + another GOP Senate majority and what& #39;s the story?

The capital gains tax on the rich has not doubled to 39.6%. The corporate tax rate stays put at 21% (and maybe goes lower).

These two portents are bullish stocks.

The capital gains tax on the rich has not doubled to 39.6%. The corporate tax rate stays put at 21% (and maybe goes lower).

These two portents are bullish stocks.

You could get a similar set up to 2016 because the Street is peddling “Blue Wave = infrastructure = buy stocks."

A Trump surprise could cause an initial sell off as that thesis dies.

But then the market realizes it has the low tax continuity candidate in Trump. Bullish.

A Trump surprise could cause an initial sell off as that thesis dies.

But then the market realizes it has the low tax continuity candidate in Trump. Bullish.

For my logic on Trump victory, see this thread. https://twitter.com/JeffWeniger/status/1317873734267686916">https://twitter.com/JeffWenig...

Read on Twitter

Read on Twitter