Super excited to announce the launch of @NEF new programme of work #ChangeFiscalRules.

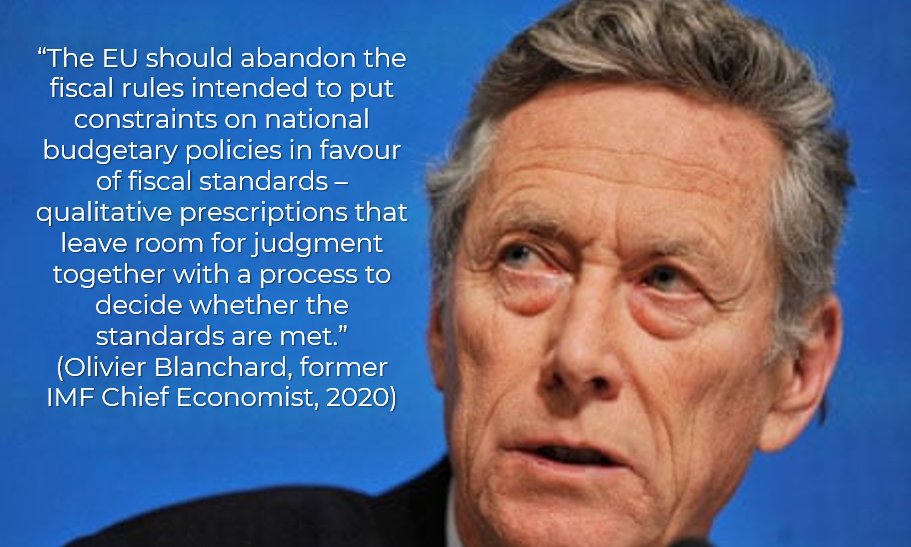

Also recently learn that @ojblanchard1 kind of shares our @alfie_stirling position!

Sharing thoughts on problems with fiscal rules and possible reform.

1/

Fiscal rules are not designed to address the economic recovery from the Covid pandemic and the unprecedented challenges facing the EU; climate change, private debt, inequality etc. Fiscal frameworks should support (not constrain) the policy response to these challenges.

2/thread

2/thread

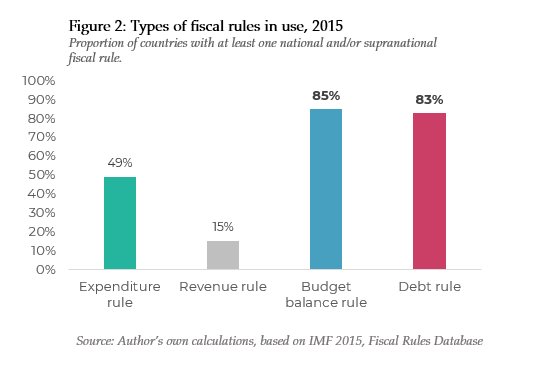

In 2015, there was 291 fiscal rules throughout 92 different countries– just under half (48%) of all countries in the world had a fiscal rule in place. All of these rules are numerical targets intended to be simple by design + focus on public sector’s balance sheet.

3/thread

3/thread

Of the countries with fiscal rules, 85% had a budget balance rule (aimed at balancing expenditure and income) and 83% had a debt rule (target for public debt relative to GDP). In total, 97% of countries with fiscal rules had a balance budget and/or debt rule in place.

4/thread

4/thread

According to the @IMF, the more frequent use of a debt and/or budget balance rule is because these rules are better suited at ensuring the sustainability of public finances.

5/thread

5/thread

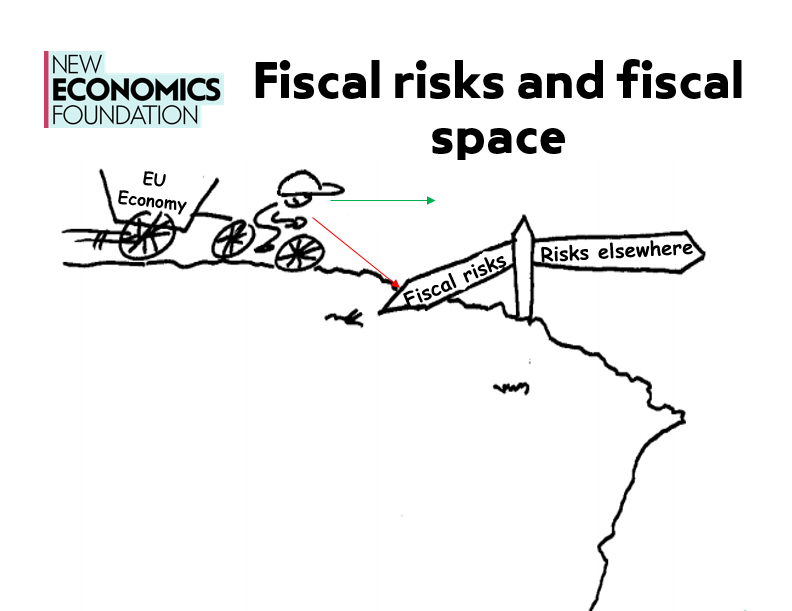

When addressing longer-term structural issues, opposed to cyclical ones, fiscal rules tend to lead to an overly narrow short-term focus on reducing the size and risks to the government’s own financial balance sheet. Our paper @alfie_stirling

6/thread https://neweconomics.org/2019/07/changing-the-fiscal-rules">https://neweconomics.org/2019/07/c...

6/thread https://neweconomics.org/2019/07/changing-the-fiscal-rules">https://neweconomics.org/2019/07/c...

The overly narrow focus on government balance sheet and deficit, known as & #39;deficit fetishism& #39;, means policy makers become obsessed with alleged & #39;fiscal space& #39;. And treats the government as completely disconnected from the rest of the economy (h/t @Frances_Coppola).

7/thread

7/thread

The Principal barometer for preparedness for a shock then becomes availability of fiscal space. Narrow focus on risks public sector balance sheet, leads to build-up of risks elsewhere - reducing our ability to cope w/ a shock (h/t @jdportes).

8/thread

https://www.prospectmagazine.co.uk/economics-and-finance/and-so-the-appalling-human-consequences-of-the-austerity-experiment-become-clear-george-osborne-economy-coronavirus-covid-19-recession">https://www.prospectmagazine.co.uk/economics...

8/thread

https://www.prospectmagazine.co.uk/economics-and-finance/and-so-the-appalling-human-consequences-of-the-austerity-experiment-become-clear-george-osborne-economy-coronavirus-covid-19-recession">https://www.prospectmagazine.co.uk/economics...

Another issue, fiscal rules are disproportionately focused on overly rigid and weak indicators of so called fiscal space. Fiscal space is complex- cannot simply be measured as a mere ratio public sector’s balance sheet to GDP. @PhilippaSigl

9/thread https://twitter.com/PhilippaSigl/status/1314929203343695872">https://twitter.com/PhilippaS...

9/thread https://twitter.com/PhilippaSigl/status/1314929203343695872">https://twitter.com/PhilippaS...

Fiscal space indicators aimed at solely measuring the government’s balance sheet tend to suffer from the streetlight problem: an observational bias illustrated by the person looking under a street lamp for their wallet that they know they lost somewhere less well lit.

10/thread

10/thread

The ‘streetlight metaphor’ depicts an issue of observational bias, where analysts search for

‘answers’ in areas that are easiest to look. The problem is particularly prevalent in measurements of fiscal space that use unsophisticated indicators most easily obtainable.

11/thread

‘answers’ in areas that are easiest to look. The problem is particularly prevalent in measurements of fiscal space that use unsophisticated indicators most easily obtainable.

11/thread

But fiscal space is determined complex macroeconomic dynamics (resource constraint, inflation, private sector’s willingness to spend/save, interest rates, debt maturity profiles etc.). The neglect complex macro dynamics means at least half the puzzle is missed.

12/thread

12/thread

Fiscal rules lack symmetry. They don& #39;t guard against under-borrowing. Whilst fiscal rules are designed to mitigate the deficit bias - they do not safeguard against the proliferation of political dynamics that causally flow in the opposite direction (deficit fetishism).

13/thread

13/thread

We are fast approaching unprecedented challenges where a bias against government borrowing and the resulting under investment today comes at a higher opportunity cost (both financial, social, and ecological) in the future.

14/thread

14/thread

Fiscal rules are also not fit (never were) for current context, especially the Knightian (fundamental) uncertainty and low interest rate environment. CBs wont hit inflation target if austerity (spending cuts) pushing in opposite direction.

15/thread https://neweconomics.org/2018/08/ending-the-fiscal-monetary-tug-o-war">https://neweconomics.org/2018/08/e...

15/thread https://neweconomics.org/2018/08/ending-the-fiscal-monetary-tug-o-war">https://neweconomics.org/2018/08/e...

While the EU& #39;s fiscal framework may have been designed to help unite the EU - the fiscal rules in their current form, or any form based on the underlying approach (deficit fetishism), could end-up dismantling the EU (h/t @katie_kedward). Think about it for a min.

16/thread

16/thread

So in sum, totally agree w/ @ojblanchard1 we should abandon fiscal rules, and replace them with fiscal principles based on an evaluation of different macro-economic dynamics - that sufficiently offer policy makers discretion to tackle today& #39;s biggest challenges.

17/End of thread

17/End of thread

Thoughts welcome please? Retweets not frowned upon @sjwrenlewis @StephanieKelton @NathanTankus @L__Macfarlane @JWMason1 @delong @BJMbraun @jryancollins @LHSummers @dandolfa @GeorgeSelgin @georgemagnus1 @GeorgeMonbiot @rodrikdani @agaviriau @MaxCRoser @JustinWolfers @pdegrauwe

Read on Twitter

Read on Twitter My most important threadhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💥" title="Symbol für eine Kollision" aria-label="Emoji: Symbol für eine Kollision">Super excited to announce the launch of @NEF new programme of work #ChangeFiscalRules.Also recently learn that @ojblanchard1 kind of shares our @alfie_stirling position! Sharing thoughts on problems with fiscal rules and possible reform.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">1/" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="💥" title="Symbol für eine Kollision" aria-label="Emoji: Symbol für eine Kollision">My most important threadhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💥" title="Symbol für eine Kollision" aria-label="Emoji: Symbol für eine Kollision">Super excited to announce the launch of @NEF new programme of work #ChangeFiscalRules.Also recently learn that @ojblanchard1 kind of shares our @alfie_stirling position! Sharing thoughts on problems with fiscal rules and possible reform.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">1/" class="img-responsive" style="max-width:100%;"/>

My most important threadhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💥" title="Symbol für eine Kollision" aria-label="Emoji: Symbol für eine Kollision">Super excited to announce the launch of @NEF new programme of work #ChangeFiscalRules.Also recently learn that @ojblanchard1 kind of shares our @alfie_stirling position! Sharing thoughts on problems with fiscal rules and possible reform.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">1/" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="💥" title="Symbol für eine Kollision" aria-label="Emoji: Symbol für eine Kollision">My most important threadhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💥" title="Symbol für eine Kollision" aria-label="Emoji: Symbol für eine Kollision">Super excited to announce the launch of @NEF new programme of work #ChangeFiscalRules.Also recently learn that @ojblanchard1 kind of shares our @alfie_stirling position! Sharing thoughts on problems with fiscal rules and possible reform.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">1/" class="img-responsive" style="max-width:100%;"/>