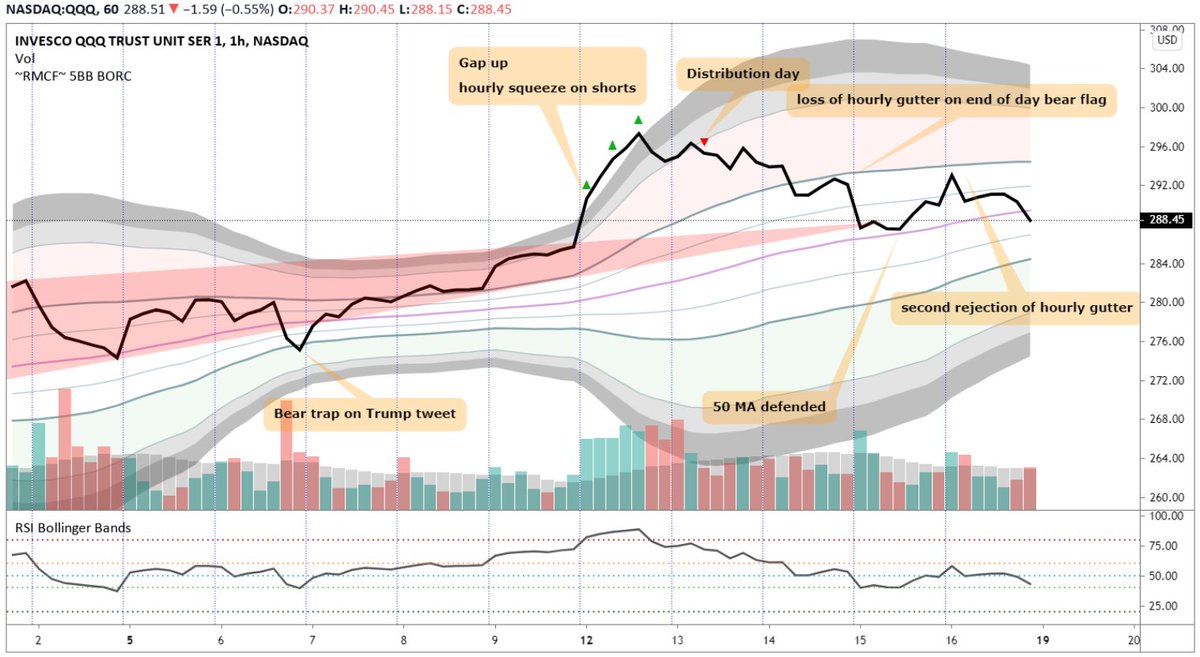

This is my take on the current technical outlook of $NDX from start to end of the week:

So the trump tweet last week was exactly what everyone thought, a big old bear trap which ended up with a Monday morning mega-squeeze, Tuesday and Wednesday we had distribution....

So the trump tweet last week was exactly what everyone thought, a big old bear trap which ended up with a Monday morning mega-squeeze, Tuesday and Wednesday we had distribution....

By the close of Wednesday we had an hourly bear flag under the bull gutter leading to Thursday& #39;s gap down...Thursday& #39;s gapped down invited a lot of BTDers which in my opinion were blindsided by the 3 pm move on Friday, whether that will be a trap or not depends on Monday& #39;s action

The daily candle on Thursday was very constructive BTD type and the close back under the bull gutter (+1 sd) does put late buyers in a tough situation

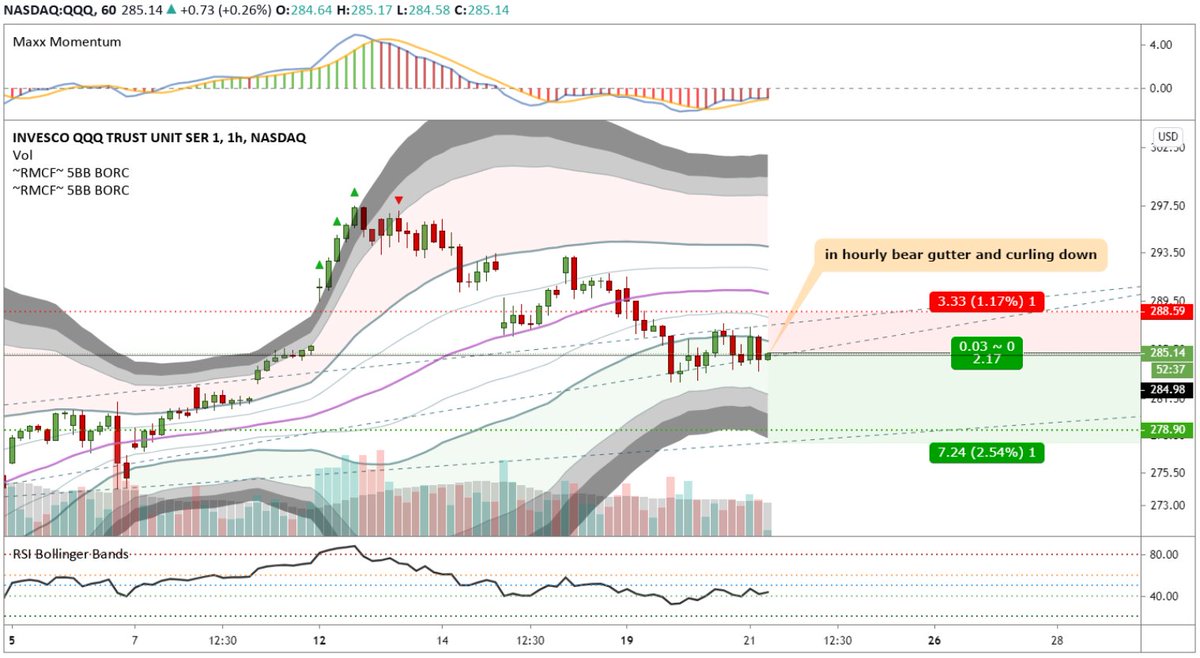

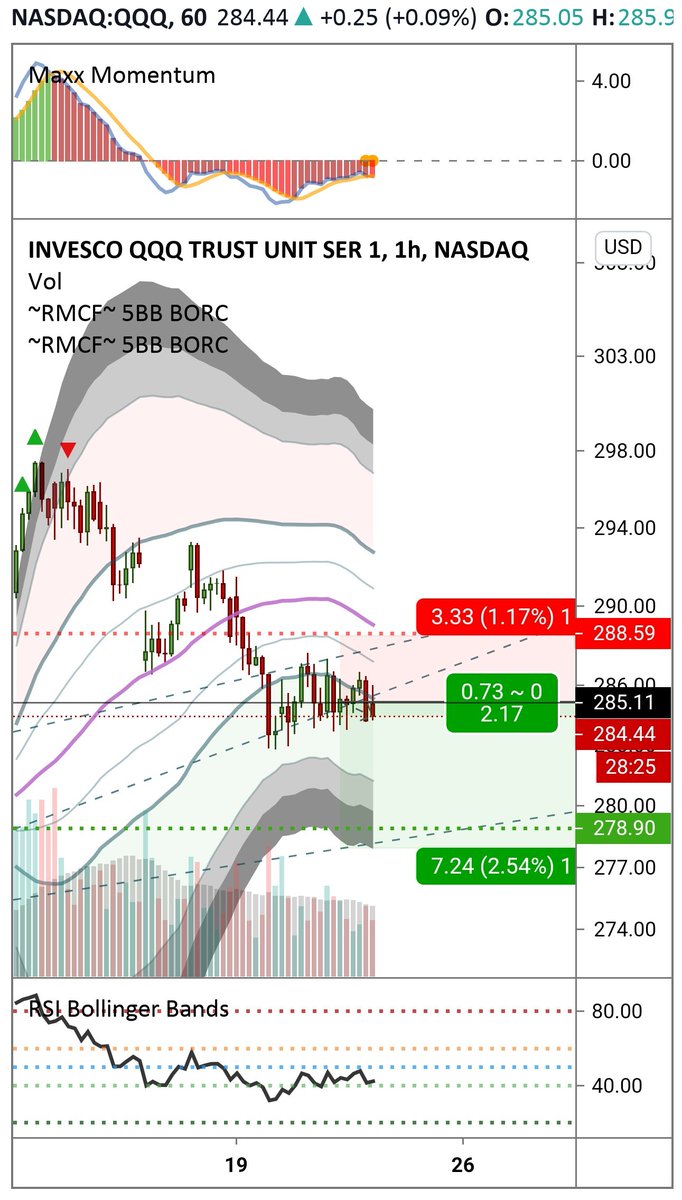

Those who didn& #39;t sell Friday came slamming sell hard early on...a close under bull gutter is very likely at this point...pressure on bulls now altho daily bands are sideways still

https://twitter.com/SoccerMomTrades/status/1318283549112414209?s=20">https://twitter.com/SoccerMom...

weak (bear flaggish) hourly structure in the bear gutter (between -1 and -2 std dev)

Anything in 285-286 range on $QQQ is a decent short targeting 278.50-280 range with a stop on hourly close above 288.50

getting weaker on all timeframes under weekly

Anything in 285-286 range on $QQQ is a decent short targeting 278.50-280 range with a stop on hourly close above 288.50

getting weaker on all timeframes under weekly

We& #39;re under $280 now but please do tell me about the cup and candles bull flag pattern..

Read on Twitter

Read on Twitter