#EFFITYLER PLEASE EXPOSE WORLDWIDE

HAUTE FINANCE IN LONDON AND AMSTERDAM......

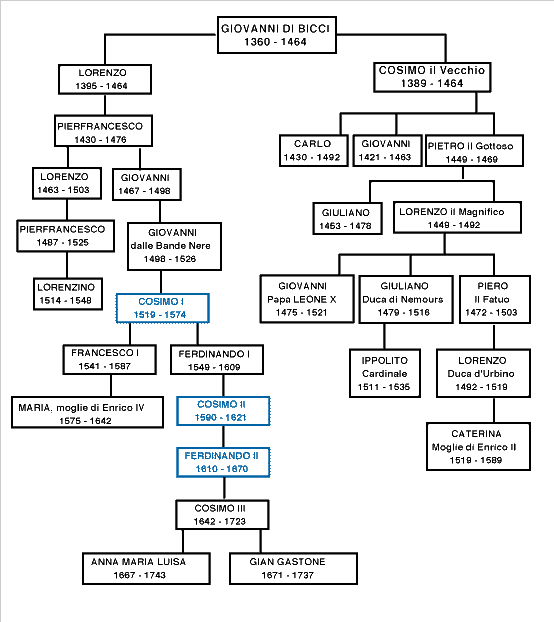

This chapter takes a look at the bankers who became tremendously rich, just as the 15th century

Medici bankers before them. However, some of the players in this world of high finance flew too

high,

HAUTE FINANCE IN LONDON AND AMSTERDAM......

This chapter takes a look at the bankers who became tremendously rich, just as the 15th century

Medici bankers before them. However, some of the players in this world of high finance flew too

high,

eventually crashing and causing major banking crises in 1763, 1772 and 1825. Many banking

houses simply disappeared as there was no lender of last resort to rescue them. Academics have

also pointed out a number of similarities between the 1763 banking crisis and both the 1998

houses simply disappeared as there was no lender of last resort to rescue them. Academics have

also pointed out a number of similarities between the 1763 banking crisis and both the 1998

collapse of hedge fund Long-Term Capital Management and the 2008 Lehman fallout. We will

take a look at the fortunes of the main bankers of 18th century Amsterdam, Hope & Co., and of

19th century London, the Rothschilds. Both banks survived several crises,

take a look at the fortunes of the main bankers of 18th century Amsterdam, Hope & Co., and of

19th century London, the Rothschilds. Both banks survived several crises,

three of which will be discussed in this chapter; the European banking crisis of 1763, the financial crisis of 1772, and the world’s first emerging markets crisis of the 1820s.

Haute finance in Amsterdam: Hope & Co

https://www.abnamro.com/nl/over-abnamro/profiel/geschiedenis/index.html">https://www.abnamro.com/nl/over-a...

Haute finance in Amsterdam: Hope & Co

https://www.abnamro.com/nl/over-abnamro/profiel/geschiedenis/index.html">https://www.abnamro.com/nl/over-a...

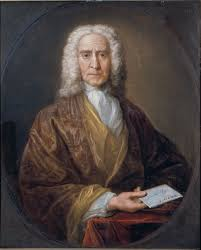

One banking dynasty that survived the crises of 1763 and 1772 and symbolized the power of the high finance bankers of the 18th century, was the Hope family. Their legacy can still be admired today in the Dutch cities of Amsterdam and Haarlem,

where they built large canal and country houses, to conduct their business and enjoy their leisure time. In 1720 the Scottish merchant banker Archibald Hope moved to Amsterdam and after his death in 1734, his brothers Adrian and Thomas continued the

business.

business.

Fifteen years later, the brothers had built up such a good reputation that stadtholder William IV asked Thomas Hope to be his advisor, and he is believed to be the author of a proposal to get the Dutch economy out of the slump it experienced in the midst of the 18th century.

At the request of William IV,

Thomas also served as a director of the Dutch East and West India Companies, aiming to help the struggling trading companies.

After the failure of several of its competitors in the 1763

and 1772 crises, Hope & Co emerged as Amsterdam ...

Thomas also served as a director of the Dutch East and West India Companies, aiming to help the struggling trading companies.

After the failure of several of its competitors in the 1763

and 1772 crises, Hope & Co emerged as Amsterdam ...

and Europe’s leading banking house of the late 18th century. It dwarfed every competitor, with a capital that was many times greater than that of its peers. Although the Dutch golden age was over, Amsterdam’s wealthy investors,

low interest rates and well-developed financial ecosystem still made it an attractive place for European governments and kings to finance their debt.

The Hope bankers were at the forefront of this issuance, mainly to the Russian emperor and the English parliament.

The Hope bankers were at the forefront of this issuance, mainly to the Russian emperor and the English parliament.

Because of the Seven Years War (1756-1763), English government debt nearly doubled to 132 million

pounds, and Hope was one of their main financiers. Moreover, the Russian emperor borrowed a total sum of 53 million guilders from Hope, an enormous amount at the time.

pounds, and Hope was one of their main financiers. Moreover, the Russian emperor borrowed a total sum of 53 million guilders from Hope, an enormous amount at the time.

By the 1790s, the Hope’s bank balance had grown to equal that of the Bank of Amsterdam, showing

the firm’s dominance in the city.

the firm’s dominance in the city.

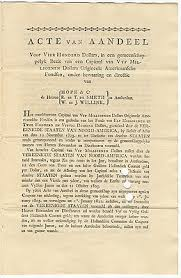

In addition to underwriting government loans, the Hope bankers made money from trading in commodities and bills of exchange. To ensure good quality information, the bank employed several news couriers so it could profit from foreign exchange and commodity price fluctuations.

The Hope bankers were true merchant bankers, combining trade with banking, as the early

Italian bankers had done. The firm had its offices and warehouses on Amsterdam’s Keizersgracht,

at the current house numbers 444-446, where it employed around 26 people.

Italian bankers had done. The firm had its offices and warehouses on Amsterdam’s Keizersgracht,

at the current house numbers 444-446, where it employed around 26 people.

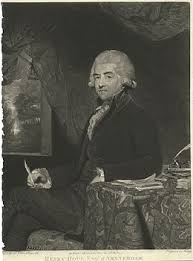

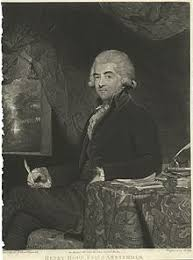

But in addition to the Hope’s impressive canal houses, which are still intact, the most prominent residence of

the family was the Welgelegen country house, which today serves as the seat of the province of

North Holland in the Dutch city of Haarlem.

the family was the Welgelegen country house, which today serves as the seat of the province of

North Holland in the Dutch city of Haarlem.

The giant country house looks like a princely palace,

displaying the enormous wealth and lavish lifestyle of Henry Hope, the company’s leading

banker in the 1780s, who regularly hosted classical concerts and possessed an art collection of

some 400 paintings.

displaying the enormous wealth and lavish lifestyle of Henry Hope, the company’s leading

banker in the 1780s, who regularly hosted classical concerts and possessed an art collection of

some 400 paintings.

The Hopes were the true high financiers of late 18th century Amsterdam, but also realized that the

hegemony of the Dutch Republic was waning. When the French occupied the Republic in 1793, the

Hope bankers decided to move to London, illustrating how power shifted from Amsterdam

hegemony of the Dutch Republic was waning. When the French occupied the Republic in 1793, the

Hope bankers decided to move to London, illustrating how power shifted from Amsterdam

to London. In 1802, the bank played an important role in the so-called Louisiana purchase, when

the US bought 2.1 million square kilometers of land from France, thereby doubling its territory.

The Hope bankers partnered up with the famous British Barings Bank,

the US bought 2.1 million square kilometers of land from France, thereby doubling its territory.

The Hope bankers partnered up with the famous British Barings Bank,

issuing shares to finance the 15 million dollar transaction, which was an enormous sum at the time. Hope & Co. existed as an independent banking house until 1962, when it merged with Mees & Zn, to form an entity

that was later acquired by the Dutch bank ABN,

that was later acquired by the Dutch bank ABN,

Read on Twitter

Read on Twitter