1/ Bancor v2.1 passed the community vote earlier today & is now live on Ethereum mainnet!

Finally, LPs can stake with single-sided AMM exposure - while earning fees & protection from impermanent loss.

Stake at: http://ban.cr/protect

Guide:https://ban.cr/protect&q... href=" https://blog.bancor.network/guide-single-sided-amm-staking-on-bancor-v2-1-93e6839959ba">https://blog.bancor.network/guide-sin...

Finally, LPs can stake with single-sided AMM exposure - while earning fees & protection from impermanent loss.

Stake at: http://ban.cr/protect

Guide:

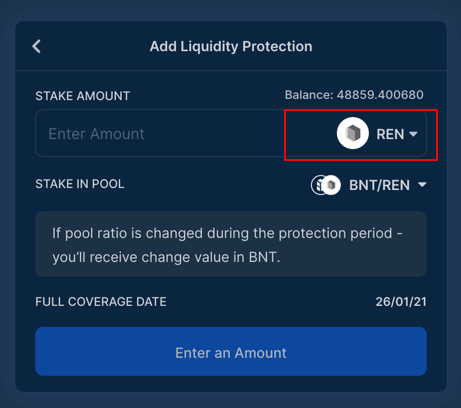

2/ $REN is among the first protected pools live, with 60+ pools going live in the coming days.

When adding liquidity to the pool, choose between 100% exposure to $REN or 100% exposure to $BNT:

When adding liquidity to the pool, choose between 100% exposure to $REN or 100% exposure to $BNT:

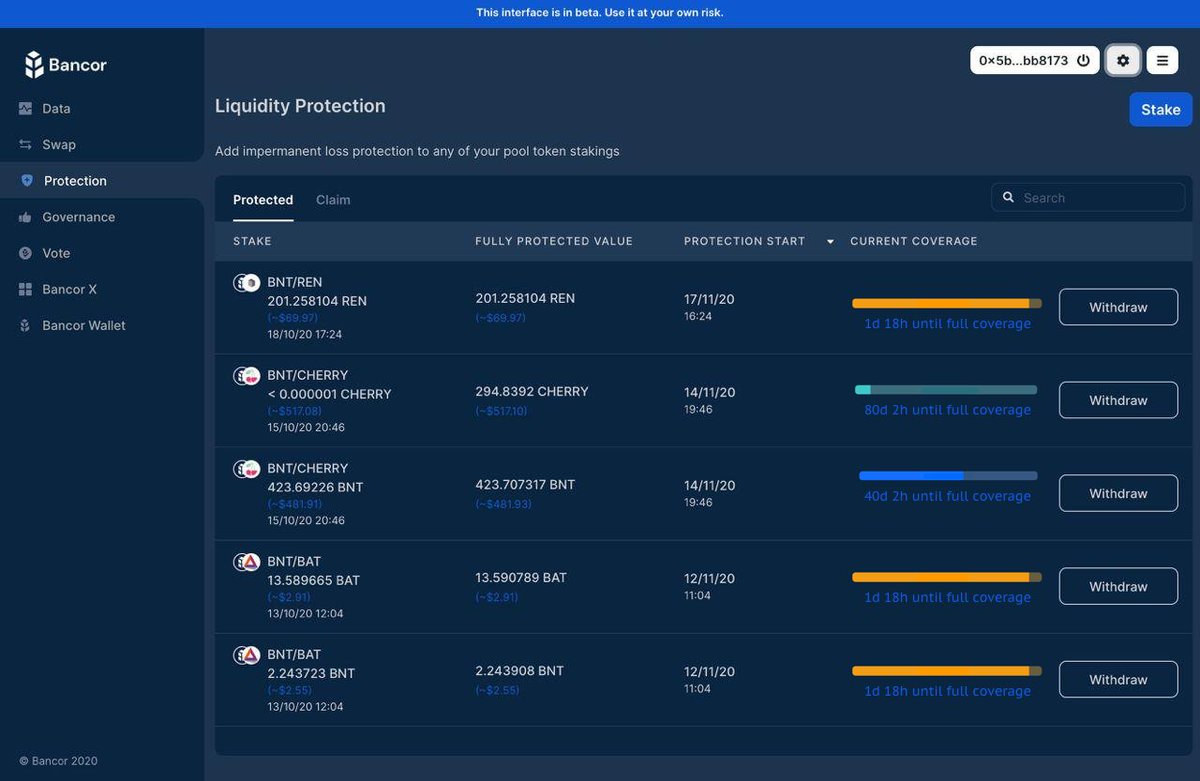

3/ Manage your protected positions in Bancor’s new pool manager.

Single-sided exposure + IL insurance + swap fees = higher ROI on collected fees.

(Individual ROI data coming soon)

Single-sided exposure + IL insurance + swap fees = higher ROI on collected fees.

(Individual ROI data coming soon)

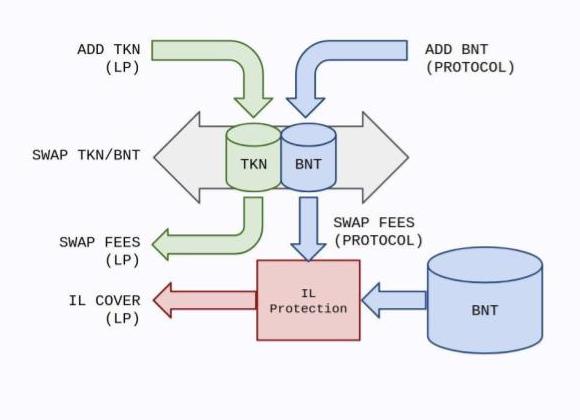

4/ How does it work?

Provide liquidity to a pool and the Bancor protocol co-invests with you by - providing the opposite side in $BNT.

The protocol earns BNT fees, which are burned to pay for IL insurance & reduce the overall BNT supply.

Learn more: https://blog.bancor.network/proposing-bancor-v2-1-single-sided-amm-with-elastic-bnt-supply-bcac9fe655b">https://blog.bancor.network/proposing...

Provide liquidity to a pool and the Bancor protocol co-invests with you by - providing the opposite side in $BNT.

The protocol earns BNT fees, which are burned to pay for IL insurance & reduce the overall BNT supply.

Learn more: https://blog.bancor.network/proposing-bancor-v2-1-single-sided-amm-with-elastic-bnt-supply-bcac9fe655b">https://blog.bancor.network/proposing...

5/ This is the 1st upgrade passed by Bancor’s new governance framework (!!) & brings a new level of sophistication to AMMs.

We are grateful to have a community of brilliant minds already proposing new ideas, voting for new pools & fine-tuning the system: http://gov.bancor.network"> http://gov.bancor.network

We are grateful to have a community of brilliant minds already proposing new ideas, voting for new pools & fine-tuning the system: http://gov.bancor.network"> http://gov.bancor.network

6/ Single-sided exposure & IL insurance aim to make AMMs less chaotic & more predictable for LPs, who can now:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin"> Long the token they want

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin"> Long the token they want

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> Earn from swap fees

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> Earn from swap fees

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌴" title="Palme" aria-label="Emoji: Palme"> Set it & forget it

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌴" title="Palme" aria-label="Emoji: Palme"> Set it & forget it

No more:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Gesicht mit Monokel" aria-label="Emoji: Gesicht mit Monokel"> stress being an LP

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Gesicht mit Monokel" aria-label="Emoji: Gesicht mit Monokel"> stress being an LP

https://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen"> getting rekt by imp loss

https://abs.twimg.com/emoji/v2/... draggable="false" alt="‼️" title="Doppeltes Ausrufezeichen" aria-label="Emoji: Doppeltes Ausrufezeichen"> getting rekt by imp loss

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend"> misleading APYs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend"> misleading APYs

No more:

7/ Stake single-sided liquidity and track your protected positions on Bancor’s new & improved app:u2028 http://app.bancor.network"> http://app.bancor.network

Read on Twitter

Read on Twitter