$DXY tagged and rejected 21DMA and trying to hold low support of a bear flag.

$DXY oopsies.

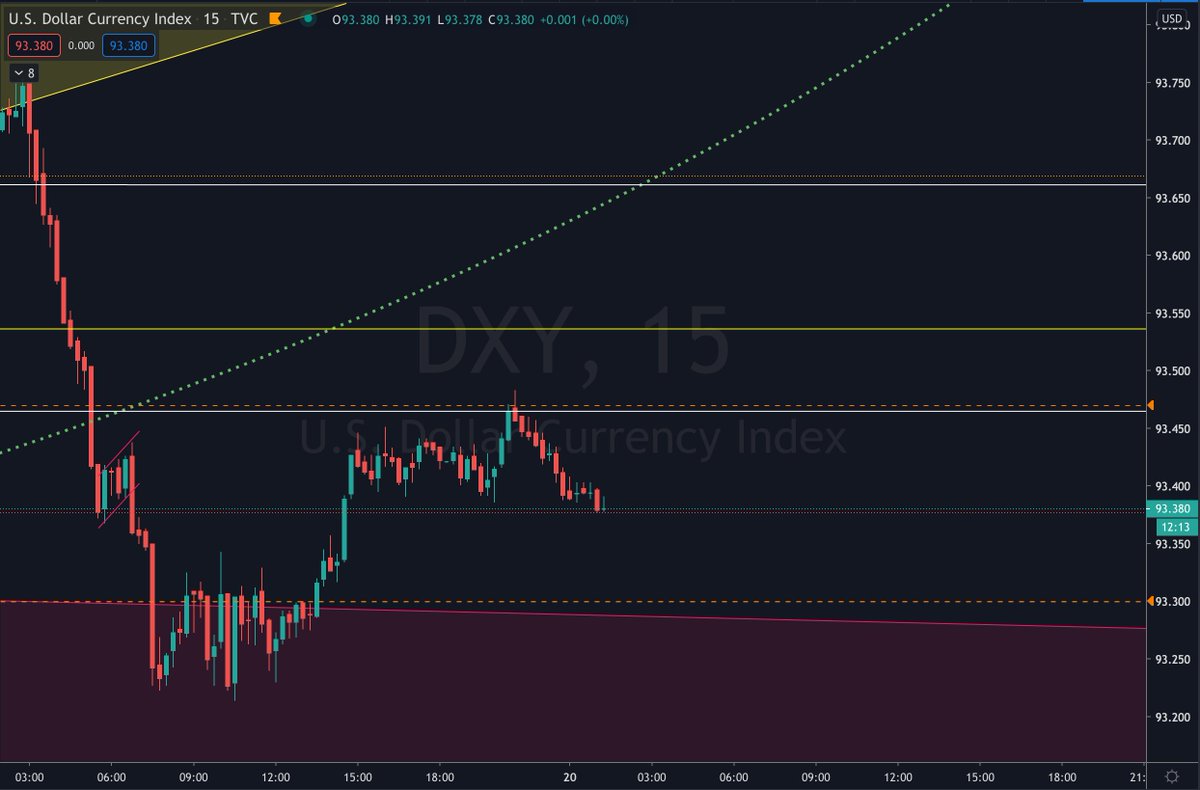

Potential bear flag break on $DXY and would like to see a triangle fill at 93.53 for confirmation and follow-through lower to the 93.47 pivot, then a break of 50DMA 93.30, then another triangle fill at 92.75.

$DXY lost the 93.47 pivot. Nothing is ever simple in FX. I expect the 50DMA to be defended, at least initially.

$DXY had a little baby bear flag.

Watch for 50DMA at 93.30. If that breaks, the much vaunted cup and handle is in question. If the 92.75 triangle fill / pivot fails, the C&H has no handle left / is invalidated.

Watch for 50DMA at 93.30. If that breaks, the much vaunted cup and handle is in question. If the 92.75 triangle fill / pivot fails, the C&H has no handle left / is invalidated.

$DXY NLOD and < the two-day Thursday-Friday range. Note Friday was an inside day doji.

The $DXY longs on my stream are oddly quiet today.

$DXY 50DMA test.

$DXY bear flag on 50DMA backtest.

$DXY - updated. Bear flag break and loss of 50DMA on initial backtest.

Possible attempt at a double bottom at 93.22 on $DXY.

Early.

Early.

$DXY getting a little perky > 50DMA now.

Saved $DXY at the 50DMA line of defense.

$DXY coming up on the 93.47 pivot.

Remarkably, $DXY still red and PMs green in spite of the broader market dump.

$DXY rejects 93.47 pivot.

$DXY NLOD.

18 hours ago and higher up in this thread, I had suggested we might see the 50DMA defended, at least initially. We had that test and bounce off the 50DMA. I would not buy as optimistic about a second test of the 50DMA - if we neared that level later today.

$DXY

$DXY

$DXY - updated. Test of the 78.6FIB.

$DXY flag break, back test of 93.377 on this 15MIN candle, new LOD.

$DXY 50DMA test on deck at 93.30. Unlikely to find the same certainty of support price found there yesterday.

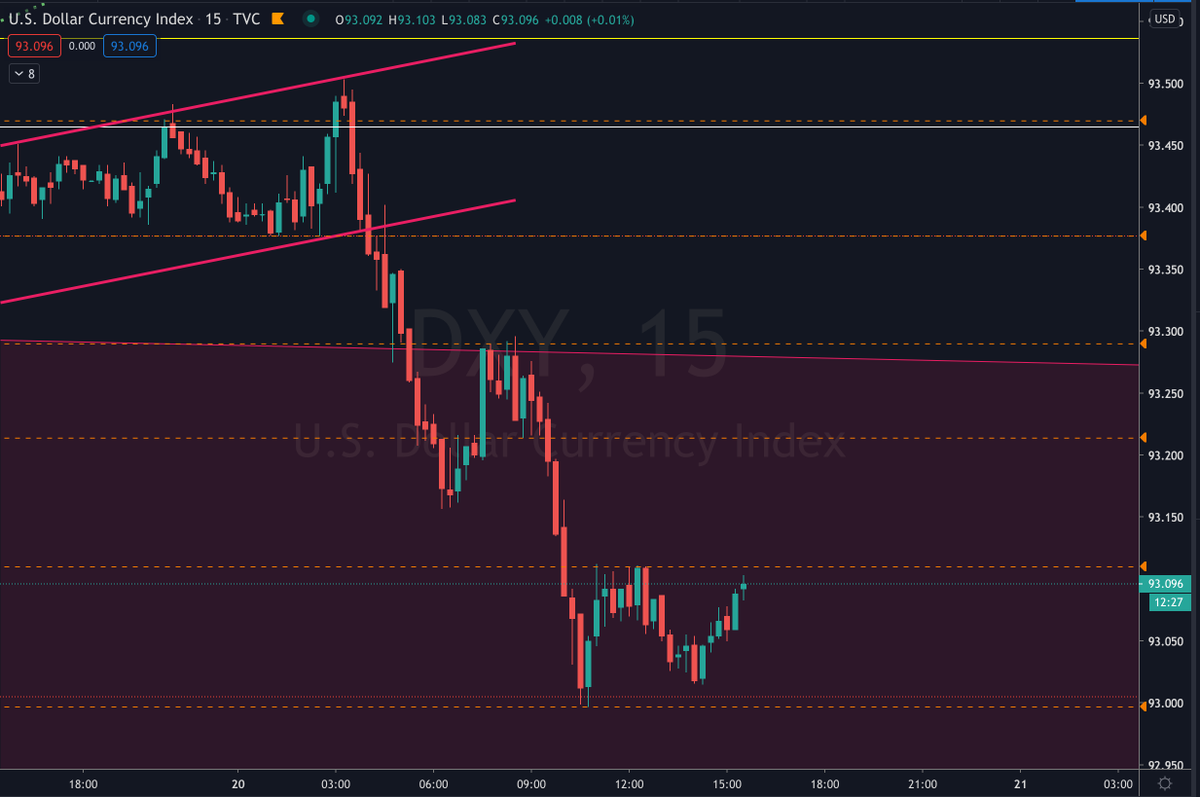

$DXY loses 50DMA support. 93.214 was yesterday& #39;s LOD and must hold for bulls. 92.75 triangle fill below.

$DXY probing PD LOD. 93 then triangle fill 92.75 on watch. Below the triangle fill fully kills the (still) potential cup and handle pattern.

$DXY < PD LOD.

$DXY oversold on 15MIN.

$DXY 50DMA backtest.

$DXY 50DMA backtest resistance successful.

Technicals on $DXY so clean since yesterday.

Started with a (yellow) bull flag break at 21DMA resistance --> drop to 50DMA support --> backtest of 93.47 pivot inside a mini bear flag --> bearflag break --> loss of 50DMA and PD LOD --> backtest of 50DMA at resistance.

Started with a (yellow) bull flag break at 21DMA resistance --> drop to 50DMA support --> backtest of 93.47 pivot inside a mini bear flag --> bearflag break --> loss of 50DMA and PD LOD --> backtest of 50DMA at resistance.

$DXY next support levels 93, then 92.75.

$DXY barely oversold on 15MIN in spite of this vertical dump. 93 seems very realistic. 92.75 kills the C&H handle.

Been saying for some weeks now USD is a momentum animal.

Counter-trend rallies are just that, counter-trend.

The. trend. is. down.

$DXY

Counter-trend rallies are just that, counter-trend.

The. trend. is. down.

$DXY

$DXY prints a 92 handle.

$DXY testing the 93 pivot.

Of course, if algos have a sense of humor, they& #39;ll attempt a double bottom here.

Stimulus "news" notwithstanding, $DXY should bring it home and fill the triangle fairly quickly if 93 is lost.

$DXY refuses to roll over and lose the 93 pivot. Limited upside to equities without a 92 handle IMO. This is still the most important chart, the song sheet for all others.

Watching $DXY 93.11.

$DXY 93.11 holding so far.

$DXY lost the 93 pivot after rejecting a backtest at 93.11.

A breach of the 92.75 triangle fill would negate the C&H definitively and open up the July 31 ref low at 92.55, possibly 91.75, with other key major support levels at 88.25, 84.75.

A breach of the 92.75 triangle fill would negate the C&H definitively and open up the July 31 ref low at 92.55, possibly 91.75, with other key major support levels at 88.25, 84.75.

$DXY nearing triangle fill.

Read on Twitter

Read on Twitter