My largest position, Leatt Corp $LEAT, has launched their 2021-product lines for

- MX ( https://www.youtube.com/watch?v=R6x6_Cb71PY)

-">https://www.youtube.com/watch... MTB ( https://www.youtube.com/watch?v=xnRHIZz1WtE)

Here& #39;s">https://www.youtube.com/watch... a short thread on why I am long Leatt (1/14)

- MX ( https://www.youtube.com/watch?v=R6x6_Cb71PY)

-">https://www.youtube.com/watch... MTB ( https://www.youtube.com/watch?v=xnRHIZz1WtE)

Here& #39;s">https://www.youtube.com/watch... a short thread on why I am long Leatt (1/14)

Dr. Chris Leatt is the company& #39;s largest shareholder, and he together with the rest of management owns >40% of Leatt stock, making the management highly aligned with shareholder interests and highly incentivized to think long-term. (2/14)

Leatt started out in 2006 as a one-product company based on Dr. Chris Leatt’s patented neck brace for MX-riders, and the Leatt brand is still strongly associated with neck protection among riders. (3/14)

While neck braces were initially very popular, and most research indicates that they provide good protection, riders are divided into "pro-brace" and "against-brace" camps, and the popularity among riders has declined. (4/14)

Meanwhile, Leatt has added Body armor (knee braces, chest protectors, etc.), Helmets, and Other (goggles, apparel, water bottles, etc.) to their MX product line, and recently started entering MTB as well. (5/14)

Chris Leatt runs the R&D-lab with a strong focus on proprietary technology, always bringing something new to the market. Leatt is no "copy-and-rebrand"-company. Swedish investors will be familiar with MIPS - Leatt has their own 360-turbine technology. (6/14)

With their launch of shoes this year’s H1, Leatt is now a head-to-toe protection provider in both MX and MTB and have a diversified product line, and are no longer the "neck-brace company". (7/14)

I believe the structural decline in neck brace sales has masked the underlying performance of Leatt& #39;s other product lines which have shown a high cadence of successful product launches and have been well-received by riders. (8/14)

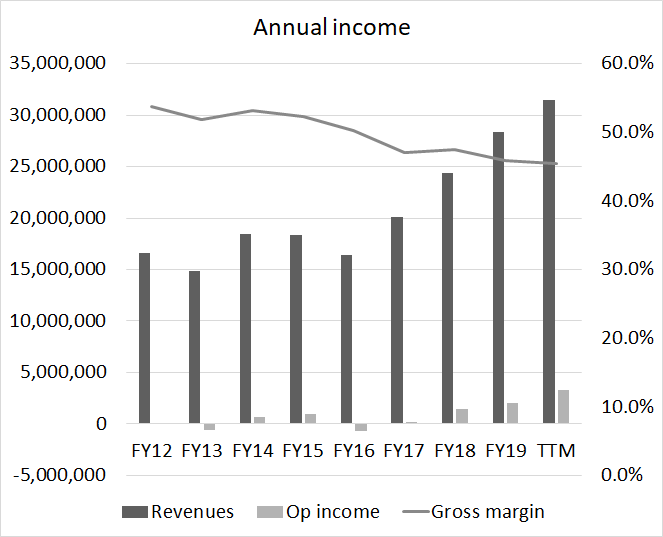

After years of stagnant growth due to a declining neck brace segment, the product mix diversification has now started to bear fruit: strong double-digit growth the past few years, fueled by an increasing share of sales stemming from the fast-growing body armor segment. (9/14)

This year& #39;s Q2 was a real beat with 32% overall growth with DECLINING OpEx. The fast-growing Body armor segment is now the largest part of the product mix, driving overall topline growth, while any further declines in neck braces will be of less importance. (10/14)

I think the Q2 performance was a testament to what Leatt can accomplish when reducing the importance of market headwinds in the Neck brace segment. (11/14)

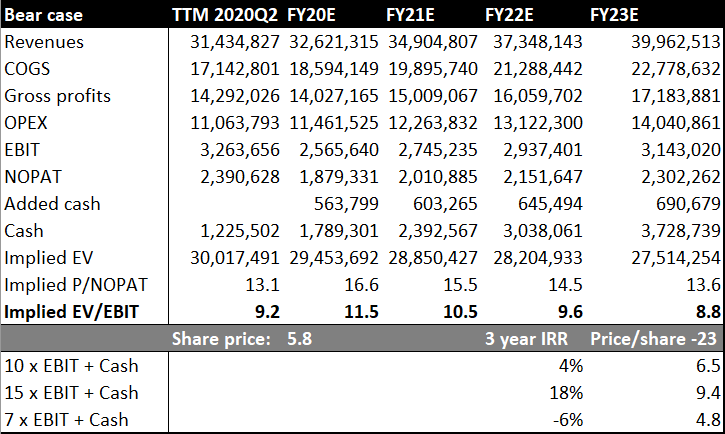

Brief figures: Market cap ~$31 million @ $5.70/share.

TTM: Revenues $31.4 million (23.5% growth). Gross margin ~46%. EBIT ~$3.2 million.

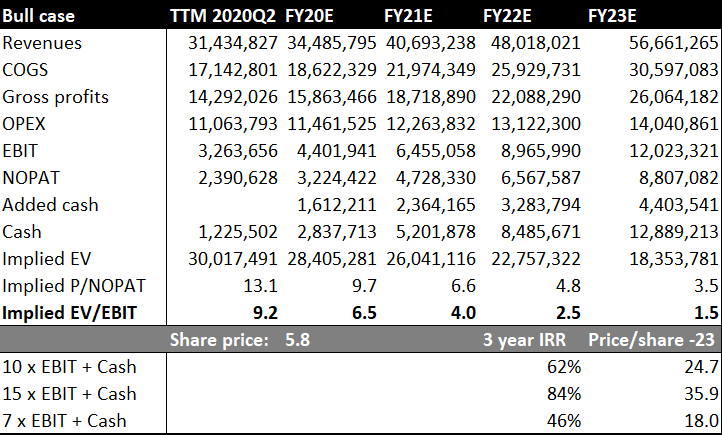

Valuation gap to "peers" in the outdoor industry (12/14)

TTM: Revenues $31.4 million (23.5% growth). Gross margin ~46%. EBIT ~$3.2 million.

Valuation gap to "peers" in the outdoor industry (12/14)

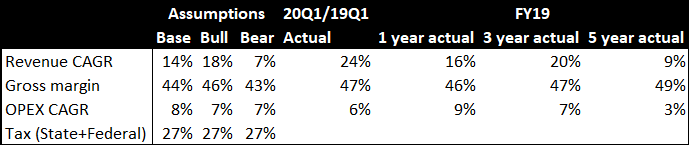

In my base case scenario, I try to be conservative, assuming that growth will decrease to CAGR ~14% over the coming 5 years and gross margins will contract slightly, and still find Leatt very attractive at the current price. (13/14)

Disc: I am long Leatt $LEAT. This is not investment advice, everything in this thread might be wrong, do your own research, etc. Happy to hear any thoughts/inputs/critique.

Thank you to twitter& #39;s Leatt Man No. 1 @oliviercolombo for excellent discussions on the company. (14/14)

Thank you to twitter& #39;s Leatt Man No. 1 @oliviercolombo for excellent discussions on the company. (14/14)

Read on Twitter

Read on Twitter