We organised a 2 week-long remote design jam (hackathon) around Account Aggregators sponsored by @Facebook and in partnership with @sahamati, @parallel_hq, @IndiaDice & @CIIEIndia

A thread of the ideas presented

We had 9 teams consisting of a designer, product managers, founders, policy experts and facilitators.

- This year& #39;s industry participants - @Razorpay, @rupeekapp, @_groww, @savemo_app, @Early_Salary and @scripbox

- Along with students from NID & Srishti

Each team were given a persona and a fintech use case (Lending, Expense Management, Portfolio Management etc. )

Design Jam& #39;s objective https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

& #39;How might we design a trustworthy UX for an individual to share data using AA& #39;

Sample Persona: https://bit.ly/3j2SAZf ">https://bit.ly/3j2SAZf&q...

Design Jam& #39;s objective

& #39;How might we design a trustworthy UX for an individual to share data using AA& #39;

Sample Persona: https://bit.ly/3j2SAZf ">https://bit.ly/3j2SAZf&q...

1. Two real-time 3 hr workshop with teams. (Thanks to @zoom_us break out rooms)

2. 8 days of async collaboration on WhatsApp along with design and policy mentoring session.

3. Final design presentations :D

Documenting an interesting idea from the jam

Team: OINK 1

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Expense Management app

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Expense Management app

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Vasanth (Trendsetter) - https://bit.ly/3j2SAZf

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Vasanth (Trendsetter) - https://bit.ly/3j2SAZf

https://bit.ly/3j2SAZf&q... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> OINK 1 uses conversational UI to solve the challenge of trust and explainability of AA.

@savemo_app

@savemo_app

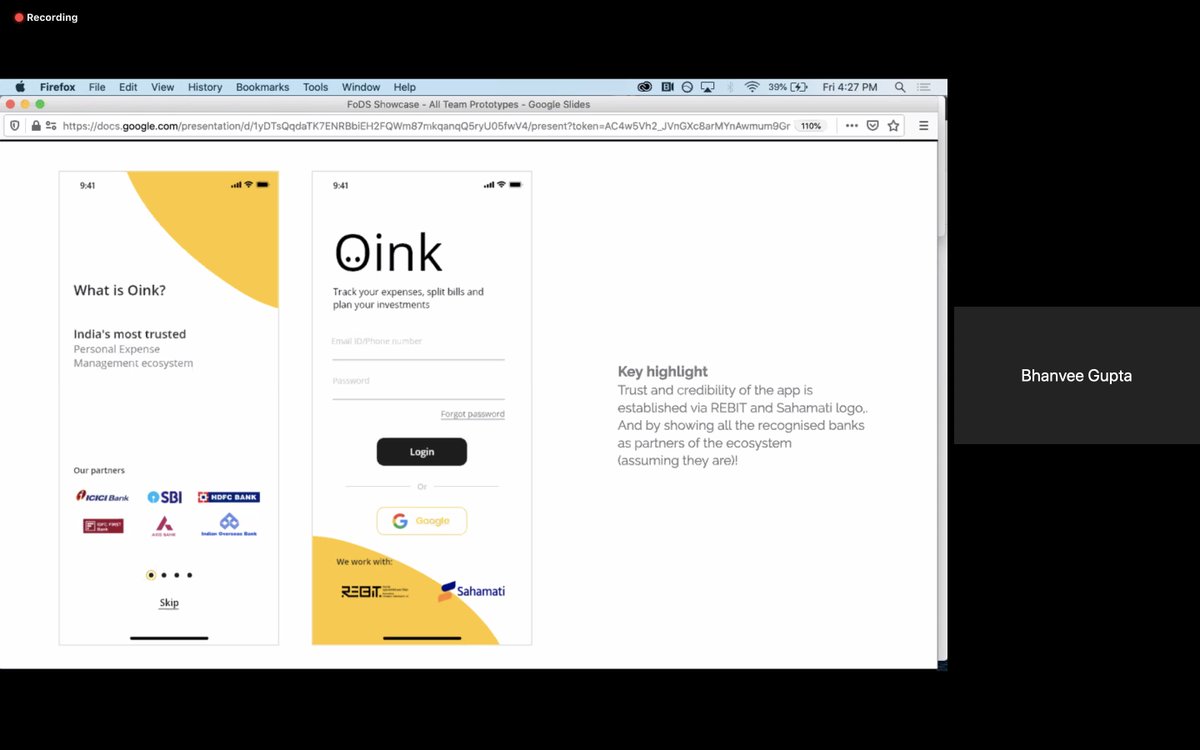

Team: OINK 2

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Expense Management app

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Expense Management app

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ

https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Uses trust markers to increase comfort.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Also provides alternate ways of data sharing and educates users about the pros and cons

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Also provides alternate ways of data sharing and educates users about the pros and cons

NID Bangalore

NID Bangalore

Team: EMI Monk 1

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Consumer durable loans

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Consumer durable loans

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ

https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Uses cultural artefacts like memes to explain the idea of account aggregator. I mean, why should all fintech apps be serious?

NID + BITS Pilani

NID + BITS Pilani

Team: EMI Monk 2

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Consumer durable loans

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Consumer durable loans

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig

https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Uses the idea of video stories to replace FAQs that explain the concept of AAs to the users

@rupeekapp

@rupeekapp

Team: Instamoney 1

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Personal Loans

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Personal Loans

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig

https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Uses universal navigation to track the loan application progress & integrates contextual video tutorials

Shristi School of Art & Design

Shristi School of Art & Design

Team: Instamoney 2

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Personal Loans

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Personal Loans

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ

https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Bring in the idea of data negotiation (i.e) shows a potential increase in the borrowing limit increase when more data is shared.

@Early_Salary

@Early_Salary

Team: Moneybox 1

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Portfolio Management

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Portfolio Management

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ

https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Uses alternate term like & #39;auto sync& #39; instead of AA to avoid jargons. App requests to sync data for tie it up with long term goals are rebalancing

@scripbox

@scripbox

Team: CashLend

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: SME Loans

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: SME Loans

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Parijat (Follower) - https://bit.ly/3o02eQd

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Parijat (Follower) - https://bit.ly/3o02eQd

https://bit.ly/3o02eQd&q... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Introduces trust markers and time markers to indicate the ease of using AA in data sharing.

A huge shoutout to all the @yltfellowship fellows who were a part of the teams and assisted the teams with the policy angle.

And our partner @TTCLabs, from whom the design jam format originates :) https://www.ttclabs.net/ ">https://www.ttclabs.net/">...

And our partner @TTCLabs, from whom the design jam format originates :) https://www.ttclabs.net/ ">https://www.ttclabs.net/">...

We would be taking a few of these prototypes to real users to test their usability. Following which a design playbook for data sharing in financial services would be published.

Do watch this space. Meanwhile, follow us on @Medium https://medium.com/91-labs/future-of-data-sharing/home">https://medium.com/91-labs/f...

Do watch this space. Meanwhile, follow us on @Medium https://medium.com/91-labs/future-of-data-sharing/home">https://medium.com/91-labs/f...

Read on Twitter

Read on Twitter Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Vasanth (Trendsetter) - https://bit.ly/3j2SAZf&q... class="Emoji" style="height:16px;" src=" " title="Team: OINK 1 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Vasanth (Trendsetter) - https://bit.ly/3j2SAZf&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Vasanth (Trendsetter) - https://bit.ly/3j2SAZf&q... class="Emoji" style="height:16px;" src=" " title="Team: OINK 1 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Vasanth (Trendsetter) - https://bit.ly/3j2SAZf&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Vasanth (Trendsetter) - https://bit.ly/3j2SAZf&q... class="Emoji" style="height:16px;" src=" " title="Team: OINK 1 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Vasanth (Trendsetter) - https://bit.ly/3j2SAZf&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Vasanth (Trendsetter) - https://bit.ly/3j2SAZf&q... class="Emoji" style="height:16px;" src=" " title="Team: OINK 1 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Vasanth (Trendsetter) - https://bit.ly/3j2SAZf&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" " title="Team: OINK 2https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" " title="Team: OINK 2https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" " title="Team: OINK 2https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" " title="Team: OINK 2https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Expense Management apphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" " title="Team: EMI Monk 1https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" " title="Team: EMI Monk 1https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" " title="Team: EMI Monk 1https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" " title="Team: EMI Monk 1https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" " title="Team: EMI Monk 2https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" " title="Team: EMI Monk 2https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" " title="Team: EMI Monk 2https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" " title="Team: EMI Monk 2https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Consumer durable loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" " title="Team: Instamoney 1https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" " title="Team: Instamoney 1https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" " title="Team: Instamoney 1https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" " title="Team: Instamoney 1https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Raghu (Survivor) - https://bit.ly/3k6k0ig&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" " title="Team: Instamoney 2https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" " title="Team: Instamoney 2https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" " title="Team: Instamoney 2https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" " title="Team: Instamoney 2https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Personal Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Tejas (Aspirant) - https://bit.ly/355isyJ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Portfolio Managementhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" " title="Team: Moneybox 1https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Portfolio Managementhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Portfolio Managementhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" " title="Team: Moneybox 1https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Portfolio Managementhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Portfolio Managementhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" " title="Team: Moneybox 1https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Portfolio Managementhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: Portfolio Managementhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" " title="Team: Moneybox 1https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: Portfolio Managementhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Riya (Cautious) - https://bit.ly/3k8goMQ&q... class="Emoji" style="height:16px;" src=" ">

Usecase: SME Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Parijat (Follower) - https://bit.ly/3o02eQd&q... class="Emoji" style="height:16px;" src=" " title="Team: CashLendhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: SME Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Parijat (Follower) - https://bit.ly/3o02eQd&q... class="Emoji" style="height:16px;" src=" " class="img-responsive" style="max-width:100%;"/>

Usecase: SME Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Parijat (Follower) - https://bit.ly/3o02eQd&q... class="Emoji" style="height:16px;" src=" " title="Team: CashLendhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobiltelefon" aria-label="Emoji: Mobiltelefon"> Usecase: SME Loanshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille"> Persona: Parijat (Follower) - https://bit.ly/3o02eQd&q... class="Emoji" style="height:16px;" src=" " class="img-responsive" style="max-width:100%;"/>