Recap for week ending Oct 18 2020. Expectations for next week.

A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://pecuniaprognosis.wordpress.com/2020/10/18/recap-for-week-ending-oct-18-2020/">https://pecuniaprognosis.wordpress.com/2020/10/1...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://pecuniaprognosis.wordpress.com/2020/10/18/recap-for-week-ending-oct-18-2020/">https://pecuniaprognosis.wordpress.com/2020/10/1...

A thread

Main Themes of the week

The employment situation in the US is deteriorating.

Jobless claims came out above forecast and are starting to show an increase. The recovery is starting to lose steam. https://twitter.com/imarinopoulos/status/1316721078912376839">https://twitter.com/imarinopo...

Jobless claims came out above forecast and are starting to show an increase. The recovery is starting to lose steam. https://twitter.com/imarinopoulos/status/1316721078912376839">https://twitter.com/imarinopo...

EU Inflation data shows deflation.

Covid cases are increasing and Government are imposing restrictions on economic activity - again this is not supportive of a recovery gaining steam. https://twitter.com/pecuniaprog/status/1317029133143166977">https://twitter.com/pecuniapr...

Covid cases are increasing and Government are imposing restrictions on economic activity - again this is not supportive of a recovery gaining steam. https://twitter.com/pecuniaprog/status/1317029133143166977">https://twitter.com/pecuniapr...

No news on the fiscal support package.

The the two parties do no seem to be able to come to an agreement ahead of the elections. The main reason being that the credit has to go to the election winner ? https://twitter.com/DeItaone/status/1317126374814003207">https://twitter.com/DeItaone/...

The the two parties do no seem to be able to come to an agreement ahead of the elections. The main reason being that the credit has to go to the election winner ? https://twitter.com/DeItaone/status/1317126374814003207">https://twitter.com/DeItaone/...

An agreement has to be reached within the next 48h for a bill before election day https://twitter.com/cnnbrk/status/1317841233218134022">https://twitter.com/cnnbrk/st...

Good news on corporate earning are not translating into gains for stocks https://twitter.com/pecuniaprog/status/1317726096373305344">https://twitter.com/pecuniapr...

Economic calendar for next week

Jobless claims, EZ consumer confidence and PMI, and the Presidential debate (if held) will be the ones to follow https://twitter.com/LiveSquawk/status/1317140304290582529">https://twitter.com/LiveSquaw...

Jobless claims, EZ consumer confidence and PMI, and the Presidential debate (if held) will be the ones to follow https://twitter.com/LiveSquawk/status/1317140304290582529">https://twitter.com/LiveSquaw...

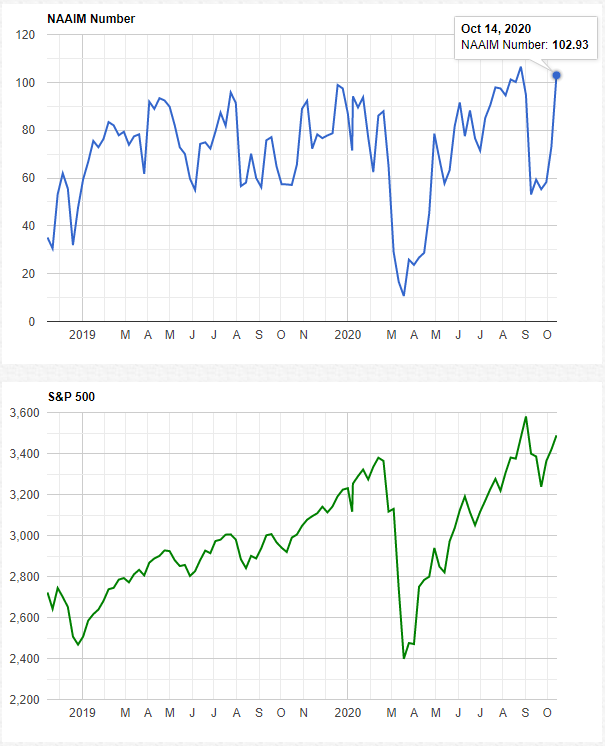

Expectations for next week

A long list of names will be reporting q3 results next week including

But as already mentioned, despite earning beats, follow up performance has been uninspiring.

A long list of names will be reporting q3 results next week including

But as already mentioned, despite earning beats, follow up performance has been uninspiring.

As we are in a K shaped recovery, some - mainly tech - companies have benefited and have seen business boom because of Covid, while most old economy companies are struggling.

With expectations very high for the high tech stocks, and it is hard for companies to beat and inspire at such valuations.

On the contrary expectation for beaten down names are low. A reversal in the outlook of the laggards would help the market and would initiate some rotation, but that would need some good news on the vaccine front, and on the stimulus bill.

Until then I find it unlikely that the market can make a significant and sustainable move higher.

Perhaps a sideways move is the best expected outcome until then.

Perhaps a sideways move is the best expected outcome until then.

This thread can be read here: https://pecuniaprognosis.wordpress.com/2020/10/18/recap-for-week-ending-oct-18-2020/">https://pecuniaprognosis.wordpress.com/2020/10/1...

Read on Twitter

Read on Twitter