I spent the weekend diving into the IRS Form 990& #39;s for the Tommy Tuberville Foundation after reading how so little of the money went to the mission of supporting veterans. I& #39;ve been a veterans advocate for 10 yrs and seen a lot of these. Strap in for a long thread! #Alabama

I looked at the 990& #39;s published by ProPublica ( https://projects.propublica.org/nonprofits/organizations/463580202).">https://projects.propublica.org/nonprofit... You won& #39;t find them on the foundations website or any information about the officers, legal framework or donations. But, you will find out how AWESOME TOMMY IS and how much he loves the troops!

The accounting and paperwork is an absolute mess. Different forms every year, different addresses, wildly missed reporting numbers, totals that don& #39;t add up and bizarre financial choices. At a minimum the foundation has been incredibly poorly and unprofessionally managed.

At worst its a sham. Let& #39;s talk about the numbers. He founded it in 2014 for $645 in New Lenox, IL filing a 990EZ. Then in 2015 they held a single golf fundraiser that made a whopping $117,688. It cost $24,224 to run. The single biggest event cash haul they had from 2014 to 2018.

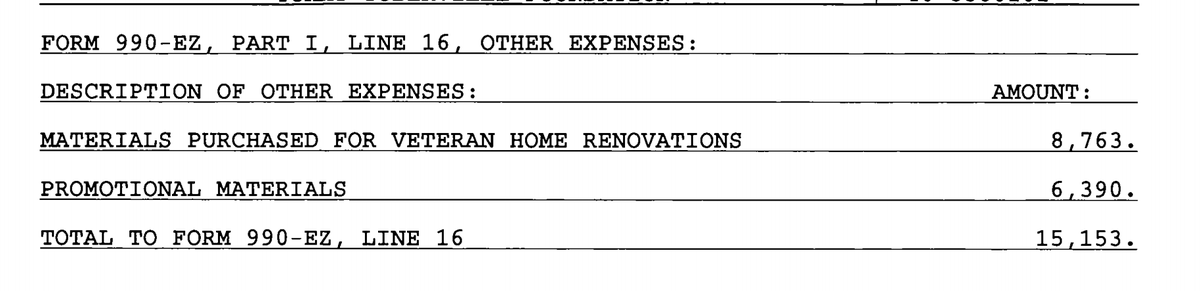

Thus $93,464 went into the bank. So, they say they gave money to renovate veterans homes. Good mission. The 990 says $8763 went to materials...and $6390 went to promotional materials. Yes 42% of the $15,153 expense went to promoting...the effort itself. Strange choice.

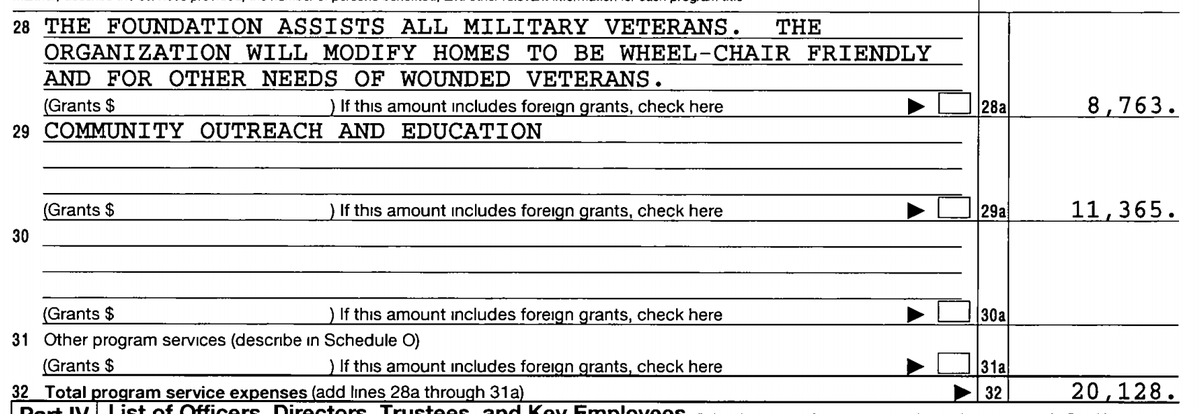

The 2015 990EZ is a mess. It only shows $8763 for home renovations and $11,365 for "Community Outreach and Education" which is said to be detailed in Schedule O. It& #39;s not. $43,838 went to professional fees/contractors. So, $93K raised and $20K went to the charitable mission?

So, 2016 is a full 990 with an address in Santa Rosa, FL. Gross was $81,034 that year with revenue of $63,689 after expenses. But...hoo boy still a hot mess. The forms say that just $23,745 went to their mission: $13,245 to home upgrades and $10,500 to "outreach and education".

So, in 2016 they spent $37,908 on professional fees/contractors. Much more than the previous year and fully $14K more than they actually spent on their mission. Also, $3458 on parking and auto expenses? Things don& #39;t make sense. But, wait then there& #39;s 2017 when it gets super fun!

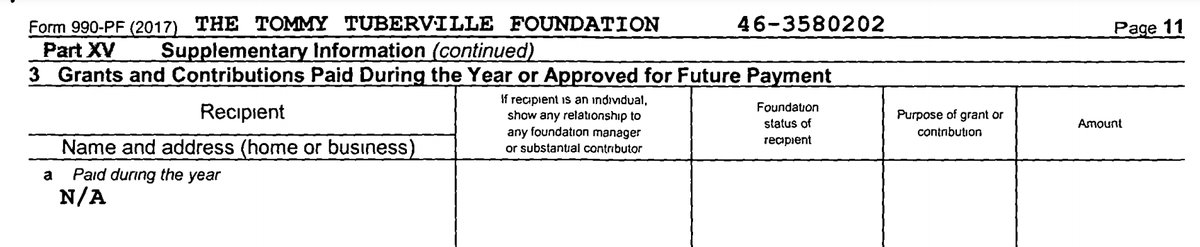

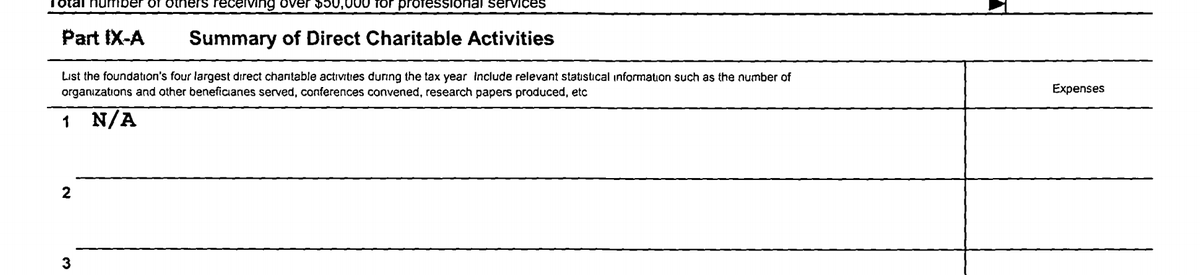

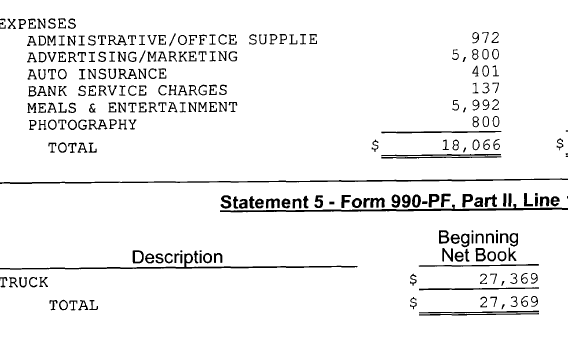

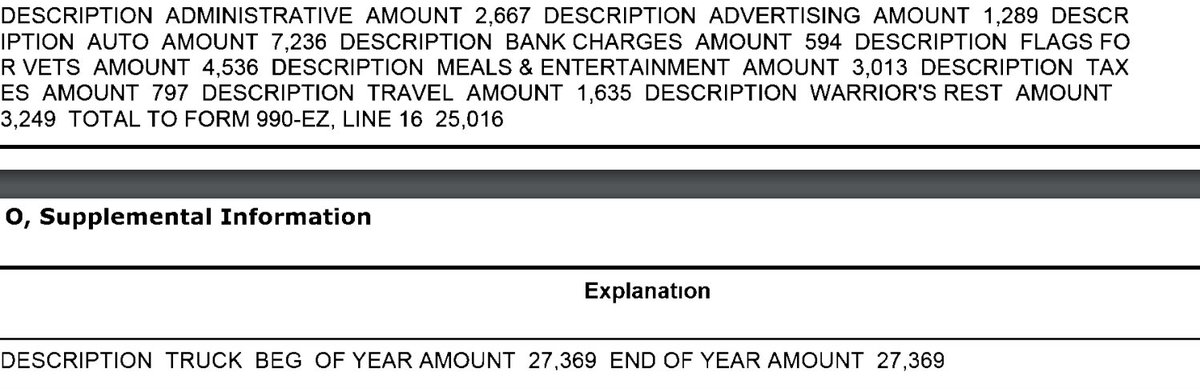

2017 finds a 990-PF (private foundation) in Auburn, AL and claims $50,087 for the year but nothing in this 990 shows any charitable giving AT ALL. But what a year! $7503 on legal fees; $27,369 bought a truck; $5800 on marketing; $5992 on meals and entertainment. Veterans? $0?

But, hey 2018 has to be better, right? Nah. Now we& #39;re on a 990EZ again. A total gross of $40,750 and claimed giving of $4536 for Flags for Vets and $3249 for Warriors Rest, a PTSD program. Tuberville& #39;s campaign sent the media an internal memo showing another $19,425 giving.

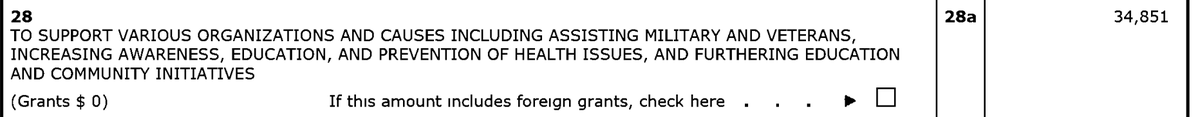

But...they claim on the form that they spent $34,851 on program expenses. They detail only $7785 and with the extra number they failed to claim on their official tax forms of another $19K adds up to just $22,674. So...where did the money go? Its horrible accounting.

So, a long thread with a lot to digest. In the most generous accounting over the life of this foundation its given just 33 to 38% of its funds/expenses to its mission. Got a nice truck. Got some good meals. Paid a lot of contractors. It& #39;s all suspicious as all get out.

Read on Twitter

Read on Twitter